- CRE Daily

- Posts

- Netflix’s Warner Bros. Buyout Could Reshape Hollywood’s Property Market

Netflix’s Warner Bros. Buyout Could Reshape Hollywood’s Property Market

100M+ SF of studios and offices may soon fall under Netflix’s control.

Good morning. Netflix’s $72B bid to acquire Warner Bros. isn’t just a streaming play—it’s a real estate power move. The deal could make Netflix one of the largest owners of studio space globally, with major implications for the CRE market.

Today's issue is sponsored by Vintage Capital. Discover why investors love resilient, high-yield MHPs backed by a decade of proven execution.

🎁 Last Call for Holiday Merch

Our holiday merch is officially live — and if you want it under the tree this year, order by December 11th. Stock is limited, so snag yours while you can. Shop the Collection

CRE Trivia 🧠

Which country now gets the largest share of its electricity from solar power, surpassing Chile’s longtime lead?

(Answer at the bottom of the newsletter)

Market Snapshot

|

| ||||

|

|

Streaming Footprint

Netflix’s Warner Bros. Buyout Could Reshape Hollywood’s Property Market

A blockbuster merger could see Netflix become one of the largest owners of entertainment real estate in the world.

Land grab: Netflix’s $72B bid for Warner Bros. could give it control of 100M+ SF of production and office space. The deal—pending regulatory approval—would unite Netflix’s expanding footprint with Warner Bros.’ iconic properties, including Burbank Studios and the Leavesden campus in the U.K.

From renter to owner: Netflix leases most of its 5.2M SF global footprint, but the Warner Bros. deal shifts it toward ownership. That could reduce reliance on landlords like Hackman and Hudson Pacific, with analysts expecting lease cuts and up to $3B in annual savings.

Occupancy under pressure: Netflix’s consolidation could hit LA’s studio market, with demand softening for independent landlords. Soundstage occupancy has dropped to 63%, down from 90% pre-pandemic, and production remains slow despite boosted California film tax credits.

Competitive edge: Owning studio space gives Netflix more control over production, reduces exposure to rent, and boosts leverage as it absorbs Warner Bros.’ assets. Its $1B New Jersey studio project and ownership of the Egyptian Theatre highlight a broader push to command its production ecosystem.

➥ THE TAKEAWAY

From tenant to titan: If approved, this deal won’t just reshape streaming—it could redefine who owns Hollywood. Netflix’s shift from tenant to studio landlord could shake up entertainment real estate and reshape LA’s studio landscape.

TOGETHER WITH VINTAGE CAPITAL

12+ years, $100MM+ of Mobile Home Park experience. Nationwide Reach.

350+ investors have invested in MHPs with our principals over the past decade plus.

Today, Vintage continues that focus on MHPs -- one of the most resilient and consistently performing real estate sectors. Our current Fund spans 14 transactions across 12 states.

Why LP's love MHPs:

Durable Demand: The most affordable housing option in the U.S. - with persistent national undersupply.

Sticky Tenants: Average tenancy (12+ years) far exceeds traditional multifamily (2-3yrs), stabilizing cash flows.

Best in class Depreciation: 1st Year Losses often double what you see in Multifamily (1-1.5x is typical)

Downside Resilience: Historically strong performance across market cycles due to essential-need positioning.

We have steady deal flow and multiple ways to invest. Low volatility, strong yield potential, and a proven operator with a long track record of success.

Interested in learning more about your investment options?

*This is a paid advertisement. Please see the full disclosure at the bottom of the newsletter.

✍️ Editor’s Picks

One Big Beautiful Bill: What real estate investors need to know — and ways to capitalize. (sponsored)

Future forces: JLL’s 2026 outlook highlights six trends—rising costs, space shortages, AI growing pains, and energy shifts—that are set to redefine global commercial real estate.

Pay gap: While 88% of CRE professionals saw salary increases in 2025, disparities remain across roles, with top executives seeing slower growth.

Cycle reset: CRE is gaining momentum heading into 2026, as stabilized prices, increased refinancing, and easing distress point to a new cycle of growth.

Rate uncertainty: While inflation data supports a potential Fed rate cut, missing October–November reports and mixed job signals leave decision-making on shaky ground.

