- CRE Daily

- Posts

- DFW Becomes a Top Target for CRE Mergers and Expansions

DFW Becomes a Top Target for CRE Mergers and Expansions

DFW’s momentum is turning it into one of the most influential markets in CRE.

Good morning. National firms are snapping up Dallas-area real estate companies. Mergers, expansions, and high-profile moves are reshaping the CRE landscape in one of the country’s fastest-growing markets.

Today's issue is sponsored by Hines. A new cycle may be here—Hines’ 2026 Global Investment Outlook explains why this recovery looks different.

CRE Trivia 🧠

What month is typically the cheapest time to rent an apartment in the U.S.?

(Answer at the bottom of the newsletter)

Market Snapshot

|

| ||||

|

|

Hot Market

DFW Becomes a Top Target for CRE Mergers and Expansions

National firms are snapping up local players to get a foothold in Dallas-Fort Worth (DFW), which is fast becoming the crown jewel of CRE.

All eyes on DFW: DFW isn’t just hot—it’s the market. National CRE firms are buying their way in, drawn by its pro-business climate, celebrity cachet, and startup energy, says site selection expert John Boyd Jr.

Planting flags: In recent months, major national firms have snapped up DFW-based companies, signaling a bigger trend—buying local is now the go-to entry strategy in North Texas.

Colliers picked up Greystone’s local multifamily investment team.

Cresa bought tenant rep firm Fischer, after its 2022 merger with ESRP (founded by NFL legends Emmitt Smith and Roger Staubach alums).

Stewart Information Services Corp. acquired Lewisville-based MCS.

A history of heavyweights: DFW has long hosted major CRE names like CBRE, Hillwood, and Trammell Crow Co. Landmark deals—CBRE’s $2.2B Trammell Crow buy in 2006 and JLL’s $727M Staubach merger in 2008—cemented the region as a launchpad for national CRE leadership.

Deep roots: DFW’s “sizzle factor” blends rising talent with celebrity players like Jerry Jones and Mark Cuban. Longstanding relationships give local pros an edge in closing deals and scaling up.

The rise of Y’all Street: DFW is fast becoming a financial hub, with the $120M-backed TXSE set to rival NYSE and Nasdaq. Major firms like Goldman Sachs and Wells Fargo are expanding, boosting the region’s clout in both CRE and finance.

Corporate relocations fuel CRE: From 2018 to 2024, DFW landed 100 HQ moves—nearly 20% of all U.S. relocations. Coupled with $18B in 2025 investment sales, the region claimed the No. 1 spot in ULI/PwC’s 2026 Emerging Trends report.

➥ THE TAKEAWAY

If you’re in CRE and not in DFW, you’re late. With a business-friendly climate, outsized investment activity, and a reputation for growing national power players, DFW isn’t just a market—it's the proving ground for the future of real estate.

TOGETHER WITH HINES

The Real Estate Recovery May Be Here After All, But It Could Look Different This Time.

Why does Hines Research think it’s ‘wheels up’ for real estate in 2026?

Hines' 2026 Global Investment Outlook says the real estate recovery is here – but this time looks different.

Deglobalization and AI are shaping new investment geographies and fueling demand around the world.

We see high-conviction opportunities forming in living, industrial, and retail, with notable regional variations.

Investors who remain measured and strategic should be positioned to navigate this evolving landscape and ascend.

Subscribe to Market Moves, your source for the latest news and updates from Hines, to receive our detailed analysis and prepare for the year ahead.

*This is a paid advertisement. Please see the full disclosure at the bottom of the newsletter.

✍️ Editor’s Picks

CRE leaders: Operations make or kill profits. Grab “The Brokerage Operations Manual” to build rock-solid systems for listings, deal tracking, and maximize consistent revenue growth. (sponsored)

Checking in: CRE experts got 2025 half right—office and data center rebounds landed, but multifamily and bank trouble didn't play out as forecasted.

Investment outlook: MSCI flags AI growth, private credit risks, and geopolitical shifts as the key market forces to watch in 2026.

Leadership locked: The Fed reappointed 11 of 12 regional presidents early, avoiding expected political interference.

Disciplined rebound: Colliers sees 2026 as a year of cautious optimism for commercial real estate, with stabilizing rates, revived capital flows, and asset-specific trends.

