- CRE Daily

- Posts

- Commercial Real Estate: Out of Favor, but Maybe Not for Long

Commercial Real Estate: Out of Favor, but Maybe Not for Long

Commercial property is quietly becoming a hedge against overheated markets.

Good morning. While most assets feel overpriced, CRE is one of the few that still looks fairly valued, and a growing number of institutions are taking notice.

🎙️This Week No Cap: Jon Schultz, Co-Founder and Managing Principal of Onyx Equities, sits down with Jack and Alex to break down the art of value creation, the future of office, and why adaptability is real estate’s most underrated skill.

CRE Trivia 🧠

What is the national U.S. office vacancy rate as of November 2025?

(Answer at the bottom of the newsletter)

Market Snapshot

|

| ||||

|

|

The Price is Right

Commercial Real Estate: Out of Favor, but Maybe Not for Long

After years of lackluster returns, commercial real estate is starting to look like a value play amid overpriced equity markets and a potential AI bubble.

CRE’s fall from favor: Institutional investors, once the backbone of the commercial property market, have stepped back. Despite five Fed rate cuts since late 2024, many remain cautious. The pandemic, inflation, and rate hikes sent values tumbling, while investors also misjudged the cost of updating aging buildings. CRE values remain 17% below 2022 peaks, with offices and apartments down 36% and 19%, respectively.

Returns don’t compare: Private real estate funds returned just 20% since Q3 2019, compared to 150% for the S&P 500. Alternatives like infrastructure, private credit, and data centers have pulled capital away. Today, lending against property often looks better than owning it. But steep CRE valuation drops are rare—and may offer contrarian upside.

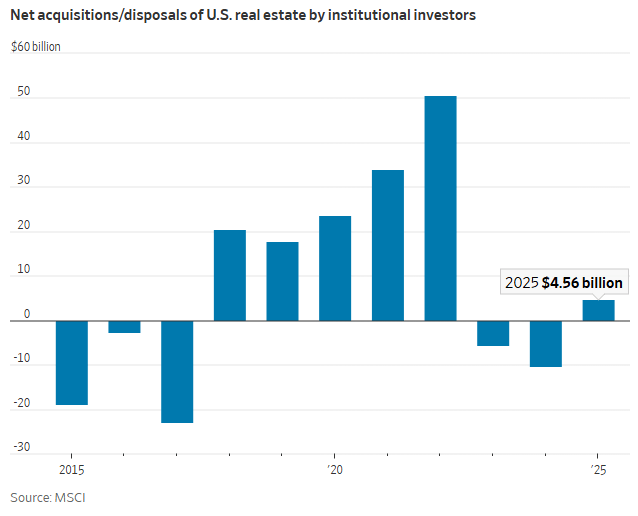

Signs of value emerging: Despite the bearish narrative, net institutional buying turned positive in 2025 for the first time in three years, per MSCI. Firms like RXR and Blackstone are picking up Manhattan and San Francisco assets at 30–50% below peak. Publicly traded real estate stocks are also at their deepest discount to U.S. equities in 20 years.

New rules of the game: The old real estate playbook—cheap debt and rising values—is outdated. Now, success depends on stable income. Sectors like senior housing, retail, and quality offices are holding up, as 40% higher construction costs since 2020 limit new supply—potentially fueling steady rent growth for current owners.

➥ THE TAKEAWAY

Still in the game: With values beaten down, new construction constrained, and income stability growing in select sectors, CRE could quietly become a haven, especially if the AI-fueled equity surge starts to sputter.

WINTER ESSENTIALS

CRE Daily’s Holiday Merch Collection is Live

CRE Daily’s Winter Collection is officially live — built for holiday parties, office gift swaps, and end-of-year client drops.

Grab yours before they’re gone!

✍️ Editor’s Picks

20-40% lower insurance rates: Strategic Insurance Group’s fixed-rate program is filling fast. Submit quote today to reserve your spot before 12/15. Limited availability. Check if your property is eligible. (sponsored)

Delinquency dip: The CMBS delinquency rate fell to 7.26% in November, driven by declines in retail, multifamily, and office loans.

Capital relief: U.S. regulators eased capital rules for big banks by capping leverage requirements tied to Treasury holdings, aiming to boost bond demand and free up lending capacity.

Fed watch: The Fed is monitoring rising risks in CRE loans due to high rates, tighter lending, and falling property values.

