- CRE Daily

- Posts

- DFW Defies Industrial Slowdown With Spec Strategy Shift

DFW Defies Industrial Slowdown With Spec Strategy Shift

While most U.S. markets hit pause on industrial builds, Dallas-Fort Worth is still hitting the gas.

Good morning. While most U.S. markets hit pause on industrial builds, Dallas-Fort Worth is still hitting the gas — though with more caution in the passenger seat.

Today’s issue is brought to you by Agora—uncover how top real estate firms are navigating today’s economic pressures and outperforming the market.

🎙️This week on No Cap Podcast, Janet LePage joins Jack and Alex to unpack her wild rise in real estate, navigating rate hikes, distressed deals, and the secret power of washer-dryer installs.

Market Snapshot

|

| ||||

|

|

Hard Costs

Can DFW’s Industrial Boom Find Its Balance?

Courtesy of ARCO/Murray

While others pause, DFW keeps building — and its pivot to smarter, tenant-focused development may be the reason why.

Leading the way: Dallas-Fort Worth led all U.S. markets in industrial construction in May, with more than 28M SF in progress — nearly 3% of total inventory, per Yardi Matrix. But the surge comes with a side effect: a 10.2% vacancy rate, one of the highest among major U.S. metros.

The strategy shift: Speculative projects are still in play — like Alliuz’s new 251K SF warehouse in Mesquite — but the development lens is focusing in. A pivot toward build-to-suit and smaller, more flexible facilities is underway, designed to limit exposure and better align with tenant demand.

Demand in check: Leasing is holding up, even as absorption slows. DFW saw 18M SF leased in the first half of 2025, surpassing five of the past ten years. That includes four 350K SF+ deals, a sign that large-space demand hasn’t disappeared — just become less predictable. Still, only about two-thirds of the 34M SF delivered over the past year has been absorbed.

What’s coming online: Hillwood and Trammell Crow are leading the spec pipeline with 1.9M SF and 1.7M SF projects, respectively. But it’s the build-to-suit segment that’s gaining ground: Amazon is constructing 1.7M SF in South Fort Worth, and McMaster-Carr is developing 841K SF up north.

➥ THE TAKEAWAY

A turning point may be near: Vacancy dropped 0.5% over the past year, and with absorption projected to outpace new supply into mid-2026, DFW’s industrial market may be on track for a more balanced, tenant-aligned future.

TOGETHER WITH AGORA

2025 Real estate market sentiment report: Insights from 200+ CRE leaders

Capital is tighter. Investors are more demanding. Strategies are shifting. Yet some firms are pulling ahead-faster, leaner, smarter.

Agora’s latest report uncovers how the most forward-thinking real estate firms are navigating today’s economic pressures and outperforming the market.

What’s inside:

- 44% of firms have already pivoted investment plans

- 58% say raising capital is more difficult in 2025

- 31% of investors are demanding more transparency

- 48% are hunting undervalued or distressed opportunities

See what’s driving real decisions and learn how leading firms are staying ahead.

*This is a paid advertisement. Please see the full disclosure at the bottom of the newsletter.

✍️ Editor’s Picks

Land intelligence is your edge: Spot undervalued, off-market deals before the competition. Acres delivers infrastructure, risk, and sales intel nationwide so you can qualify prime opportunities fast. (sponsored)

Trend shift: IREI's decade-long review of investor preferences shows how institutional sentiment toward property types like life sciences and retail has swung dramatically.

Capital crunch: More than half of CRE investment firms are struggling to raise capital in 2025, forcing many to shift strategies amid investor anxiety and tightening markets.

Hidden hazards: A recent Trepp analysis highlights five under-the-radar risks that could quietly undermine commercial real estate stability.

Growth engines: Education and health services led June’s job gains, with NY on top and Sun Belt momentum fading.

Downtown vision: Centerton is planning a 400-acre mixed-use district to evolve from bedroom community to full-service city.

🏘️ MULTIFAMILY

Improvement focus: Landlords are pulling back from buying and selling in 2025, focusing instead on property upgrades and efficiency.

Booking boom: CoStar posted record-breaking Q2 bookings and raised its 2025 revenue forecast, driven by strong growth from Apartments.com and Homes.com.

Bronx boost: Beitel Group secured $305M in financing for a 755-unit, two-tower multifamily project in Mott Haven.

🏭 Industrial

Tax breaks: New tax breaks are fueling rural data center investment, with bonus depreciation and OZ updates attracting fresh capital.

Bay Area buy: BKM Capital Partners and Kayne Anderson Real Estate acquired a 16-building, 505K SF light industrial portfolio in the East Bay and Contra Costa.

EV pivot: Prologis plans to convert a 107K SF San Jose industrial site into an EV delivery and service hub.

Power crunch: A $90B AI data center boom is pressuring the PJM grid, with experts warning of blackout risks amid outdated infrastructure and rising demand.

🏬 RETAIL

Luxury landmark: One Beverly Hills is set to deliver a high-end hotel, residences, and retail by 2028.

Historic offering: A 60% ownership stake in San Francisco’s historic Gump’s building near Union Square is up for sale.

Foot traffic: Trader Joe’s, Aldi, and Lidl led grocery visit growth in H1 2025 through smart expansion and strong customer appeal.

🏢 OFFICE

Biotech revival: Alexandria’s record Novartis lease hints at a biotech rebound amid growing US drug manufacturing investment.

Creative reuse: Falling office values and rising storage demand are driving a wave of office-to-self-storage conversions.

Distress sale: Rockwood Capital is marketing its Midtown Manhattan office tower for around $270M, more than $100M below its 2018 purchase price.

Office pause: No new office projects broke ground in LA last quarter as high vacancies and low demand halt development.

🏨 HOSPITALITY

Mixed signals: Hilton's Q2 RevPAR dipped 0.5%, but signs of rebounding business travel and global growth keep long-term outlook upbeat.

Debt reset: DiamondRock secured a $1.5B credit facility, using $300M to retire three hotel loans and eliminate all debt maturities until 2028.

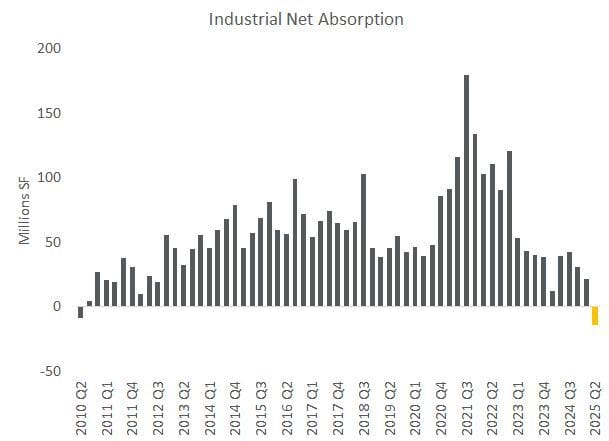

📈 CHART OF THE DAY

Industrial real estate just saw its first negative net absorption since the GFC, highlighting how tariff uncertainty is impacting demand, especially in coastal states reliant on imports.

You currently have 0 referrals, only 1 away from receiving Multifamily Stress Test Model.

What did you think of today's newsletter? |

Reply