- CRE Daily

- Posts

- Owner-Occupier Transactions Fill Growing Gap in Office Sales

Owner-Occupier Transactions Fill Growing Gap in Office Sales

Owner-occupier deals—once a minor share of the office market—have surged since 2022. By 2024, these deals made up nearly 30% of office acquisitions.

Good morning. As challenges persist in the office market, a surprising group is stepping up: the tenants themselves. Tech giants and other occupiers are buying buildings they once leased, reshaping the office market in the process.

Today’s issue is brought to you by LendingOne—the nation’s fastest-growing build-to-rent (BTR) and SFR portfolio lender for institutional investors.

🎙️This week on No Cap Podcast, RockStep Capital CEO Andy Weiner breaks down why the retail apocalypse was overblown and how his team is turning forgotten malls into durable cash flow machines.

Market Snapshot

|

| ||||

|

|

TENANT TAKEOVER

Owner-Occupier Transactions Fill Growing Gap in Office Sales

Occupiers across industries are stepping in as buyers, reshaping a market once dominated by institutional investors.

Strategic space grab: US tech giants are increasingly opting to buy the office buildings they occupy, taking advantage of steep discounts in a still-reeling CRE market. Apple, Amazon, LinkedIn, Bet365, and others have collectively spent over $1B in recent months to purchase office properties, signaling a notable shift in strategy from leasing to ownership.

Data confirms the trend: Owner-occupier deals, once a small part of the office market, have surged since 2022, reaching nearly 30% of acquisitions by 2024, according to Site Selection Group. JLL reports a 20% share in Q125, still well above historical norms. This rise is helping offset a 55% YoY drop in overall US office sales, as institutional investors retreat and corporate buyers with long-term plans step in.

Why buy now? For many companies, buying their buildings offers a trifecta of advantages: greater control over workspace customization, long-term cost predictability, and avoidance of unstable leasing markets. With loan distress mounting—47% of all troubled commercial real estate loans tied to office properties—deals are available at steep discounts.

Institutions step back: REITs and large investment firms remain net sellers, constrained by debt maturities and cautious underwriting. Their pullback has opened the door for corporate occupiers to step in and secure quality assets. Many began by consolidating into owned space during downsizing, and now, as they expand, they continue to favor ownership.

Shadow still looms: Despite the flurry of purchases, the broader US office sector remains under stress. More than $2.2T in CRE loans are set to mature by 2027, and the office sector holds nearly half of all distressed CRE loans, per Savills. As lenders grapple with defaults, expect more deed-in-lieu transactions, foreclosures, and fire sales ahead.

➥ THE TAKEAWAY

Filling the gap: Owner-occupiers, particularly in tech, are reshaping the office market. While traditional investors tread cautiously, companies with cash and conviction are securing space on their own terms. As distressed assets hit the market, the next big buyer might not be a fund, but a future tenant.

TOGETHER WITH LENDINGONE

Strategic Financing Options for Institutional Investors

LendingOne is one of the nation’s fastest-growing Build-to-Rent (BTR) and SFR Portfolio lenders for institutional investors. Our Institutional Group provides flexible financing, specializing in high-value deals and customized solutions to help empower institutional investors to scale.

Benefits of Working with Us

BTR Aggregation/Reno Facilities and SFR Portfolio Term Loans

Backed by a Leading Global Asset Manager

Customized Non-Recourse Financing

$100M+ Loan Capacity

5, 7, 10-Year Term Options

*This is a paid advertisement. Please see the full disclosure at the bottom of the newsletter.

✍️ Editor’s Picks

Protect your margins: Disorganized transaction workflows are a hidden tax on your growth. Discover how Buildout Manage & Close eliminates mistakes and builds in compliance by default, protecting your profit margin. (sponsored)

Capital flexibility: Family offices are emerging as key players in commercial real estate, blending flexibility, risk tolerance, and long-term strategies to rival institutional investors.

Business boost: Florida will eliminate its unique sales tax on commercial rent starting October 1, giving tenants a financial break and boosting the state’s appeal.

Cautious climb: Amid tariffs, economic uncertainty, and cooling job growth, RealPage forecasts modest 2.3% national rent gains through mid-2026.

Wealth rankings: New York remains the top global hub for centimillionaires, while cities like Miami are quickly climbing the ranks.

Score shift: Fannie Mae and Freddie Mac will now accept VantageScore 4.0 for mortgage approvals, prompting debate over its impact on homeownership access.

Solar setback: A post-tax-bill executive order from President Trump has added new uncertainty to commercial rooftop solar financing.

🏘️ MULTIFAMILY

Care gap: Senior housing occupancy hit 88.1% in Q225, its highest in years, driven by a growing aging population.

Seasonal savings: As peak rental season fades, landlords are more open to negotiating, with renters saving up to $100/month by leasing in slower winter months.

Buyout battle: A Florida appeals court sided with Biscayne 21 condo owners, blocking a developer’s $150M buyout plan and setting a new legal precedent that could slow future condo redevelopments.

Asset auction: A London-based developer’s stalled plan for a 28-story, 400-unit tower in Boston’s Fenway neighborhood is heading to auction.

NYSE makeover: GFP is converting a former New York Stock Exchange site into 382 apartments amid FiDi’s office-to-resi boom.

🏭 Industrial

Distribution downsizing: FedEx will lay off nearly 500 workers and close key US facilities as part of a sweeping cost-cutting plan to shutter 30% of its distribution network by 2027.

Supply strain: As data center developers race to build self-powered facilities, outdated utility rules and slow-moving bureaucracy are stalling progress.

