- CRE Daily

- Posts

- CBRE: 2026 to See Increased CRE Buying Activity

CBRE: 2026 to See Increased CRE Buying Activity

As pricing stabilizes and debt costs ease, investors are increasing capital allocations to real estate.

Good morning. Investor sentiment is turning a corner in 2026. CBRE’s latest survey shows 95% of investors plan to maintain or increase buying activity this year as pricing stabilizes and debt costs ease.

Today’s issue is sponsored by Delve—the AI copilot turning painful compliance work into a guided, automated workflow.

🎙️Worth a listen: VICI Properties CEO Edward Pitoniak explains how experiential real estate outperformed expectations, turning Caesars’ bankruptcy into control of half the Las Vegas Strip.

CRE Trivia 🧠

What part of the U.S. recorded the highest snowfall total during the January 2026 snowstorm?

(Answer at the bottom of the newsletter)

Market Snapshot

|

| ||||

|

|

Investor Sentiment

CBRE: 2026 to See Increased CRE Buying Activity

Investor appetite is on the rise in 2026, with most planning to deploy more capital into CRE, signaling renewed confidence in a market poised for recovery.

Capital allocations climb: 95% of investors plan to buy the same or more assets than in 2025, and 55% are increasing capital allocations to real estate this year—up from 48% last year. Stabilizing interest rates, better pricing, and improved fundamentals are driving this bullish shift.

Sunbelt stars: Dallas-Fort Worth remains the top U.S. market for the fifth year, followed by Atlanta and a surging San Francisco. Charlotte and Tampa cracked the top 10, signaling strong investor interest in Sun Belt and select gateway markets.

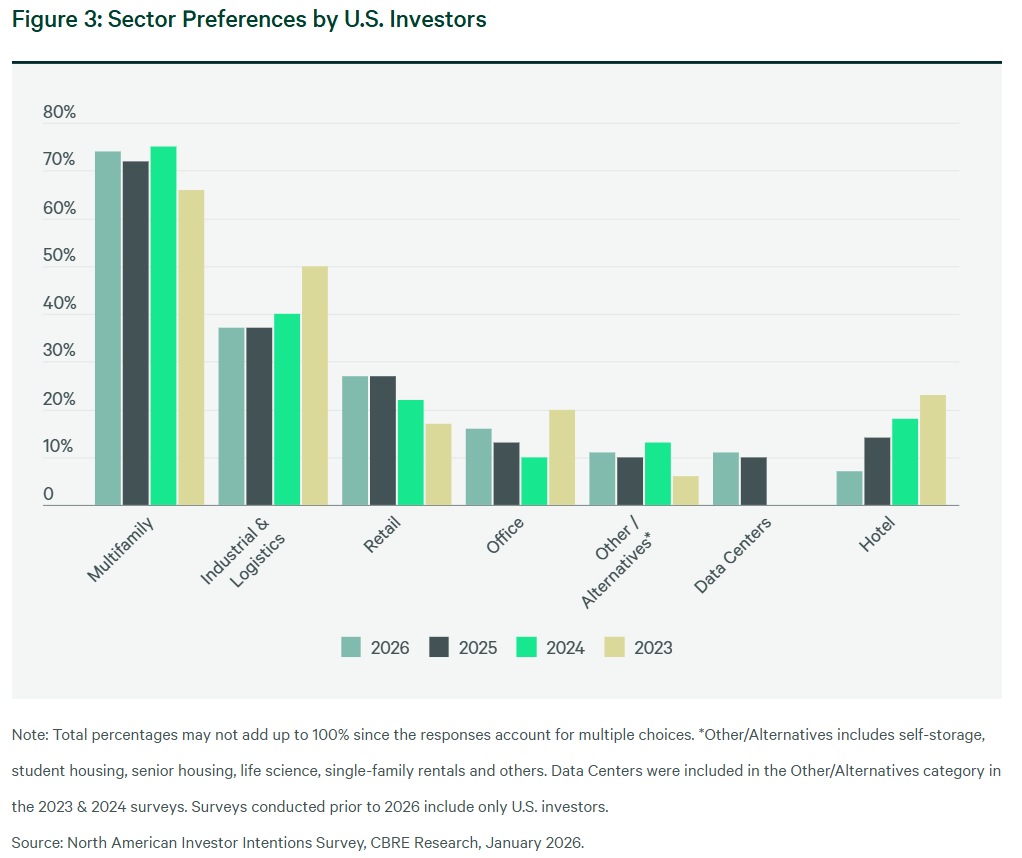

Top sector picks: Multifamily leads investor interest at 74%, followed by industrial (37%) and retail (27%), while office saw a modest rebound to 16%, focused on Class A assets. Only 11% are targeting alternatives like self-storage, as most favor repriced traditional sectors.

