- CRE Daily

- Posts

- CRE Lending Set to Surge Past 2024 Levels

CRE Lending Set to Surge Past 2024 Levels

A strong first half for securitized and agency loans points to a bullish 2025 for commercial real estate debt markets.

Good morning. A strong first half for securitized and agency loans points to a bullish 2025 for commercial real estate debt markets. Plus, liquidity is returning, fundraising is reviving, and Brookfield is betting big on high-quality assets.

Today’s issue is brought to you by Warespace—the next generation of small-bay industrial.

Join James Nelson (Avison Young) and No Cap podcast hosts Jack Stone and Alexander Gornik for a LinkedIn LIVE this Thursday at 12 PM ET as they break down what’s driving commercial real estate investment in 2025.

Market Snapshot

|

| ||||

|

|

LENDING MARKET

New Issuances and Loan Volumes Projected to Exceed 2024 Levels

A rebound across securitized and agency lending points to a busier—and more selective—year for commercial real estate finance.

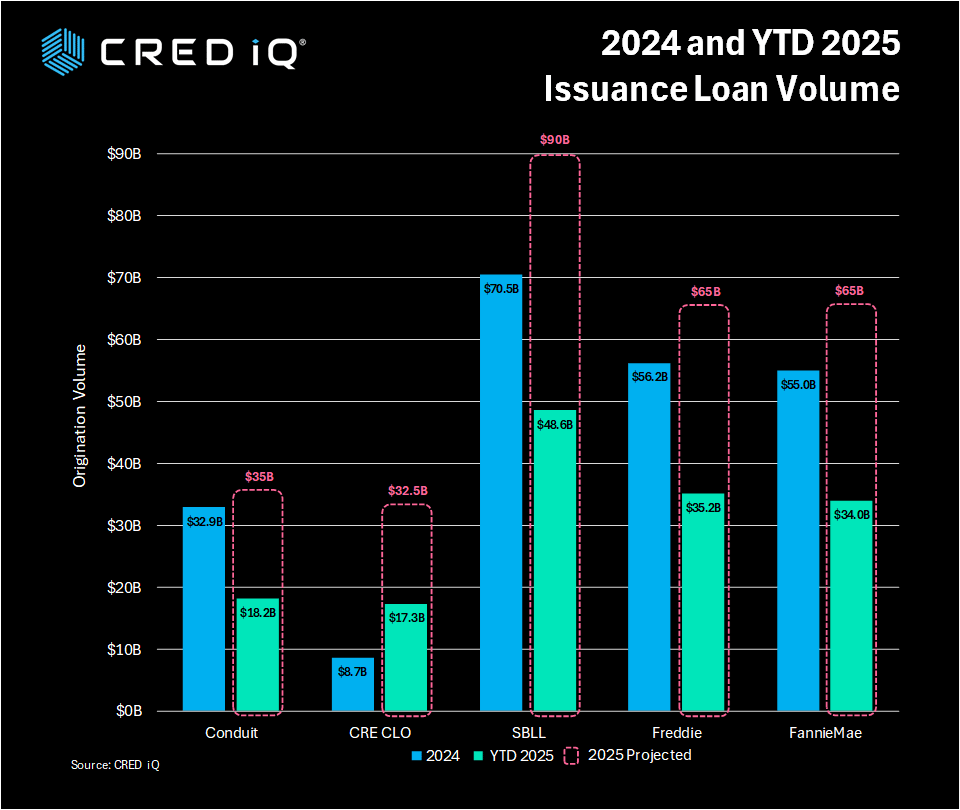

Debt markets regain momentum: According to a recent analysis by Cred-iQ, CMBS conduit issuance is expected to hit $35B in 2025—a 6.4% bump from last year—while CRE CLOs are booming, with projected issuance up 274% to $32.5B. Single-borrower large loans are also on track to reach $90B, a 28% gain over 2024.

Agencies back in action: Government-sponsored entities are also stepping up. Freddie Mac and Fannie Mae are each projected to originate $65B in loans by year-end, a roughly 19% increase from 2024. This resurgence reflects not only stronger multifamily demand but also a more active lending environment following a two-year slump.

Rates reflect risk appetite: Agency debt remains the most affordable, while riskier, floating-rate debt products demand higher yields.

Freddie Mac: 5.71%

Fannie Mae: 5.74%

CMBS conduit loans: 6.63%

CRE CLOs: 7.62%

Single-borrower large loans: 8.30%

From the horse’s mouth: Blackstone COO Jonathan Gray pointed to slowing construction and renewed interest in logistics and multifamily assets as early signs of recovery. With the Fed easing rates, the lending climate is gradually thawing.