Claim game: Despite a rough 2025 job market, new unemployment claims dropped 12.4% week-over-week in late November, with Florida and New Hampshire reporting the fewest claims per capita.

Ballot backers: Developers back Eileen Higgins in Miami’s mayoral runoff, favoring her stance on permitting reform and housing over rival Emilio Gonzalez.

🏘️ MULTIFAMILY

Risky renters: Surging student loan delinquencies are tanking renters’ credit scores, shrinking the qualified tenant pool.

Algorithm approved: A DOJ deal lets RealPage keep its rent-setting software with data limits, easing landlord concerns but disappointing tenant advocates.

Dallas dealflow: KKR has acquired two Irving multifamily communities totaling 673 units from Lone Star Funds for $118M.

Seller standoff: Southeast multifamily sellers are clinging to peak pricing, stalling deals amid weak rent growth and tighter financing.

Brooklyn boost: Clipper Equity is set to secure $450M in financing for Tower 77, a 766-unit mixed-income development in Brooklyn.

Funding fallout: HUD’s last-minute overhaul of homelessness funding has triggered a lawsuit from cities and nonprofits, who warn the changes could displace up to 170,000 people.

Platform launch: Subtext has launched its student housing acquisitions platform with the purchase of District Flats in Columbia, MO.

🏭 Industrial

Storage score: Brookfield and GIC have struck a $2.7B deal to acquire Australia’s largest self-storage operator, National Storage REIT.

Power politics: Europe is enforcing stricter sustainability and energy-use rules on data centers than the U.S., reshaping site selection, cooling methods, and grid participation.

Green build: Penzance has broken ground on a 45MW, next-gen AWS data center in Chantilly, VA.

Midwest move: A 1.3 MSF industrial portfolio in Indianapolis sold at 97% occupancy after strategic upgrades by Stos, Cardinal, and Long Wharf.

SoCal sale: A Brookfield-backed fund sold a fully leased 526K SF warehouse in San Bernardino to Overton Moore Properties for over $100M.

🏬 RETAIL

Center snapped: Ashkenazy Acquisition Corp. bought Chicago’s Orland Park Place retail center for $60M in a fast, no-contingency deal.

Retail exit: Site Centers plans to sell its remaining shopping center assets after divesting $3.7B in properties and spinning off Curbline, its convenience-focused REIT.

Tariff tactics: Off-price retailers TJX, Ross, and Burlington overcame Q3 tariffs through smart inventory and pricing strategies.

Credit expansion: Westwood Financial secured $145M in new financing, raising its total credit facility to $470M to support its Sun Belt retail portfolio.

Angry expansion: Hot chicken chain Angry Chickz is expanding into Texas and New Mexico with 25 new locations over five years.

🏢 OFFICE

Office outlook: Office demand rebounded in Q3 2025 with 19.8M SF absorbed nationwide, signaling a possible market recovery.

Mixed signals: Manhattan office availability hit a five-year low in November, but leasing activity dropped nearly 18%.

HQ takeover: Riot Games has acquired its longtime West LA headquarters from Hudson Pacific for $231M, paying $150M for the property and $81M to exit its lease.

Hochul hype: Despite missing earnings expectations for 2026, SL Green got a public vote of confidence from Gov. Kathy Hochul, who urged investors to double down.

Dallas deal: Stream Realty Partners secured $228M in financing from KKR for The Quad, its eight-building Uptown Dallas office campus.

Opportunity knocks: SL Green has closed its $1.3B Opportunistic Debt Fund, surpassing its original goal and positioning itself to target high-quality NYC assets.

🏨 HOSPITALITY

Luxury lift: Killington is set for a $3B transformation into a high-end ski destination with luxury homes, spas, and retail.

Magnificent exit: Pebblebrook Hotel Trust has sold the 752-room Westin Michigan Avenue, Chicago, for $72M to Vinayaka Hospitality.

Texas exception: While the national hotel market struggles, DFW stands out with a booming pipeline of nearly 200 hotel projects, most in luxury and mixed-use developments.

A MESSAGE FROM HINES

The Real Estate Recovery May Be Here After All, But It Could Look Different This Time.