Moderate risk wins: Two-thirds of investors prefer value-add and core-plus strategies in 2026, favoring stable income with upside potential. Opportunistic and distressed plays are losing steam, with limited fire-sale activity expected—even for underperforming office assets.

Debt outlook: More than 70% of investors plan to keep debt-to-equity ratios steady. Nearly half are prepared to accept negative leverage for a year, confident that rent growth and refinancing at lower rates will boost returns long-term.

➥ THE TAKEAWAY

Back to buying: 2026 marks a cautious but confident return to CRE, fueled by improved pricing, stable fundamentals, and easing rate concerns. Investors are focusing on long-term growth with quality assets and moderate-risk strategies—not distressed deals.

TOGETHER WITH DELVE

Your copilot for compliance is here

Ever been tired, stuck, and miserably documenting something it feels like AI was born to do? AI finally delivered.

Delve's AI copilot understands your entire tech stack and tells you exactly what to do next. Just ask it "What's my next step? Take me there" and watch Copilot read your screen and start doing tasks for you. Congrats, you've found the light at the end of the tunnel.

Join Wisprflow, 11x, Bland, and more in the future of compliance with Delve.

Book a demo here to get $1,500 off compliance and see Copilot in action.

*This is a paid advertisement. Please see the full disclosure at the bottom of the newsletter.

✍️ Editor’s Picks

Multifamily math: As margins tighten, operators turn to deal models that reflect how the deal actually gets done—debt, equity, and investor terms included. (sponsored)

Alt surge: Alternative investment fundraising reached $203.7B in 2025, up 31% YoY as investor appetite for non-traditional assets remained strong.

Rate pause: CRE leaders welcomed the Fed’s decision to hold rates steady, sparking hope for a more favorable lending environment this year.

CMBS resilience: CMBS volume notched another solid year in 2025, supported by a resilient multifamily sector and steady investor demand.

Immigration drag: CRE underwriting is being reshaped as slowing immigration pushes jobless growth, reducing long-term demand assumptions.

🏘️ MULTIFAMILY

Golden goodbye: Camden Property Trust is reportedly looking to exit California with a $1.5B multifamily portfolio sale amid regulatory and return concerns.

Cold start: Rents continue sliding nationwide as a flood of new multifamily units meets tepid demand, pushing vacancies and time-on-market to record highs.

Tenant fallout: Restrictive immigration policies have created instability in the multifamily sector, weakening household formation and renter demand.

Raleigh rise: A new report projects growing investor interest and rent growth in Raleigh’s multifamily market, fueled by job and population gains.

Playbook markets: Top-performing multifamily markets use similar strategies—low supply, steady job growth, and affordability—to stay ahead.

🏭 Industrial

Mega deal: Ares and Makarora completed a $2.1B deal for Plymouth Industrial REIT, continuing the trend of consolidation in the industrial space.

Regional strength: Transwestern delivered a new 560K SF industrial park in Houston, targeting strong logistics and distribution demand in the region.

Power shift: The U.S. is letting power grids draw electricity from data centers to prevent blackouts during winter storms, revealing new energy trade-offs.

🏬 RETAIL

Brew boost: Starbucks plans to open up to 650 new stores in 2026 as its turnaround gains traction, signaling confidence in global retail expansion.

Retail scoop: Arizona snapped up three locations of a frozen yogurt chain, highlighting opportunistic retail plays in secondary markets.

Consumer confidence: Retail markets are benefiting from stable consumer demand, while experiential tenants continue to drive leasing activity.

Retro revival: A mid-century Googie-style diner was saved from demolition and converted into a Chick-fil-A, blending preservation with fast food.

🏢 OFFICE

Lab exit: BXP is exiting West Coast lab markets and reallocating capital into office and housing assets, reflecting shifting investor priorities.

Deloitte deal: Deloitte signed the largest office lease by value since the pandemic, signaling renewed demand for high-end workspace.

Desk demand: Office demand cooled 8% in Q4 2025 but still rose 6% year-over-year, as a softening labor market gave employers more leverage to push for in-office work.

🏨 HOSPITALITY

Historic housing: Bridgeton purchased the Sheraton Miami Airport Hotel, indicating confidence in airport-adjacent hospitality assets.

Project reset: A stalled hotel-condo site in Williamsburg sold for $30M to Joyland Management, ending its troubled development saga.

