- CRE Daily

- Posts

- CRE Development Injected $1.55 Trillion into the U.S. Economy in 2025

CRE Development Injected $1.55 Trillion into the U.S. Economy in 2025

A new NAIOP report shows CRE’s economic reach grew sharply from pre-2025 levels.

Good morning. CRE didn’t just build properties in 2025—it built economic momentum. A new NAIOP report breaks down just how far that impact reached.

Today’s issue is sponsored by Columbia Business School—helping real estate professionals apply AI to sourcing, analysis, and management.

🎙️This week on No Cap: Alex Killick of CW Capital takes us inside special servicing, breaking down how distressed loans are worked out—and why this cycle looks nothing like the past.

CRE Trivia 🧠

Which large U.S. metro has seen the sharpest rent decline over the past year?

(Answer at the bottom of the newsletter)

Market Snapshot

|

| ||||

|

|

Economic Impact

CRE Development Injected $1.55 Trillion into the U.S. Economy in 2025

CRE development surged in 2025, making a massive $1.55 trillion contribution to U.S. GDP and fueling millions of jobs, according to a new NAIOP report.

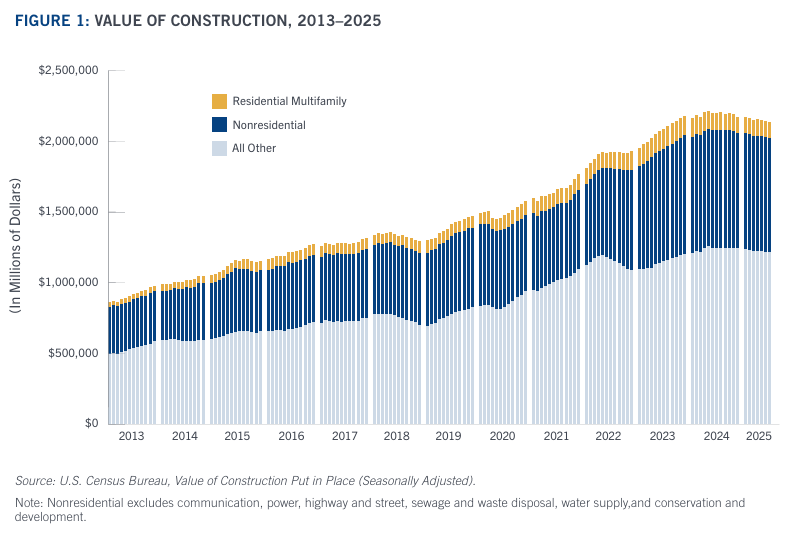

Economic engine: A new NAIOP report highlights CRE’s outsized impact in 2025, driven by a strong multiplier effect. Direct development spending hit $632.21B, supporting 7.37M jobs and $554.75B in personal earnings—up from $1.25T in GDP contribution and 6.23M jobs in 2021.

Wider impact: Including ripple effects like supplier activity and induced spending, CRE development's total contribution hit $5.3T in 2025—17.5% of U.S. GDP and 25.6M jobs. Residential, government, and hospitality projects were excluded.

What got built: Construction spending varied sharply by sector:

Multifamily led with $135.3B, up from $119.7B in 2021

Office rose significantly to $85.5B (from $41.1B)

Industrial jumped to $50.5B (from $32.4B)

Warehouse dipped slightly to $42.0B

Retail/Entertainment grew to $22.9B

The space breakdown: In square footage terms, office development grew to 129M SF, while industrial and warehouse volumes fell. Multifamily held steady at 703M SF—by far the largest slice of space under construction.

Construction costs in flux: Office project costs climbed 15.8%, while industrial saw a 5.6% decline. Retail/entertainment and multifamily each experienced a 6.6% increase, contributing to an average construction cost uptick of 5.8% across all segments.

➥ THE TAKEAWAY

Building the GDP: CRE development isn’t just about buildings—it’s a major economic engine. With $5.3T in impact and over a quarter of U.S. jobs tied to it, the sector’s influence runs deep despite shifting costs and demand.

TOGETHER WITH COLUMBIA BUSINESS SCHOOL

There’s more to AI than ChatGPT.

