- CRE Daily

- Posts

- Independent Landlord Rent Collections Hit Post-Pandemic Low

Independent Landlord Rent Collections Hit Post-Pandemic Low

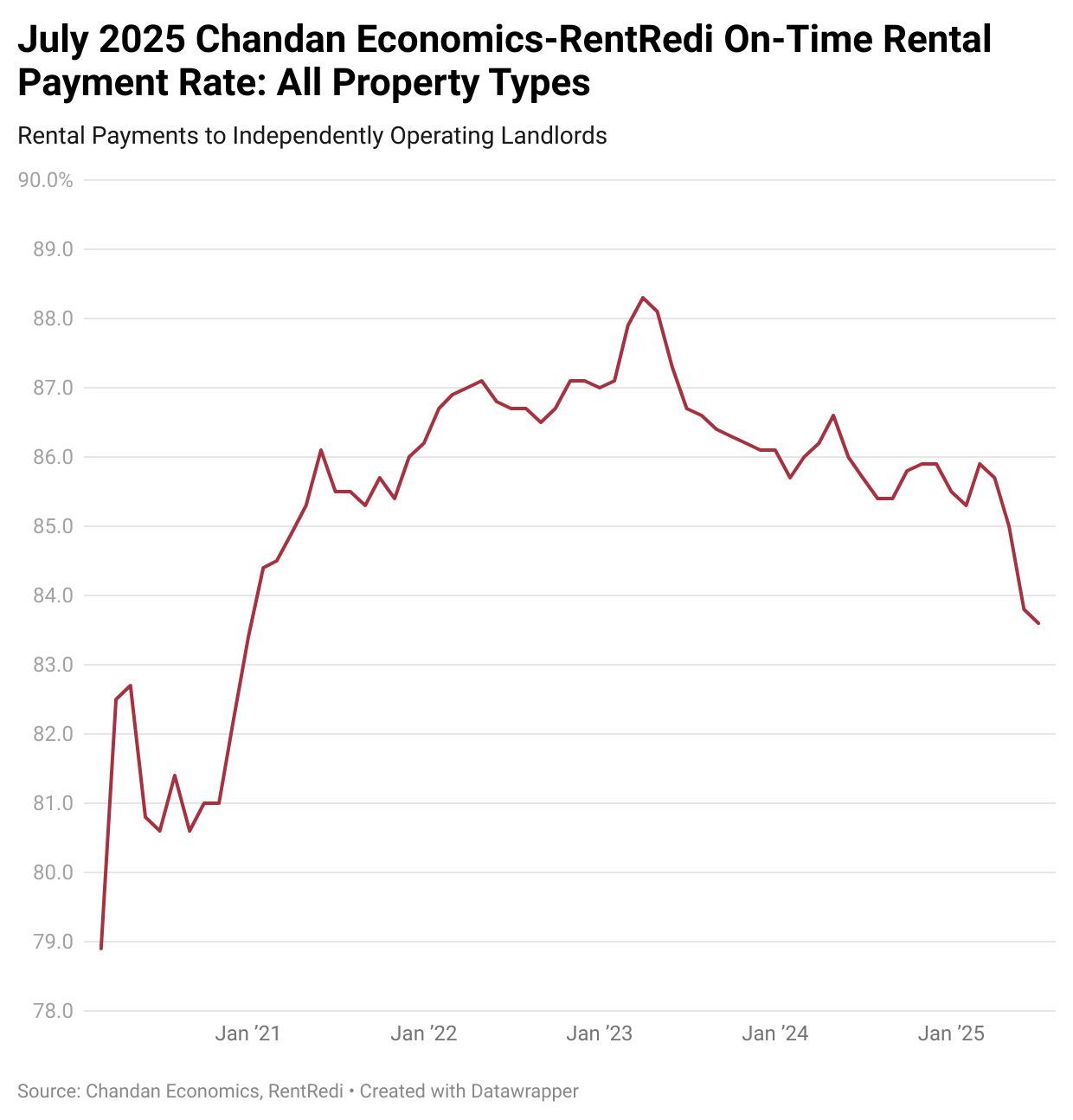

The on-time payment rate for independently operated rentals dipped 20 bps to 83.6%, the lowest in four months.