Why does Hines Research think it’s ‘wheels up’ for real estate in 2026?

Hines' 2026 Global Investment Outlook says the real estate recovery is here – but this time looks different.

Deglobalization and AI are shaping new investment geographies and fueling demand around the world.

We see high-conviction opportunities forming in living, industrial, and retail, with notable regional variations.

Investors who remain measured and strategic should be positioned to navigate this evolving landscape and ascend.

Subscribe to Market Moves, your source for the latest news and updates from Hines, to receive our detailed analysis and prepare for the year ahead.

*This is a paid advertisement. Please see the full disclosure at the bottom of the newsletter.

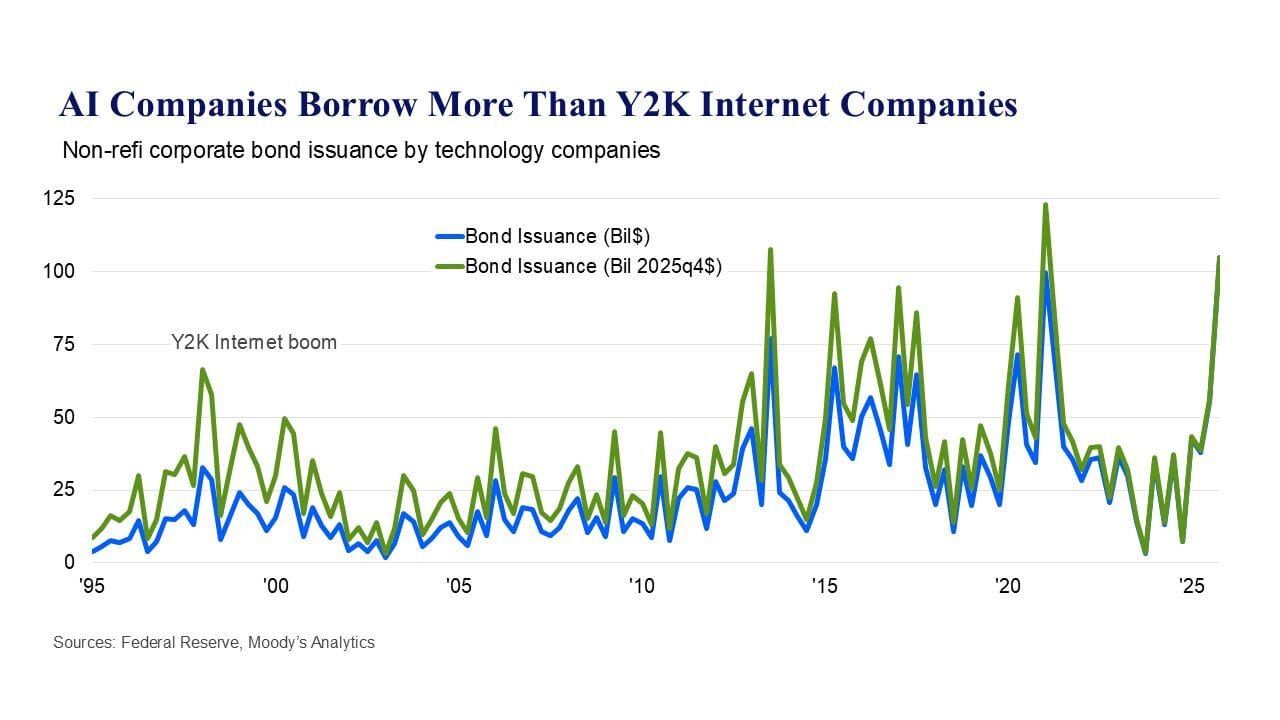

📈 CHART OF THE DAY

Tech companies’ bond issuance, driven heavily by today’s AI giants, has already surpassed Y2K-era levels in nominal terms and sits near record highs even after inflation.

CRE Trivia (Answer)🧠

Hungary now tops the world in solar share, producing nearly one-quarter of its electricity from the sun—up from just 7% five years ago.

You currently have 0 referrals, only 1 away from receiving Multifamily Stress Test Model.

What did you think of today's newsletter? |

Reply