- CRE Daily

- Posts

- Multifamily Starts Surge in June, Raising Questions About a Rebound

Multifamily Starts Surge in June, Raising Questions About a Rebound

The seasonally adjusted annual rate (SAAR) for multifamily starts shot up 30.6% in June to 414K units

Good morning. Multifamily construction surged in June, but shaky permit trends and falling completions raise questions about whether this rebound has legs.

Today’s issue is brought to you by Acres—make confident, data-backed land decisions.

🎙️This week on No Cap Podcast, Janet LePage joins Jack and Alex to unpack her wild rise in real estate, navigating rate hikes, distressed deals, and the secret power of washer-dryer installs.

Market Snapshot

|

| ||||

|

|

Starts Surge

Multifamily Starts Surge in June, Raising Questions About a Rebound

Despite volatility in the data, June’s spike in multifamily construction starts hints that the sector may be bottoming out.

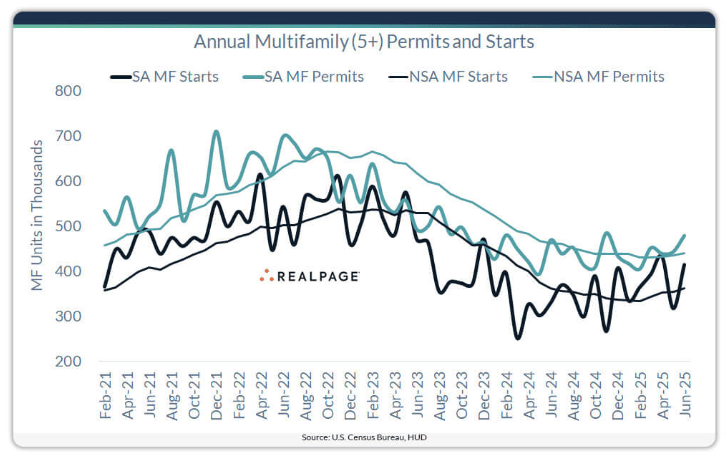

Proceed with caution: The seasonally adjusted annual rate (SAAR) for multifamily starts jumped 30.6% in June to 414K units, rebounding from a sharp drop in May. While that signals fresh momentum, experts caution the data—based on a small sample—can swing wildly. Starts are up 25.8% YoY, but it’s too early to call it a trend.

Permits up slightly: Multifamily permitting rose 8.1% from May to June, hitting a SAAR of 478K units. However, the YoY growth was a modest 2.1%. Unadjusted data show a flat permitting trend over the past four months, suggesting the surge in starts may not yet have support from the usual leading indicator.

Regional mixed bag: Annualized multifamily starts more than doubled in the Northeast (up 145.8%) and climbed nearly 29% in the South. The Midwest saw a 37.9% drop, while the West posted only a slight decline. Permitting also rose in the Midwest and South, while the Northeast and West recorded monthly declines.

Construction cools off: Despite the jump in starts, the number of multifamily units under construction dropped 0.6% from May and 19.6% YoY to 720K units. Completions also fell sharply, down 21% from May and nearly 40% from last June, pointing to a sector still in cooldown mode.

➥ THE TAKEAWAY

Too soon to call: The surge in multifamily starts could signal the start of a supply cycle rebound, but without a corresponding rise in permits and completions, it’s more of a hopeful blip than a full-fledged turnaround. Investors and developers should watch closely for consistency in the data before making any bullish bets.

TOGETHER WITH ACRES

Make confident land investment decisions

When it comes to land, Acres delivers the full picture—power access, zoning, land values, risk, and more—on one map-based platform.

Whether you're tracking emerging CRE markets or searching for off-market deals, Acres helps you make confident, data-backed decisions.

Top investors are already using Acres to spot risk early and find undervalued land. Want in?

*This is a paid advertisement. Please see the full disclosure at the bottom of the newsletter.

✍️ Editor’s Picks

Resilient returns: CRE remains a smart 2025 play, with long-term fundamentals and tax advantages outweighing short-term market volatility. (sponsored)

Safe haven: Private real estate is attracting investors seeking stability amid market volatility and rising tariffs.

Funding freeze: Trump’s proposed $27B HUD cut is stalling affordable housing projects as developers and lenders grow wary of Section 8 funding's future.

Bank health: Banks saw solid early-2025 earnings, but rising delinquencies and tariff impacts may slow growth in the second half.

Deal momentum: Buyers and sellers are finally aligning on prices, boosting CRE transactions in 2025.

Cautious optimism: Strong consumer spending is easing recession fears, but Trump–Fed tensions are clouding the outlook.

🏘️ MULTIFAMILY

Conversion surge: NYC may gain 17K apartments from office conversions, though tax breaks could cost the city $5B.

Housing headwinds: Moody’s Mark Zandi warns high mortgage rates are turning housing into a growing drag on the US economy.

Retention gap: Multifamily property managers remain upbeat despite 2025 retention rates falling short of goals, with a growing focus on aligning priorities with renters' actual needs.

Investor revival: Large multifamily sales in San Francisco nearly doubled, marking a clear shift toward a landlord-friendly market.

Urban affordability: Jonathan Rose Companies raised $660M to preserve and improve affordable housing in high-opportunity urban markets nationwide.

🏭 Industrial

Power play: xAI has acquired a former power plant near its Memphis data centers, hinting at an expansion of its AI energy infrastructure.

Inland acquisition: Bridge Logistics acquired a fully leased, three-building industrial complex in Fontana for $84M.

Steel shift: Cleveland-Cliffs may sell idle mills to data center developers to cut debt and repurpose assets.

