- CRE Daily

- Posts

- HUD Weighs Two-Year Cap on Rental Aid

HUD Weighs Two-Year Cap on Rental Aid

Leasing may be cooling, but pre-leased builds are gaining serious momentum.

Good morning. A proposed policy shift could shorten how long low-income families receive federal housing support—potentially impacting over a million households.

Today’s issue is brought to you by FarmTogether—diversify your portfolio with income-producing farmland.

🎙️This week on No Cap Podcast, Janet LePage joins Jack and Alex to unpack her wild rise in real estate, navigating rate hikes, distressed deals, and the secret power of washer-dryer installs.

Market Snapshot

|

| ||||

|

|

Rental Assistance

HUD Floats Time Limits on Rental Aid, Sparking Controversy

A potential two-year cap on federal rental assistance has ignited debate over affordability, fairness, and the future of subsidized housing.

The proposal: HUD is weighing a policy change that would impose a two-year limit on Section 8 vouchers and public housing subsidies. Citing concerns over program sustainability and fraud, HUD Secretary Scott Turner argued during a June congressional hearing that rental aid was never intended to be permanent, noting the average stay currently exceeds six years.

Critics warn: Opponents—including researchers and tenant advocates—warn the change could displace as many as 1.4 million low-income households, many of them working families with children. They argue that housing costs have outpaced wages, and many beneficiaries simply can’t afford market-rate rents without assistance.

Red tape: Landlords, too, are uneasy. While HUD programs can be bureaucratic, they offer reliable, long-term tenants and steady income. A two-year limit could undermine that stability, potentially prompting some landlords to exit the system altogether.

Digging into the data: According to NYU research, about 70% of affected households already stay beyond the proposed two-year cap. However, the policy would exclude elderly and disabled residents, who make up nearly half of HUD-assisted households. Proponents argue limits could reduce long waitlists and encourage self-sufficiency, pointing to mixed results from local pilots in New Hampshire and California.

➥ THE TAKEAWAY

The bigger picture: A time limit on rental assistance might clear HUD’s backlog—but at what cost? The move could destabilize millions of working families in the name of efficiency, forcing policymakers to weigh program integrity against real-world affordability.

TOGETHER WITH FARMTOGETHER

1031 Exchange-Eligible Farmland Available Today

For investors navigating a 1031 exchange, U.S. farmland offers a unique replacement property option—combining income potential, long-term appreciation, and low correlation to traditional CRE sectors.

Through FarmTogether, accredited investors can access high-quality farmland investments structured to meet 1031 exchange requirements. Each offering undergoes rigorous due diligence, is professionally managed, and supports a defined cash yield strategy.

In today’s compressed cap rate environment, farmland stands out for its scarcity, inflation resilience, and fundamentals tied to food demand—not interest rates or urban migration.

This is not a DST or REIT. It’s direct ownership in a real, producing asset class—one that’s historically been out of reach for most investors.

FarmTogether’s current 1031-eligible offering, Landmark Mandarin Grove, is an 80-acre mandarin grove in California targeting a 9.4% net cash yield and 11.1% target net IRR. Structured for 1031 exchange compatibility, the deal is available for a limited time ahead of escrow close.

*This is a paid advertisement. Please see the full disclosure at the bottom of the newsletter.

✍️ Editor’s Picks

Scale smarter: Ready to attract top producers and accelerate deal closures? See how Buildout Manage & Close provides real-time visibility, automates commissions, and embeds operational best practices. (sponsored)

Cap rate compression: Multifamily underwriting metrics improved modestly in Q2, with slight cap rate compression and stronger value-add buyer sentiment.

Distress retreat: CRE CLO distress dropped 230 bps in June to 10.9%, signaling a temporary reprieve in a volatile market.

Confidence creeps: Builder sentiment rose slightly in July, but high rates still weigh on housing.

Capital crunch: CRE dealmaking is slowing as rising borrowing costs and cautious lending tighten access to capital.

DST boom: DST offerings hit a 2025 high in June, raising $630M and pushing YTD equity up nearly 50% over last year.

Tiny loans: A new bipartisan bill would let the federal government back second mortgages for ADU construction.

Construction dip: Single-family housing starts fell 10% YoY in June as rising inventory and sluggish buyer demand pressured builders to pull back.

RIP: Donald Soffer, the visionary developer who transformed swampland into Aventura and helped shape South Florida’s skyline, has died at 92.

🏘️ MULTIFAMILY

Housing setback: NYC pulled the plug on the Haven Green project, halting affordable senior housing in favor of preserving a small park.

Miami makeover: Related Group will redevelop a Miami public housing site into 115 affordable units, part of a broader partnership with Miami-Dade.

New venture: Invesco and Bozzuto formed a $1B multifamily investment venture, kicking off with a 220-unit value-add acquisition in Orlando.

Regional momentum: Developers in North Carolina’s Triad region are planning thousands of new units, driven by job growth and relatively affordable housing.

🏭 Industrial

Factory pivot: California Forever, once pitched as a utopian city, now plans a 2,100-acre industrial park focused on defense manufacturing.

