- CRE Daily

- Posts

- Federal Real Estate’s Roller Coaster Year: Chaos, Confusion & Course Corrections

Federal Real Estate’s Roller Coaster Year: Chaos, Confusion & Course Corrections

Lease terminations, rescinded sales, and a GSA in flux defined federal real estate this year.

Good morning. It’s been a whirlwind year for federal real estate. Bold promises to slash the government’s office footprint gave way to reversals, leadership shakeups, and minimal real progress.

Today's issue is sponsored by 1031 Crowdfunding—helping investors access investment-grade real estate through tax-advantaged vehicles.

CRE Trivia 🧠

Which company is the largest industrial tenant in the U.S.?

(Answer at the bottom of the newsletter)

Market Snapshot

|

| ||||

|

|

Federal Footprint

Federal Real Estate’s Roller Coaster Year: Chaos, Confusion & Course Corrections

After a fast and furious start to 2025, the Trump administration’s aggressive moves to slash federal office space slowed to a crawl, leaving behind uncertainty, leadership gaps, and an agency in flux.

Fizzling fast: Days into office, Trump launched the Department of Government Efficiency, led by Elon Musk, to cut bureaucracy and office space. DOGE quickly announced lease cancellations and property sales—many of which were reversed within days, leaving the market in confusion and limbo.

The year full of pivots: Most of the 748 leases DOGE claimed to cancel were already set to expire, and many terminations were later rescinded. One rare surprise—a 290K SF lease for the U.S. Agency for Global Media—hinted at political motives.

GSA in turmoil: The GSA faced a major leadership vacuum and staff exodus in 2025, shrinking from over 5,600 to just 3,100 employees. Frequent leadership changes stalled decision-making until Edward Forst’s confirmation in December, which insiders hope will bring stability.

Plans fall short: Despite bold intentions to cut the owned portfolio, progress was limited. A list of 443 buildings (80M SF) was released in March, then quickly pulled. Just 90 buildings totaling 3M SF were sold in 2025, mostly already marked for disposal.

Downsizing lite: Despite DOGE’s noise, the leased portfolio declined only modestly—from 173.6M SF to 170.6M SF nationally, and 42.9M SF to 40.7M SF in D.C. Most new leasing involved VA, Homeland Security, and immigration agencies. Only one major shift from owned to leased space occurred: HUD’s move to Alexandria.

➥ THE TAKEAWAY

Eyes on 2026: Federal real estate in 2025 was more noise than action, but with new leadership and a full-time office mandate driving January occupancy reporting, 2026 could finally trigger the long-awaited portfolio reset.

TOGETHER WITH 1031 CROWDFUNDING

Access Tax-Advantaged Real Estate Investments

1031 Crowdfunding is a one-stop-shop for real estate investments, offering a diverse range of investments that prioritize tax deferral and non-correlated market returns. We are uniquely positioned to offer expertise, a diverse inventory, and proprietary tools to help you create a portfolio tailored to your financial goals.

Why invest with 1031 Crowdfunding?

100+ ready-to-invest offerings: Explore a broad marketplace of tax-advantaged vehicles such as Delaware Statutory Trusts, REITs, Opportunity Zone Funds, and more.

Due Diligence at Your Fingertips: Every offering on our platform is vetted through a proprietary model designed to help you invest with confidence.

Comprehensive Real Estate Documentation: Review detailed offering materials, financials, and property information so you can conduct your own independent due diligence and ensure the right fit for your portfolio.

White-Glove Service: From helping you select the right investment to providing ongoing support after closing, our management team delivers personalized guidance at every step of your investment journey.

Register for free today to explore our full range of offerings.

*Investments offered by Capulent LLC, member FINRA/SIPC. This is a paid advertisement. Please see the full disclosure at the bottom of the newsletter.

✍️ Editor’s Picks

Effortless landlording: Simplify how you manage your rentals for free with TurboTenant, the all-in-one platform helping landlords run their portfolios with ease. (sponsored)

Mixed signals: Conflicting data on inflation, jobs, and spending are clouding the outlook, leaving analysts unsure where the U.S. economy is headed.

