- CRE Daily

- Posts

- October Sees Surge in CRE Bidding, Led by Multifamily

October Sees Surge in CRE Bidding, Led by Multifamily

Rate cuts and housing shortages are fueling fierce competition for multifamily deals.

Good morning. As we take tomorrow off to celebrate Thanksgiving, we’re grateful for your continued readership. Wishing you a Happy Thanksgiving!

Today’s issue is brought to you by RealAI—the ChatGPT for Real Estate is here.

🎙️This Week on No Cap: Jack and Alex talk with Lev founder & CEO Yaakov Zar about turning mortgage frustration into a leading CRE tech platform, and how AI is transforming the future of CRE financing.

CRE Trivia 🧠

In Q2 2025, which commercial real estate sector led all property types in transaction volume with a 39.5% year-over-year increase, reaching $34.1 billion and accounting for nearly one-third of all aggregate CRE dollar volume?

(Answer at the bottom of the newsletter)

Market Snapshot

|

| ||||

|

|

Deal Activity

October Sees Surge in CRE Bidding, Led by Multifamily

Investor appetite for CRE intensified in October, with multifamily assets drawing the most competition across the board.

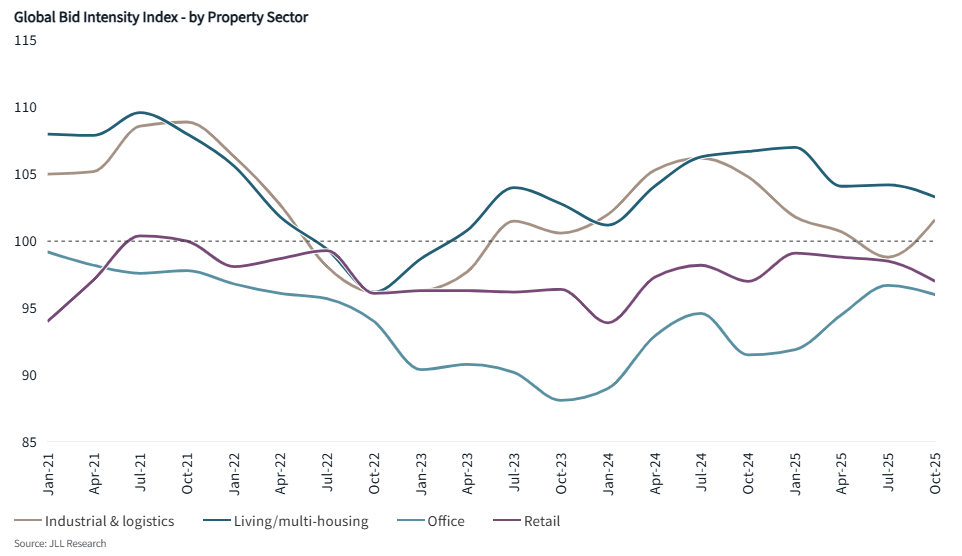

Bidding activity rises: October marked the second-highest monthly jump in bidding activity this year, per JLL’s Global Bid Intensity Index. The trend, which began in July, has been driven by back-to-back Fed rate cuts, signaling a broader return of liquidity to private real estate markets.

Front of the pack: Multifamily led all sectors in competitive bidding, largely due to a nationwide shortage of 3.5M housing units and soaring home prices keeping renters in place longer. While vacancy rates remain elevated in the near term, JLL anticipates they’ll trend lower as new supply gets absorbed. The sector’s fundamentals continue to attract strong investor conviction.

Industrial bounces back: The industrial and logistics market also saw a sharp uptick in bidding competitiveness. A slight calming of trade policy uncertainty helped renew investor interest in this segment, which had previously seen slower activity.

Sectors in transition: Retail saw softer competition, not from weaker demand, but from increased supply giving buyers more choice. Investor interest remains steady, supported by strong consumer spending. Meanwhile, the office sector is slowly recovering, with bidder interest and lender activity up from 2023 lows.

Confidence creeping back: Although future rate cuts remain uncertain—particularly in light of stronger-than-expected September jobs data—investors appear less fixated on timing. Confidence is rising, and many are showing greater tolerance for risk heading into 2026.

➥ THE TAKEAWAY

2026 outlook strengthens: Multifamily remains the top CRE pick as housing shortages and stable rental demand drive investor interest. With capital returning and risk tolerance rising, 2026 is shaping up to be more competitive across asset classes.

TOGETHER WITH REALAI

The ChatGPT for Real Estate is here

RealAI can answer any real estate question in seconds.

