- CRE Daily

- Posts

- Flight to Quality Drives U.S. Commercial Property Pricing Trends

Flight to Quality Drives U.S. Commercial Property Pricing Trends

Pricing data highlights a flight to quality in CRE, with institutional capital targeting core assets.

Good morning. Capital is flowing back into top-tier office and multifamily assets, pushing CRE prices higher in major markets. But pricing remains mixed across sectors and regions, underscoring a selective recovery.

Today’s issue is sponsored by 1031 Crowdfunding—helping investors access investment-grade real estate through tax-advantaged vehicles.

🗽Inside NYC: Want tomorrow’s NYC real estate briefing? Subscribe to CRE Daily New York for market-specific deals, data, and capital moves.

CRE Trivia 🧠

What was the most commonly used word in corporate earnings calls in 2025?

(Answer at the bottom of the newsletter)

Market Snapshot

|

| ||||

|

|

Price Recovery

Flight to Quality Drives U.S. Commercial Property Pricing Trends

While the CRE is returning to growth overall, performance is diverging sharply across regions and sectors, highlighting a shift toward quality over quantity.

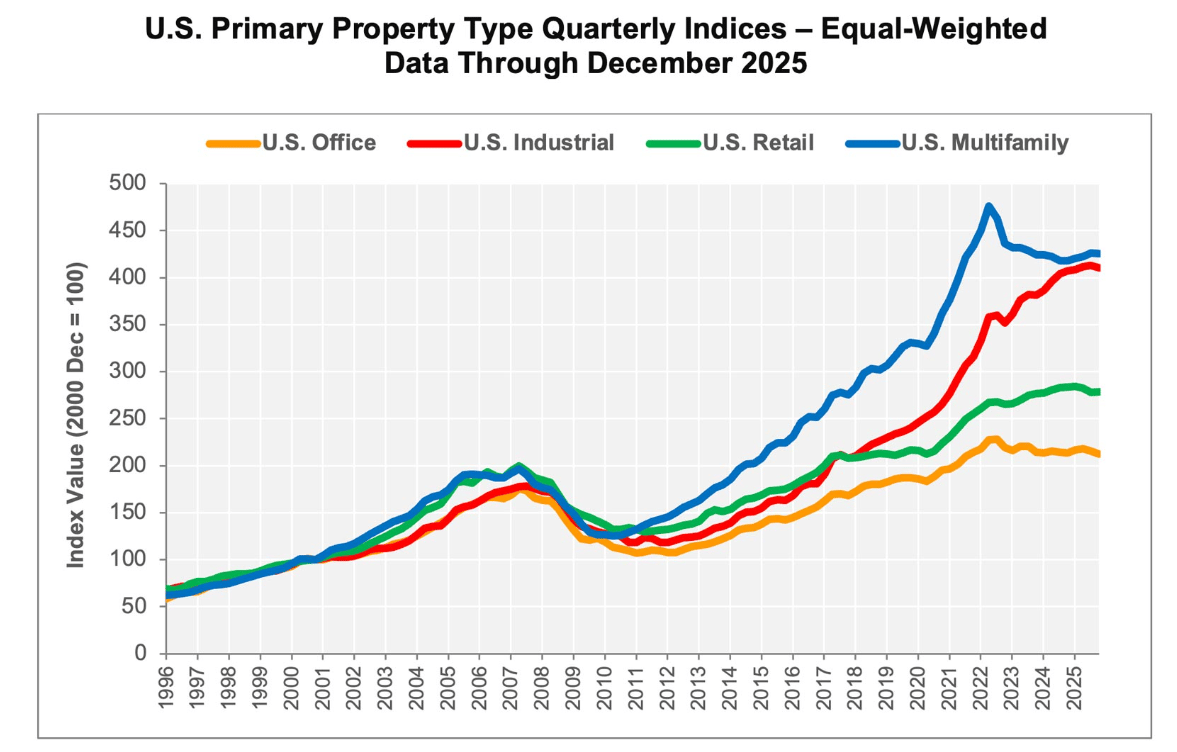

Office rebound: Value-weighted office prices rose 3.8% year-over-year in December 2025, per CoStar’s CCRSI—reversing 2024’s 11.4% drop. The gain signals renewed investor interest in high-end assets in major markets, despite ongoing uncertainty around hybrid work.

Mixed results: Multifamily posted a modest 0.7% annual gain after a 2.3% drop in 2024. Industrial and retail edged up 0.4%, well below their 2024 gains. The equal-weighted index, reflecting smaller deals, rose just 0.3%, with office and retail prices dipping slightly.

Source: CoStar

Regional star: The Midwest led with a 7.4% annual jump in value-weighted prices, fueled by strong multifamily and industrial gains. The South followed with a 3.1% rise, while the Northeast and West fell 2.7% and 5.8%, respectively, amid weaker retail and office performance.

