- CRE Daily

- Posts

- Build-to-Rent Developers Emerge as Winners in Trump’s Housing Crackdown

Build-to-Rent Developers Emerge as Winners in Trump’s Housing Crackdown

A policy shift is turning builders into the big winners of a crackdown meant to cool the housing market.

Good morning. Trump’s housing crackdown isn’t hitting every investor equally. In fact, one growing sector — build-to-rent — just got a political tailwind.

Today’s issue is sponsored by Reap Capital—acquiring mismanaged assets and restoring performance through proven local execution.

This week on No Cap: From Caesars’ bankruptcy to controlling half the Las Vegas Strip, VICI Properties CEO Edward Pitoniak reveals how experiential real estate quietly outperformed the skeptics.

CRE Trivia 🧠

What share of the industrial construction pipeline is now build-to-suit?

(Answer at the bottom of the newsletter)

Market Snapshot

|

| ||||

|

|

BTR Advantage

Build-to-Rent Developers Emerge as Winners in Trump’s Housing Crackdown

A new Trump policy cracking down on big investors buying homes has a loophole — and build-to-rent developers are walking right through it.

Wall Street goes BTR: President Trump’s latest order cracks down on institutional investors buying existing single-family homes to address affordability concerns. However, it carves out an exemption for BTR developments—a fast-growing sector that builds entire rental communities from the ground up.

Why it matters: BTR communities don’t compete with individual buyers, helping them avoid political backlash. With the exemption, firms like Quinn Residences, Invitation Homes, and Pretium are likely to speed up their shift toward the model, which offers scale, efficiency, and a political edge as a perceived “solution.”

Changing suburban landscape: Expect more suburban land to turn into rental enclaves as BTR expands. Experts see a shift in the owner-to-renter mix, driven by affordability pressures and rising demand for long-term rentals in school districts where buying is out of reach.

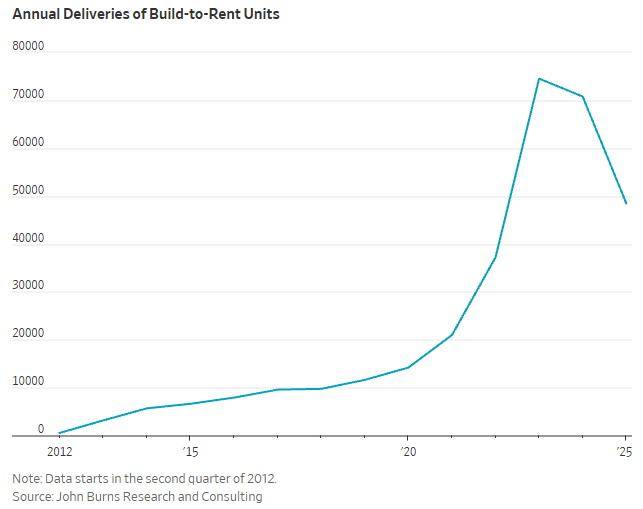

For context: BTR was growing well before the executive order. Since 2012, over 321,000 BTR homes have been built, with more than 75% built in the past five years. Rising rates and home prices had already pushed investors toward purpose-built rentals from builders like D.R. Horton and Lennar.

Lingering questions: Trump’s order boosts BTR but leaves questions, like whether pre-construction sales to investors qualify for the exemption. With Senate action possible, many investors are waiting for clearer rules.

➥ THE TAKEAWAY

BTR’s big moment: Build-to-rent was already rising — now it’s politically protected. Trump’s crackdown may accelerate a model that reshapes suburbs and recasts the American Dream as a lease rather than a mortgage.