Analyze a market in seconds - Generate forward-looking insights on trends and risks

Accelerate high-quality deal flow - Screen markets, price deals and surface off-market opportunities

Evaluate tenant make-up - Understand average household income, FICO and net worth of tenants

…and more

RealAI is already being used by thousands to manage billion-dollar real estate portfolios. Try it for yourself—for free and in seconds.

*This is a paid advertisement. Please see the full disclosure at the bottom of the newsletter.

✍️ Editor’s Picks

Expanding portfolio: Conserve Holdings has expanded into Spartanburg with the acquisition of Auden Upstate, a 486 bed student housing community serving USC Upstate, managed in partnership with PeakMade Real Estate. (sponsored)

Momentum builds: October saw $34.6B in U.S. commercial real estate deals, the highest mid-cap volume of 2025.

Lender frenzy: Bank lending to commercial real estate surged 85% YoY as regional banks and debt funds flood back into the market

Permit divide: Fort Worth tops a national ranking of permitting speed, while cities like Cambridge and Los Angeles lag far behind.

Construction spike: Construction starts jumped 21% in October, fueled by a wave of multibillion-dollar manufacturing, infrastructure, and data center projects.

DOGE dissolves: The Trump-led DOGE agency disbanded early, reversing many federal lease cuts and leaving its downsizing mission largely unfinished.

Middle squeeze: Rising costs and flat incomes are eroding middle-class confidence, with consumer sentiment hitting a three-year low.

🏘️ MULTIFAMILY

Affordability shift: Incomes are finally outpacing rents in most major U.S. metros, but affordability remains strained as asking rents sit 35% above pre-pandemic levels.

Software settlement: RealPage settled with the DOJ over antitrust claims, agreeing to limit how its rent-setting software uses data, without admitting wrongdoing.

Rodent panic: A viral rat infestation at a Maryland apartment complex led to a condemned unit, code violations, and a full-scale pest control response by management.

Reuse rise: NYC leads the U.S. in office-to-residential conversions, with nearly 11,000 new apartments, half of which are in Midtown.

Occupancy dip: DFW apartment occupancy fell to 93.8% in Q3 amid record supply growth, prompting rent concessions even as construction begins to cool.

🏭 Industrial

Small but mighty: Small-scale industrial properties are becoming a key focus in modern logistics strategies, according to Yardi Matrix.

Institutional acceptance: Data centers have become a staple of securitized CRE markets, with 2025 issuance hitting $3.68B and cap rates stabilizing around 6.5%.

Facility refresh: Amazon is closing older facilities like its Sterling, VA center as it shifts to newer, high-tech warehouses.

Construction peak: After years of exponential growth, data center construction is expected to peak in 2026 as Big Tech shifts its AI spending.

Federal upgrade: Amazon plans to invest up to $50B starting in 2026 to expand AI and supercomputing capacity across its AWS regions dedicated to U.S. government use.

Blue highways: Prologis is investing in New York City’s Blue Highways initiative to shift urban freight from trucks to boats.

Distribution deal: Blackstone sold a 13-building, 1.3M SF last-mile industrial portfolio in West Sacramento for $155M.

🏬 RETAIL

Subsidy shop: Atlanta has opened its first downtown supermarket in 20 years, funded by $8M in public funds.

PPI dip: Core wholesale prices rose just 0.1% in September—below expectations—while retail sales posted modest gains.

Anchor upgrade: Whole Foods will anchor the $530M transformation of Sarasota Square into a luxury, mixed-use hub.

October deals: NYC’s top five retail sales in October topped $70M, with notable deals across Manhattan, Queens, and beyond.

Furniture flop: Value City’s parent filed for bankruptcy after plunging sales tied to the housing slump and inflation.

🏢 OFFICE

Share your insights: Early rate cuts have lifted sentiment but market uncertainty lingers; share your take in our Q4 2025 CRE sentiment survey.

Bright spot: Manhattan leads the nation in low office vacancy, even as utilization trends vary widely across U.S. markets.

Cowboy chic: Boot Barn’s new HQ in Irvine channels Western style with dramatic design touches like wild horse stonework and a four-story waterfall.

Ring returns: Amazon is calling Ring employees back to the office, reinforcing its push for in-person work.

Rudin recap: Rudin is finalizing a $350M recap to convert Manhattan’s 845 Third Avenue from office to residential.

Bio break: IQHQ has halted vertical development on its $1B Fenway Center life sciences project until it secures 50% leasing.

Refi ready: A joint venture is securing $700M to refinance Chicago’s Bank of America Tower, as occupancy climbs to nearly 98%.

🏨 HOSPITALITY

Distress discount: Two San Francisco Hilton hotels sold for 75% below their 2016 value, signaling deep distress—and possible recovery—in the city’s hotel market.