Data duel: CoStar is asking the U.S. Supreme Court to toss an antitrust case brought by rival Crexi, a legal battle that could reshape competition rules for digital real estate platforms.

Fraud fallout: Mark Nussbaum claims he's owed over $300M as filings reveal a vast web of real estate loans and alleged fraud tied to his collapsed law firm.

Visa for sale: The Trump administration launched a $1M “gold card” visa program that grants fast-tracked U.S. residency, posing a direct challenge to the EB-5 program.

Landmark liquidation: Miami approved a $29M sale of Watson Island land for luxury development, despite appraisals valuing it far higher due to a devaluing lease.

🏘️ MULTIFAMILY

Housing timeout: GOP pulls national affordability reforms from $925B defense bill, stalling bipartisan housing efforts.

Waterfront boost: Panepinto landed $384M from Kennedy Wilson and Affinius to fund its 678-unit Harborside 8 project in Jersey City.

BTR boom: Build-to-rent housing is now a key solution to affordability and housing shortages, backed by major investors and strong renter demand.

Affordable appetite: Walker & Dunlop’s latest survey shows surging optimism for affordable housing, with 90% of industry execs expecting increased investment in 2026.

Silver conversion: BrookWynn Capital and AHC acquired a $42.3M multifamily tower in Downtown Silver Spring and will convert 100 units into affordable housing.

🏭 Industrial

Core markets: The 25 leading U.S. industrial markets now account for the majority of supply, construction, and demand.

Blackstone logistics: Blackstone is backing another major European CMBS—"Project Wapping"—secured by its newly acquired UK Warehouse REIT portfolio.

Lilly picks Alabama: Eli Lilly will build a $6B manufacturing plant in Huntsville, the largest private industrial investment in Alabama’s history.

Spec build: Crow Holdings and Buchanan Capital Partners are launching a 424K SF speculative industrial project in Whitsett, N.C.

Space race: SpaceX, Blue Origin, and other tech giants are racing to launch AI-powered data centers into orbit, aiming to escape Earth-bound constraints.

Production move: Swire Coca-Cola will build a $475M, 620K SF bottling plant in Colorado Springs—replacing its 90-year-old Denver facility.

🏬 RETAIL

Leasing leaders: Prime retail corridors in New York, Los Angeles, and Miami are dominating leasing activity post-pandemic, with NYC leading a luxury-driven rebound.

Retail refi: Alexander’s Inc. secured a $175M loan to refinance the Rego Park II retail center in Queens, retiring a 2018 Bank of China loan ahead of its maturity.

Gateway grab: Space Investment Partners bought the 123K SF Topanga Gateway retail center in L.A. for $64M, backed by a $42.9M loan.

Buyer gap: Retailers are catering to a sharply divided consumer base as wealthier shoppers drive the majority of sales.

Wealth shift: Soaring wealth among Gen Z is redefining luxury retail, as young consumers outspend older generations on experiences, sustainability, and secondhand goods.

Queens debut: Whole Foods has signed a 22,000-square-foot lease at 55-60 Myrtle Avenue in Ridgewood, marking the Amazon-owned grocer’s first location in Queens.

🏢 OFFICE

Conversion pause: A rebound in office leasing is prompting some landlords, like Vornado, to scrap conversion plans in favor of upgrading assets.

Federal footprint: Lawmakers are urging the GSA to speed up efforts to shrink the federal real estate footprint ahead of a key reporting deadline.

Stalled science: Taconic’s $2B life sciences gamble in NYC has hit a wall as lab leasing stalls and vacancies rise across a saturated market.

UN downsizing: The UN Population Fund is cutting its Manhattan office space by more than half, relocating from 605 to 730 Third Ave.

🏨 HOSPITALITY

Stepping down: AHIP CEO Jonathan Korol resigned as the hotel REIT sells assets and cuts debt, with co-founder John O’Neill stepping back in.

Meeting makeover: Marriott Minneapolis Northwest has rebranded to highlight its role as a top-tier conference destination.

Nashville growth: Tidal Real Estate Partners secured $400M in financing—led by Madison Realty Capital and KSL Capital—to develop The Nashville Edition Hotel & Residences.

