- CRE Daily

- Posts

- Apartment Supply Falls Below 100K Units for First Time in Nearly Three Years

Apartment Supply Falls Below 100K Units for First Time in Nearly Three Years

After 10 quarters of sky-high deliveries, multifamily supply is finally cooling—markets leading or pulling back are starting to stand out in Q4 2025.

Good morning. The apartment construction boom may finally be losing steam. After nearly three years of record-breaking supply, Q4 2025 marked a notable slowdown, with some regions easing faster than others.

Meanwhile, the Fed held rates steady, but dissent within the ranks signals a growing debate over when to cut.

Today’s issue is sponsored by AirGarage—the gateless parking platform helping developers boost revenue by 20% with automation and smart pricing.

🎙️Worth a listen: VICI Properties CEO Edward Pitoniak explains how experiential real estate outperformed expectations, turning Caesars’ bankruptcy into control of half the Las Vegas Strip.

CRE Trivia 🧠

Which U.S. city ranked #1 overall as the nation’s best walk-and-ride city?

(Answer at the bottom of the newsletter)

Market Snapshot

|

| ||||

|

|

Supply Shift

Apartment Supply Falls Below 100K Units for First Time in Nearly Three Years

After 10 straight quarters of historically high completions, U.S. apartment supply finally hit the brakes in Q4 2025.

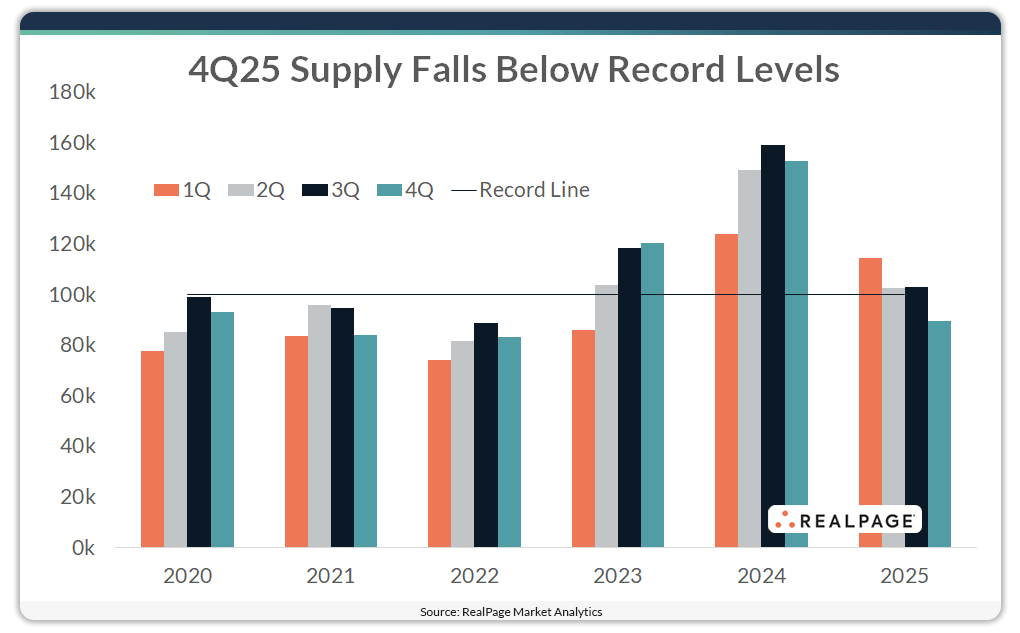

Deliveries dip: In Q4 2025, about 89,400 units were delivered, marking the first time since early 2023 that supply fell below 100,000 units. This ends a historic run that began in Q2 2023 and peaked in Q3 2024, highlighting a broader slowdown in construction activity.

Hitting the brakes: The South remained the top supplier, delivering about 47,500 units—more than twice as many as the next region. But it also saw the sharpest drop, down from nearly 91,800 units in Q3. This was the South’s first sub-50,000-unit quarter in nearly three years.

Regional snapshot: The West delivered just over 22,000 units—3,700 fewer than Q3 and well below its Q3 2024 peak of 37,200. The Northeast (9,961 units) and Midwest (9,918 units) saw milder, more consistent delivery volumes.

Market standouts: Phoenix and New York led the metro-level rankings, each surpassing 6,000 new units delivered between October and December, reflecting ongoing localized strength in construction despite national deceleration.

➥ THE TAKEAWAY

Cooling the frenzy: Apartment deliveries are finally slowing, pointing to a more manageable supply pace. Slowing pipelines—especially in high-growth regions like the South—could bring relief to oversupplied markets and support future rent stabilization.

TOGETHER WITH AIRGARAGE

How Gateless Parking Delivered 20% Revenue Growth for a Delaware Developer

The Problem

BPG’s parking operations were fragmented and manual, leading to missed payments, tenant frustration, exit congestion, and a gated LPR system that created more problems than it solved.

The Solution

AirGarage replaced gates with a fully gateless system, automated billing and enforcement, and introduced demand-based pricing with real-time dashboards for visibility and control.