Negative demand: LA industrial vacancy hit a record 7% in Q2 as smaller space demand waned, pushing rents down 6.6% YoY.

🏬 RETAIL

Consumer connection: Tanger CEO Stephen Yalof says the future of retail lies in creating community-driven, experiential centers that blend physical and digital to meet evolving consumer expectations.

Luxury experiment: French retailer Printemps is testing a new department store model in NYC, blending luxury retail with dining, art, and experiences.

Bowling bet: Lucky Strike Entertainment has acquired the real estate under 58 of its US venues for $306M, cutting rent costs and boosting financial flexibility.

Fast fashion: Temu and Shein face steep US tariffs but may stay competitive through local warehouses and ultra-low prices.

🏢 OFFICE

Back to work: June office visits rose 8.3% year-over-year, marking the fourth-busiest month post-pandemic as return-to-office momentum builds.

Y'all Street: DFW’s office market is gaining momentum, with leasing activity up 35% YoY.

Office outlier: While most CRE sectors slowed in May, office sales jumped 41% YoY, the only asset class to post gains amid a broader 12% decline.

🏨 HOSPITALITY

SEC scrutiny: A developer behind multi-billion-dollar resort plans in Georgia faces scrutiny over failed deals, dubious filings, and SEC red flags.

Mid-market momentum: Sub-$50M hotel deals are fueling US transaction activity as smaller investors stay active despite economic headwinds.

📈 CHART OF THE DAY

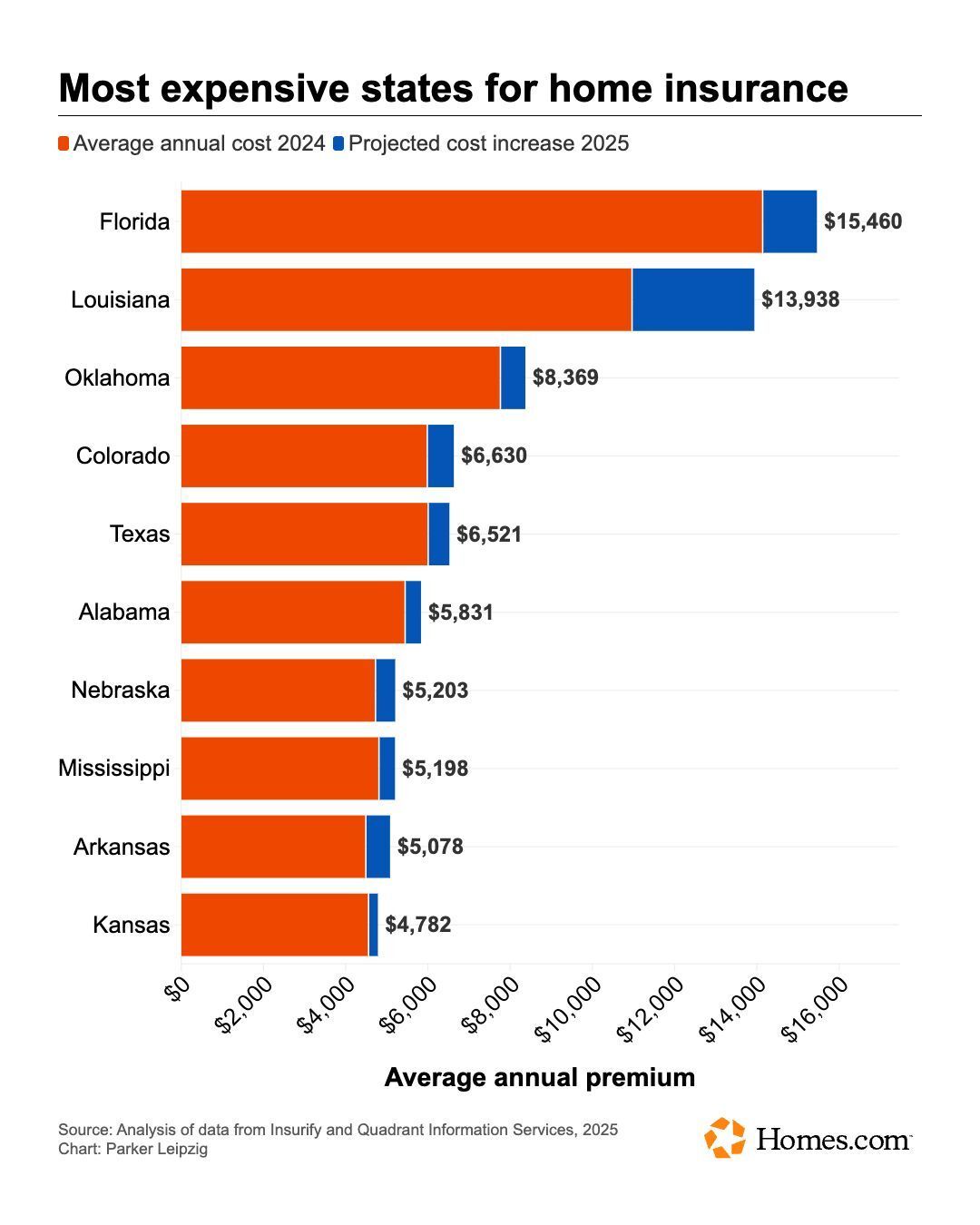

Climate change, wildfire models, and mounting claim costs are making home insurance sharply more expensive, especially in states already struggling with severe weather impacts.

You currently have 0 referrals, only 1 away from receiving Multifamily Stress Test Model.

What did you think of today's newsletter? |

Reply