- CRE Daily

- Posts

- CMBS Debt Wall Arrives, But Crisis Isn’t Guaranteed

CMBS Debt Wall Arrives, But Crisis Isn’t Guaranteed

A record wave of maturing CMBS loans is testing the market’s ability to refinance amid high rates and tighter credit.

Good morning. Over $100B in CMBS loans are set to mature in 2026, testing CRE’s ability to adapt. But instead of a crash, experts see a recalibration, with both challenges and unexpected opportunities emerging.

Today’s issue is sponsored by Delve—the AI copilot turning painful compliance work into a guided, automated workflow.

🎙️ Don’t miss this one: Hoya Capital’s David Auerbach unpacks the growing disconnect between public and private REIT valuations, and what it means for capital heading into 2026.

CRE Trivia 🧠

Which major CRE asset class had the lowest vacancy rate in 2025?

(Answer at the bottom of the newsletter)

Market Snapshot

|

| ||||

|

|

Maturity Wall

CMBS Debt Wall Arrives, But Crisis Isn’t Guaranteed

The looming wave of commercial mortgage maturities in 2026 isn’t the crisis some feared — but it’s certainly reshaping the landscape.

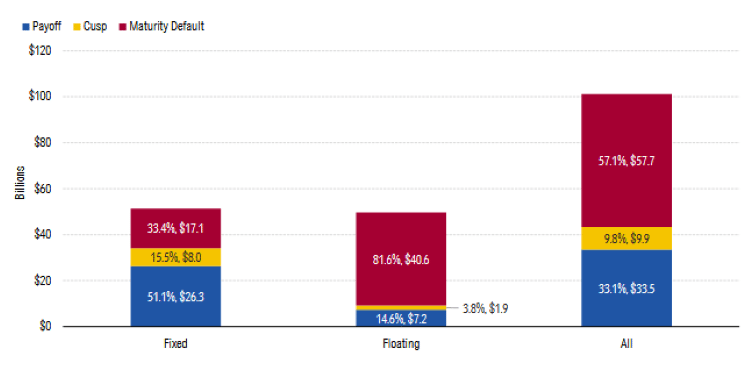

The maturity wall: Over $100B in CMBS loans mature in 2026, with over half likely to miss repayment. Instead of widespread defaults, many will be modified—historically a lower-loss path that gives borrowers time to recover.

2026 Payoff Forecast. Chart courtesy of Intex and Morningstar DBRS

A repricing, not a panic: Experts see the CMBS maturity wave as a market correction, not a crisis, driven by post-peak repricing. Past “maturity wall” fears rarely materialized, with the real challenge now being the gap between past cap rates and today’s higher return expectations.

A gradual reset: CMBS accounts for just 15% of $1T in maturing CRE debt, suggesting dispersed risk and a gradual workout, not a sharp shock. Refinance activity is up 42% and private debt funds have surged 50%, expanding options for even troubled assets.

Still the weak link: Morningstar remains bearish on office due to steep value declines, but the market is clearly split. Top assets are still leasing, while outdated ones are being repurposed, prompting lenders to focus on asset-level performance over broad sector trends.

Retail’s resurgence: Retail is a 2026 bright spot, despite valuation drops. Tight supply, strong demand, and solid returns are drawing institutional capital, positioning retail as one of the most defensive—and promising—asset classes.

➥ THE TAKEAWAY

Navigating the reset: The 2026 CMBS wall is a stress test, not a crisis. With rising refinancing and retail momentum, the market is recalibrating, creating opportunity for investors.

TOGETHER WITH DELVE

Your copilot for compliance is here

Ever been tired, stuck, and miserably documenting something it feels like AI was born to do? AI finally delivered.

Delve's AI copilot understands your entire tech stack and tells you exactly what to do next. Just ask it "What's my next step? Take me there" and watch Copilot read your screen and start doing tasks for you. Congrats, you've found the light at the end of the tunnel.

Join Wisprflow, 11x, Bland, and more in the future of compliance with Delve.

Book a demo to get $1,500 off compliance and see Copilot in action.

*This is a paid advertisement. Please see the full disclosure at the bottom of the newsletter.

✍️ Editor’s Picks

AI underwriting assistant: Reduce underwriting time by 10x — parse, analyze, and identify the most promising multifamily deals in minutes with your personal AI underwriting assistant. (sponsored)

Rate rage: As insurers report near-record profits, political pressure mounts to curb home and auto rate hikes that continue to strain household budgets.

Grind ahead: CRE’s long slog to recovery could stretch through 2029, as maturing debt, high long-term rates, and uneven sector performance reshape the market’s trajectory.

Estate strategy: Delaware Statutory Trusts are seeing record demand amid limited supply and a historic wealth transfer as investors seek tax deferral, estate-planning benefits, and passive income.

Euro exit: European investors are retreating from U.S. real estate over political uncertainty and rising geopolitical tensions.

Proptech pause: Fifth Wall is cutting staff and halting fundraising as interest rate whiplash and shifting climate policies chill investor confidence.

Funding frenzy: Developers are scrambling to unlock new capital sources as the $3T AI data center boom pushes traditional financing to its limits.

