- CRE Daily

- Posts

- Large CRE Deals Surge Back in Q3 2025

Large CRE Deals Surge Back in Q3 2025

Q3 marked a decade-high growth rate for CRE transactions over $10M, totaling $76B.

Good morning. After a slow start to the year, large U.S. CRE deals roared back in Q3. Transaction volume and investor activity reached levels not seen since 2022.

Today's issue is sponsored by QC Capital—unlock steady cash flow and major tax advantages in a recession-resilient asset class.

CRE Trivia 🧠

Which U.S. city currently has the most apartments under construction?

(Answer at the bottom of the newsletter)

Market Snapshot

|

| ||||

|

|

Big Buys

Large CRE Deals Surge Back in Q3 2025

After a quiet first half of the year, big-ticket CRE deals rebounded in Q3, marking a clear signal of renewed investor confidence.

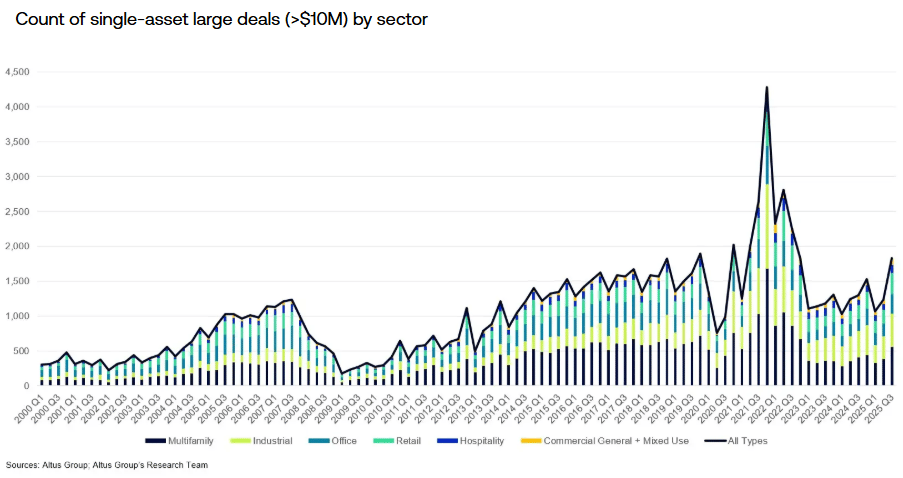

Big deal energy: Large single-asset CRE deals over $10M surged in Q3 2025, hitting 1,826 transactions—up 48% from Q2 and 41% YoY. According to Altus Group, these deals made up nearly 68% of total investment volume, the highest share since mid-2022.

Sizing the market: Deal volume surged in Q3, but median deal size stayed below 2021 levels at $19.6M—down 8.6% from the peak. Industrial and multifamily held up best, while office trailed, still 24% below its 2013 high.

Mixed price signals: Pricing per square foot rose 0.6% both quarterly and annually across all property types, signaling early stabilization. Office continued to lag, with prices down 3.0% from Q2 and 4.4% year-over-year. Multifamily saw a slight 0.6% dip in Q3 but posted a solid 5.0% annual gain.

Signs of stabilization: Though still below 2021–2022 highs, rising volume and activity—especially in industrial, retail, and multifamily—signal a step toward normalization. Median deal size is up 4.7% since Q4 2023, led by a 14.2% rebound in multifamily.

➥ THE TAKEAWAY

Turning the corner: Q3 2025 marked the strongest momentum shift in large CRE deals in years. If borrowing costs hold steady, the rebound could carry into 2026. But for now, the top end of the market is showing real signs of life.

TOGETHER WITH QC CAPITAL

Accredited Investors: Unlock High-Cash Flow Alternatives with Powerful Tax Benefits

Looking for an investment that delivers strong cash flow and meaningful tax advantages?

QC Capital’s Car Wash Fund is designed for accredited investors seeking both.

✅ 12% Annual Cash Flow – Consistent monthly distributions backed by a proven business model.

✅ 100% Bonus Depreciation 2025 – Take advantage of one of the most valuable tax benefits available today.

✅ Projected 2x+ Equity Multiple – Growth potential over a 5-year hold period.

✅ Portfolio Diversification – Hedge against volatility with a recession-resilient asset class.

This isn’t just about cash flow—it’s about keeping more of what you earn. With bonus depreciation, investors can offset taxable income in the same year they invest.

Spaces are limited as Fund II officially closes September 30, 2025.

*This is a paid advertisement. Please see the full disclosure at the bottom of the newsletter.

✍️ Editor’s Picks

Maximizing innovation benefits: CSSI's latest guide covers restored R&D expense deductions, substantial catch-up opportunities for prior years, and critical compliance changes businesses need to address now. (sponsored)

Startup stars: Phoenix and Austin lead U.S. cities in startup growth, driven by low costs and strong talent.

Distress dynamics: The CMBS special servicing rate rose to 10.86% in November 2025, its highest point in 12 years.

Digital builds: Walmart is scaling up its partnership with Alquist 3D to build over a dozen commercial properties using 3D printing.

Liquidity lift: The New York Fed will buy $40B in Treasury bills starting Dec. 12 to manage reserves and meet seasonal demand, with elevated purchases expected through April.

Cut commentary: CRE leaders see the Fed’s latest rate cut as a modest boost, with hopes for improved liquidity, though long-term rates and investor caution still temper expectations.

Fund reset: Norges Bank is revamping its real estate strategy with broader sector, geographic, and platform diversification after recent underperformance.

