- CRE Daily

- Posts

- Fed’s Treasury Pivot Sparks Mixed Signals for Long-Term Borrowing

Fed’s Treasury Pivot Sparks Mixed Signals for Long-Term Borrowing

The Fed’s Treasury purchases may ease short-term stress, but long-term rates remain elevated.

Good morning. The Fed quietly resumed short-term Treasury buys this month, but continued MBS reductions mean little relief for long-term borrowers or CRE.

Today's issue is sponsored by Blew—delivering reliable ALTA surveys and due diligence support across every CRE asset class.

CRE Trivia 🧠

Which city ranked No. 1 as the most popular U.S. housing market on Zillow in 2025?

(Answer at the bottom of the newsletter)

Market Snapshot

|

| ||||

|

|

Borrowing Pressure

Fed’s Treasury Pivot Sparks Mixed Signals for Long-Term Borrowing

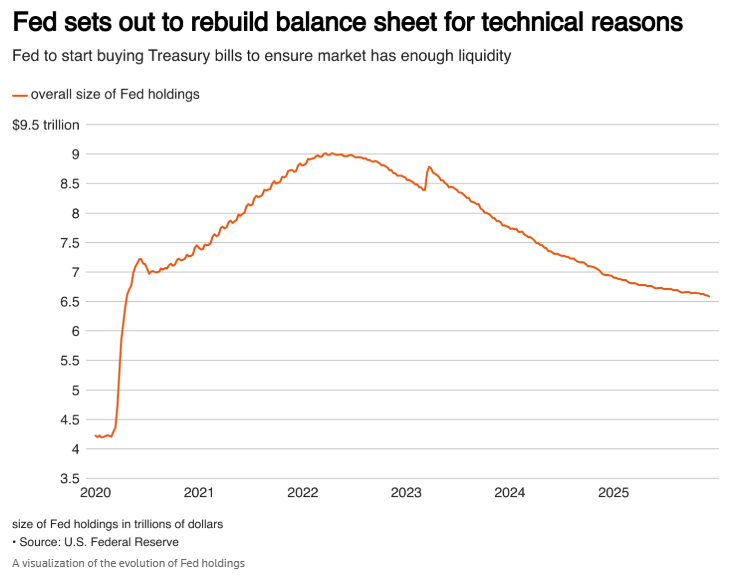

The Fed has resumed buying short-term Treasuries to stabilize liquidity—just as it continues winding down its mortgage bond holdings, leaving long-term borrowing costs elevated.

Reversing course: After pausing its balance sheet unwind, the Fed reversed course, announcing $40B in monthly short-term Treasury buys to maintain reserves and ease funding volatility. The purchases are set to taper by spring.

Repo market volatility: Recent spikes in key short-term lending benchmarks—SOFR and TGCR—highlight growing tension in overnight funding markets. The Fed’s intervention is meant to calm repo trading volatility and ensure smoother functioning across banks and financial institutions.

CRE rates remain elevated: While short-term liquidity is rising, the Fed continues to shrink its MBS portfolio, keeping long-term rates elevated. Pimco estimated that halting the wind-down could cut mortgage spreads by 20–30 bps, but those gains remain unrealized.

Market reactions split: Some on Wall Street, including Morgan Stanley, saw the Fed’s pivot as a sign of easing inflation concerns. Others warned that relying on high reserve levels signals fragility, not strength, and pointed to the Treasury’s increased short-term Bill issuance as conveniently aligned with the Fed’s new purchases.

➥ THE TAKEAWAY

No break for CRE: The Fed’s short-term Treasury buys may stabilize liquidity, but continued MBS reductions keep long-term rates—and CRE borrowing costs—elevated. For real estate finance, relief remains on the sidelines.

TOGETHER WITH BLEW

The nation’s leading provider of ALTA Surveys

With the 2026 ALTA/NSPS standards update approaching, our team will ensure your surveys meet their closing deadlines with the latest requirements through our in-house network of professionals.

Our integrated approach provides clients with reliable due diligence support across every asset type, market, and transaction.

Accurate and consistent solutions every time, Blew is your one-stop shop for CRE transaction services nationwide.

*This is a paid advertisement. Please see the full disclosure at the bottom of the newsletter.

✍️ Editor’s Picks

Tax smart returns: Invest in recession-resilient mobile home parks targeting 15-20% IRR, monthly cash flow, and 1-1.5x front-end bonus depreciation. (sponsored)

Acquisition mode: REIT property deals are picking up steam as public and private valuations converge, setting the stage for more acquisitions heading into 2026.

Data doubts: Billionaire CRE investor Fernando de Leon warns of risky fundamentals in the booming data center market.

Master planning: is a key risk-hedging strategy. Learn how Hines’ Conceptual Construction Group can reduce risk and position large-scale projects for resilient growth and long-term value. (sponsored)

Softening signals: Slowing job growth and rising unemployment signal headwinds for rent demand, while hopes for further Fed rate cuts may be on hold until spring 2026.

Asset ambitions: Pimco has raised over $7 billion for a growing asset-based finance platform, targeting loans backed by real and financial assets.

Repayment risk: Student loan delinquencies have spiked post-pause, with over 9M borrowers missing payments and credit scores dropping.

🏘️ MULTIFAMILY

2025 recap: In 2025, the rental market saw a surge in Southern construction, record office conversions, larger units, and a rise in millionaire and Gen Z renters reshaping demand.

Multifamily reset: Multifamily housing in 2026 faces slower growth, less construction, and a pivot to tech and tenant retention.

Staying put: Multifamily performance in 2026 is expected to improve modestly, driven by record-high lease renewals, stable occupancy, and strategic concessions.