Favoring quality: The disparity between value- and equal-weighted indices highlights a “flight to quality,” with capital increasingly flowing toward larger, high-value assets in top-tier markets. Office leasing demand from sectors like AI in places like San Francisco contributed to optimism in select metros.

➥ THE TAKEAWAY

Big picture: The 2025 CRE market showed cautious optimism, with investors returning to prime office assets. But pricing remains weak in secondary and lower-tier markets, signaling a selective—not broad—recovery.

TOGETHER WITH 1031 CROWDFUNDING

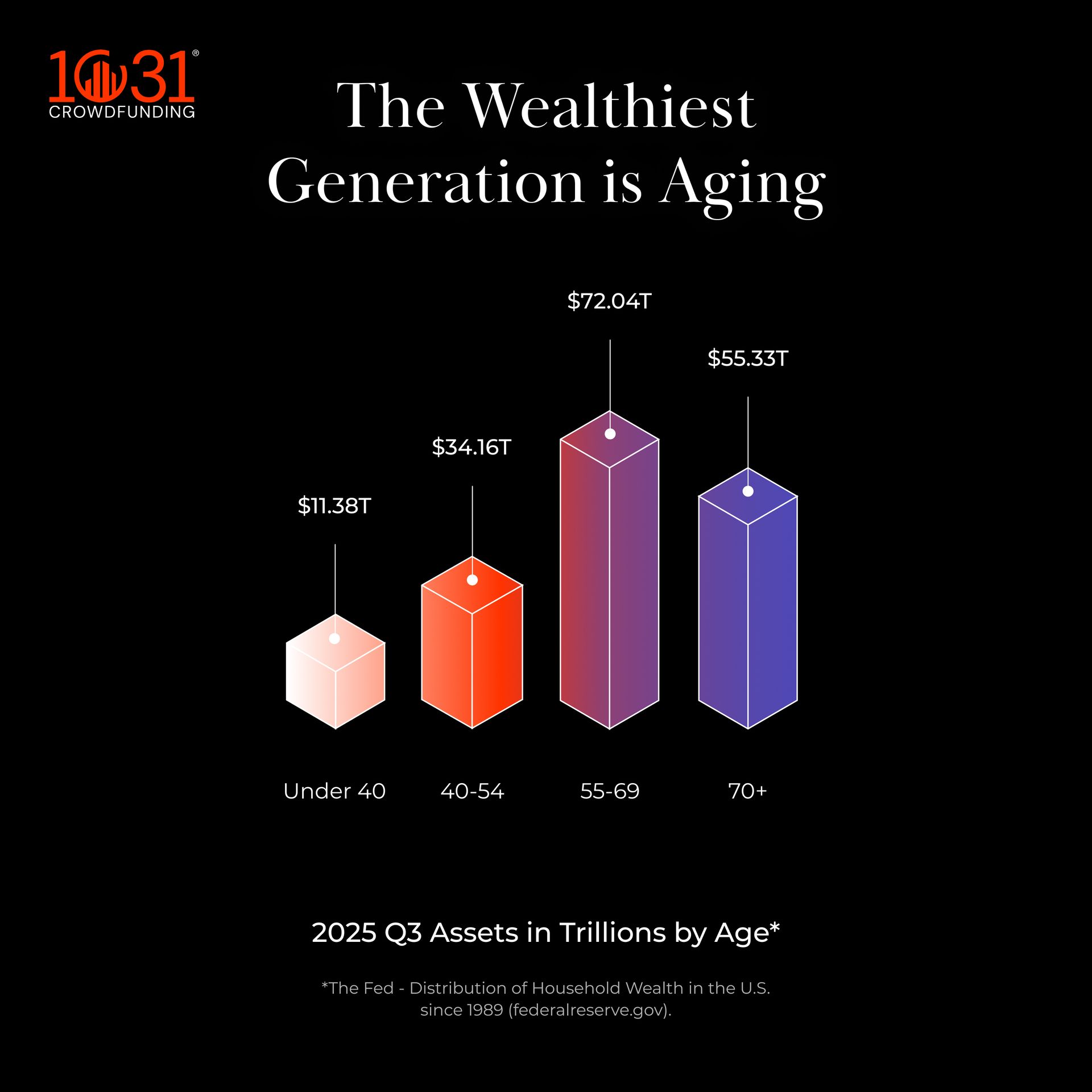

Unprecedented Demand for Senior Housing

Senior housing has gained traction with institutional investors as the Baby Boomer generation, the wealthiest generation in U.S. history, ages into higher levels of care. This demographic shift is fueling unprecedented demand for assisted living and memory care communities.

Why invest in Senior Housing?

