- CRE Daily

- Posts

- Office Market Hits Reset in 2025 as Deep Discounts Spark Investor Activity

Office Market Hits Reset in 2025 as Deep Discounts Spark Investor Activity

Deep discounts drove $37B in office sales this year, but is a recovery truly underway?

Good morning. After years of stalled sales and falling values, the U.S. office market finally showed signs of life in 2025. Deep discounts drove a surge in deals, but the real question now is whether stabilization is here to stay.

Today's issue is sponsored by LendingOne—the nation’s fastest-growing build-to-rent (BTR) and SFR portfolio lender for institutional investors.

🎁 Last Call for Holiday Merch

Our holiday merch is officially live — and if you want it under the tree this year, order by December 11th. Stock is limited, so snag yours while you can. Shop the Collection

CRE Trivia 🧠

Which restaurant was just named the highest-grossing independent restaurant in America?

(Answer at the bottom of the newsletter)

Market Snapshot

|

| ||||

|

|

Office Reset

Office Market Hits Reset in 2025 as Deep Discounts Spark Investor Activity

After a brutal stretch for U.S. office properties, steep price cuts sparked renewed investor activity—and maybe, just maybe, the first signs of a rebound.

Discounts drive deal volume: A long-awaited thaw hit the office market in 2025, fueled by steep discounts on underperforming assets. Nearly 1,930 properties sold in the first three quarters for $37.6B—up 40.3% YoY, per Yardi.

Major markdowns: The deepest discounts clustered in Houston, San Francisco, Manhattan, D.C., and Dallas, where over 60% of deals were marked-down trades—yet these were also the most active markets for Class-A properties.

Eye-popping examples include:

135 W. 50th St. in NYC: Sold for just $8.5M, a 97.5% drop from its 2006 purchase price.

Market Street towers in San Francisco: Sold for $177M, 76% less than in 2019.

Downtown Denver towers: Traded at $5.3M, down from $176M in 2013.

Bouncing off the bottom: Trepp’s Q3 Property Price Index shows early signs of stabilization. Office values remain ~15% below their 2022 peak but rose 5.38% year-over-year—outpacing the broader CRE market’s 2.8% gain.

What’s driving the shift? Return-to-office mandates, renewed leasing, and two fall rate cuts by the Fed, which lowered the funds rate to 3.75%–4%, helping support valuations, per Trepp’s Eric Bao.

Urban core outpaces suburbs: CBD office prices rose 5.1% YoY in September, edging out the 4.5% suburban gain, per MSCI—the first time since early 2022 that CBD values led the pack.

Big money moves: High-dollar office deals surged in 2025, with sales over $100M surpassing 2023’s full-year total by Q3. Investment volume hit $19B, up 35% YoY, as buyers returned to chase discounted assets with long-term upside.

➥ THE TAKEAWAY

Don’t call it a comeback: The worst may be behind us, but the recovery is still fragile. Office values took historic hits in 2025, and while early signs of a rebound are emerging, the next few quarters will test whether momentum holds—or stalls.

TOGETHER WITH LENDINGONE

Strategic Financing Options for Institutional Investors

LendingOne is one of the nation's fastest-growing Build-to-Rent (BTR) and SFR Portfolio lenders for institutional investors. Our Institutional Group provides flexible financing, specializing in high-value deals and customized solutions to help empower institutional investors to scale.

Benefits of Working With Us:

BTR Aggregation/Reno Facilities and SFR Portfolio Term Loans

Backed by a Leading Global Asset Manager

Customized Non-Recourse Financing

$100M+ Loan Capacity

5, 7, 10-Year Term Options

*This is a paid advertisement. Please see the full disclosure at the bottom of the newsletter.

✍️ Editor’s Picks

Final days for 20-40% lower insurance: Strategic Insurance Group’s master schedule closes 12/15. Limited spots remain for 20-40% lower rates. Stop overpaying, get your lower insurance quote now. (sponsored)

Momentum slips: CRE transaction volume turned negative for the first time since early 2024, as high interest rates and market uncertainty stall deal momentum.

Unexpected support: Despite spending millions to block his win, real estate players are now donating to Mayor-elect Zohran Mamdani’s transition team.

REIT outlook: After a rocky 2025, REITs are poised for a strong 2026 as public-private valuation gaps close, international diversification pays off, and institutional capital ramps up.

CMBS caution: Fitch warns of a weakening 2026 outlook for CMBS, with rising office delinquencies and macro pressures dragging asset performance across key sectors.