➥ THE TAKEAWAY

Looking ahead: CRE capital markets are heating up again—but underwriting remains tight. Capital is moving, but with caution.

TOGETHER WITH WARESPACE

We’re deploying $500M to acquire industrial properties

WareSpace is the next generation of small-bay industrial—co-warehousing designed for small and growing businesses. One simple monthly payment covers everything: property tax, utilities, equipment, racking, shared-kitchens, conference rooms, etc. The kind of features small businesses actually want.

We’re actively acquiring flex, industrial, office, and big box retail properties (50K–250K SF) with $500M in capital ready to deploy.

We’re targeting:

Immediate or near-term vacancies

Class A–C assets with loading docks or drive-ins

Transitional properties that need capex

All-cash closings. Fast timelines. And now offering a $1/SF broker bonus on every deal. Yes, you read that right—$1 per square foot as a direct broker incentive, on top of standard market commissions.

Offer valid for all deals closed before 12/31/25.

Have a deal? Send it to VP of Acquisitions, Jeff Jenkins at [email protected].

We close fast, pay cash, and move quickly. Let’s make a deal!

*This is a paid advertisement. Please see the full disclosure at the bottom of the newsletter.

✍️ Editor’s Picks

Smart reporting: Keyway has launched a new AI-powered platform to streamline and standardize rent roll and T12 analysis. (exclusive)

Brookfield is bullish: After years of sluggish activity, mega property deals are finally returning, says Brookfield’s freshly appointed real estate chief.

YIMBY vision: Pro-housing advocates say zoning reforms like single-stair rules can increase density and improve building aesthetics.

Small bets: As high rates sideline traditional buyers, small investors are snapping up a record share of single-family homes.

Spring slump: The US housing market has just suffered its slowest spring in 13 years, as uncertainty and high costs have frozen buyers.

Profit dip: Home sellers averaged a 50% profit in Q225, down from last year but still strong by historical standards.

Debt shift: The Trump administration is shaking up traditional Treasury borrowing practices by delaying long-term bond issuance in hopes of lower rates.

Agency dysfunction: Senators warn that leadership gaps and budget cuts at the Appraisal Subcommittee risk destabilizing the real estate appraisal system.

🏘️ MULTIFAMILY

Rent stretch: A $1,500 rental budget goes farthest in the Midwest and South while barely covering 200 SF in Manhattan.

Housing reform: A new bipartisan Senate bill targets zoning reform and supply boosts to ease the housing affordability crisis.

Athlete deal: Kris Humphries’ Casey Capital bought a 64-unit Eagan apartment complex for $9.9M, marking a 17% value gain since its 2020 sale.

Asset grab: JPMorgan bought a Midtown NYC rental tower for $243.5M, deepening its bet on multifamily.

Portfolio collapse: Over 3K Houston-area apartments tied to Kalkan Capital are headed to auction as the investor faces $125M in loan defaults.

🏭 Industrial

Deal drought: Industrial deal volume stalled in Q2 as warehouse vacancies hit 7.1%, the highest since 2014.

Don’t Loudoun my Louisa! Amazon canceled a proposed $10 billion data center campus in Louisa County after local backlash, despite Virginia already hosting over 70% of the world’s internet traffic.

Growth streak: Despite rising vacancies driven by new supply and move-outs, industrial demand stayed positive for the 60th quarter.

Future hub: CBRE and partners broke ground on a 473K SF Fremont project targeting AI and tech tenants.

🏬 RETAIL

Retail buyout: Onyx Partners is buying 119 J.C. Penney stores for $947M in cash, closing a major chapter in the retailer’s post-bankruptcy sell-off.

Grocery anchor: Whole Foods will anchor The Mix, a $3B mixed-use project underway in Frisco, Texas.

OC acquisition: Regency Centers bought five OC retail centers for $357M to expand in a tight coastal market.

🏢 OFFICE

Tower tumble: Once valued at $222M, the Atlanta Financial Center sold for just $45M as vacancy climbs and a potential demolition looms.

Leasing spotlight: CBRE has been named the exclusive leasing agent for Manhattan’s historic Paramount Building.

Flight to quality: Fisher Phillips leased new offices in LA and Woodland Hills, joining the market’s broader flight-to-quality trend.

🏨 HOSPITALITY

F1 ambitions: Atlantic City greenlit a $3.3B plan to turn a defunct airport into an F1-style racetrack with housing, retail, and luxury car condos.

New launch: M2G Ventures has launched a new hospitality division, appointing Crescent Real Estate veteran Chris Hanrattie to lead efforts.