🏘️ MULTIFAMILY

Rent relief: Renter affordability improved at the end of 2025, with falling rents, record concessions, and slowing growth easing the pressure on household budgets.

Strategic renting: Gen Z and millennial renters are adapting to high housing costs by delaying milestones, prioritizing flexibility, and reshaping what “making it” looks like in 2026.

Model shift: As multifamily lending tightens, lenders are leaning on discounted cash flow models to navigate a post-boom landscape of uneven property performance and rising credit risk.

Fresh capital: Three AION Partners alums have launched Cold Spring Capital, aiming to invest $1B in middle-market and workforce multifamily deals across the Northeast, Midwest, and Mid-Atlantic.

🏭 Industrial

Record year: Prologis set a record with 228M SF leased in 2025 and is ramping up data center development amid rising logistics and AI demand.

IOS shift: With pricing misaligned, IOS owners are holding and leasing as tighter underwriting and zoning hurdles reshape the market.

Chip rush: TSMC is accelerating its $165B Phoenix expansion, now aiming to open a second chip plant by 2027.

Sunbelt push: Realterm has acquired a 325K SF, 22-property industrial portfolio across nine states, expanding its IOS and high-flow through footprint.

Cold deal: Lineage Logistics has sold a 226K SF cold storage facility in Santa Maria, CA for $60M, expanding Arctic Cold’s state footprint to 1.3M SF.

🏬 RETAIL

Center strategy: Investor demand and strong sales fundamentals are driving shopping center prices to record highs in 2026.

Minimal exposure: GameStop’s 400-plus store closures in early 2026 pose little risk to CMBS, with low exposure and solid loan performance making it a leasing event, not a credit concern.

Steady footing: Vacancies held at 4.3% in Q4 2025 as the market absorbed past bankruptcies, with strong absorption and limited new supply supporting retail stability.

🏢 OFFICE

Buyer return: NYC office investment jumped 30% to $11B in 2025, signaling renewed confidence in the sector after a wave of high-profile deals.

Loop listing: Blackstone is exploring a sale of Chicago’s Willis Tower as it tests the market amid major leases and a $1.3B loan.

Distress deals: Private buyers are seizing discounted D.C. office buildings as institutions pull back and lenders sell at a loss.

🏨 HOSPITALITY

Western gains: Hotel sales grew across Denver and other Mountain West cities in 2025, while coastal markets like Seattle slowed amid shifting investor priorities.

Calendar upside: Weekend-aligned holidays in 2026 are driving stronger hotel demand in leisure markets, giving hoteliers a revenue edge despite ongoing weakness in business travel.

📈 CHART OF THE DAY

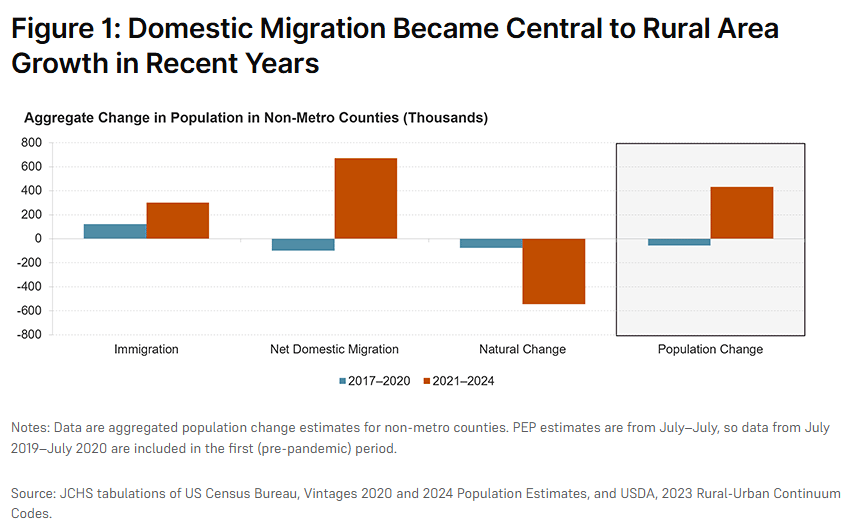

Rural population growth flipped positive after the pandemic as surging domestic migration more than offset rising natural population losses.

CRE Trivia (Answer)🧠

According to CoStar, Retail posted the lowest vacancy rate, as limited new supply and years of over-correction pushed vacancies below pre-pandemic levels in many markets.

More from CRE Daily

📬 Newsletters: Stay ahead of the market with local insights from CRE Daily Texas and CRE Daily New York.

🎙️Podcast: No Cap by CRE Daily delivers an unfiltered look at the biggest trends—and the money game behind them.

🗓️ CRE Events Calendar: The largest searchable calendar of commercial real estate events—filter by city or sector.

📊 Market Reports: A centralized hub for brokerage research and market intelligence, all in one place.

📈 Fear & Greed Index: A fully interactive sentiment tracker on the pulse of CRE built in partnership with John Burns Research & Consulting.

You currently have 0 referrals, only 1 away from receiving Multifamily Stress Test Model.

What did you think of today's newsletter? |

Reply