The Outcome

Operations became frictionless and scalable, congestion disappeared, cash flow stabilized, and BPG’s garages became significantly easier to manage—and more profitable.

*This is a paid advertisement. Please see the full disclosure at the bottom of the newsletter.

✍️ Editor’s Picks

CRE Analysis Q4 2025: See the latest CRE valuation and performance trends, what’s driving returns by sector, and how shifting market conditions could impact portfolio decisions. (sponsored)

CoStar clash: CoStar’s slumping stock price has drawn scrutiny from activist hedge fund Third Point, which is pushing CEO Andy Florance to refocus strategy amid concerns over its residential ambitions.

Risk transfer: Apollo Commercial REIT is offloading $9B in commercial property loans to its insurance affiliate, streamlining its balance sheet and signaling a shift toward more stable, long-duration capital sources.

Dealmakers' moves: In 2025, top CRE buyers and sellers like Blackstone and Starwood adapted to high interest rates by offloading assets and targeting opportunistic acquisitions, signaling a shift in investment strategy.

Red tape: A Trump executive order aims to fast-track fire-related rebuilding projects by overriding state and local permitting rules, drawing both support for disaster relief speed and criticism over environmental oversight.

Consumer engine: U.S. economic growth in 2025 was driven largely by resilient consumer spending, cushioning the impact of high rates and weak business investment.

Tight terms: CRE lenders in 2026 are facing a tough recalibration as capital remains scarce, loan extensions run thin, and underwriting gets stricter.

🏘️ MULTIFAMILY

Stress signs: Multifamily loans originated during the peak years of 2021-2022 are showing the earliest signs of stress, as inflated valuations and high leverage clash with today’s cooler market and tighter credit.

Founder’s flip: Uber co-founder Travis Kalanick is now targeting the housing sector with a new startup aiming to disrupt the apartment rental experience using the same tech-driven, efficiency-first model he brought to ride-hailing.

LIC lift: Carlyle and partners secured $224M in financing for a luxury residential and mixed-use tower in Long Island City, signaling confidence in high-end urban living despite broader market headwinds.

🏭 Industrial

Cooling trend: The U.S. industrial market showed signs of cooling in Q4 2025, with vacancy rates rising to 5.4% amid record levels of new supply.

Refi reset: Faropoint refinanced a 150-property industrial portfolio with a $273M debt package, showing lenders' continued appetite for logistics assets with proven performance.

Nashville rush: Nashville’s industrial market surged in 2025 with a 72% YoY demand increase, driven by population growth and distribution needs, even as new supply struggles to keep up.

Storage expansion: 10 Federal Self Storage is entering Arkansas—its third new state in a month—by acquiring a seven-facility portfolio, reflecting aggressive growth in secondary and tertiary markets.

🏬 RETAIL

Discount deal: Blackstone sold a Chicago-area shopping center at a steep discount, underscoring ongoing challenges in brick-and-mortar retail and the broader trend of repricing legacy assets.

Makeover mode: Despite being shuttered, San Francisco’s largest mall is getting a temporary makeover to host Super Bowl events—highlighting creative reuse amid long-term uncertainty.

Fat trouble: Fatburger’s parent company filed for Chapter 11 to restructure $1B in debt, becoming the latest fast-casual brand to struggle under mounting financial pressure.

🏢 OFFICE

Comeback kid: The co-working sector is bouncing back fast post-pandemic, fueled by remote-hybrid flexibility, corporate downsizing, and a growing appetite for short-term, amenity-rich office space.

Miami moves: Post-pandemic tenants who relocated to Miami are now expanding, signaling sustained office demand in the region as growth companies seek favorable tax and lifestyle conditions.

Bio bounce: Alexandria Real Estate saw a leasing rebound in Q4 2025, hinting at renewed biotech demand after a year of pullbacks and lab space consolidations.

Core stress: Downtown San Diego’s office market is facing rising distress, with vacancy rates climbing and sublease space increasing amid tenant downsizing and slower leasing activity.

🏨 HOSPITALITY

Stylish debut: IHG’s Ruby Hotels brand is launching in North America, betting on a design-forward, affordable luxury model to attract younger, urban travelers.

Pipeline power: Hilton posted record-breaking growth in 2025, adding nearly 800 hotels and hitting 520,000 rooms under development.

A MESSAGE FROM COVERCY

Stop scrambling. Start impressing investors.

Every year it's the same story: February arrives. Your team scrambles to pull together spreadsheets, recreate transaction histories, and reconcile investor accounts.

Time to try Covercy?

K-1s by March 15: Clean books & K-1s delivered on time, every year.

Lower Tax Costs: Less CPA time spent on data cleanup = lower tax bills.

Investor Confidence: On-time, accurate tax documents build trust.

Reduced Stress: No more tax season panic.

*This is a paid advertisement. Please see the full disclosure at the bottom of the newsletter.