Scape goats: HUD’s latest housing report shifts blame for the affordability crisis toward rising demand from immigration and unmarried households.

Affordable luxury: Billionaire Mark Stevens turned a luxury apartment complex in Steamboat Springs into affordable housing for local workers, offering below-market rents without public subsidies.

Distress deal: Revere Housing has acquired a $570M defaulted loan tied to 1,500 Veritas-controlled San Francisco apartments, continuing a wave of distressed multifamily sales in the city.

🏭 Industrial

Oracle exposure: Oracle’s $248B in long-term data center leases risks overexposure if AI demand slows before short-term client contracts offset costs.

Manhattan rebrand: Storage Post secured a $47M loan for its East Village self storage facility, recently upgraded and now 91% leased.

Tech corridor: BKM and Kayne Anderson acquired San Jose's PacTrust Business Center for $30M, 55% below replacement cost.

For sale: Bridge Industrial is selling its 534K SF redeveloped Oakland industrial park after investing $92M into transforming the former GE site.

🏬 RETAIL

Private resurgence: Single-tenant net lease retail saw a sales rebound in 2025, driven by private investors returning to the market and favoring high-credit, long-term assets.

Southern strength: Charlotte topped CoStar’s 2025 ranking of U.S. retail markets, driven by job growth and demand for new grocery-anchored retail in Sunbelt cities.

Spending stall: U.S. retail sales flatlined in October, signaling a consumer pullback as inflation, weak hiring, and fading wage growth weigh on household budgets.

Grocery push: Bain Capital and 11North raised $1.6B to expand their grocery-anchored retail portfolio across the U.S. and Canada.

Luxury liquidation: Kering sold a 60% stake in its Fifth Avenue retail property for $900M, 7% less than it paid in 2024, partnering with Ardian as part of a global asset selloff.

Bond trouble: Illinois’ first STAR bond mall redevelopment faces uncertainty after a key developer’s financial troubles triggered lawsuits and foreclosure risks.

🏢 OFFICE

Premium preference: Office values are showing early signs of recovery globally, but gains are concentrated in high-quality assets as weaker properties continue to struggle.

Office opportunity: Cannon Hill Capital is targeting distressed office and mixed-use assets in the Northeast, leveraging tenant demand and local insight to reposition or redevelop properties.

Medical refi: Harrison Street and Archer Property Partners refinanced the 114,209-square-foot Pacifica Medical Plaza in Irvine, CA with a $51M loan after converting it from office to medical use.

Moving south: Citadel is leaving its namesake Chicago tower, downsizing to 50K SF as it shifts operations to Miami.

FiDi fallout: Bushburg Properties bought 100 William Street in Manhattan’s Financial District for $70M, less than half its $166.5M sale price in 2013.

Delayed turnaround: Boston extended its office-to-residential conversion program, but high costs and slow progress limit large-scale success.

🏨 HOSPITALITY

Streaming getaways: Hollywood hits are turning global filming locations into travel hotspots, with "set-jetting" expected to drive billions in tourism dollars in 2026.

Lease liquidation: Nearly 200 former Sonder properties across 17 states are up for grabs as the once-hyped short-term rental startup undergoes Chapter 7 bankruptcy.

Cleary's comeback: Houston developer Joe Cleary returns to Post Oak Boulevard with a skyline-defining Ritz-Carlton condo and hotel tower.

📈 CHART OF THE DAY

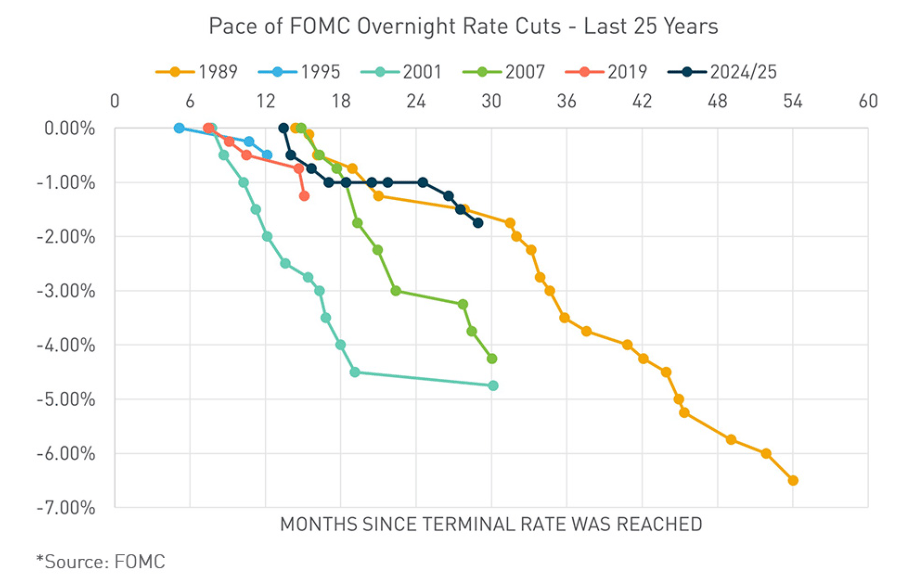

The current rate-cutting cycle is unfolding far more gradually than previous ones, highlighting a deliberate and measured approach by the Fed compared to the swift, aggressive cuts seen during past economic downturns.

CRE Trivia (Answer)🧠

Rockford, Illinois which rose from No. 2 to No. 1 on Zillow’s 2025 list as buyers prioritized affordability, Midwest markets, and fast-moving homes near major job hubs like Chicago.

You currently have 0 referrals, only 1 away from receiving Multifamily Stress Test Model.

What did you think of today's newsletter? |

1

Reply