- CRE Daily

- Posts

- CRE Deal Activity Surges to Close Out 2025 — Even Without the Data Center Boost

CRE Deal Activity Surges to Close Out 2025 — Even Without the Data Center Boost

CRE transactions climbed for a second straight year as market momentum continues to build across sectors.

Good morning. CRE transactions finished 2025 on a strong note, with deal volumes rising for the second year in a row. Even without a headline-grabbing data center deal, activity was up across nearly every major property type.

Today’s issue is sponsored by Covercy—upgrade your stack with real-time sync and investor reports you can trust.

🎙️This week on No Cap: From Caesars’ bankruptcy to controlling half the Las Vegas Strip, VICI Properties CEO Edward Pitoniak reveals how experiential real estate quietly outperformed the skeptics.

CRE Trivia 🧠

Which U.S. region ranked as the most competitive rental market in 2025, according to the Rental Competitiveness Index?

(Answer at the bottom of the newsletter)

Market Snapshot

|

| ||||

|

|

Transaction Volume

CRE Deal Activity Surges to Close Out 2025 — Even Without the Data Center Boost

CRE transactions accelerated sharply in Q4 2025, signaling renewed investor confidence and a broader market thaw.

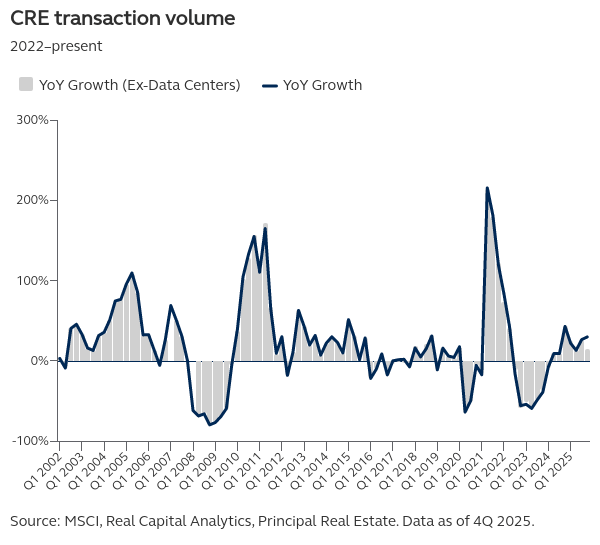

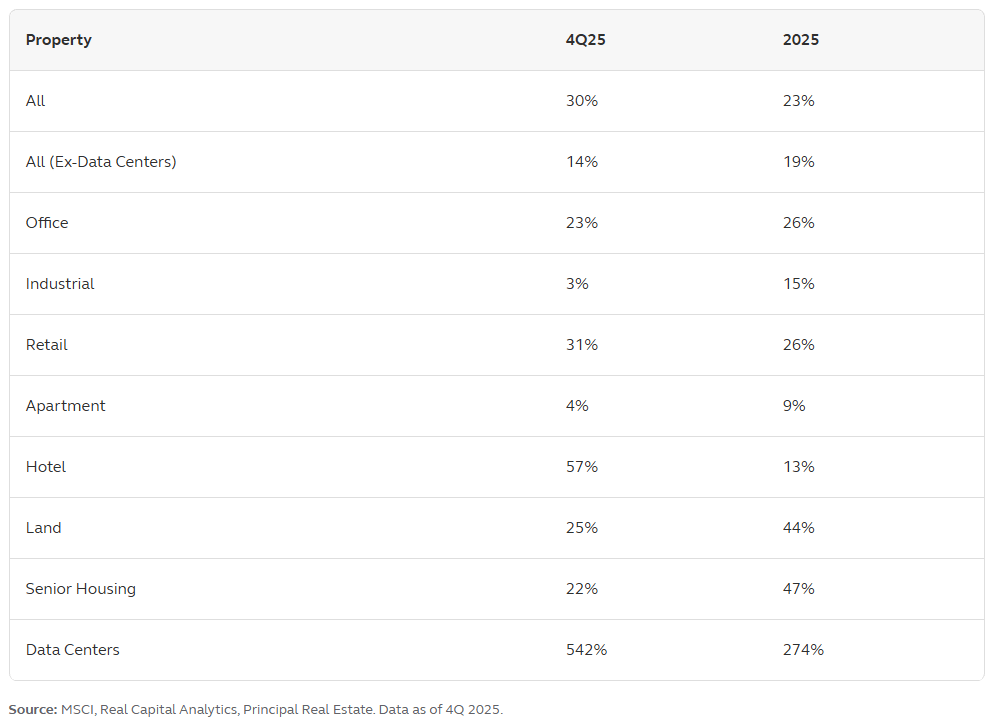

Big finish to the year: CRE transaction volume reached $71.4B in December 2025, up 12% YoY. Fourth-quarter deals totaled $185.8B, a 30% increase from Q4 2024, bringing full-year volume to $545.3B, up 23% and marking a second consecutive year of growth.

