- CRE Daily

- Posts

- Corporate Bond Surge Crowds Out Treasuries, Raising Rate Pressure

Corporate Bond Surge Crowds Out Treasuries, Raising Rate Pressure

A surge in corporate bond issuance is competing with Treasuries, putting upward pressure on rates and raising concerns about long-term debt sustainability.

Good morning. With companies and the U.S. government both ramping up debt, investors may face tough choices—and rising rates could be the result.

Today’s issue is sponsored by Crexi—the smarter way to search, analyze, and manage CRE deals at scale.

🎙️No Cap is back for Season 5, and we’re kicking things off with Bridge Investment Group’s Colin Apple on how institutional investors are underwriting multifamily, managing risk, and positioning for the next cycle.

CRE Trivia 🧠

Which company ranks as the #1 data center developer globally?

(Answer at the bottom of the newsletter)

Market Snapshot

|

| ||||

|

|

Rate Pressure

Corporate Bond Surge Crowds Out Treasuries, Raising Rate Pressure

A flood of corporate debt could squeeze demand for U.S. Treasuries, pushing yields higher and rattling bond markets.

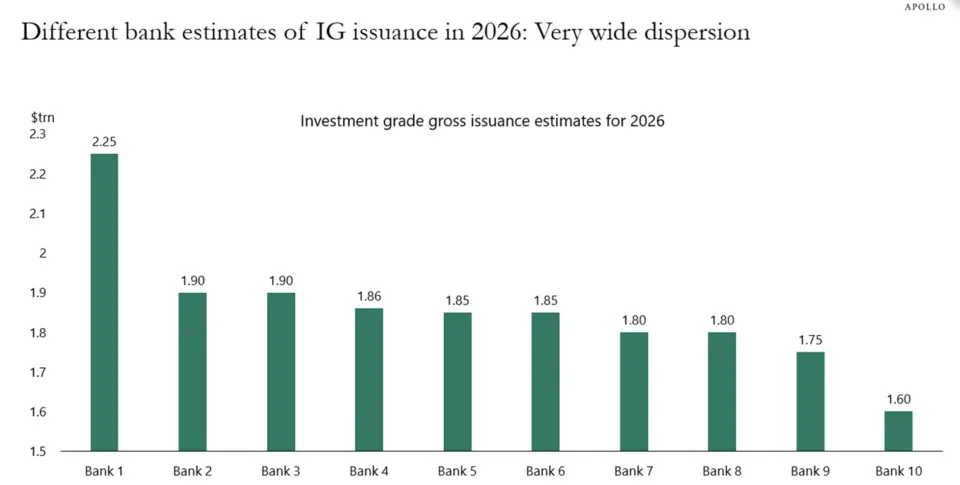

Corporate debt surge: Corporate America is on a borrowing spree, with investment-grade bond issuance projected to hit $2.25 trillion in 2026 as data-hungry hyperscalers raise capital for AI-driven data centers and infrastructure. This surge in high-quality debt is competing with U.S. Treasuries for investor dollars, potentially pushing rates higher.

Federal borrowing pressure: The Treasury has already borrowed $601B in early fiscal 2026, and demand may keep rising. Looming policy shifts—like potential tariff reversals and a proposed $500B defense spending boost—could slash revenue and deepen deficits.

Stubborn treasury yields: Despite Fed rate cuts last fall, Treasury yields remain elevated near September 2025 levels. If yields don't stay competitive with corporate bonds, investors may shift away, raising government borrowing costs.

Foreign pullback: Foreign governments, once the cornerstone of Treasury demand, now hold under 15% of outstanding U.S. debt, down from over 40%. Yield-driven private investors are filling the gap, making the market more sensitive to rate and supply shocks.

➥ THE TAKEAWAY

Rising rate volatility: The U.S. faces a growing squeeze between federal and corporate borrowing. If Treasury yields lag, the risk of fiscal dominance increases, forcing the Fed to support mounting deficits and fueling volatility in interest rates.

TOGETHER WITH CREXI

How Do Top CRE Professionals Stay Ahead of the Market?

CRE data lives across too many platforms—slowing decisions and costing deals. Crexi consolidates critical data and tools into one marketplace for brokers, investors, analysts, and appraisers.

How It Works:

Search 153M+ property records and 46M+ verified comps with AI-powered filters.

Extract data from OMs and rent rolls in minutes, not hours.

Research, market, and manage deals in one workspace without platform switching.

One platform. Complete intelligence. Built for CRE professionals.

*This is a paid advertisement. Please see the full disclosure at the bottom of the newsletter.