Price slide: Home price declines have spread from 6 to 32 major U.S. markets in 2025, marking the broadest slowdown in over a decade.

Gradual recovery: Zillow forecasts modest home price growth, improved affordability, and AI-powered transactions as the housing market stabilizes.

🏘️ MULTIFAMILY

Market softness: U.S. apartment rents fell for the fifth straight month in November, posting the steepest decline for the month in over 15 years.

White house watch: Congress dropped key housing reforms from the defense bill, but pressure remains to address affordability and advance a potential Fannie-Freddie IPO ahead of 2026.

Occupancy slips: U.S. apartment rents declined again in November as national occupancy fell below 95%, with rent cuts persisting in oversupplied Sun Belt and Western markets.

Payments resume: HUD resumed delayed Section 8 payments after the shutdown, restoring funds to housing authorities and landlords nationwide.

Transparency mandate: Following a $24M settlement with Greystar, the FTC is launching a rulemaking process to require rental housing operators to disclose all mandatory fees upfront.

Refi of the day: Madison Realty secured a $285M refi for its 473-unit Greenpoint Central project, reinforcing investor confidence in Brooklyn’s rental market.

Rent cap: LA has passed its first major rent stabilization overhaul in 40 years, capping annual rent hikes on older units at 4%.

Southern squeeze: Multifamily markets in the Sun Belt face rising vacancies and rent declines as population growth slows and job creation falters.

🏭 Industrial

Prime pickup: Morgan Stanley bought a newly built Amazon-leased warehouse near LAX for $211M, nearly $1,500/SF.

Power pair: Google and NextEra Energy plan to co-develop gigawatt-scale data centers with on-site power plants.

Soft takeover: SoftBank is in talks to acquire DigitalBridge, valuing the data center giant at up to $5B as AI demand fuels interest in digital infrastructure investments.

Data deal: KKR is investing billions in Compass Datacenters to support global expansion amid rising data demand.

Inland investment: Brookfield sold a Kohl’s-leased warehouse in San Bernardino to Overton Moore for $120M+.

Defense boost: Boeing completed its $8.3B acquisition of Spirit AeroSystems, while Airbus and CTRM bought other global assets.

🏬 RETAIL

Island buyout: Blackstone and partners are taking Alexander & Baldwin private in a $2.3B deal, acquiring Hawaii’s top retail landlord.

Mindset shift: Retailers are moving beyond generational labels as overlapping behaviors and shared values across age groups drive a new focus on the "perennial consumer."

Retail layoffs: Retail job cuts have surged nearly 140% year-over-year, with 92,000 announced so far in 2025.

Grocery growth: Cohen & Steers and Phillips Edison acquired the 99% leased Springs Plaza in Florida, expanding their open-air retail portfolio.

Discount dominance: Big-box value retailers like Costco, TJX, and Walmart are aggressively expanding into essentials and grocery, redefining what counts as “core” retail in 2026.

🏢 OFFICE

Downtown departure: Real estate mogul Donald Bren has exited downtown San Diego, selling off his office portfolio at steep discounts after losing faith in the area’s growth potential.

Value grab: Synergy has acquired 101 Merrimac St. in Boston’s West End for $22.5M, well below its previous $64M assessment.

Bottom found: Distressed office sales in 2025 have set clear pricing benchmarks, ending years of market guesswork.

Plan B: SL Green plans to turn its 1515 Broadway office tower into a 1,000-room hotel and entertainment venue after its casino plan fell through.

Gables discount: AEW Capital sold Coral Gables’ Ryder Colonnade office building for $70.4M, 13% less than its 2013 purchase price.

🏨 HOSPITALITY

Sonder fallout: Former Sonder-leased hotels in Los Angeles are now vacant liabilities for owners, who face a tough market as they scramble to find new operators or sell.

Venue upgrade: Fort Worth completed the $95M first phase of its convention center expansion, setting the stage for a $606M transformation into a modern events hub.

Local luxe: Chicago hotels are embracing neighborhood-focused design to attract modern travelers and capitalize on strong tourism demand.

Tourism upgrade: Arlington will replace its Sheraton with a $410M Loews hotel as part of a hospitality push ahead of the 2026 World Cup.

A MESSAGE FROM ARBOR REALTY TRUST

Arbor Realty Trust’s Affordable Housing Trends Report

As the cost of living in the U.S. climbs, the shortage of affordable housing is a persistent challenge for many communities. As calls for change grow louder, Arbor Realty Trust and Chandan Economics document federal and state initiatives aimed at alleviating housing pressure.

