- CRE Daily

- Posts

- Banks Tiptoe Back Into CRE Lending Even As Old Troubles Stick Around

Banks Tiptoe Back Into CRE Lending Even As Old Troubles Stick Around

Delinquencies are flat, but warning signs still flash on bank balance sheets.

Good morning. After a long slowdown, banks are cautiously reentering CRE lending. But behind the rebound lies a growing pile of delinquent loans and a strategy of kicking the can down the road.

Today’s issue is brought to you by 1031 Crowdfunding—helping investors access institutional-quality real estate through tax-advantaged vehicles.

🎙️This Week No Cap: Jon Schultz, Co-Founder and Managing Principal of Onyx Equities, sits down with Jack and Alex to break down the art of value creation, the future of office, and why adaptability is real estate’s most underrated skill.

CRE Trivia 🧠

What is the tallest residential building in the Western Hemisphere?

(Answer at the bottom of the newsletter)

Market Snapshot

|

| ||||

|

|

Lending Landscape

Banks Tiptoe Back Into CRE Lending Even As Old Troubles Stick Around

Banks are lending again—but the backlog of troubled, low-rate-era loans is far from resolved.

A lending thaw: After a yearslong freeze, banks are reentering the CRE debt market. Newmark reports $227B in loans issued in the first nine months of 2025—up 85% YoY and back to 2019 levels. Multifamily made up half of Q2 originations, and even office is drawing selective capital, signaling confidence in reset valuations.

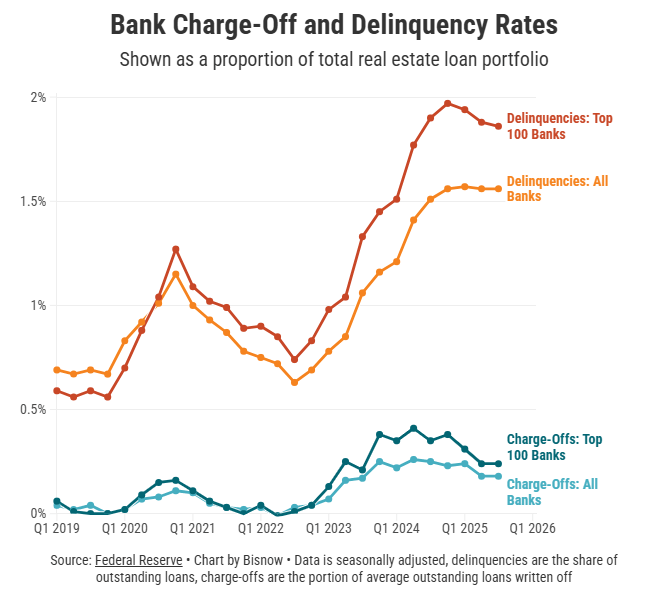

Legacy debt lingers: As new loans rise, old issues persist. CRE delinquencies sit at 1.56%—the highest since 2014—and 1.86% at top banks. Nonperforming loans are climbing, especially at large institutions. Analysts say the calm reflects cautious lender behavior, not stronger fundamentals.

Extend and pretend: Modifications and extensions remain banks’ go-to move, pushing 2025 maturities to $957B—nearly half held by banks. Instead of a single “maturity wall,” the market now faces a rolling wave through 2030. Banks also hold 46% of the $663B due in 2026, the largest near-term exposure of any lender.

Macro clouds darken: The economic outlook is shaky, with rising stagflation risks and fading hopes for a soft landing. Recession odds range from 35% to 93%. A downturn or surprise rate hike could trigger forced sales and push delinquencies higher.

Slow burn: For now, banks are working out distressed loans gradually, avoiding a mass liquidation. But analysts warn that without an “inciting incident,” the drip will continue—if one emerges, the process could become a rush.

➥ THE TAKEAWAY

Big picture: Banks are back to lending, but they're still carrying the baggage from the last cycle. Unless a major economic shakeup forces their hand, expect a drawn-out resolution period—defined more by slow drips than a sudden flood.