✍️ Editor’s Picks

Behind the trophy office surge: Trophy offices are defying the market slump. Here's why—and where the opportunity is. (sponsored)

Distress dip: Special servicing rates dropped to 10.71% in December 2025, driven by notable declines in distressed office and lodging loans.

CLO comeback: CLO lending for multifamily surged in 2025 as investors sought flexible, short-term financing to weather rent drops and delayed stabilizations.

Red tape: New York aims to speed up housing by loosening environmental review rules that often delay development.

Hiring slowdown: Job growth in top U.S. metros continued to decelerate in late 2025, with fewer markets posting large gains.

Fed firestorm: A criminal probe into Fed Chair Jerome Powell—widely seen as politically motivated—has sparked concerns over central bank independence.

🏘️ MULTIFAMILY

Buyer focus: Trump’s housing plan targets lower mortgage rates and investor limits, but lacks solutions for the ongoing supply crunch.

Privatization pause: The potential IPO of Fannie Mae and Freddie Mac has multifamily lenders and investors in wait-and-see mode as uncertainty clouds the future of GSE-backed financing.

Rent slump: U.S. multifamily rents declined again in December, capping off the weakest Q4 in years and erasing early 2025 gains.

🏭 Industrial

Industrial outlook: As growth in the industrial sector matures, power constraints, automation, and supply chain resiliency are redefining how—and where—new facilities get built in 2026.

Storage selloff: W. P. Carey hit a record $2.1B in 2025 investments while effectively exiting the self-storage sector.

Inland investment: Orden Company acquired a fully leased 257K SF warehouse in Ontario, CA for $57M.

Owner comeback: Orange County industrial sales jumped 40% in 2025 as owner-users returned to the market.

🏬 RETAIL

Strong year: The retail sector ended 2025 on a high note, with record-setting holiday sales, tighter vacancies, rising rents, and strengthened investor confidence.

Discount growth: Aldi will open 180+ U.S. stores in 2026, expanding into Colorado and Maine and accelerating conversions from its Southeastern Grocers acquisition.

Brick bet: Amazon has proposed its first-ever big-box retail store—a 229K SF concept in suburban Chicago—marking a bold new push into physical retail.

Scaling strategy: Bob’s Discount Furniture filed for an IPO with plans to double its store count to 500 by 2035.

🏢 OFFICE

Financing win: Stiles and Shorenstein secured $185M in financing for The Main, a fully leased Fort Lauderdale office tower.

Biotech bet: Healthpeak bought a $600M South SF lab campus as part of a $925M spree, while preparing to spin off its senior housing arm, Janus Living.

Lab leap: Nvidia and Eli Lilly are investing $1B to build an AI-powered drug discovery lab in Silicon Valley.

🏨 HOSPITALITY

Hotel duo: Tidal Real Estate is adding a second, square-shaped hotel next to Raleigh’s iconic round Holiday Inn, now being preserved and rebranded as a Hotel Indigo.

Marriott expansion: Primo Investments is seeking rezoning approval in Rock Hill, SC, to build two Marriott-branded hotels totaling over 230 rooms.

A MESSAGE FROM ALTUS GROUP

Extend valuation and performance insights beyond modeling teams

Join us as we show you how teams share valuation and performance data from ARGUS Enterprise across their organizations, without waiting on reports.

See how firms are:

Breaking down silos by sharing consistent performance data across teams

Creating alignment with a shared view of asset and portfolio performance

Accelerating decision-making through standardized data and analytics

*This is a paid advertisement. Please see the full disclosure at the bottom of the newsletter.

📈 CHART OF THE DAY

Since the introduction of reciprocal tariffs last April, U.S. job growth has stalled or declined, with manufacturing, transportation, and agriculture sectors hit hardest.

CRE Trivia (Answer)🧠

Digital Realty Trust is the world’s largest data center developer, operating 300+ facilities across 25 countries.

More from CRE Daily

📬 Newsletters: Stay ahead of the market with local insights from CRE Daily Texas and CRE Daily New York.

🎙️Podcast: No Cap by CRE Daily delivers an unfiltered look at the biggest trends—and the money game behind them.

🗓️ CRE Events Calendar: The largest searchable calendar of commercial real estate events—filter by city or sector.

📊 Market Reports: A centralized hub for brokerage research and market intelligence, all in one place.

📈 Fear & Greed Index: A fully interactive sentiment tracker on the pulse of CRE built in partnership with John Burns Research & Consulting.

You currently have 0 referrals, only 1 away from receiving Multifamily Stress Test Model.

What did you think of today's newsletter? |

Reply