🏘️ MULTIFAMILY

Rent peak: Manhattan rents hit a record $4,750 in November, up 13% YoY amid rising affordability concerns.

Affordable upside: Despite capital constraints and low supply, 2026 could be a breakout year for affordable housing investors.

Pre-lease push: Student housing pre-leasing for Fall 2026 jumped to 17.3% in November, rebounding from a sluggish October.

Fast track: LA has made its affordable housing streamlining ordinance permanent after approving 40,000 units in three years, but only a fraction have started construction.

Funded future: Apple-backed housing fund doubles to $100M to speed up Bay Area affordable projects with faster, flexible financing.

Fee warning: Following its Greystar settlement, the FTC warned 13 rental software firms to stop obscuring mandatory fees in listings.

🏭 Industrial

Amazon buildout: Amazon bought two Mesa warehouses totaling 1M+ SF for $71M, expanding its logistics footprint amid a $125B nationwide investment push.

Incentive edge: Incentives like tax breaks and infrastructure support now drive industrial site selection as much as location or cost.

Phoenix footprint: Provident Industrial is launching its first Phoenix project, an $80M, 471K-SF industrial park called Aldea Exchange.

Power play: NextEra Energy is partnering with Google, Meta, and Exxon on massive data center developments tied to new power generation.

Google growth: Google will invest $880M to expand its Midlothian, TX data center, part of a $40B push to scale infrastructure across Texas.

🏬 RETAIL

Luxury eats: Fifteen South Florida restaurants made the top 100 grossing list, with Mila ranked No. 1 amid soaring rents and dining costs in Miami.

Brand battles: Retailers are battling high rents and tight space in top urban corridors, turning to experiential stores and bold branding to break through.

Streaming space: Netflix opened its second immersive venue in Dallas, transforming a former department store into a 100,000 SF entertainment hub.

Retail reach: DLC and DRA Advisors bought a $429M, 2.1M-square-foot retail portfolio across five states, expanding into Phoenix and Oklahoma.

🏢 OFFICE

Office overflow: JPMorgan Chase has subleased another 60,000 SF at 390 Madison Ave., expanding its Manhattan footprint to nearly 500,000 SF next to its new $3B HQ.

Campus consolidation: GM plans to downsize to a 400K SF Silicon Valley hub, likely in Sunnyvale, consolidating offices across the Bay Area for efficiency and hybrid work.

Fresh start: SLS Properties has reopened a fully renovated, 285K SF Galleria-area office building in Houston, now lease-ready after clearing past legal and financial issues.

Defense play: Related Ross is targeting defense tech firms in its push to expand West Palm Beach’s business ecosystem beyond finance.

Lab loan: Cabot, Cabot & Forbes landed $79.3M from Kawa Capital to fund The Bolt, a 180,000-SF life sciences project in Woburn, MA.

🏨 HOSPITALITY

Distressed exit: Hotel REIT Ashford Hospitality Trust is exploring a potential sale as it struggles with $2.6B in mostly floating-rate debt.

Room gouging: Hotel prices in 2026 World Cup host cities have surged over 300%, with some rooms topping $3,800 per night following the match schedule release.

Times transfer: The InterContinental New York Times Square hotel has been sold for $230M to a group including Highgate, Gencom, and Argent Ventures.

📈 CHART OF THE DAY

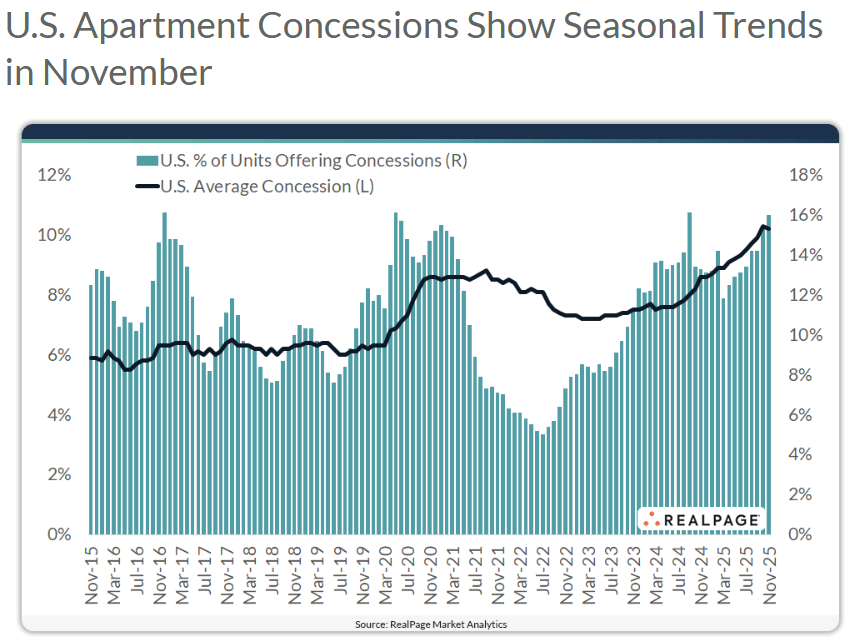

Apartment concessions rose in November 2025, with 16% of stabilized units offering discounts—the highest in Class C properties.

CRE Trivia (Answer)🧠

For the fourth year in a row, New York City leads the nation in apartment construction, with an estimated 30,023 units underway in 2025, according to RentCafe.

You currently have 0 referrals, only 1 away from receiving Multifamily Stress Test Model.

What did you think of today's newsletter? |

1

Reply