TOGETHER WITH 1031 CROWDFUNDING

Now is the Time to Tap into Senior Housing Demand

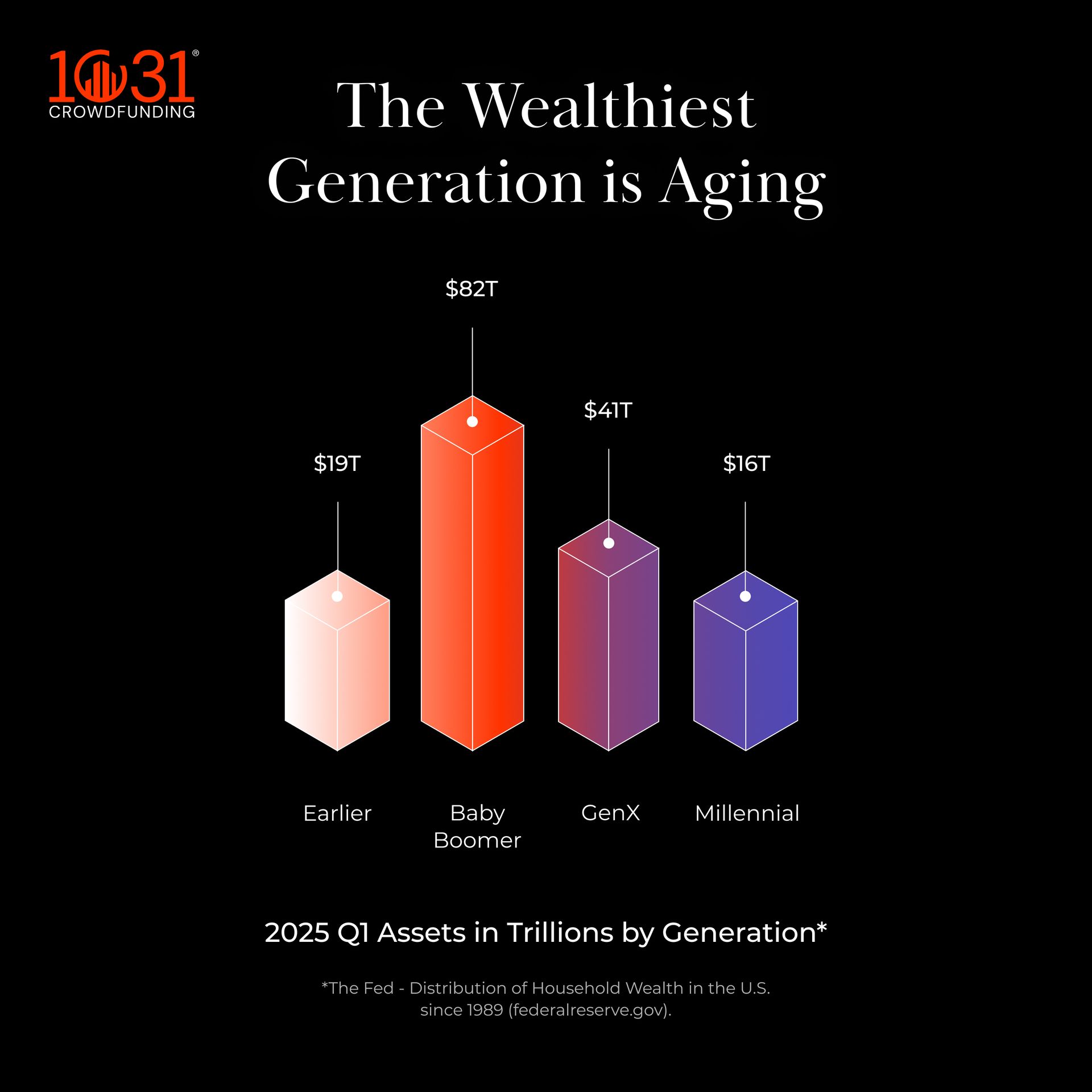

Senior housing has gained traction with institutional investors as the Baby Boomer generation, the wealthiest generation in U.S. history, ages into higher levels of care. This demographic shift is fueling unprecedented demand for assisted living and memory care communities.

Why invest in Senior Housing?

10,000 Americans turn 80 every day starting this year

+50% increase in demand for Americans ages 65+ who require nursing home care by 2030

Senior housing stands out as a sector built on necessity and backed by enduring demand

At 1031 Crowdfunding, we help investors access senior housing opportunities through tax-advantaged vehicles. We provide exposure to professionally managed portfolios while eliminating the challenges of direct property ownership.

