- CRE Daily

- Posts

- New Apartments Still Command a Premium in Competitive Markets

New Apartments Still Command a Premium in Competitive Markets

New supply is still commanding a premium—even in oversupplied markets.

Good morning. Despite record-breaking deliveries, new apartment supply continues to command higher rents than stabilized properties. Strategic location, modern amenities, and lifestyle appeal are driving this persistent lease-up premium across many markets.

Today’s issue is brought to you by Agrippa—build connections and us AI to transform your dealmaking capabilities.

🎙️This Week on No Cap: With New York’s mayoral election looming, former Deputy Mayor and founder of M Squared Alicia Glen breaks down how the next administration could reshape affordability, zoning, and the politics of getting housing built.

Market Snapshot

|

| ||||

|

|

Leasing Trends

New Apartments Still Command a Premium in Competitive Markets

Despite a flood of new inventory, renters are still willing to pay more for the latest apartment offerings—and not just in the usual big-city suspects.

Premiums hold strong: New apartments are leasing at a 6% premium nationwide—$1,982 vs. $1,871 for stabilized units. Despite heavy supply, demand for quality keeps the gap intact. With 22% rent-to-income ratios and 95%+ on-time payments, renters are choosing value, not overextending.

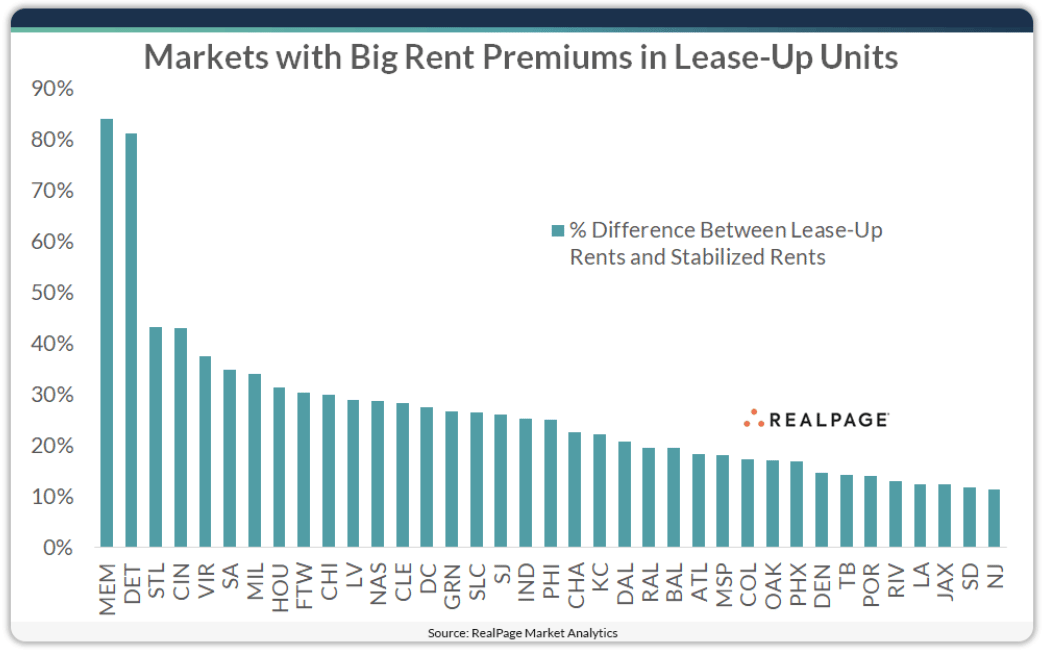

Big cities, big gaps: In major metros like DC, Chicago, LA, and Dallas, new supply is leasing 20–30% above stabilized rents. Strong job bases and demand for modern living drive the trend. Even in markets like Memphis and Detroit, premiums top 80% due to strategic sites.

Submarket sweet spots: In submarkets like East Nashville and Houston’s Upper Kirby, lease-up units command a much higher markup. These lifestyle-focused neighborhoods offer walkability, retail, and amenities that attract renters willing to pay more—boosted further by waterfronts, culture, and skyline views.

Premiums aren’t automatic: Not every market tells the same story. In markets like Brooklyn and Downtown San Francisco, stabilized rents outpace lease-ups due to affordability limits and concessions. Premiums aren’t guaranteed; they must be earned through smart location, timing, and design.

➥ THE TAKEAWAY

Modest, but meaningful: A $111 national premium may seem modest, but across thousands of units, it signals strong demand for new, well-located, lifestyle-driven apartments. For developers, it’s about execution and site selection; for operators, competing on service; and for investors, lease-up premiums point to long-term pricing power.

TOGETHER WITH AGRIPPA

Meet Marcus: Agrippa's AI Negotiation Engine

Agrippa is launching Marcus, an AI-powered negotiation assistant, to enhance connections on platform.