Soft landing: LightBox’s CRE Index saw a mild seasonal dip in November, signaling renewed stability and growing momentum as the market gears up for a stronger 2026.

Visa capital: Trump’s $1M Gold Card visa program could attract wealthy foreigners, but unlike EB-5, it doesn’t channel funds directly into CRE projects.

Library landed: A judge has cleared the path for Trump’s $67M presidential library site in Downtown Miami, reviving plans that could reshape a prime CRE parcel.

Valuation gap: Bluerock’s $3.6B CRE fund is listed at a 38% discount, revealing a sharp disconnect between private valuations and public market pricing.

Ground risk: A ticking ground lease at 1407 Broadway led to a 75% drop in value, exposing hidden risks in CRE deals.

Lender takeover: Sagamore and Goldman Sachs handed undeveloped land at Baltimore Peninsula to Bank OZK, while Hines takes over as asset manager.

🏘️ MULTIFAMILY

Stable spreads: Multifamily loan spreads remain stable, but record-high 7.2% vacancy and softening rents point to oversupply concerns heading into year-end.

Core waits: Multifamily deals are gaining momentum as private buyers fill the gap left by cautious core capital, with hopes for a stronger return in late 2026.

First dibs: NYC passed COPA and other housing bills despite CRE industry objections, granting nonprofits early-bid rights on distressed multifamily buildings.

Cautious rebound: The multifamily sector is expected to stabilize in 2026, with soft markets working through oversupply and investors shifting focus to value-add and workforce housing.

Policy sabotage: Outgoing NYC Mayor Eric Adams made last-minute appointments to the Rent Guidelines Board to thwart incoming Mayor Zohran Mamdani’s 2026 rent freeze plan.

Metropark move: Brooksville and Torchlight secured a $98M loan to acquire The Grande at MetroPark, a Class A multifamily in Northern NJ.

Flex appeal: San Diego’s short-term rental market is thriving thanks to steady demand from remote workers, military personnel, and seasonal renters.

🏭 Industrial

Cooling gains: Self-storage saw increased investment in 2025, even as rent growth decelerated under continued supply pressure.

Mixed bag: Manufacturing investment rose in 2025, but policy shifts and EV slowdowns stalled many projects, while defense, energy, and AI-linked sectors led new growth.

Rail expansion: Union Pacific is building a 2,000-acre industrial park near Houston with rail access and 20M SF potential.

Going postal: USPS will open access to 18,000 delivery units in 2026, allowing more shippers to tap its vast network.

Desert data: Eric Schmidt’s Bolt is teaming with Texas Pacific Land to build AI data centers in West Texas.

Digital expansion: Ares acquired two fully leased hyperscale data centers and a 314-acre development site in Northern Virginia.

🏬 RETAIL

Pricing clarity: Single-tenant retail sales are rising, driven by private investors seeking stable returns amid high cap rates and improved pricing clarity.

Urban pioneer: Atlanta’s Atlantic Station continues to thrive as a model for mixed-use development, even as tenants like Publix and DSW exit and newer projects follow its blueprint.

Shopping spree: AlbaneseCormier acquired four open-air shopping centers across the Midwest and Southeast.

Coffee culture: Nespresso opened a 13,900 SF flagship in NYC’s Flatiron district, blending immersive coffee experiences with retail.

Experience economy: California’s retail sector remains strong going into 2026, with investors focused on necessity-based and experiential properties.

🏢 OFFICE

Delayed decisions: While 70% of companies plan to add office space in 2026—up from 56% in 2024—economic uncertainty is prompting many to delay those moves.

Golden exit: Paramount shareholders approved a $1.6B sale to Rithm Capital—while rejecting the CEO’s $34M exit package, which he’s set to receive anyway.

Legal leasing: Law firm office leasing is on track for a record year in 2025, driven by relocations, expansions, and a strong appetite for high-end, amenity-rich space.