📈 CHART OF THE DAY

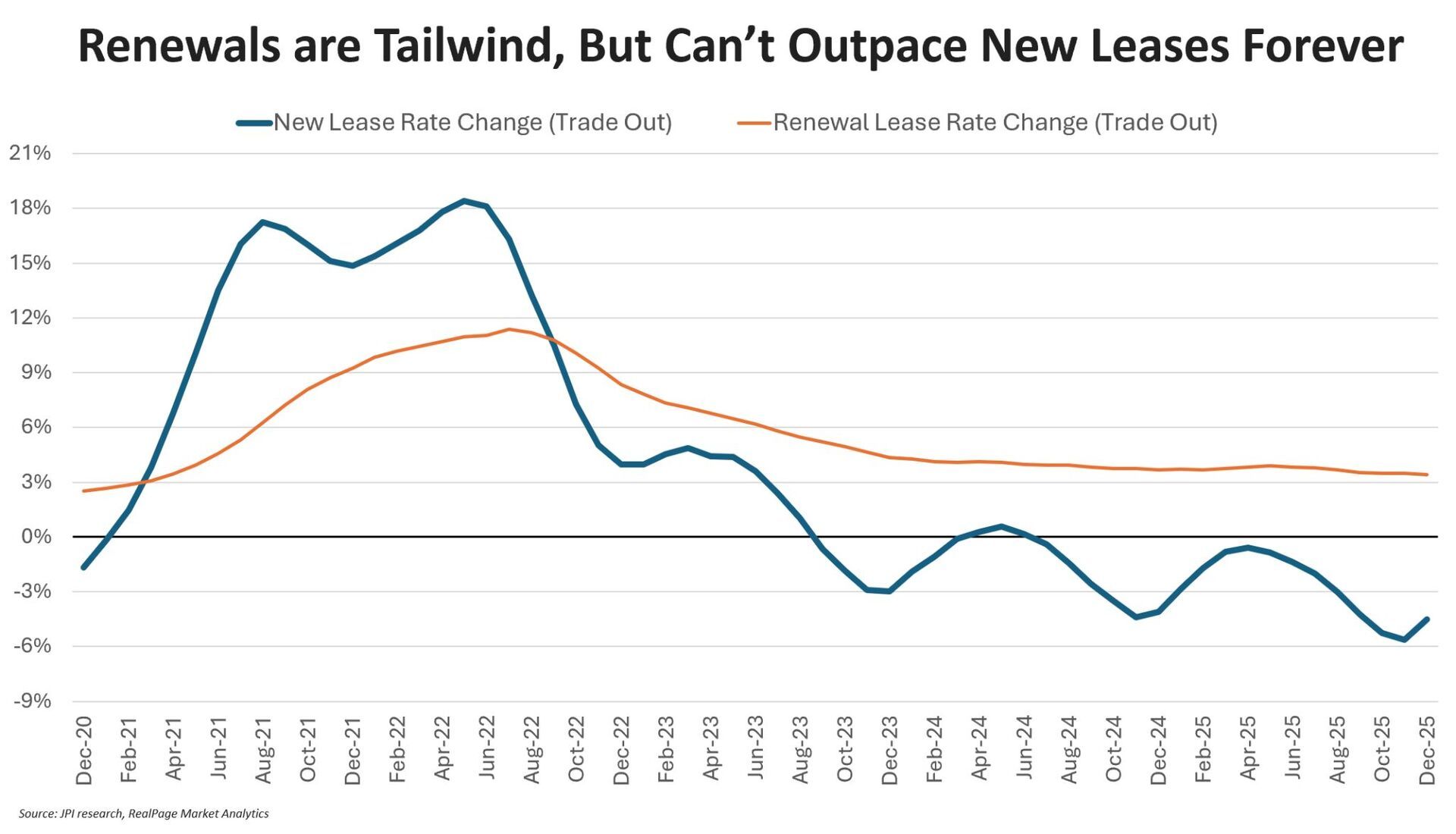

In oversupplied markets like Austin, Denver, and Phoenix, a growing number of apartment operators are facing “inverted rent rolls,” where renewal rents exceed new lease prices—forcing tough choices between cutting rents or risking costly turnover heading into spring 2026.

CRE Trivia (Answer)🧠

Minneapolis, MN ranked #1 thanks to top-tier walkability, an 83 bike score, and extensive bike and transit infrastructure that supports car-optional living.

More from CRE Daily

📬 Newsletters: Stay ahead of the market with local insights from CRE Daily Texas and CRE Daily New York.

🎙️Podcast: No Cap by CRE Daily delivers an unfiltered look at the biggest trends—and the money game behind them.

🗓️ CRE Events Calendar: The largest searchable calendar of commercial real estate events—filter by city or sector.

📊 Market Reports: A centralized hub for brokerage research and market intelligence, all in one place.

📈 Fear & Greed Index: A fully interactive sentiment tracker on the pulse of CRE built in partnership with John Burns Research & Consulting.

You currently have 0 referrals, only 1 away from receiving Multifamily Stress Test Model.

What did you think of today's newsletter? |

Reply