- CRE Daily

- Posts

- CMBS Delinquency Inches Higher, But Office Shows Unexpected Resilience

CMBS Delinquency Inches Higher, But Office Shows Unexpected Resilience

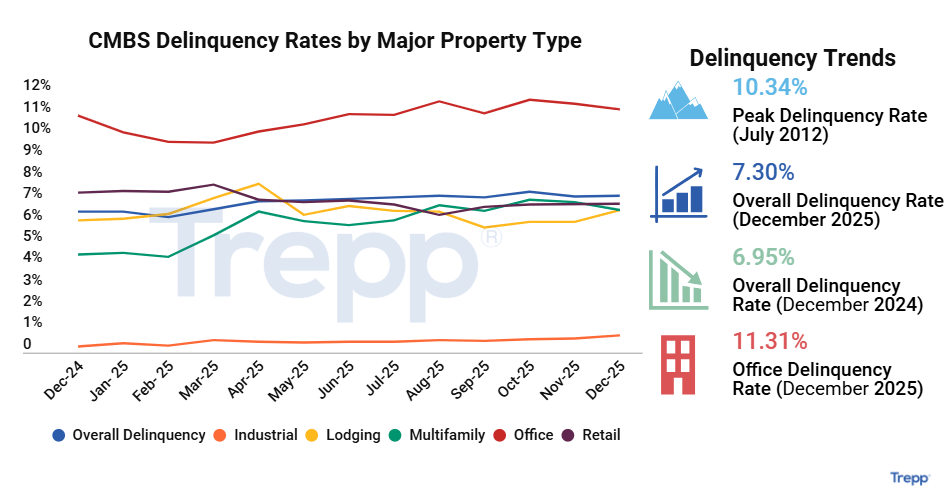

Delinquencies rose slightly in December, but office properties posted their second month of improvement.

Good morning. CMBS delinquencies ticked up at year-end, but not all sectors are moving in lockstep. Office showed a rare second month of improvement, hinting at early signs of stabilization.

📊 In case you missed it: The Q4 2025 Burns + CRE Daily Fear & Greed Index offers key insights into 2026. Explore investor sentiment, capital access, and sector-level outlooks shaping the CRE landscape.

CRE Trivia 🧠

Data centers now consume roughly what percentage of total U.S. electricity demand?

(Answer at the bottom of the newsletter)

Market Snapshot

|

| ||||

|

|

Delinquency Update

Commercial Real Estate Poised for Cautious Recovery in 2CMBS Delinquency Inches Higher, But Office Shows Unexpected Resilience026

After a slight dip last month, CMBS delinquencies crept back up in December, but office once again surprised with improving numbers.

By the numbers: The CMBS delinquency rate rose to 7.30% in December, up 4 bps from November and 73 bps year-over-year. Lodging, industrial, and retail saw increases, while office (-37 bps to 11.31%) and multifamily (-34 bps to 6.64%) improved.

Signs of life: Office posted the only significant net improvement, cutting $510M in delinquencies—its second straight month of gains. Still, it's up 973 bps from December 2022.

Retail drives stress: Retail led new delinquencies with a $179M net increase, followed by mixed-use at $145M. Nearly $2.9B in new delinquencies were offset by $3.0B in cures, resulting in a modest $103M net decline.

CMBS 2.0+: The CMBS 2.0+ delinquency rate rose three bps to 7.20%, while serious delinquencies dipped slightly to 6.90%. Excluding defeased loans, the rate rises to 7.41%, up eight bps.

Serious delinquencies steady: Across all CMBS loans, the percentage considered “seriously delinquent” remained flat at 7%. This includes loans 60+ days delinquent, in foreclosure, REO, or non-performing matured balloons.

➥ THE TAKEAWAY

Big picture: Despite a slight rise in overall delinquency, continued improvement in the office sector is a key bright spot heading into 2026. Investors should watch retail and mixed-use, now emerging as primary stress points.

FEAR & GREED

How CRE Investors Really Feel Heading Into 2026

Capital access is improving for the first time in survey history—and sentiment just hit its strongest level of the year.

The Q4 2025 Burns + CRE Daily Fear & Greed Index reveals where investors see opportunity, where distress is building, and how expectations are shifting across multifamily, office, retail, and more.