Limestone legacy: Architect Robert A.M. Stern, known for blending classical design with modern luxury in NYC landmarks, has died at 86.

Bowser's exit: Mayor Bowser departs amid D.C. redevelopment progress and ongoing struggles with office vacancies and federal relations.

Debt strategy: Nuveen closed its $650M real estate debt fund to finance transitional properties as traditional lenders retreat.

🏘️ MULTIFAMILY

Crash warning: Analyst Melody Wright predicts U.S. home prices could fall over 50%, outpacing the 2008 crash.

Care capital: Kayne Anderson has raised $2.5B for a real estate fund focused on senior housing, medical offices, and student housing.

Soft market: Apartment sales dropped 28% YoY in October to $10.2B, though prices and cap rates remained stable.

Urban reuse: GFP and Metro Loft landed an $835M refi from Apollo and GIC for their office-to-resi project at 25 Water Street in Manhattan.

Aging opportunity: Town Lane and Kelly Sheehy launched Arcole to target value-add senior housing deals across the U.S.

🏭 Industrial

Soaring sales: Self storage sales hit $1.6B in Q3 2025, up 62% year-over-year as REITs and private investors ramp up acquisitions.

Funding gap: OpenAI faces a $200B shortfall to meet its massive data center commitments by 2030, per HSBC.

Warehouse giant: Ares launched Marq Logistics, merging global platforms to manage 600M SF across 2,000 properties, making it the third-largest industrial landlord.

Amazon deal: Amazon paid $79M for a Pasadena flex property, signaling possible future use tied to digital infrastructure or data centers.

Mega build: Trammell Crow has proposed a $21B, 12M SF data center campus in Forsyth, Georgia, one of the largest such projects in U.S. history.

🏬 RETAIL

Growth partnerships: With retail construction slowing, national chains are partnering with developers to creatively deliver new sites and drive growth.

Rent gap: Retail workers earn far too little to afford the average apartment, with many spending over half their income on rent.

Retail resilience: Retail remains strong despite high costs and limited supply, driven by adaptive reuse, strategic leasing, and steady demand for essential retail.

Tech town: Huntsville’s MidCity is turning a former mall into a walkable hub for tech talent, fueled by job growth, young professionals, and national retail interest.

Pizza playbook: Papa Johns is expanding with 52 new mid-Atlantic locations by 2030 as Pie Investments takes over 85 stores.

🏢 OFFICE

Cost creep: Office fit-out costs in 2025 varied globally due to labor shortages, supply chain strain, and rising tech and sustainability demands.

Hedge HQ: TGS Management is planning a $300M office campus in Irvine, doubling its footprint with a low-density, amenity-filled design.

Lease cliff: California’s CBD office markets face rising distress as a wave of large 10-year lease expirations from 2018–2019 approaches.

Adaptive reuse: Metro Loft and GFP Real Estate secured $835M to refinance 25 Water Street, one of the nation’s largest office-to-residential conversions.

Distress hunt: Cannon Hill and TriPost Capital have formed a $1.5B partnership to target distressed office assets in NYC, Boston, and D.C.

Plan pivot: Manulife US REIT is seeking shareholder approval to sell up to $350M in office assets and invest $600M into industrial, multifamily, and retail properties.

🏨 HOSPITALITY

Brand fusion: Waterford Hotel Group and Maverick Hotels have merged, surpassing 50 properties and forming a unified hospitality group.

Vegas boost: Blackstone is receiving an $800 million preferred equity investment from Realty Income for its CityCenter Las Vegas assets.

Goal rush: Smaller and leisure-focused hotel markets like Kansas City and Vancouver are poised for the biggest RevPAR boosts during the 2026 World Cup.

A MESSAGE FROM THE AI FOR CRE COLLECTIVE

AI for CRE That Actually Works

The AI for CRE Collective is where commercial real estate professionals go to actually implement AI.

400+ brokers, investors, developers, and operators sharing what works. Weekly live trainings, 115+ tested workflows, role-specific guidance for your exact job.

This isn't AI hype—it's practitioners solving real problems: faster underwriting, better market research, deal analysis that doesn't consume your weekend.

Join the community where CRE meets AI that actually works.

*This is a paid advertisement. Please see the full disclosure at the bottom of the newsletter.