AI is becoming part of how real estate deals are sourced, analyzed, and managed.

This 8-week online program shows how you can use AI in practical, day-to-day real estate work—from underwriting and forecasting to portfolio analysis—without needing a technical background.

You’ll get:

Practical AI workflows applied to real estate analysis and investment decisions

A global peer community with lifelong access to events and meetups

Instruction from Columbia Executive Education faculty and industry leaders

Save $500 with early enrollment + code CREDAILY before Feb. 17. Enroll today.

*This is a paid advertisement. Please see the full disclosure at the bottom of the newsletter.

✍️ Editor’s Picks

People first: The best capital strategies don’t automate relationships away. Discover how people-first fundraising helps GPs scale trust without sacrificing personalization. (sponsored)

Profit paradox: Blackstone posted record quarterly earnings in Q4 despite continued weak real estate valuations, highlighting the firm's strategic shift toward higher-performing sectors like private credit and infrastructure.

Delayed recovery: CRE’s recovery is likely to drag into 2027 due to high interest rates, tenant pullbacks, and disparate performance across property types and regions.

Sales radar: CenterCheck maps out where money is actually spent, using card transaction data to provide precise insights for retail site selection and lease decisions. (sponsored)

Capital comeback: CRE investment picked up in Q4 2025, led by apartments and industrial assets, though volumes remain well below pre-pandemic levels.

Underwriting reset: CRE lenders and investors are adopting stricter underwriting and lower leverage as the sector braces for a $2T+ maturity wall and persistent pricing uncertainty.

Fed shift: President Trump has tapped former Fed Governor Kevin Warsh—an inflation hawk critical of pandemic-era stimulus—to head the central bank, signaling a potential pivot in monetary policy.

🏘️ MULTIFAMILY

Rent collusion: Apartment giant MAA agreed to settle a class action lawsuit alleging rent coordination via RealPage software, underscoring growing legal scrutiny in multifamily pricing practices.

Rent gap: Large multifamily buildings now make up the largest share of U.S. rental housing for the first time on record, as SFRs fall to a historic low.

ID mandate: HUD now requires public housing authorities to verify immigration status with the SAVE database, a move raising both administrative burdens and tenant concerns.

Zoning showdown: Massachusetts sued nine municipalities for failing to comply with state housing laws requiring zoning near transit to allow multifamily development.

🏭 Industrial

Robot pivot: Tesla is planning a $20B investment in CA real estate to support its robotics and AI ventures, signaling a major pivot in its physical footprint and R&D priorities.

Server surge: Tech giants like Meta and Microsoft are doubling down on massive data center investments, justifying the spend as essential for AI scalability and long-term growth.

Storage scam: Two individuals were arrested for impersonating staff and squatting in self-storage units in Georgia, spotlighting security risks in the sector.

🏬 RETAIL

Selective comeback: Retail real estate is staging a selective comeback, with institutions showing renewed interest in top-tier assets as consumer habits stabilize post-pandemic.

Luxury lean: Following bankruptcy, Saks is shuttering 57 locations and focusing on luxury shoppers, betting high-end retail can carry the brand forward.

Fowl play: Chicken chains like Dave’s Hot Chicken are aggressively expanding retail footprints, fueling demand in an otherwise cautious retail leasing market.

🏢 OFFICE

Office outlook: Office investment is expected to remain sluggish in 2026, with bifurcation between trophy assets and struggling Class B/C properties defining the market.

Class A: BXP is benefiting from rising demand for high-end office space, defying broader sector weakness with strong leasing in premier markets.

Trophy foreclosure: A New York judge ruled in favor of Gary Barnett’s effort to foreclose on Worldwide Plaza, intensifying the high-stakes drama over the troubled trophy office tower.

Postal play: The federal government is moving to sell the historic Old Post Office Building in D.C., potentially opening a rare redevelopment opportunity in a prime location.

🏨 HOSPITALITY

Stay hybrid: Hilton and Placemakr are launching a blended apartment-hotel brand targeting extended stays, as flexible living models reshape hospitality real estate.

