- CRE Daily

- Posts

- Multifamily Market Momentum Falters as Rent Growth Stalls in Q3

Multifamily Market Momentum Falters as Rent Growth Stalls in Q3

Multifamily rents saw rare Q3 declines as new supply flooded the market and leasing momentum softened across key metros.

Good morning. Multifamily rents declined in September, marking their weakest performance for the month in over a decade. A new report by Yardi shows that a surge in new supply and a slowing economy weighed on growth—especially in the Sun Belt—while coastal markets continued to stay strong.

Today’s issue is brought to you by QC Capital—invest in one of the most resilient and scalable asset classes in CRE.

🎙️This week on No Cap: Heitman’s Brian Pieracci explains why alternatives like self-storage and senior housing are outperforming traditional CRE and reshaping what “core” really means.

Market Snapshot

|

| ||||

|

|

Market Update

Multifamily Market Momentum Falters as Rent Growth Stalls in Q3

The multifamily sector hit the brakes in Q3, as slowing demand and swelling supply triggered the first 3rd quarter rent cut since the GFC.

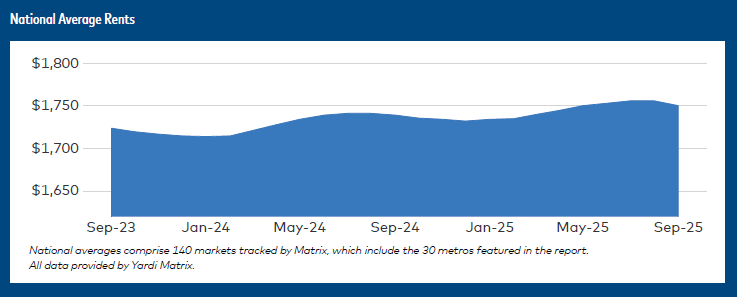

Unseasonable rent dip: According to Yardi Matrix, average rents fell $6 to $1,750 in September, marking the sharpest September drop since 2009. Annual growth slowed to 0.6%, as a surge of new supply and waning demand left over 525,000 units in lease-up, pushing operators to trim rents and increase concessions.

Deliveries keep coming: Occupancy slipped 30 bps to 95.4% in Q3, ending five quarters of gains. Despite slowing starts, 474,000 units were delivered over the past year—still above norms and weighing on high-supply markets.

Rent decline: Dallas, Phoenix, Austin, and Charlotte led the decline in rent, while Denver (-4.3%), Austin (-4.0%), and Phoenix (-3.3%) saw the steepest annual decreases. Tourism hubs like Las Vegas and Orlando also softened amid weaker spending.

Headwinds slow leasing: Leasing momentum cooled as job growth stalled—only 22,000 jobs added in August—and unemployment rose to 4.3%. With confidence slipping and more renters staying put, the Fed’s 25-bps rate cut may offer limited relief as household formation and leasing velocity weaken heading into 2026.

Bright spots emerge: Amid the slowdown, coastal and Midwest metros remain resilient. New York (4.8%), Chicago (3.9%), the Twin Cities (3.4%), and San Francisco (3.3%) led annual rent gains, while Kansas City, Columbus, and Philadelphia maintained their occupancy rates above 95% due to affordability and limited new supply.

Softening SFR: The single-family BTR market softened alongside multifamily, with rents down $15 in September to $2,194, the sharpest drop since 2015. Annual growth is now flat, though high homeownership costs and 95% occupancy suggest demand could rebound as new BTR supply slows.

➥ THE TAKEAWAY

Reality check: The Q3 apartment data is “a bag of mixed signals—chew toys for optimists, doomers, and realists alike,” says rental housing economist Jay Parsons. Absorption is moderating but solid, renters are staying put and signing longer leases, and fundamentals remain healthy even as rent growth stalls.

TOGETHER WITH QC CAPITAL

Discover the Power of Passive Flex Space Investing

Looking for an investment that delivers stability and long-term growth?

QC Capital’s Flex Space Fund is designed for accredited investors seeking passive income and strategic upside.

✅ 8% Preferred Return – Consistent income backed by fully leased assets.

✅ 70% Back-End Equity Kicker – Offers immediate cash flow and long-term value.

✅ Hands-Off Investing – Zero operational responsibility through NNN leases.

✅ Exposure to a Fast-Growing Asset Class – Flex space is in high demand nationwide.

This isn’t just about passive income, it’s about investing in one of the most resilient and scalable asset classes in commercial real estate.

Round 2 Commit Date Deadline: October 31st. Spots are first come, first serve.

*This is a paid advertisement. Please see the full disclosure at the bottom of the newsletter.

✍️ Editor’s Picks

Earn more: HAH Parking is a software suite proven to boost revenue with zero capex. CRE pros earn 50% gross profits for 12 months per referred parking lot. Learn More. (sponsored)

Steady gains: Green Street’s Commercial Property Price Index rose 0.2% in September and 2.9% year-over-year, signaling a stable CRE market with modest growth and steady transaction volume.

Issuance surge: CMBS issuance reached $30.7B in Q3, led by single-borrower deals and on pace for the strongest year since 2007.

Labor lag: Construction job openings fell sharply, yet worker shortages persist as new projects stall amid economic uncertainty.

Mobile money: Madison Group landed a $36M interest-only, non-recourse refi for six park-owned manufactured housing communities in the Southeast.

Rooftop runways: Cushman & Wakefield is scouting LA sites for VertiPorts as flying taxis prepare for the 2028 Olympics.