📈 CHART OF THE DAY

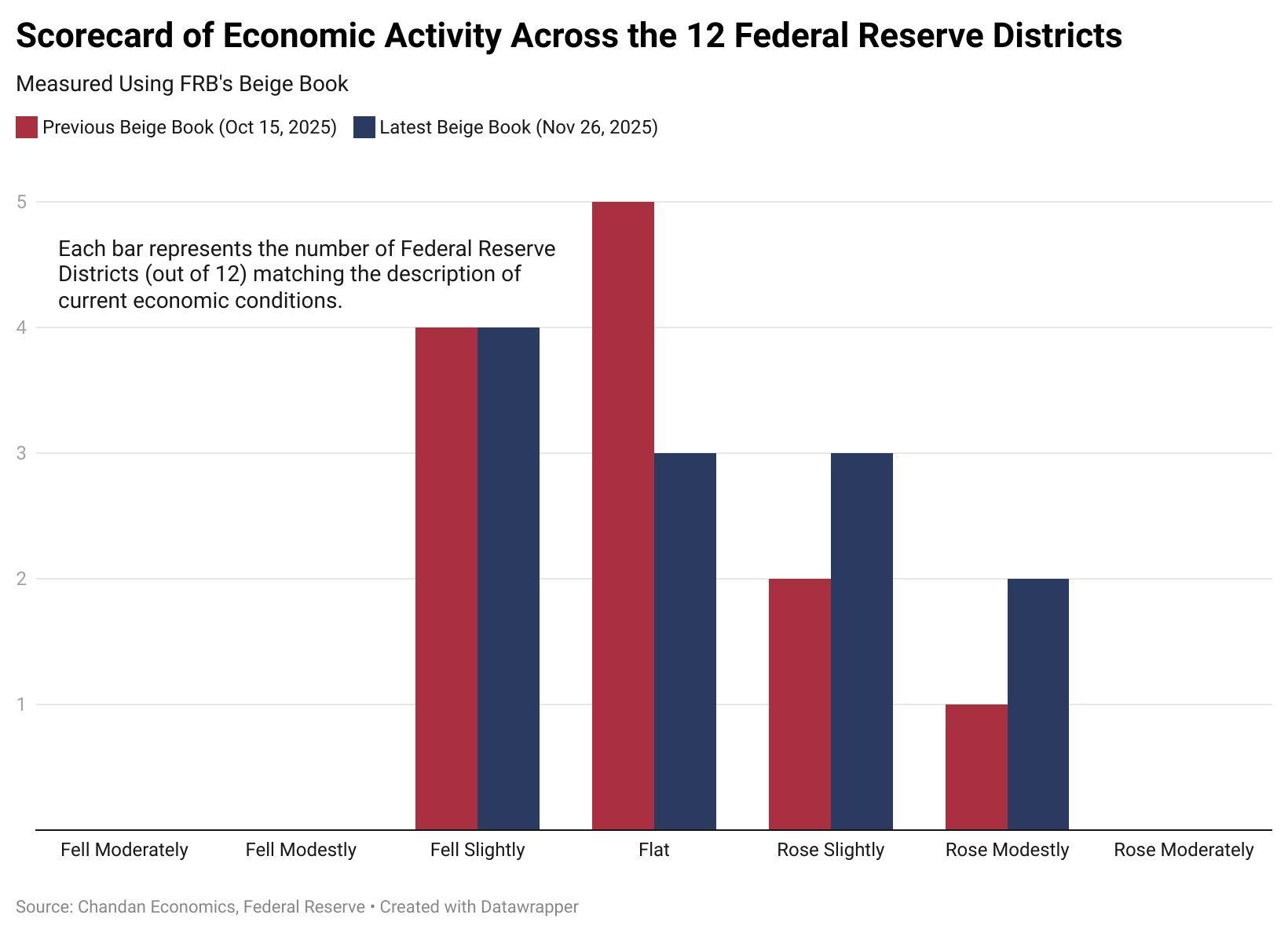

The latest Beige Book shows a mild shift toward expansion, with 5 districts reporting slight or modest growth, 3 flat, and 4 seeing slight declines.

CRE Trivia (Answer)🧠

The national U.S. office vacancy rate is 18.6% as of November 2025, reflecting still-elevated availability despite modest improvements in some markets, according to CommercialCafe.

You currently have 0 referrals, only 1 away from receiving Multifamily Stress Test Model.

What did you think of today's newsletter? |

Reply