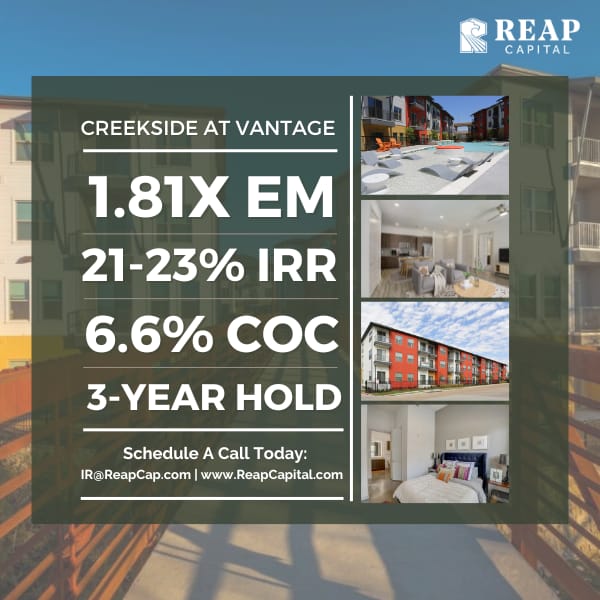

TOGETHER WITH REAP CAPITAL

2017 Vintage Operational Distress Creates Rare Dallas Value‑Add

We’re acquiring a mismanaged asset at 76% occupancy from an out‑of‑state owner who is severely cash‑constrained, resulting in underfunded operations, deferred turns, and stalled leasing momentum.

Entering at a 5.8% cap on stabilized occupancy, we unlock immediate operational upside by restoring basic execution.

As a Dallas-based operator with 1,000+ units within a 3‑mile radius, we’ve repeatedly taken assets from the low‑70% range to 90%+. This is a proven, repeatable Reap Capital strategy.

*This is a paid advertisement. Please see the full disclosure at the bottom of the newsletter.

✍️ Editor’s Picks

2026 Global Investment Outlook: Why does Hines Research think real estate is cleared for takeoff in 2026? Read the report for the latest views on how the ongoing recovery is playing out – and where. (sponsored)

SFR rethink: Negative rent growth in overbuilt Sun Belt metros is pushing SFR operators to slow starts, cut pricing, and pivot toward selective dispositions.

Walmart vs. Target: Only one is built for this economy. We analyze their sales trends to see two divergent tales. (sponsored)

Financing scrutiny: Senators are urging a probe into data center financing structures, raising underwriting and regulatory risk for highly leveraged projects.

Debt climb: Commercial and multifamily mortgage debt outstanding rose in Q3 2025, signaling refinancing activity is picking up despite elevated rates.

Fiscal stress: Analysts outline scenarios for a US fiscal crisis, with higher rates and forced spending cuts posing risks to real estate financing conditions.

🏘️ MULTIFAMILY

Multifamily forecast: The 2026 view anticipates improving transaction volume as rate pressure eases and bid-ask spreads narrow.

No firesales: Multifamily pricing softened, and deal flow slowed, but owners are avoiding forced sales as lenders extend maturities.

Cash stability: Independent landlords showed steadier rents and occupancy than larger owners, supporting more consistent cash flow.

Chicago buy: Giannis Antetokounmpo purchased a Chicago multifamily building, extending a personal acquisition streak amid selective buying.

🏭 Industrial

Storage pause: Self-storage fundamentals cooled entering 2026 as new supply peaks, pressuring rent growth and short-term valuations.

Defense lease: Anduril secured a major property deal tied to rising US defense spending, benefiting specialized industrial real estate.

Rail winners: Industrial demand is shifting toward secondary hubs along north–south rail lines as nearshoring reshapes logistics flows.

California question: Power, permitting, and water constraints are clouding California’s data center growth despite AI-driven demand.

🏬 RETAIL

Store uptick: US store openings are projected to rise in 2026 as retailers expand value, discount, and service-driven formats despite cautious overall growth.

Local focus: Retail strategies are shifting toward hyper-local concepts focused on daily needs and neighborhood convenience.

Stabilized sale: DJM sold a Mission Viejo retail property in Orange County, reflecting buyer interest in stabilized centers.

🏢 OFFICE

Shared offices: New shared-office models emphasizing private suites and services are reviving flexible workspace demand.