Tariff impact: Despite solid fundamentals and robust leasing, the Inland Empire’s industrial market faces falling rents and investor hesitation.

Investor settlement: Equinix will pay $41.5M to settle claims it inflated earnings by misclassifying expenses to boost executive bonuses.

Profit jump: Rexford Industrial posted $113M in Q2 net income, a 42% increase YoY.

🏬 RETAIL

Brady brand: Tom Brady’s CardVault memorabilia chain is opening its first Midwest store near Wrigley Field.

Cargo crime: As organized retail crime shifts from stores to supply chains, Congress is weighing new legislation to tackle a surge in cargo theft.

Debt discount: SL Green and Jeff Sutton bought the $219.5M mortgage on their struggling Times Square retail property for just $63M, less than 30% of its balance.

Deal dropped: Canadian retailer Couche-Tard has officially abandoned its $47B bid to acquire 7-Eleven parent Seven & i Holdings.

🏢 OFFICE

Adaptive reuse: More than 3% of Houston’s total office inventory is set to be converted, as the city becomes a national leader in repurposing outdated buildings.

Capital confidence: SL Green has topped $1B in fundraising for its NYC-focused debt fund, boosted by distressed asset plays and strong leasing momentum.

Resilient sector: Despite over $1T in federal healthcare cuts, the medical office market remains steady.

Regional hub: Rivian is opening a new East Coast headquarters in Atlanta ahead of its long-awaited Georgia EV factory build.

Google exit: Google plans to give up a Sunnyvale office it’s failed to sublease, adding to its broader pullback from Silicon Valley.

🏨 HOSPITALITY

Hotel dispute: Crescent Heights is suing CitizenM, alleging the hotelier failed to transfer commercial units tied to a Miami Beach project.

Historic hoops: A 132-year-old basketball court discovered in St. Stephen, New Brunswick, the oldest known to survive, is being transformed into an interactive museum to drive tourism.

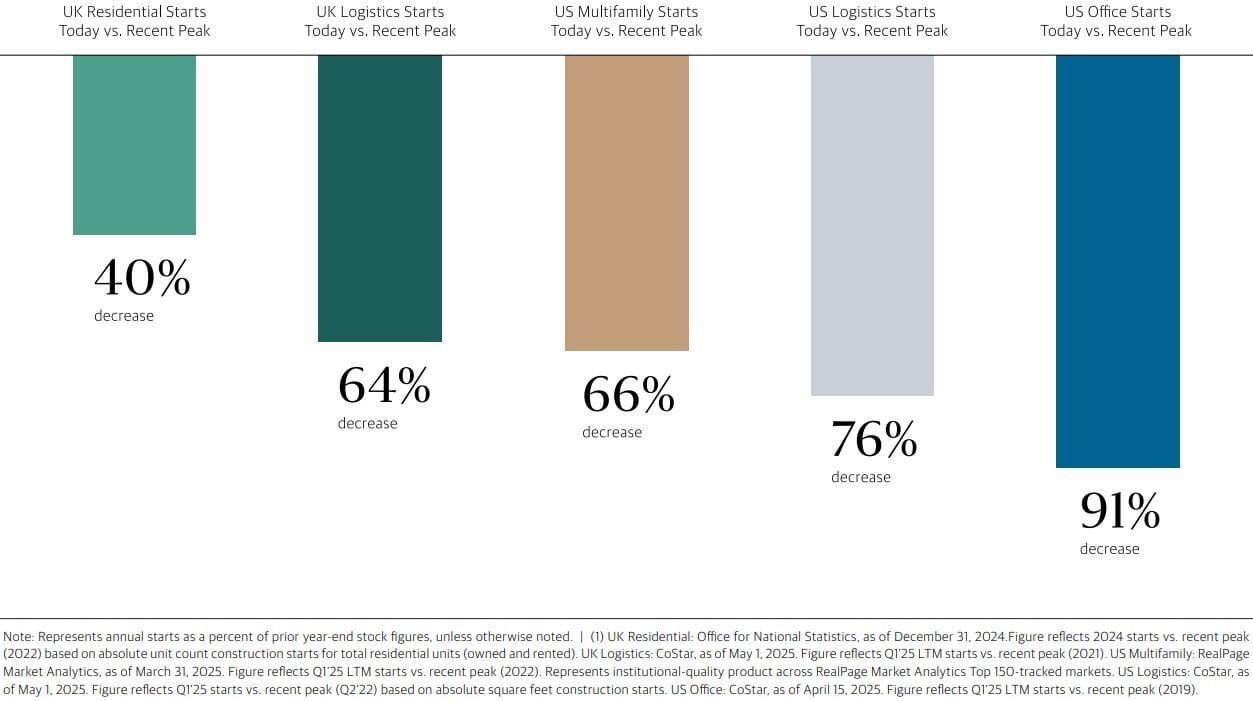

📈 CHART OF THE DAY

With new construction slowing globally and supply tightening, Blackstone has gone on the offensive, deploying $26B over the past year to capitalize on the imbalance.

You currently have 0 referrals, only 1 away from receiving Multifamily Stress Test Model.

What did you think of today's newsletter? |

Reply