Explore our investor’s guide to find out how new affordable housing opportunities and lingering challenges are converging in a sector known for its strength, stability, and consistency.

*This is a paid advertisement. Please see the full disclosure at the bottom of the newsletter.

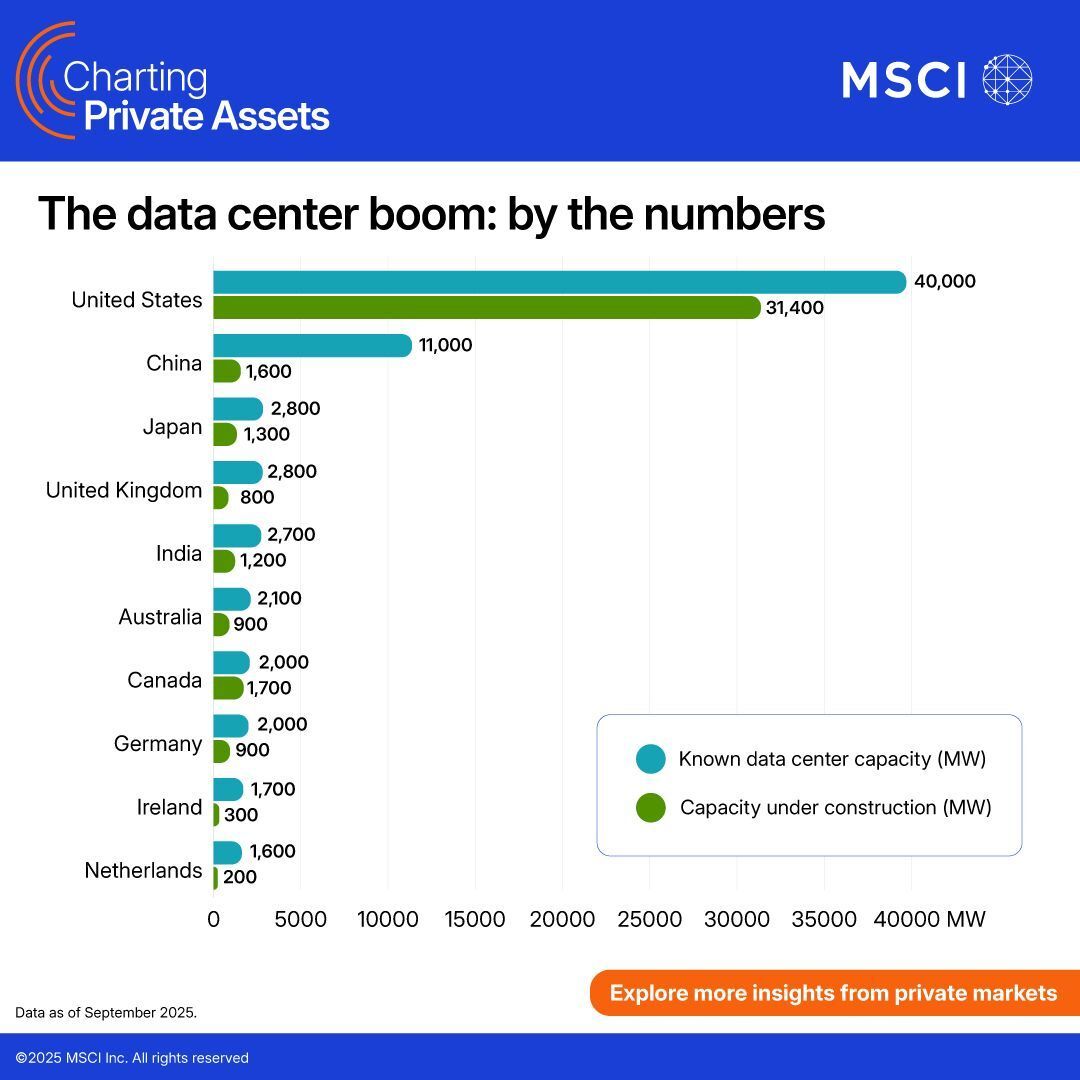

📈 CHART OF THE DAY

Global data center capacity is set to grow by 50% with over 47,000 megawatts under construction—valued at $550B—but rising power demand raises serious questions about future grid strain.

CRE Trivia (Answer)🧠

According to Restaurant Business, MILA Miami topped the national list with $51,115,747 in sales.

You currently have 0 referrals, only 1 away from receiving Multifamily Stress Test Model.

What did you think of today's newsletter? |

1

Reply