Conversions shelved: New York City office owners are dropping residential conversion plans as costs and incentives fail to pencil.

Office lending: Office loan originations surged 92% in key California metros, driven by recapitalizations and renewed lender activity.

🏨 HOSPITALITY

Mocktail boost: Mocktails helped hotel bars sustain January revenue, creating a margin-friendly beverage category.

Football funding: The Pro Football Hall of Fame campus secured $135M in financing, advancing its mixed-use development timeline.

A MESSAGE FROM ARBOR REALTY TRUST

Arbor Realty Trust’s Affordable Housing Trends Report

As the cost of living in the U.S. climbs, the shortage of affordable housing is a persistent challenge for many communities. As calls for change grow louder, Arbor Realty Trust and Chandan Economics document federal and state initiatives aimed at alleviating housing pressure.

Explore our investor’s guide to find out how new affordable housing opportunities and lingering challenges are converging in a sector known for its strength, stability, and consistency.

*This is a paid advertisement. Please see the full disclosure at the bottom of the newsletter.

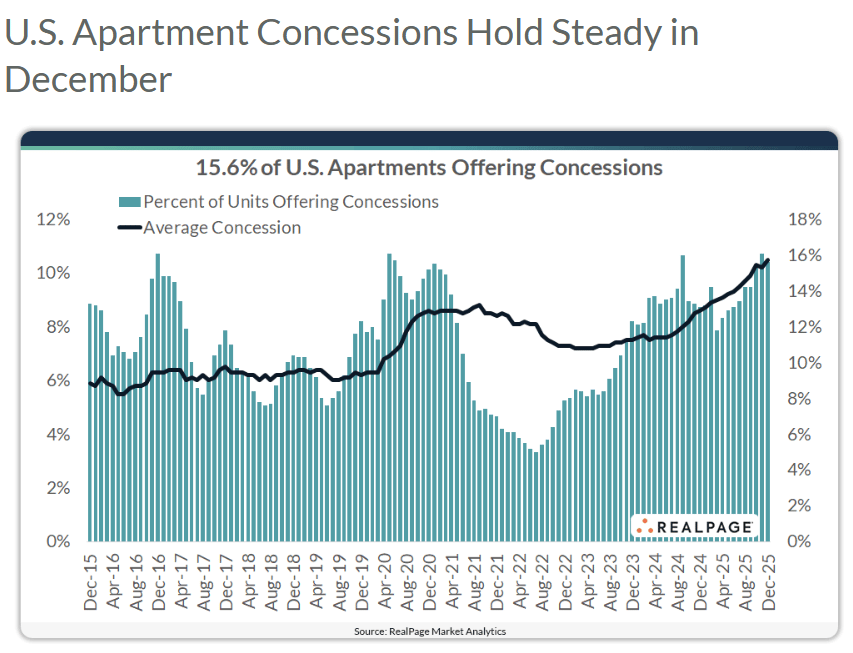

📈 CHART OF THE DAY

U.S. apartment concessions held steady in December, with 15.6% of stabilized units offering discounts averaging about 10.5%, the highest December usage rate since 2016.

CRE Trivia (Answer)🧠

Build-to-suit projects now account for 39% of the industrial construction pipeline, up from 34% a year ago.

More from CRE Daily

📬 Newsletters: Stay ahead of the market with local insights from CRE Daily Texas and CRE Daily New York.

🎙️Podcast: No Cap by CRE Daily delivers an unfiltered look at the biggest trends—and the money game behind them.

🗓️ CRE Events Calendar: The largest searchable calendar of commercial real estate events—filter by city or sector.

📊 Market Reports: A centralized hub for brokerage research and market intelligence, all in one place.

📈 Fear & Greed Index: A fully interactive sentiment tracker on the pulse of CRE built in partnership with John Burns Research & Consulting.

You currently have 0 referrals, only 1 away from receiving Multifamily Stress Test Model.

What did you think of today's newsletter? |

Reply