Travel rebound: After a sharp drop tied to the 43-day government shutdown, air travel and hotel demand rebounded in mid-November.

Property limbo: Morgan Stanley and CBRE may advise Pakistan on the future of NYC’s Roosevelt Hotel, as the billion-dollar site remains in long-term limbo.

📈 CHART OF THE DAY

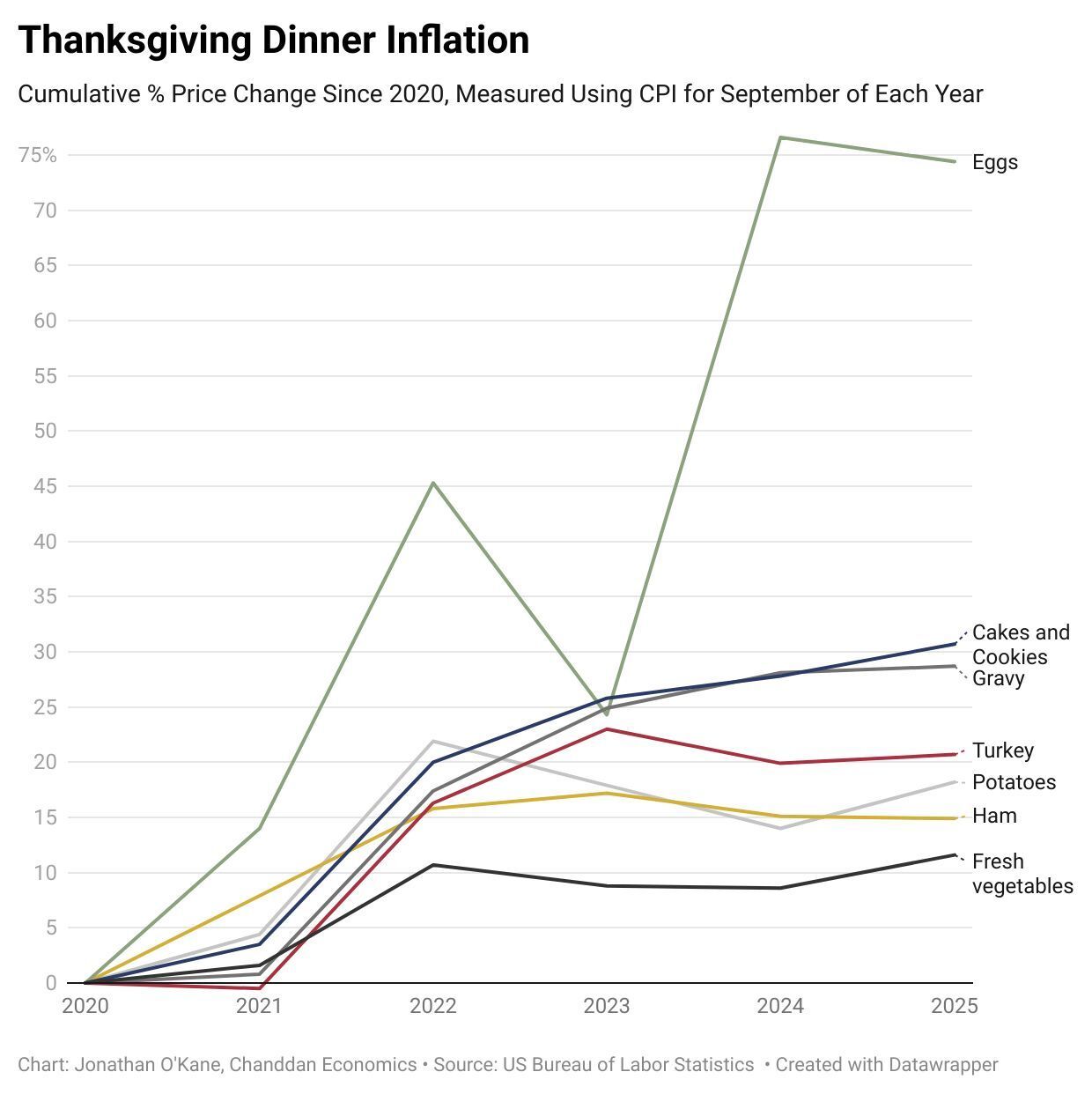

Thanksgiving prices are up across the board since 2020, but eggs—still 75% higher—are the biggest inflation culprit.

CRE Trivia (Answer)🧠

According to Altus Group, the multifamily sector was the clear leader in Q2 2025 transaction activity, driven by persistent housing affordability challenges and strong investor confidence in rental housing demand.

You currently have 0 referrals, only 1 away from receiving Multifamily Stress Test Model.

What did you think of today's newsletter? |

Reply