🏬 RETAIL

Grocery glow-up: Grocers are investing in design to boost dwell time and community connection.

Quiet hikes: Despite promising to keep prices low, Amazon raised prices on over 1,200 everyday essentials.

Center snag: Invesco snapped up Georgia Crossing, a fully leased 317K SF shopping center near the Mall of Georgia, for $82M.

🏢 OFFICE

Office report: Stubborn vacancy rates, sluggish job growth, and looming loan maturities are intensifying pressure on the US office sector.

Studio sale: Santa Fe Studios is up for sale, testing New Mexico’s appeal as a growing, incentive-rich film production hub.

Wynwood expansion: Amazon added 25K SF to its Wynwood Plaza lease, upping its Miami office footprint to 75K SF.

Fintech expansion: Clear Street is doubling down on Lower Manhattan, expanding its HQ lease to 88K SF across two floors at 4 World Trade Center.

Tenant trends: LA tenants are prioritizing quality, value, and worker-friendly spaces in a still-soft office market.

🏨 HOSPITALITY

F1 expansion: Austin is weighing a deal with Rida Development to build a 1,000-room hotel and convention center near its Formula 1 racetrack.

Earnings season: Hotel brands are staying upbeat ahead of earnings, but REITs remain cautious amid tariffs and property sell-offs.

Hot hotels: NYC hotel performance is strong, but investor caution is rising amid labor, supply, and political risks.

📈 CHART OF THE DAY

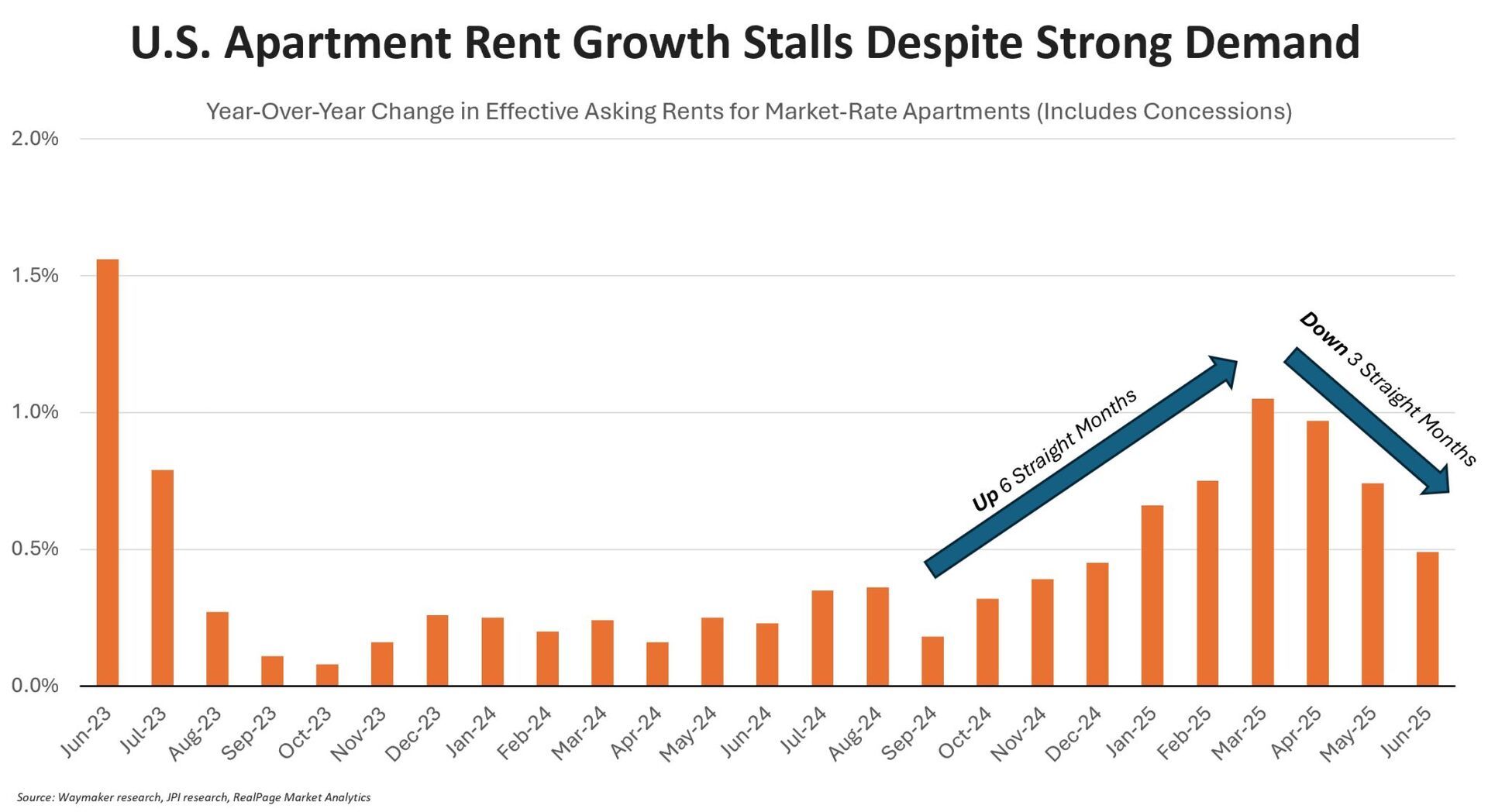

After six months of steady gains, apartment rent growth has now decelerated for three straight months, with year-over-year effective rent change falling from 1.05% in March to just 0.49% in June.

You currently have 0 referrals, only 1 away from receiving Multifamily Stress Test Model.

What did you think of today's newsletter? |

Reply