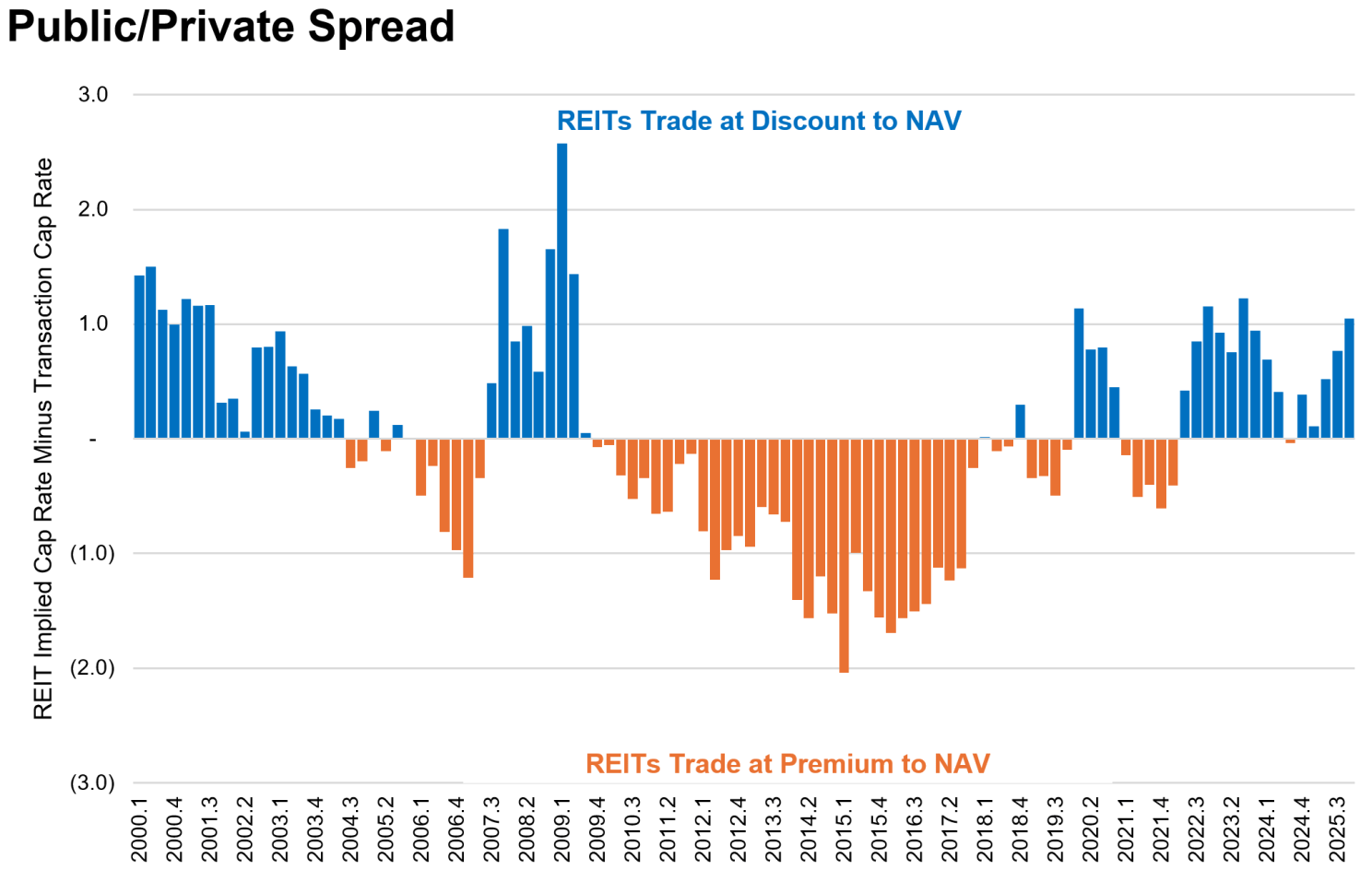

📈 CHART OF THE DAY

Apartment REITs are trading below asset values as public markets price in realities that the private market hasn’t fully recognized.

CRE Trivia (Answer)🧠

November. Demand slows ahead of the holidays and colder weather, giving renters more leverage and prompting landlords to lower rents or offer move-in incentives.

You currently have 0 referrals, only 1 away from receiving Multifamily Stress Test Model.

What did you think of today's newsletter? |

1

Reply