Good morning. On-time rent payments slipped again in July, extending a two-year streak of declines for independent landlords. As financial stress builds for renters, small property owners are feeling the squeeze.

Today’s issue is brought to you by CREModels—your on-call analyst team for underwriting, due diligence, and asset management.

🎙️This week on No Cap Podcast, Janet LePage joins Jack and Alex to unpack her wild rise in real estate, navigating rate hikes, distressed deals, and the secret power of washer-dryer installs.

Market Snapshot

|

| ||||

|

|

Rental stress

Independent Landlord Rent Payments Dip Again in July, Marking 24th Straight Monthly Decline

July brought more bad news for independent landlords, as on-time rent payments fell again, marking two straight years of decline.

Collection drops again: The share of on-time rent payments in independently operated rental units dropped to 83.6% in July 2025 — a 20 basis point (bps) decline from June. That figure marks a 209 bps year-over-year decrease and continues a troubling 24-month streak of declining performance.

Digging deeper: Though the July drop was modest compared to steeper declines in May (-68 bps) and June (-128 bps), the overall trend remains negative. Compounding the concern: June’s figure was revised downward to 83.8%, showing the deterioration may have been understated initially.

Forecast hits a low: The broader forecast full-payment rate — which factors in late payments and typical late-pay behavior — fell to 93.4%. That’s the weakest reading since December 2020, at the height of the pandemic-era rental disruption.

Property performance: Among rental property types, small multifamily (2–4 unit) buildings led with an 84.0% on-time payment rate. Single-family rentals followed at 83.6%, while larger multifamily units trailed at 82.4%. The 162 bps spread between best and worst performers is the widest since May 2024 — suggesting growing segmentation in the small landlord market.

The regional divide: Western states continue to dominate the top-performing markets. Idaho (93.5%), Hawaii (92.3%), and Alaska (91.6%) lead the nation in on-time payment rates. In fact, eight of the top ten states are located in the West. In contrast, states like West Virginia (-1002 bps YoY), Vermont (-718 bps), and Massachusetts (-675 bps) experienced the most severe declines.

➥ THE TAKEAWAY

Pressure building: The softening rent collection figures align with wider signs of consumer distress. Rising delinquencies in auto loans, credit cards, and student loans — particularly among younger and lower-income households — are putting added pressure on tenants' ability to pay rent on time.

TOGETHER WITH CREMODELS

Add Bandwidth & Brainpower to Your Team

CREModels plugs in as an extension of your team, combining seasoned analysts with AI-powered tools to help you move faster—without adding headcount. Underwrite smarter, catch red flags earlier, and manage assets with confidence.

Where we help:

Acquisition Underwriting

Development Pro Formas

Lease Abstracts & CAM Reviews

Fund Admin & Investor Reporting

Reforecasting & Predictive Analytics

*This is a paid advertisement. Please see the full disclosure at the bottom of the newsletter.

✍️ Editor’s Picks

Tailored capital: BTR is booming, but its hybrid nature demands a tailored financing approach that traditional lenders often can't provide. (sponsored)

Office momentum: Office attendance is up to 72.6% of pre-COVID levels, fueling a broader CRE rebound.

Debt test: Blackstone is pursuing €500M in financing for a Paris office, testing Europe's office market rebound.

Accidental landlords: Frustrated home sellers are turning unsold listings into rentals, creating unexpected competition for institutional landlords.

Investor access: A new House bill would let more people invest in private markets by passing an SEC test, regardless of income or net worth.

REIT value: REITs offer strong upside due to solid fundamentals, steep discounts, and a history of rebound after downturns.

Public pullback: OPM downsizing signals more office space reductions, tightening demand in the government-leased CRE sector.