Download the full 28-page report for sector-by-sector data, charts, and investor commentary.

*This is a paid advertisement. Please see the full disclosure at the bottom of the newsletter.

✍️ Editor’s Picks

Top reads for 2026: From investing and development to proptech and leadership, this curated list features 2026’s must-read books for every stage of your CRE journey.

Fraud fallout: Walker & Dunlop may repurchase $100M in loans after borrower fraud tied to Freddie Mac deals comes to light.

Bankruptcy boom: U.S. corporate bankruptcies surged to their highest level since 2010, with over 700 large firms filing as inflation, high rates, and affordability pressures weigh heavily on businesses.

Trust belt: States like South Dakota are attracting fund managers with trust structures that shield carried interest from state taxes while offering long-term asset protection.

Hiring chill: Big employers are freezing or trimming hiring in 2026 as AI adoption and economic uncertainty reshape workforce strategies and slow job growth—without a recession.

🏘️ MULTIFAMILY

Desert demand: Sunstone and Capital Square are launching a 238-unit build-to-rent project in Buckeye, AZ, as Phoenix’s BTR pipeline swells but occupancy remains strong at 93.6%.

Luxury glut: Boston’s luxury condo market is oversupplied and underperforming amid high prices, slowing demand, and economic headwinds, which are stalling sales.

Growth imbalance: Fast growth along Austin–San Antonio’s I-35 corridor is straining rents and occupancy despite solid job and population gains.

Seattle surge: Timberlane and PCCP acquired the 532-unit Jackson Apartments for $173M as Seattle multifamily sales more than doubled year-over-year to $3.7B.

🏭 Industrial

Display deal: SoarDist Displays & Apparel signed an 89-month lease for 30K SF of industrial space in Garden Grove, CA.

Capacity race: U.S. data center construction could hit up to $930B annually by 2027, per Fed projections, as AI and cloud demand drive an unprecedented building boom.

Sector shift: Texas manufacturing activity declined in December, with output, new orders, and shipments all falling, according to the Dallas Fed's latest survey.

🏬 RETAIL

Debt spiral: Saks Global is nearing bankruptcy after missing a $100M interest payment and struggling under debt from its Neiman Marcus merger.

Mini market: Amazon is testing smaller-format Whole Foods stores in dense urban areas, aiming to boost convenience and attract new shoppers.

Brew reset: Facing profit declines and overexpansion fatigue, Starbucks is closing hundreds of stores and pivoting to smaller, efficiency-focused formats.

Sweet goodbye: Sprinkles Cupcakes, the pioneer of gourmet cupcake retail and creator of the cupcake ATM, is closing all its stores after nearly two decades in business.

🏢 OFFICE

Golden exit: A growing wave of companies—including Chevron, In‑N‑Out, and Realtor.com—left California in 2025, citing high taxes, regulation, and business costs.

Valley surge: Phoenix’s office market saw over $1B in sales and the lowest vacancy among peers in 2025, driven by steady development, major deals, and growing coworking demand.

Orange loan: Wells Fargo loaned $57M to MGR Real Estate for its $89M purchase of the 384K SF Orange City Square office campus in Southern California.

Lease lift: Nvidia led Austin’s nearly 1M SF in major office leases for 2025, with tech firms favoring the Domain despite rising vacancies and a still-heavy sublease market.

🏨 HOSPITALITY

Partner push: In 2025, hotel brands turned to partnerships to scale efficiently, with India leading global expansion efforts.

Goal rush: The 2026 FIFA World Cup is set to drive a $900M boost in hotel revenue in the U.S., with international fans flooding host cities, and some markets expected to see Super Bowl-level demand surges.

📈 CHART OF THE DAY

Source: JBREC and CRE Daily

Local governments in several markets are increasingly restricting new self-storage development through moratoriums and tighter review processes, making entitlement risk, timing, and political awareness more critical for developers than ever.

CRE Trivia (Answer)🧠

Data centers account for about 4% of total U.S. electricity demand — a figure expected to double by 2030, according to the US Department of Energy.

You currently have 0 referrals, only 1 away from receiving Multifamily Stress Test Model.

What did you think of today's newsletter? |

Reply