Token towers: Zach Witkoff aims to tokenize the Trump family’s real estate portfolio, letting everyday investors buy into properties like Trump Tower Dubai.

Cash is king: Nearly one in three U.S. homes sold in 2025 were bought with cash, highlighting how wealthier buyers and investors continue to dominate the market.

🏘️ MULTIFAMILY

Youth magnet: Minneapolis leads CommercialCafe’s 2025 ranking as Midwest and Southern cities outpace costly coasts in drawing Gen Z talent.

Buyer's market: Condo sellers outnumber buyers by over 70%, led by Florida’s oversupply and rising ownership costs.

Golden rebound: AvalonBay is testing investor appetite with the $100M-plus sale of its Sunset Towers near Golden Gate Park, signaling renewed confidence in San Francisco’s multifamily market.

Boomer boom: Senior housing is nearing multifamily and industrial occupancy levels, with record demand driven by the rapidly growing 80-plus population.

Risk modeling: With cap rates less reliable, discounted cash flow is becoming the go-to tool for multifamily valuation.

Campus cohousing: UC Riverside is opening a $285M shared complex for university and community college students to ease California’s housing crunch.

🏭 Industrial

Icy oversupply: Cold storage vacancies have reached a 20-year high as a surge in new supply, aging facilities, and increased cooling demand strain the industrial food logistics sector.

Boom or bust: Tech giants are spending hundreds of billions on data centers, driving a massive AI boom that could spark either growth or a bubble.

Global Groq: AI chip startup Groq plans to more than double its global data center footprint by 2026 as demand shifts from AI training to inference computing.

Import impact: Rising import tariffs are inflating industrial construction costs and prompting developers to reassess their supply chains and project strategies.

🏬 RETAIL

Retail yield: Cap rates for restaurant net leases vary by brand, with IHOP stable near 6% and higher yields for riskier chains like Red Lobster and Hooters.

End of an era: Rite Aid permanently closed its final 89 stores following a second bankruptcy, ending more than 60 years in business.

Pickleball takes Texas: Utah-based pickleball chain The Picklr is opening multiple large venues in Houston, with five more planned by 2027.

Second act: After decades of local resistance, Walmart has purchased Pennsylvania’s Monroeville Mall for $34 million with plans to redevelop it into an open-air shopping and entertainment complex.

Grocery growth: SJC Ventures partnered with a global insurer in a $1B JV to build grocery-anchored retail and luxury multifamily projects across the East Coast.

🏢 OFFICE

Fading landmark: Providence’s vacant Superman Building faces an uncertain future after its developer’s death, mirroring struggles to revive aging U.S. office towers.

Full house: SL Green’s 919 Third Avenue in Midtown Manhattan hit full occupancy after a major state lease expansion, cementing its rebound with tenants like Bloomberg and P.J. Clarke’s.

Dallas hub: Goldman Sachs is building a $500M all-electric Dallas campus for 5,000 employees, its largest hub yet.

🏨 HOSPITALITY

Venue debut: Convene Hospitality will open The Mallory, a 50,000 SF upscale venue at Manhattan’s Terminal Warehouse.

Record financing: Bain Capital and Bungalow Projects landed a $156M C-PACE loan for two sustainable Brooklyn film studios.

NYC exit: Magna Hospitality sold four NYC hotels, including the Motto by Hilton Chelsea, for nearly $490M, the city’s largest post–Safe Hotels Act deal.

TOGETHER WITH CRE DAILY

Start the New Year Ahead of Your Competition

Reach the most engaged audience in commercial real estate. Download CRE Daily’s 2026 Media Kit and see how top brands grow with us.

*This is a paid advertisement. Please see the full disclosure at the bottom of the newsletter.

📈 CHART OF THE DAY

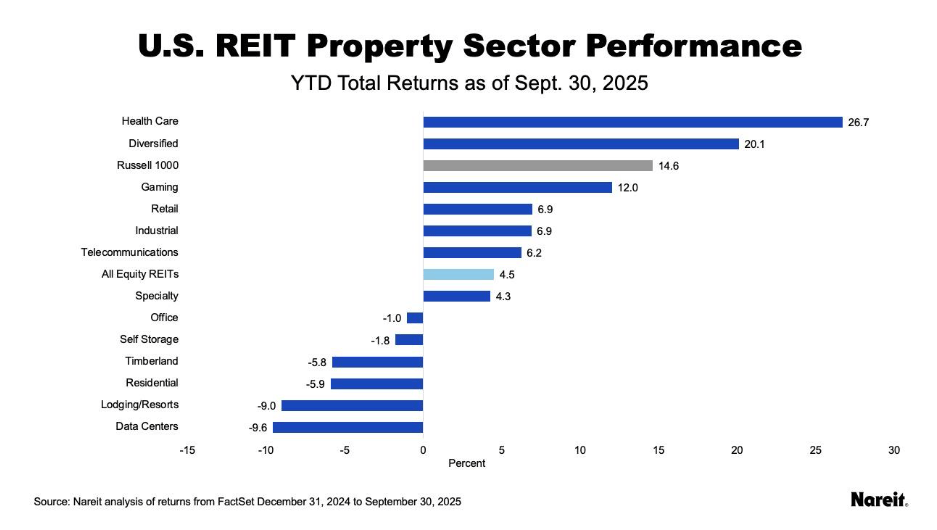

In September, the best-performing REIT sectors were specialty, health care, and office, while health care remains the top YTD performer.

You currently have 0 referrals, only 1 away from receiving Multifamily Stress Test Model.

What did you think of today's newsletter? |

Reply