Conversion craze: Chicago is leading a national boom in office-to-residential conversions, backed by city incentives and creative financing.

Class A: Bromley Companies secured a $163M refinance for 122 Fifth Avenue after a $107M renovation transformed it into a Class A office hub.

🏨 HOSPITALITY

Beachfront boost: Peachtree Group provided $85M in bridge financing to recapitalize two Hilton- and Marriott-branded hotels in Myrtle Beach.

Luxury refi: Ian Schrager secured a $310M refinance for his 367-key Public Hotel on Manhattan’s Lower East Side.

Music city refi: Virgin Hotels Nashville secured a $51M refinancing from Apollo to support its luxury lifestyle hotel.

Tourism trouble: U.S. hotel performance fell again in December, driven by weak demand and hurricane-impacted markets.

A MESSAGE FROM AIRGARAGE

Can your parking operator answer these 7 questions?

We talk to hundreds of owners who assume their operator has it covered — until they start asking deeper questions.

Questions about how pricing decisions are made, how performance is tracked, or what’s actually being done to grow NOI. That’s where the cracks usually show.

We've laid out the key questions every owner should ask — and what a confident answer sounds like.

If your operator can’t answer clearly, it might be time for a change.

*This is a paid advertisement. Please see the full disclosure at the bottom of the newsletter.

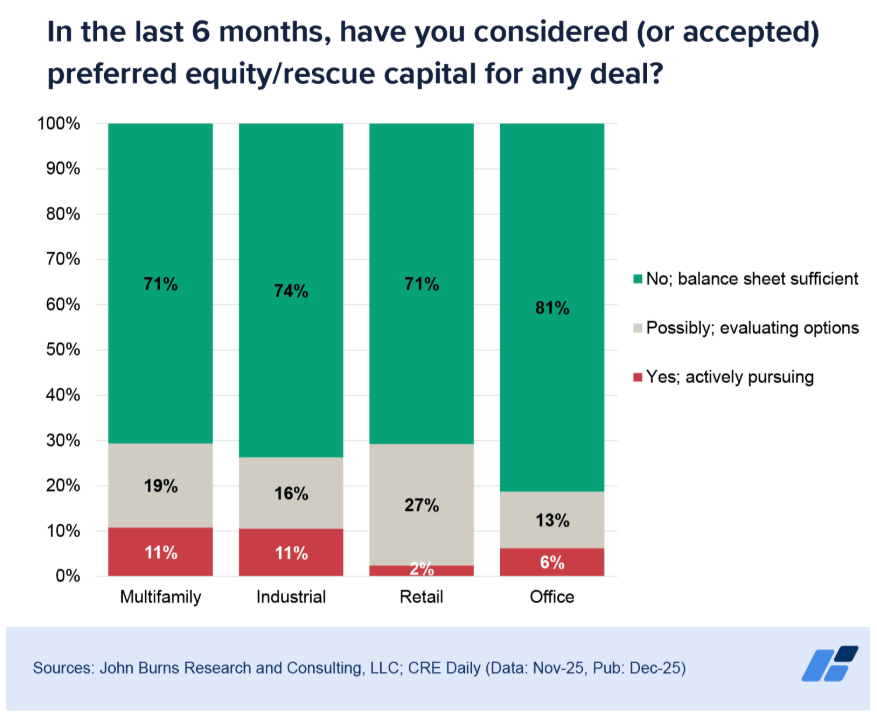

📈 CHART OF THE DAY

According to the Q425 Fear and Greed Index, more than 70% of CRE investors have not pursued preferred or rescue capital in the past six months, though multifamily investors are doing so at higher rates than other sectors.

CRE Trivia (Answer)🧠

Amazon is the largest industrial real estate tenant in the U.S., occupying more than 400M SF of logistics space nationwide.

You currently have 0 referrals, only 1 away from receiving Multifamily Stress Test Model.

What did you think of today's newsletter? |

1

Reply