Senior housing stands out as a sector built on necessity and backed by enduring demographic demand.

10,000 Americans turn 80 every day.

NIC estimates that more than 800,000 additional senior housing units will be needed nationwide by 2030.

At 1031 Crowdfunding, we help investors access senior housing opportunities through tax-advantaged vehicles. We provide exposure to professionally managed portfolios while eliminating the challenges of direct property ownership.

Click to learn more about our featured senior housing investments today.

*Investments offered by Capulent LLC, member FINRA/SIPC. This is a paid advertisement. Please see the full disclosure at the bottom of the newsletter.

✍️ Editor’s Picks

Mobile home parks under scrutiny: As institutional capital floods the sector, investors are wrestling with whether the asset class can deliver returns without exploiting residents. (sponsored)

Brookfield buyout: Brookfield is acquiring Peakstone Realty Trust in a $1.2B all-cash deal, adding over 13 MSF of net lease assets to its portfolio.

Efficient cuts: Despite record corporate earnings, companies are cutting jobs to preempt economic headwinds, prioritize AI investments, and maintain margins.

Boulder debut: Sundance is wrapping up its final year in Utah as Boulder, CO gears up to host the iconic film festival starting in 2027.

Yield trap: Governments worldwide are subtly taxing capital through inflation and low yields, putting pressure on real estate investors navigating tighter monetary environments.

Buyer's market: Higher inventory, longer listing times, and more frequent price cuts are tipping the balance of power in the housing market back toward buyers.

🏘️ MULTIFAMILY

Cleaner closings: Fannie Mae reports a steady decline in multifamily mortgage fraud, attributing it to enhanced due diligence and improved data transparency.

Industry pulse: Industry leaders at NHMC discussed cautious optimism for 2026, citing strong demand tempered by regulatory, capital, and construction hurdles.

Policy jam: HUD’s push for stricter immigration verification has landlords caught between federal requirements and state-level tenant protection laws.

🏭 Industrial

Conversion capital: New York City leads the nation in converting buildings to self-storage, capitalizing on high urban demand and underutilized commercial spaces.

Industrial report: The industrial sector remains resilient with solid leasing activity and rent growth, though new supply is expected to temper pricing in 2026.

Big data: Elon Musk and Mark Zuckerberg are racing to build next-gen data centers, each aiming to dominate the AI infrastructure space.

Demand endures: New Jersey’s industrial market remains tight with strong leasing demand and minimal vacancies, even as construction moderates slightly.

🏬 RETAIL

Reel appeal: Movie theaters are getting a Gen Z glow-up, with operators investing in elevated experiences to match shifting entertainment preferences.

Discount dominance: TJ Maxx is set to redefine off-price retail in 2026 by doubling down on physical expansion, smart inventory, and loyal bargain-hunters.

Star power: Celebrity-backed ventures and major financial tenants are energizing Miami’s retail scene, merging nightlife, luxury, and investment confidence.

🏢 OFFICE

Tower takeover: Anthropic just signed a 13-year lease for all 27 floors of a downtown San Francisco tower, marking one of the city’s biggest office deals since 2019.

Trophy tenant: Developer SHVO inked a record-breaking office lease in San Francisco, a rare bright spot in an otherwise challenged urban office market.

Class act: Class A urban office spaces led 2025’s biggest leases as top-tier amenities and location continue to lure large corporate tenants.

Quiet exit: Federal agencies are quietly shrinking their office footprints, reshaping long-term demand for government-leased commercial space.

🏨 HOSPITALITY

Room shortage: New hotel construction has hit a low due to high interest rates and softening demand, signaling a slow-growth era for hospitality.

Missed departures: Travel industry leaders say visa delays, outdated infrastructure, and geopolitical friction are causing the U.S. to miss out on global tourism gains.

📈 CHART OF THE DAY

Despite price declines since 2022, distressed asset sales have remained minimal—accounting for just 3% of transaction volume—unlike in the post-2008 cycle, when distress peaked at 20%.

CRE Trivia (Answer)🧠

According to FactSet, “AI” was the most commonly used word in corporate earnings calls in 2025.

More from CRE Daily

📬 Newsletters: Stay ahead of the market with local insights from CRE Daily Texas and CRE Daily New York.

🎙️Podcast: No Cap by CRE Daily delivers an unfiltered look at the biggest trends—and the money game behind them.

🗓️ CRE Events Calendar: The largest searchable calendar of commercial real estate events—filter by city or sector.

📊 Market Reports: A centralized hub for brokerage research and market intelligence, all in one place.

📈 Fear & Greed Index: A fully interactive sentiment tracker on the pulse of CRE built in partnership with John Burns Research & Consulting.

You currently have 0 referrals, only 1 away from receiving Multifamily Stress Test Model.

What did you think of today's newsletter? |

Reply