- CRE Daily

- Posts

- Peak Rental Season Isn’t What It Used to Be

Peak Rental Season Isn’t What It Used to Be

Remote work, flexible leases, and too much supply are reshaping when renters sign, and landlords should take note.

Good morning. The rental market’s once-reliable summer surge is losing steam. Shifts in renter behavior, new supply, and post-pandemic ripple effects are flattening seasonality and pulling peak activity earlier in the year.

Today’s issue is sponsored by Reap Capital—sourcing compelling multifamily opportunities across top U.S. markets.

🎙️This week on No Cap: Hoya Capital’s David Auerbach pulls back the curtain on the REIT market—breaking down public vs. private valuations, capital flows, and the signals investors can't afford to miss heading into 2026.

CRE Trivia 🧠

Which city had the largest total number of manufactured homes in 2025?

(Answer at the bottom of the newsletter)

Market Snapshot

|

| ||||

|

|

Seasonal Shift

Peak Rental Season Isn’t What It Used to Be

The once-predictable summer surge in rental activity is fading, as shifts in renter behavior, operator strategy, and new supply reshape the leasing calendar.

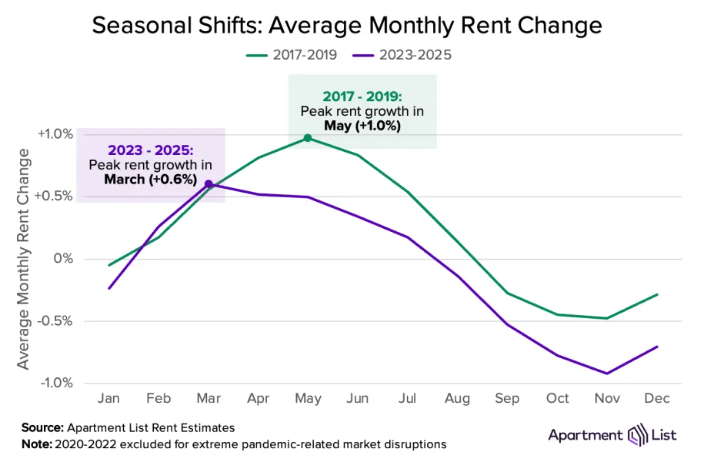

Flattening the rental curve: Summer was once the undisputed peak rental season—thanks to school breaks, good weather, and fewer holidays. But recent data shows seasonality is shifting: rent hikes are milder, peak pricing is arriving earlier, and the traditional summer surge is giving way to a more balanced leasing cycle.

Three forces are reshaping the rental rhythm:

Pandemic Disruptions scrambled lease timing in 2020, causing lasting turnover shifts.

Lease Staggering lets operators ease summer congestion by incentivizing off-peak start dates.

Supply Surge—with 1M+ units added since 2022—gives renters more choice and flexibility, reducing pressure to move during peak months.

Earlier renter activity: Renters are starting searches earlier, with over 30% of “interests” now in Q1—up from pre-pandemic levels. Lease signings still peak in summer but are shifting toward spring, as tech, remote work, and ample supply give renters more time and flexibility.

Regional variations: Not all metros are experiencing the same flattening.

Austin, TX: March is now the lone month with consistent rent growth, amid heavy supply and falling prices.

Orlando, FL: Market energy fizzles after Q1, with stalled rent growth.

Chicago, IL: New momentum has emerged in February–April.

Portland, OR: Its once-reliable summer rent spikes have nearly vanished.

Boston, MA: Seasonality remains intact, though swings between winter and summer are amplified by weather.

What’s here to stay: Some trends are temporary, like oversupply, which will ease as construction slows. But others—like remote work and diversified lease timing—point to lasting change. Even as demand rebounds, operators may stick with this balanced approach to reduce churn and volatility.

➥ THE TAKEAWAY

No more off-season: The rental calendar is shifting. Supply, renter behavior, and operator strategy are softening traditional seasonality, making the "off-season" less off than ever.

TOGETHER WITH REAP CAPITAL

2017 Vintage Basis Reset Opportunity

At 25% below replacement cost, The Creekside at Vantage in Dallas, TX is the basis reset opportunity you have been looking for. Underperforming due to a capital constrained owner, we are going in at a 5.8% cap rate with occupancy normalized.

The deal targets 21–23% IRR, 6.6% cash-on-cash returns, and a 3-year hold with minimal capex and 100% depreciation. Explore this opportunity and future deals by connecting with our team today.

*This is a paid advertisement. Please see the full disclosure at the bottom of the newsletter.

✍️ Editor’s Picks

Investor acquisition: See how you can impress and build lasting relationships with both institutional and individual investors in just 30 days. (sponsored)

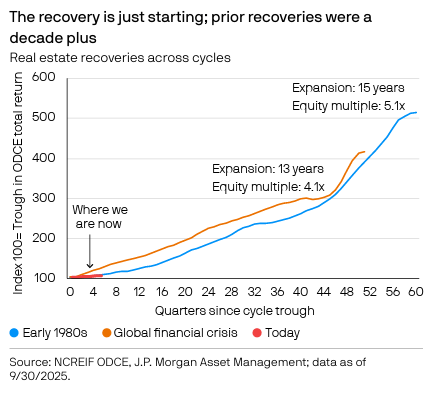

Tactical turn: With credit flowing again, Brookfield sees 2026 as the moment to go tactical, targeting housing, logistics, data centers, and hospitality in a reawakening real estate cycle.