🧠 Counterparty Intelligence: Utilize platform data and web research to measure behavioral patterns.

♟️ Game-Theoretic Prediction: Forecast acceptance/denial probabilities to guide your strategy.

📊 Market Shock Detection: Anticipate when market sentiment spikes impact your leverage.

⚠️ Risk Exposure Estimation: Run 1,000+ Monte Carlo simulations to visualize worst-case scenarios.

⌛ Join Agrippa: Build connections and deploy Marcus to transform your dealmaking capabilities.

*This is a paid advertisement. Please see the full disclosure at the bottom of the newsletter.

✍️ Editor’s Picks

Rate squeeze: In Q3, CRED iQ found the average interest rate (6.57%) nearly matched the average cap rate (6.34%), signaling tight spreads and rising pressure across CRE.

Core cooling: Core real estate fund returns remained positive in Q3 2025 but slowed to 0.73%, reflecting weaker appreciation.

Mortgage roulette: Homebuyers are turning to adjustable-rate mortgages for lower initial costs, betting on future rate cuts before higher payments kick in.

Stability signs: Multifamily relief and steady office gains hint at a broader market stabilization across CRE.

Billboard boom: AI startups in San Francisco are flooding the city with high-priced billboards to stand out in a crowded market.

Real playgrounds: Sports-anchored districts are transforming stadiums into vibrant, year-round urban hubs, driving strong real estate performance.

Spread myth: CRE borrowers are mispricing loan terms, assuming a 40–50 bps premium for 10-year debt when the real spread is closer to 15.

Political pressure: Fannie Mae fired its ethics staff as part of a broader shake-up, sparking concerns over motives and oversight.

🏘️ MULTIFAMILY

Investor caution: Oversupply and softening rents are cooling Miami’s multifamily market, making investors wary of new development.

GID expands: GID has launched a dedicated multifamily platform, led by a former Mill Creek executive, aiming to invest $1.25B in new development.

Multifamily milestone: West Shore closed a $600M loan to refinance debt and acquire 1,500 units, marking one of 2025’s largest multifamily deals.

Loop conversion: Chicago approved a $241.5M plan to convert the historic Field Building from vacant offices into 386 apartments.

🏭 Industrial

Record size: Related Companies will develop a $7B+ AI-powered data center campus in Michigan for Oracle and OpenAI’s Stargate project.

Dallas dominance: DataBank’s CEO says Dallas is on track to rival Ashburn, VA, as the U.S. leader in data center capacity.

Industrial edge: Despite rising cap rates, industrial real estate continues to outperform, driven by strong demand, steady pricing, and minimal distress.

Miami move: Outpost paid $52.1M for a vacant industrial outdoor storage site near Miami International Airport—77% above its previous sale.

Portfolio refi: Blackstone is set to secure $1.6B in refinancing for a 94-property industrial portfolio spanning 14.7 MSF.

Creative space: David Stark Design leased Prologis’s revamped 31,500 SF Bushwick building, drawn by its modern, flexible industrial space.

🏬 RETAIL

Holiday headwinds: Retail real estate has held strong in 2025, but tariffs, weak consumer sentiment, and economic uncertainty threaten a shaky holiday season.

Growth pivot: Retailers are eyeing tertiary markets for growth as high rents and tight space squeeze primary metros.

Retail reach: KeyPoint Partners has added eight New England retail properties to its management portfolio, expanding its footprint to over 21 MSF.

Full control: Simon Property Group now wholly owns Taubman Realty Group after acquiring the remaining 12% stake to boost growth and efficiency.

🏢 OFFICE

Foreclosure fallout: Brookfield lost control of five suburban D.C. office buildings at auction as CMBS lenders took over, marking another blow to its distressed office portfolio.

Portfolio panic: Office Properties Income Trust filed for Chapter 11 after collapsing cash flow and debt woes overwhelmed its 17M SF portfolio.

Recovery signs: Manhattan office leasing surged to 3.6M SF in October—its strongest month in years—pushing availability to its lowest point since 2020.

Tower turnover: BGO surrendered its 26-story Midtown East office tower at 757 Third Ave. to lender New York Life via a deed-in-lieu of foreclosure.

Deep discount: Izek Shomof scored a Long Beach office tower for $50M—$86M below its 2013 price.

Coworking expansion: Premier Workspaces opened a new coworking hub in El Segundo’s Continental Park.

🏨 HOSPITALITY

Luxury lifeline: New York’s richest are propping up the local economy, spending big on luxury despite broader economic concerns.

Country club economy: Texas country clubs are booming, with values soaring as luxury amenities and golf demand defy the broader real estate slump.

Strip surprise: Vici Properties beat Q3 earnings expectations with $1.01B in revenue, defying tourism slowdowns on the Las Vegas Strip.