Click to learn more about our diverse selection of senior housing investments today.

*Investments offered by Capulent LLC, member FINRA/SIPC. This is a paid advertisement. Please see the full disclosure at the bottom of the newsletter.

✍️ Editor’s Picks

Investor acquisition: See how you can impress and build lasting relationships with both institutional and individual investors in just 30 days. (sponsored)

Payment pause: Section 8 payments are delayed nationwide after the prolonged government shutdown.

Cooling rents: Rents dropped 1% in November as vacancies hit a record 7.2%, signaling ongoing softness in the multifamily market.

Fiscal pressure: Boston’s commercial property values are set to fall another 6%, as Mayor Wu pushes higher business taxes to shield homeowners from rising bills.

Boom county: Collin County has emerged as a North Texas economic engine, driven by tech growth, business-friendly policies, and coordinated local development.

Rent-linked raise: Santa Fe became the first U.S. city to tie minimum wage hikes to both inflation and housing costs.

🏘️ MULTIFAMILY

ULA fallout: Multifamily construction is down across Southern California, with developers wary of building in Los Angeles due to Measure ULA.

Housing venture: Crescent Communities and Heitman launched a second joint venture with up to $340M to expand their HARMON BTR communities.

Coastal edge: West Coast apartment markets outperformed national averages in Q3 2025 with stronger rent growth and higher occupancy.

Rent transparency: Greystar will pay $24M to settle allegations from the FTC and Colorado over hidden rental fees, following an earlier $7M antitrust settlement.

Delayed ownership: As the median age of first-time homebuyers hits 40, high mortgage costs and home prices continue pushing demand toward multifamily rentals.

🏭 Industrial

Speed sells: Amazon's new 30-minute delivery pilot, Amazon Now, is boosting demand for smaller urban warehouses.

Hub shutdown: FedEx will close its 280K SF Coppell, TX hub by April 2026, cutting 856 jobs after a key client switched to a new logistics provider.

Going big: Investcorp acquired a $400M industrial portfolio spanning 2.6M SF across 7 high-demand U.S. markets.

Warehouse worries: Industrial demand is improving but still trails supply, with high vacancies and cautious investor sentiment.

Risky growth: Skyrocketing demand for AI and data processing is driving data center development into high-risk markets like Houston and Miami.

Vertical logistics: Prologis approved to build San Francisco’s first multi-story warehouse, adding 1.6M SF of modern industrial space in Bayview.

Chicken hub: Chick-fil-A will open a $150M, 244,000 SF distribution center in Winter Haven, Florida by 2027.

🏬 RETAIL

Expansion mode: Retailers absorbed 5.5M SF in Q3 as chains like Dollar Tree and Tractor Supply rush to fill vacant space.

Bank buyback: J.P. Morgan Chase repurchased its Miami Beach retail branch for $23.5M, triple its 2010 sale price.

Corner conversions: Walgreens’ new owner, Sycamore Partners, may repurpose hundreds of store locations as it reassesses the chain’s real estate post-buyout.

Suburban strength: Chicago retail is booming in neighborhoods and suburbs due to limited supply, rising rents, and strong tenant demand.

Cyber surge: Cyber Monday sales hit $14.25B in the U.S., boosted by over $1B in Buy Now, Pay Later purchases.

🏢 OFFICE

Book deal: Scholastic is selling its NYC HQ for $386M and Missouri warehouses for $95M in sale-leasebacks.

Utilization rises: Office use is rising and vacancy is dipping as demand rebounds and new construction slows to a 25-year low.

Insta office: Instagram will require full-time office work starting in February, echoing a broader tech shift away from remote work.

WTC exit: Moody’s is negotiating a major downsizing, consolidating from 758K SF at 7 World Trade Center to 400K SF at Brookfield Place.

Stable sector: Medical office real estate remains a top performer in CRE, with steady rent growth and long-term tenant stability.

Investor alert: SL Green may cut its dividend in 2026, ending nearly a decade of steady payouts as earnings decline.

🏨 HOSPITALITY

Hotel flip: Clearview Hotel Capital secured a $48M loan from Knighthead Funding to acquire the Stamford Marriott and partially convert one of its towers into residential apartments.

Confidence returns: Blackstone’s acquisition of the Four Seasons Hotel in downtown San Francisco marks a vote of confidence in the city’s AI-driven hospitality rebound.