A MESSAGE FROM ACRES

Are You Seeing the Full Picture Before You Invest?

Top CRE investors use Acres to surface undervalued, off-market land before the competition catches on. With 4M+ transactions, 1,400+ data layers, and complete land intelligence across 150M+ parcels, Acres delivers what others can’t—unmatched speed, insight, and access.

From zoning and power to risk and ownership, it’s the data advantage that turns hidden potential into secured deals.

*This is a paid advertisement. Please see the full disclosure at the bottom of the newsletter.

📈 CHART OF THE DAY

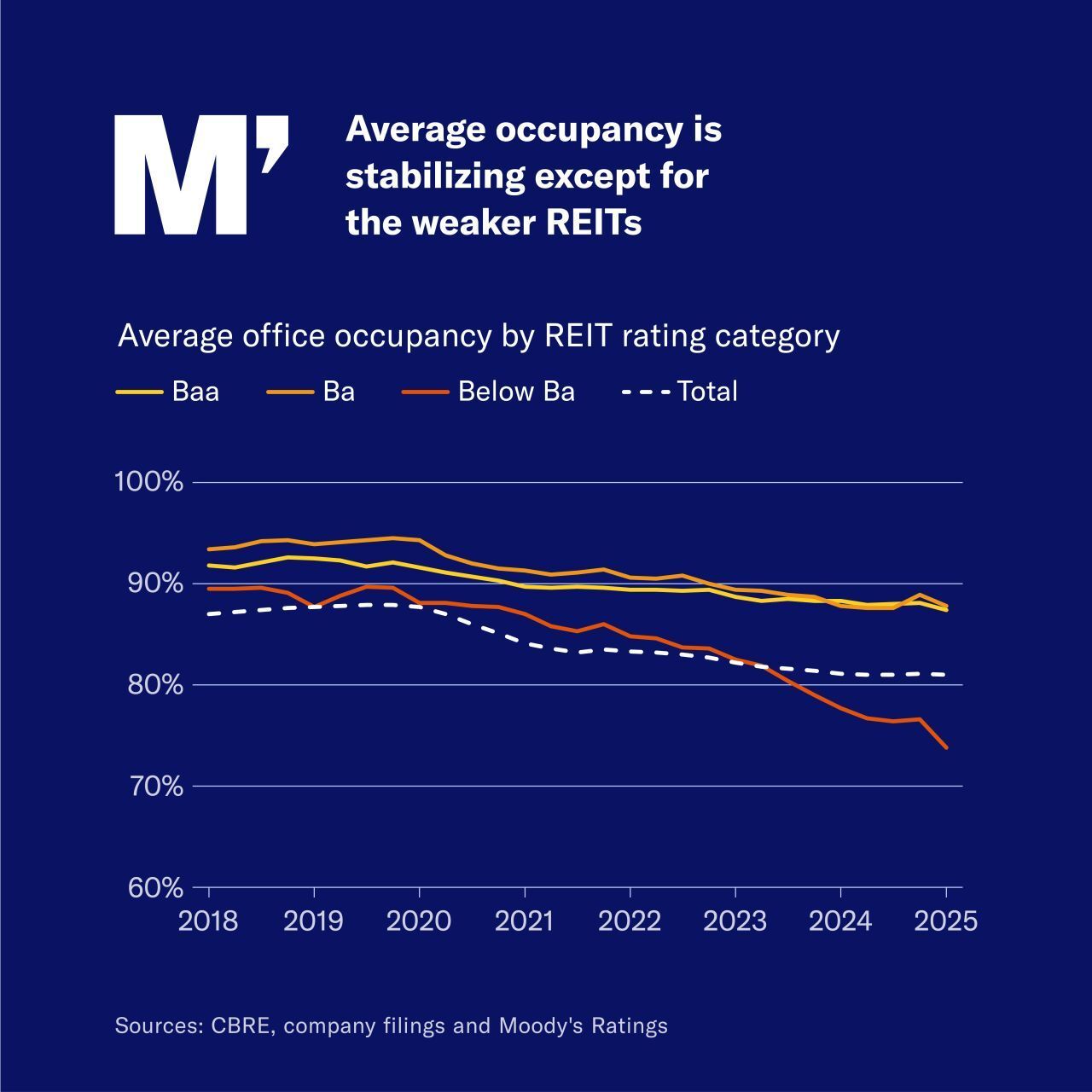

Office attendance plummeted during the pandemic, but occupancy rates are now beginning to stabilize.

You currently have 0 referrals, only 1 away from receiving Multifamily Stress Test Model.

What did you think of today's newsletter? |

Reply