Shelter sale: A former Chicago hotel turned homeless shelter has sold for $13M, reflecting shifting asset uses and renewed investor appetite for repositioning opportunities.

A MESSAGE FROM REAP CAPITAL

2017 Value‑Add. Their Distress. Our Playbook. Your Opportunity.

We're acquiring a mismanaged 249-unit asset at 76% occupancy from a cash-constrained, out-of-state owner. Underfunded operations. Deferred turns. Stalled leasing. Their distress is our entry point.

The investors who see beyond the challenges of the immediate past to the opportunity of the imminent future will be the ones best positioned when the cycle turns.

That's exactly what we're doing—entering at a 5.8% cap on stabilized occupancy with immediate operational upside by simply restoring basic execution. As a Dallas-based operator with 1,000+ units within a 3-mile radius, we've taken assets from the low-70s to 90%+ occupancy repeatedly.

This isn't speculation. It's a proven Reap Capital playbook.

*This is a paid advertisement. Please see the full disclosure at the bottom of the newsletter.

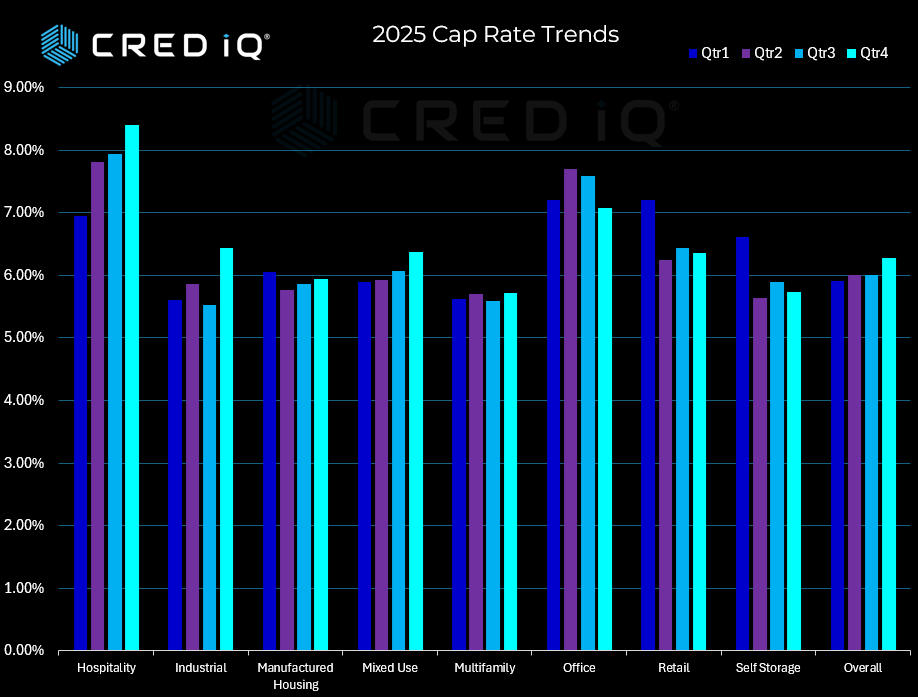

📈 CHART OF THE DAY

Cap rates across CRE widened modestly in 2025, with hospitality and industrial assets seeing the sharpest increases, while multifamily and retail showed resilience and compression.

CRE Trivia (Answer)🧠

According to Apartment List, Austin, TX saw the sharpest decline with rents down 6.3% year over year.

More from CRE Daily

📬 Newsletters: Stay ahead of the market with local insights from CRE Daily Texas and CRE Daily New York.

🎙️Podcast: No Cap by CRE Daily delivers an unfiltered look at the biggest trends—and the money game behind them.

🗓️ CRE Events Calendar: The largest searchable calendar of commercial real estate events—filter by city or sector.

📊 Market Reports: A centralized hub for brokerage research and market intelligence, all in one place.

📈 Fear & Greed Index: A fully interactive sentiment tracker on the pulse of CRE built in partnership with John Burns Research & Consulting.

You currently have 0 referrals, only 1 away from receiving Multifamily Stress Test Model.

What did you think of today's newsletter? |

Reply