🏘️ MULTIFAMILY

Leadership change: Atlanta Housing’s real estate chief exits as federal budget cuts strain agency operations.

Credit confidence: ACRE has closed its $1B Credit Fund II, betting big on multifamily lending amid tight supply and looming loan maturities.

Sun Belt surge: Apartment demand is outpacing new starts nearly 4 to 1 nationwide, and up to 5.6 to 1 in key Sun Belt cities.

Lease shock: A 450% rent hike tied to a ground lease threatens to displace residents of Carnegie House, one of Midtown Manhattan’s last affordable co-ops.

🏭 Industrial

Space secured: WareSpace expands its Denver footprint to 200K SF with the off-market acquisition of a 129K SF warehouse in Park Hill.

Drug development: AstraZeneca is launching a $50B US expansion, beginning with a major GLP-1 plant in Virginia.

Keep it cool: California leads the US in cold storage with 17% of national revenue and space.

Leasing surge: Industrial leasing and user sales in the Northeast soared 68% in Q2, even as vacancy rose to 7.9%.

Lake makeover: Prologis plans to transform a 40-acre man-made lake in Fort Lauderdale into a $64M industrial park.

Data dispute: OpenAI is moving forward with data center deals, while its $500B Stargate venture with SoftBank remains stalled.

🏬 RETAIL

Luxury wellness: Saint, a private sauna and ice bath brand, signed a 10-year lease at MAG Partners’ Ruby complex in Chelsea.

Spending shift: Retail sales rose in the first half of 2025, but foot traffic lagged as consumers focused more on essentials.

Friendly takeover: A longtime Friendly’s franchisee bought parent company Brix Holdings and plans to expand the chain into the South.

🏢 OFFICE

Tech rise: Emerging US markets like Austin, Pittsburgh, Raleigh-Durham, and Denver are rising tech hubs, driven by talent, affordability, and corporate investment.

MOB mentality: Houston, DC, LA, Chicago, and Manhattan lead US medical office markets by size and investor interest.

Office strain: Delinquencies are rising in the office sector as loan maturities peak, according to Yardi’s July 2025 national report.

DC conversions: Washington, DC has 6.2M SF of office space in conversion, with adaptive reuse poised to cut vacancy rates by over 15%.

Heat mapping: Companies are using AI-driven heat sensors to anonymously track office activity and optimize layouts.

Chef's kiss: Backed by Gordon Ramsay, HexClad is expanding in LA’s Arts District with nearly 39K SF of office and warehouse space.

🏨 HOSPITALITY

Stadium revival: Hawaii is nearing a $650M plan to replace Aloha Stadium with a mixed-use district and new home for UH football.

Charged dining: Tesla opened an LA diner merging EV charging with retro flair to create an immersive brand experience.

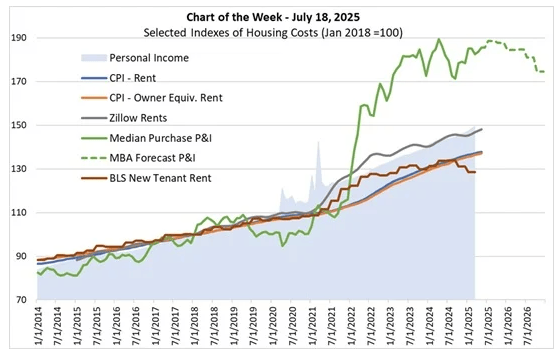

📈 CHART OF THE DAY

Sources: MBA, Zillow, U.S. Census Bureau, U.S. Bureau of Economic Analysis, Bureau of Labor Statistics.

Monthly home payments are up 86% since 2018, but falling rates and prices may ease the pressure by late 2026. Affordability remains strained as mortgage costs outpace rents and incomes.

You currently have 0 referrals, only 1 away from receiving Multifamily Stress Test Model.

What did you think of today's newsletter? |

Reply