📈 CHART OF THE DAY

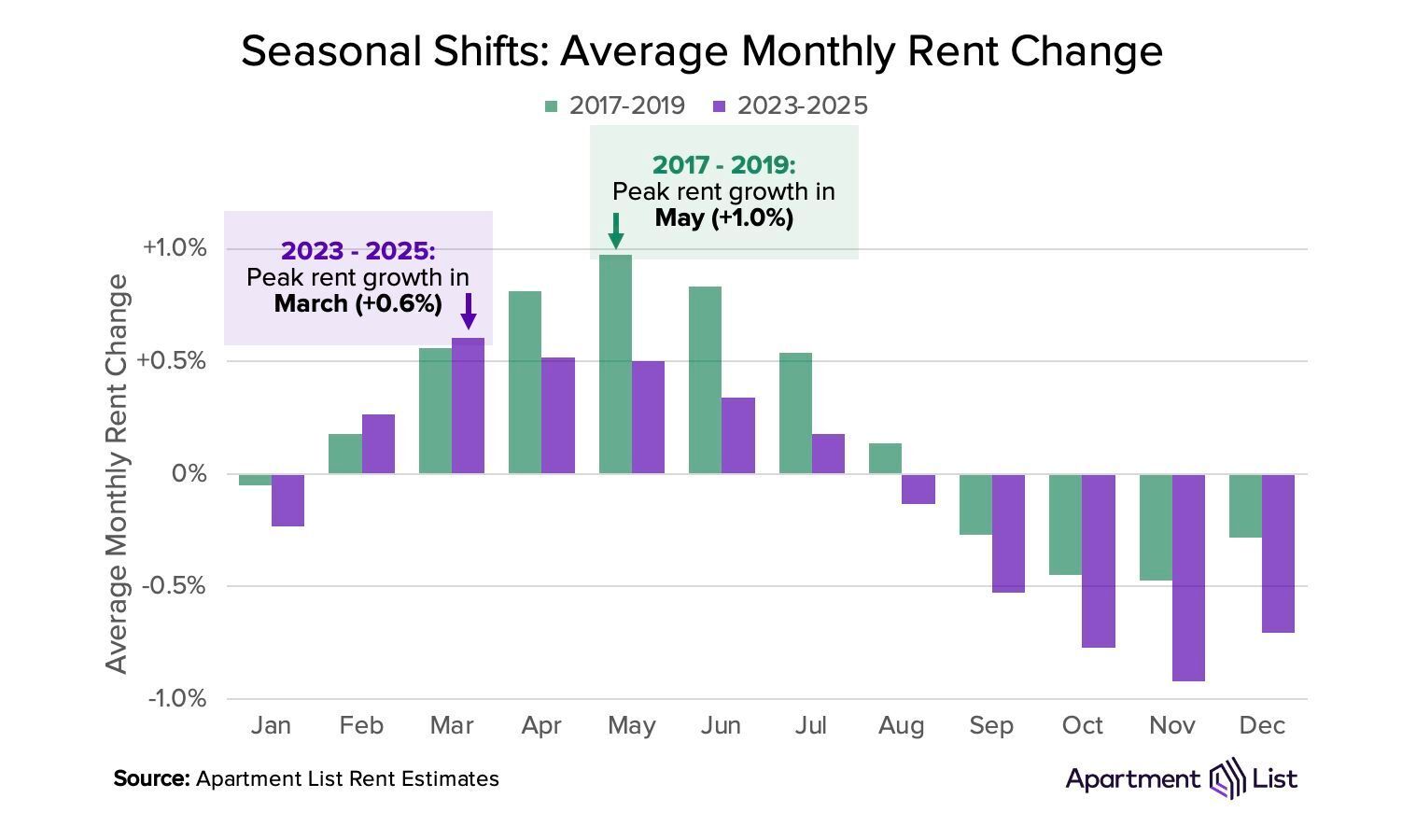

Since mid-2022, rent growth has not only trended downward overall but also shifted earlier in the year, with seasonal peaks now occurring in March at lower rates than pre-pandemic highs in May.

CRE Trivia (Answer)🧠

The Bonito Lake area near Ruidoso, New Mexico, recorded the highest total, with about 31 inches of snow.

More from CRE Daily

📬 Newsletters: Stay ahead of the market with local insights from CRE Daily Texas and CRE Daily New York.

🎙️Podcast: No Cap by CRE Daily delivers an unfiltered look at the biggest trends—and the money game behind them.

🗓️ CRE Events Calendar: The largest searchable calendar of commercial real estate events—filter by city or sector.

📊 Market Reports: A centralized hub for brokerage research and market intelligence, all in one place.

📈 Fear & Greed Index: A fully interactive sentiment tracker on the pulse of CRE built in partnership with John Burns Research & Consulting.

You currently have 0 referrals, only 1 away from receiving Multifamily Stress Test Model.

What did you think of today's newsletter? |

Reply