A MESSAGE FROM LENDINGONE

The BTR Playbook for Multifamily Operators

Join us Nov. 12 at 1 PM ET for a live webinar where LendingOne’s Matthew Neisser and Jaime Arouh reveal why Build-to-Rent (BTR) is outpacing traditional multifamily—and how you can capitalize on it.

Learn proven financing strategies, real-world project insights, and how your current MF skillset translates to success in BTR.

Can’t make it live? Register anyway for on-demand access.

*This is a paid advertisement. Please see the full disclosure at the bottom of the newsletter.

📈 CHART OF THE DAY

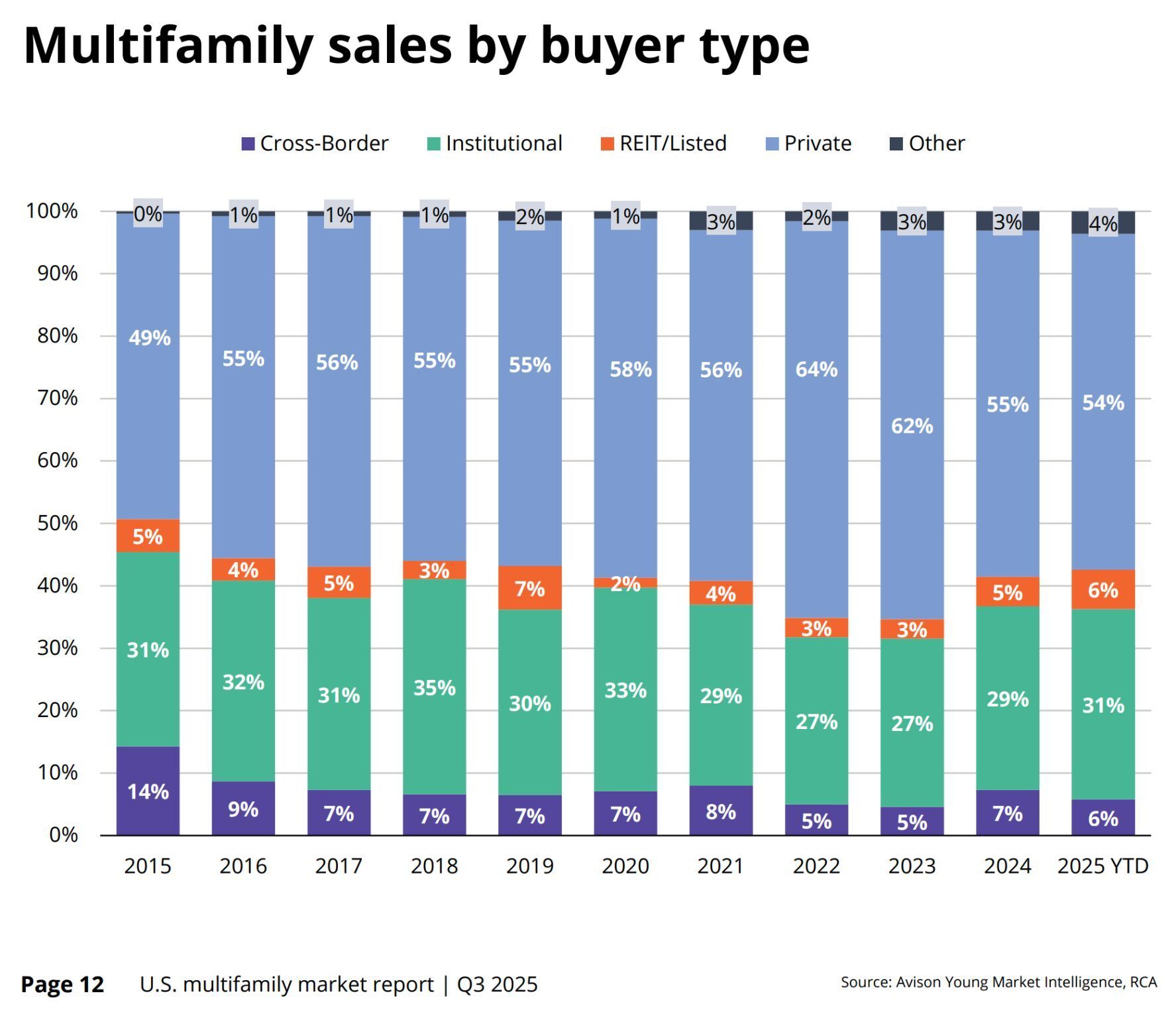

Institutions and REITs now account for 37% of 2025 multifamily purchases—their highest share since 2019—as well-capitalized buyers lead amid soft early returns.

You currently have 0 referrals, only 1 away from receiving Multifamily Stress Test Model.

What did you think of today's newsletter? |

Reply