Queens exit: Taconic Capital sold a former LIC hotel for $25.5M, nearly $13M less than its 2021 purchase price.

WINTER ESSENTIALS

CRE Daily’s Holiday Merch Collection is Live

CRE Daily’s Winter Collection is officially live — built for holiday parties, office gift swaps, and end-of-year client drops.

Grab yours before they’re gone!

📈 CHART OF THE DAY

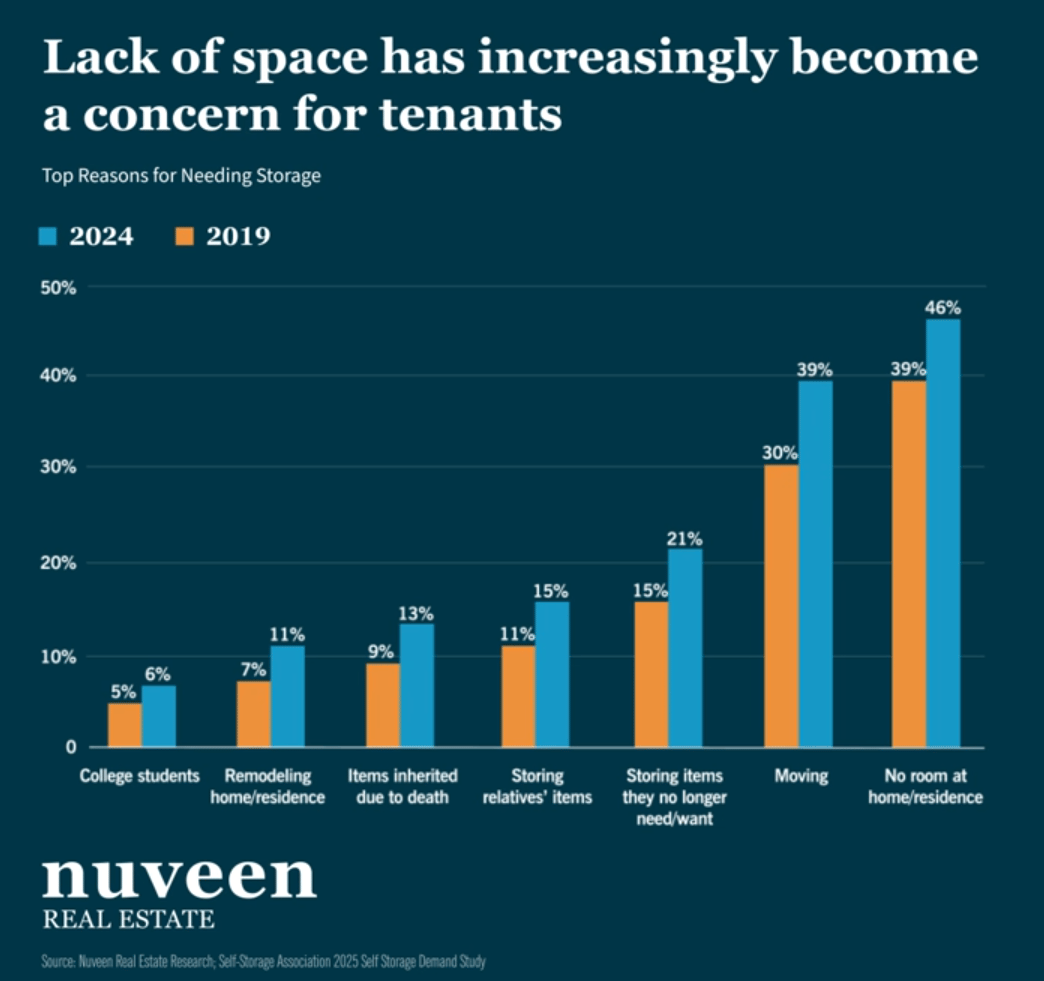

As homes get smaller and affordability tightens, self-storage demand is shifting from temporary moving needs to long-term space constraints, signaling more stable, lower-risk returns for investors.

CRE Trivia (Answer)🧠

The tallest residential building in the Western Hemisphere is Central Park Tower in New York City, which stands at 1,550 feet tall.

You currently have 0 referrals, only 1 away from receiving Multifamily Stress Test Model.

What did you think of today's newsletter? |

Reply