Beyond data: A $23B data center forward sale boosted 2025 totals, but even excluding data centers, Q4 volume rose 14% and full-year activity climbed 19%, signaling a broader market recovery.

Who’s Leading the Rebound? Most major property types saw solid gains in late 2025, with retail, office, hotels, senior housing, and land posting strong double-digit growth. Apartments and industrial rose more modestly, while data centers surged far ahead of the pack.

Market at a crossroads: Rising transaction volume often marks a shift in sentiment, echoing the post-GFC recovery. Despite ongoing risks and dispersion, CRE appears to be entering a new phase—less a broad rebound, more a selective opportunity.

➥ THE TAKEAWAY

Selective dealmaking: The CRE market is warming, but not all deals are equal. With liquidity returning, 2026 success will depend on precision over broad participation.

TOGETHER WITH COVERCY

Your Property Data Deserves Better

If you're running property management and investment management separately, you're wasting hours on manual exports and data reconciliation.

Covercy changes that.

Our Rent Manager integration syncs property data automatically so your investor reports, distributions, and waterfalls are always accurate and up-to-date.

✓ Real-time data sync

✓ Eliminate manual exports

✓ Reporting investors actually trust

Hundreds of real estate firms already use Covercy. Ready to upgrade your stack?

*This is a paid advertisement. Please see the full disclosure at the bottom of the newsletter.

✍️ Editor’s Picks

Prospect faster: DealGround converts your documents and rent rolls into actionable intelligence and generates high-quality leads for you with verified names, emails, phone numbers, and source links – all built for broker-led prospecting. (sponsored)

Private prevails: REIT IPOs have all but disappeared as commercial real estate firms increasingly favor private capital over navigating the costs, scrutiny, and volatility of public markets.

When and how to rebalance your portfolio: Investors should consider evaluating allocations at least once a year. Learn about 5 rebalancing strategies to manage risk and enhance diversification. (sponsored)

Debt spiral: Jamie Dimon cautions that the U.S.’s surging $38.5T national debt could spark a future financial crisis, reinforcing long-term rate and volatility risks for real asset investors.

ULA exemption: A proposed 15-year Measure ULA exemption for new commercial projects could improve LA development feasibility by reducing transfer-tax exposure.

🏘️ MULTIFAMILY

Affordable pipeline: Affordable housing construction remains concentrated in select metros, highlighting where subsidy pipelines may support future multifamily supply.