Cautious capital: CRE transactions fell 10% YoY in November, but investors are doubling down on high-value assets such as medical offices and data centers.

Core focus: BXP offloaded $1B in suburban and noncore assets to fund high-return developments in gateway city business districts, moving closer to its $1.9B disposition target.

Stress signals: Deloitte forecasts a sluggish 2026 defined by soft growth, high debt, and global economic stress, even as AI and strong stock markets offer glimmers of upside.

Commanders campus: The Commanders unveiled plans for a 70,000-seat stadium at the RFK site, blending classical D.C. architecture with a $3.8B mixed-use redevelopment.

Heir estate: As $4.6T in real estate shifts to Gen X and Millennials, wealthy families are fast-tracking inheritance by buying luxury homes for their kids now.

🏘️ MULTIFAMILY

Housing boost: Freddie Mac’s multifamily volume surged 17% to $77B in 2025, driven by record LIHTC investments and a sharp focus on affordable housing.

Adaptive reuse: Yellowstone Real Estate secured a $326M loan to convert Manhattan’s former Watson Hotel—once used as a migrant shelter—into 312 apartments.

Mystery buyer: An unknown firm won Genesis HealthCare’s $1B bankruptcy auction, outbidding rivals to take control of one of the nation’s largest nursing home chains.

Development deal: Radnor and Piazza landed $141M in financing for The Piazza at Ardmore, a 270-unit mixed-use project set to deliver in 2027.

Slow climb: Multifamily recovery is being dragged down by oversupply, weak demand, and cautious rent growth, especially in the Sunbelt.

🏭 Industrial

Industrial reset: After years of explosive growth, the U.S. industrial market is cooling as rents decline, vacancies rise, and tenants regain leverage, according to CompStak.

Inland edge: Inland Empire East saw 2.1M SF of Q4 absorption, signaling a gradual industrial rebound amid steady demand and limited new supply.

Amazon expands: Amazon signed 1.1M SF in new L.A. warehouse leases in Q4 2025, including a 615K SF deal with Prologis.

🏬 RETAIL

Cautious cheer: Holiday 2025 retail sales rose 4.2% despite cautious consumers, as value formats, AI tools, and selective spending reshaped shopping behavior.

Amazon clash: Saks Global’s bankruptcy has triggered a financing fight with Amazon as the retailer seeks court approval to cut leases and restructure after burning through cash and missing payments.

Cultural expansion: California-based Vallarta Supermarkets opened its first Arizona store in Glendale, kicking off a regional growth plan aimed at meeting rising demand for Latino foods.

🏢 OFFICE

Sublease signal: Miami office leasing jumped 36% in 2025, but rising concessions and subleases hint at softening demand.

Downtown deal: Real Capital Solutions acquired 401 N. Michigan Ave. for $132.5M, the largest Chicago office deal since 2022.

Distress deal: The Jemal family snapped up D.C.’s historic Colorado Building for $20M after foreclosure, just a fraction of its 2017 price.

Quiet cracks: Office delinquencies appear stable, but hidden workouts, extensions, and looming loan maturities reveal deeper market distress not reflected in headline numbers.

🏨 HOSPITALITY

Extended stay: Hilton is partnering with Placemakr to add 3,000 furnished units to its portfolio, expanding its reach in the fast-growing extended-stay rental segment.

Suite deal: Kasa acquired most of Mint House's portfolio in an all-equity deal, adding 1,000 rooms and expanding its presence in the tech-enabled, apartment-hotel space.

Debt detour: Ashford Hospitality extended a $724M loan and paused dividends as it explores a potential sale to ease mounting debt.

A MESSAGE FROM ALTUS GROUP

Faster underwriting = more deals

New features in ARGUS Intelligence help CRE investment teams eliminate manual work and analyze deals faster to make accurate investment decisions.

Rent roll imports - instantly create or update leases (watch a quick tutorial)

Model comparisons - compare property scenarios side-by-side

Custom views - same data, same page, tailored views

Quickly create and update property financial models for more reliable cash flow analysis - in minutes, not hours.

*This is a paid advertisement. Please see the full disclosure at the bottom of the newsletter.

📈 CHART OF THE DAY

The CRE recovery is in its early stages, with historical patterns suggesting expansions can last over a decade and multiply invested capital several times over.

CRE Trivia (Answer)🧠

According to StorageCafe, Mesa, Arizona leads the nation with more than 29,300 manufactured homes.

More from CRE Daily

📬 Newsletters: Stay ahead of the market with local insights from CRE Daily Texas and CRE Daily New York.

🎙️Podcast: No Cap by CRE Daily delivers an unfiltered look at the biggest trends—and the money game behind them.

🗓️ CRE Events Calendar: The largest searchable calendar of commercial real estate events—filter by city or sector.

📊 Market Reports: A centralized hub for brokerage research and market intelligence, all in one place.

📈 Fear & Greed Index: A fully interactive sentiment tracker on the pulse of CRE built in partnership with John Burns Research & Consulting.

You currently have 0 referrals, only 1 away from receiving Multifamily Stress Test Model.

What did you think of today's newsletter? |

Reply