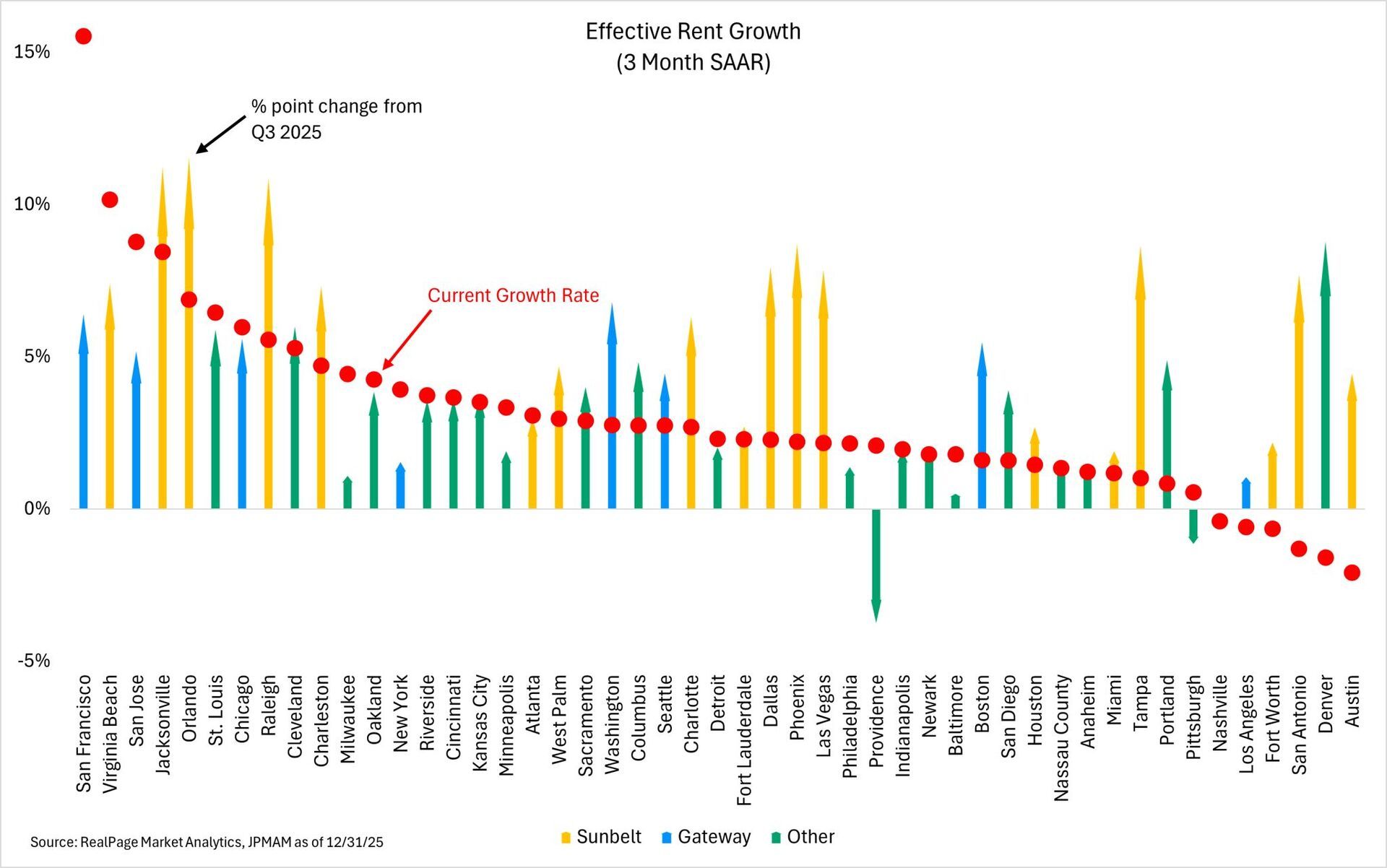

Regional shift: Housing strength is shifting toward Midwest and Northeast hubs as Southern and Western metros cool, affecting near-term rent growth assumptions.

Shrinking payout: Elme Communities sold three assets as part of its liquidation, lowering expected returns and underscoring pricing pressure for office-heavy portfolios.

Funding freeze: Developers face mounting uncertainty as HUD’s paused shift to temporary housing threatens stability for tens of thousands relying on Continuum of Care grants.

🏭 Industrial

Detention impact: A planned ICE detention center could double a small Texas town’s population, driving sudden demand for housing, infrastructure, and services.

Industrial trade: BlackRock and IDI traded an industrial asset for $73M, reflecting continued liquidity and pricing discovery in core logistics facilities.

Denver sale: A $47M sale of an industrial portfolio north of Denver is signaling sustained investor appetite for secondary-market distribution assets.

Small bay: Investors are targeting small-bay industrial as AI and e-commerce boost demand from local distributors and service users.

🏬 RETAIL

Store conversions: Amazon is converting some Fresh and Go locations to Whole Foods, reshaping grocery footprints and retail real estate demand.

Stability ahead: Colliers’ 2026 outlook sees retail stability tied to necessity-based tenants, supporting selective leasing and acquisition strategies.

Napa reposition: Knighthead is repositioning Napa Valley office and retail assets, reflecting capital rotation into lifestyle-oriented, tourism-driven properties.

Grocery buy: Carlyle and Pebb acquired a Sprouts-anchored retail center, highlighting continued investor preference for grocery-backed cash flow.

🏢 OFFICE

Office spark: A rebound in venture capital funding is lifting early signals of tech office demand, supporting selective leasing recoveries.

Sale review: Orion Properties is exploring a sale after resisting private investors, reopening consolidation possibilities among office REITs.

HQ splash: Speedo is planning a new U.S. headquarters ahead of the 2028 Olympics, adding office demand tied to brand expansion.

🏨 HOSPITALITY

Hotel revival: Ian Schrager is forming a new partnership to revive his hotel brand, reopening development and branding opportunities in lifestyle hospitality.

Loan refi: Lone Star refinanced a hotel portfolio loan ahead of its 2026 maturity, reducing near-term refinancing risk amid tight credit markets.

A MESSAGE FROM ALTUS GROUP

Q4 2025 valuation trends by market and property type

Join this webinar for a break down of recent quarterly returns by asset class and geography - giving you a clearer view into CRE performance and market conditions.

Altus experts will:

Review how returns are shifting across sectors and markets

Explore key drivers such as yield and cash flow across property types and geography

Cover property value variances across the major metropolitan markets

Date: Thursday, February 5 | 1:00 PM ET

*This is a paid advertisement. Please see the full disclosure at the bottom of the newsletter.

📈 CHART OF THE DAY

Multifamily rent growth accelerated in Q4 2025, averaging over 3% annually with sharp regional differences and broad momentum gains across major cities.

CRE Trivia (Answer)🧠

The Northeast — with an RCI score of 80.6, narrowly edging out the Midwest and Florida.

More from CRE Daily

📬 Newsletters: Stay ahead of the market with local insights from CRE Daily Texas and CRE Daily New York.

🎙️Podcast: No Cap by CRE Daily delivers an unfiltered look at the biggest trends—and the money game behind them.

🗓️ CRE Events Calendar: The largest searchable calendar of commercial real estate events—filter by city or sector.

📊 Market Reports: A centralized hub for brokerage research and market intelligence, all in one place.

📈 Fear & Greed Index: A fully interactive sentiment tracker on the pulse of CRE built in partnership with John Burns Research & Consulting.

You currently have 0 referrals, only 1 away from receiving Multifamily Stress Test Model.

What did you think of today's newsletter? |

Reply