- CRE Daily

- Posts

- Population Decline Marks a Turning Point for Atlanta

Population Decline Marks a Turning Point for Atlanta

Domestic migration slipped into the negative for the first time in decades.

Good morning. Atlanta’s decades-long growth streak is officially over, as more Americans are now leaving the metro than moving in. A combination of rising costs, traffic congestion, and slow housing development is prompting people to move toward smaller, more affordable Southern cities.

Today’s issue is brought to you by AirGarage—maximize parking asset performance with smart operations.

🎙️This week on No Cap Podcast, Janet LePage joins Jack and Alex to unpack her wild rise in real estate, navigating rate hikes, distressed deals, and the secret power of washer-dryer installs.

Market Snapshot

|

| ||||

|

|

Moving Out

Population Decline Marks a Turning Point for Atlanta

After decades of being a top migration magnet, metro Atlanta is now seeing more people move out than in—for the first time in modern history.

A historic shift: Between mid-2023 and mid-2024, census data show metro Atlanta experienced a net loss of domestic migrants—about 1,330 people—marking the region's first such decline in over 30 years. This signals a sharp break from decades of near-continuous growth fueled by new residents from other US cities, especially from the North.

Driving the exodus: Affordability and housing access are no longer enough to keep people in Atlanta. Rising home prices, worsening traffic, and strained infrastructure are prompting even well-off residents to seek smaller, more affordable cities like Chattanooga, Knoxville, and Greenville in search of a better balance.

Housing lag: While apartment construction surged post-pandemic, single-family home building has significantly slowed. Housing stock grew just 0.6% between 2020 and 2023, far below past decades’ pace. Compounding the issue, the rise of data centers is further straining land availability for new homes.

Vacancy problem: A quarter of Atlanta’s office space sits empty, well above the national average. High-profile projects like Microsoft’s planned Westside campus are on hold indefinitely. Apartment vacancies are also rising, especially among luxury units aimed at wealthier newcomers, who are no longer arriving in the same numbers.

Smaller cities gain ground: As Atlanta and other large Sunbelt metros cool off, nearby smaller cities are experiencing renewed growth. Huntsville, Wilmington, Knoxville, and Chattanooga are outpacing pre-pandemic domestic migration trends. These metros benefit from lower housing costs, reduced traffic, and the continued growth of remote work.

➥ THE TAKEAWAY

Rethinking growth: Atlanta’s long-time growth advantage has run into modern headwinds, namely price, congestion, and housing supply. As smaller Southern cities win over cost-conscious, quality-of-life-focused movers, Atlanta may need to rethink its housing strategy and urban infrastructure to stay competitive.

TOGETHER WITH AIRGARAGE

Featured Guide: The Asset Manager’s Playbook for Parking Revenue Growth

Managing parking lots and garages often hides inefficiencies that cost you revenue. AirGarage’s latest guide shows how CRE professionals can modernize parking management to boost NOI.

You'll learn:

How to structure rate models that actually drive revenue

What to look for in enforcement and reporting (beyond ticket counts)

How to use real-time data for pricing, access, and utilization

Red flags in ops agreements that drag down NOI

Tech-Forward Solutions

AirGarage partners with CRE owners, hotels, and universities to modernize operations—no gate arms, no hidden fees, and a 23% average NOI boost.

*This is a paid advertisement. Please see the full disclosure at the bottom of the newsletter.

✍️ Editor’s Picks

Lending evolution: As BTR communities expand rapidly, traditional lenders struggle to keep pace with the sector’s unique financing needs. (sponsored)

Leasing leverage: While fewer US apartments are offering rent concessions, the average value of those discounts has grown.

Price pressure: June’s inflation data stayed soft overall, but rising prices in tariff-hit goods signal early pressure on consumers.

Boomer equity: Baby boomers now hold up to $19T in US housing wealth, with Florida dominating the top retiree markets.

Bank rebalancing: Bank OZK posted strong Q2 CRE loan originations, but real estate’s share of its total portfolio continues to shrink.

REIT relief: Congress has made permanent a 20% tax deduction on REIT dividends via Section 199A, reducing effective tax rates for investors.

Servicing sale: HomeStreet is offloading a $794M Ginnie Mae servicing portfolio as it repositions its balance sheet ahead of a merger with Mechanics Bank.

🏘️ MULTIFAMILY

Multifamily reset: Rent growth is soft, but strong demand and falling supply point to a healthy market rebound ahead.

Coastal contrast: Florida’s Gulf Coast rents are falling while Atlantic Coast cities see gains, reflecting regional vacancy shifts and storm recovery pressures.

Rent-buy gap: The cost advantage of renting over buying is shrinking in many US cities, signaling a shift in affordability.

Midyear check: Economist Jay Parsons says multifamily demand remains strong, but rent growth is still suppressed by intense lease-up competition.

🏭 Industrial

Spec shift: As speculative industrial construction slows, build-to-suit projects now make up a growing share of the pipeline.

Strategic sale: Mapletree sold a 2.4M SF industrial portfolio across the Sun Belt to EQT Real Estate for $241M.

CEO buyout: Blackstone paid $3B to buy out QTS founder Chad Williams, clearing the way for new co-CEOs to accelerate global data center growth.

Tenant market: San Diego’s industrial market continues to favor tenants, with elevated vacancy, softer rents, and leasing concentrated in small to mid-sized spaces.

Growth mode: Scotts Miracle-Gro signed Phoenix’s biggest industrial lease of 2025, taking 734K SF in Glendale.

🏬 RETAIL

Botox boom: Med spas are flooding retail spaces nationwide, but lax regulations and safety risks may slow the momentum.

Comeback king: Investor Ian Jacobs is scooping up discounted buildings near San Francisco’s Union Square, betting that the battered retail corridor is poised for a comeback.

Tenant support: To speed up tenant openings amid LA’s slow permitting, landlords are increasingly taking the lead on space buildouts.

Tariff impact: Tariffs and weak demand are squeezing profits for department stores and apparel retailers, leaving little room to raise prices.

🏢 OFFICE

Office mandate: More than half of Fortune 100 companies now require full-time office attendance, marking the end of hybrid dominance.

High stakes: Despite San Francisco’s sky-high office vacancy rate, Hines is betting big with a proposal to build the West Coast’s tallest tower.

Office offload: Sterling Bay is negotiating to buy Boeing’s half-empty former HQ tower in Chicago, though a complex ground lease adds risk.

Equity exit: JP Morgan has exited its stake in Carr Properties, trading its 36% share for three DMV-area office buildings.

🏨 HOSPITALITY

Miami standoff: Nahla Capital has bid $275M for Michael Shvo’s stalled Miami Beach project, as Shvo faces pressure to match the offer and avoid losing the site.

Mountain debt: Reed Hastings is facing a $76M lawsuit from EB-5 investors over unpaid debt tied to his luxury ski project at Utah’s Powder Mountain.

Code violations: NYC is suing the Chetrit family over the derelict Hotel Carter in Times Square, calling it a public safety threat.

Distress play: Peachtree Group has launched a $250M special situations fund to target distressed hotel and CRE assets.

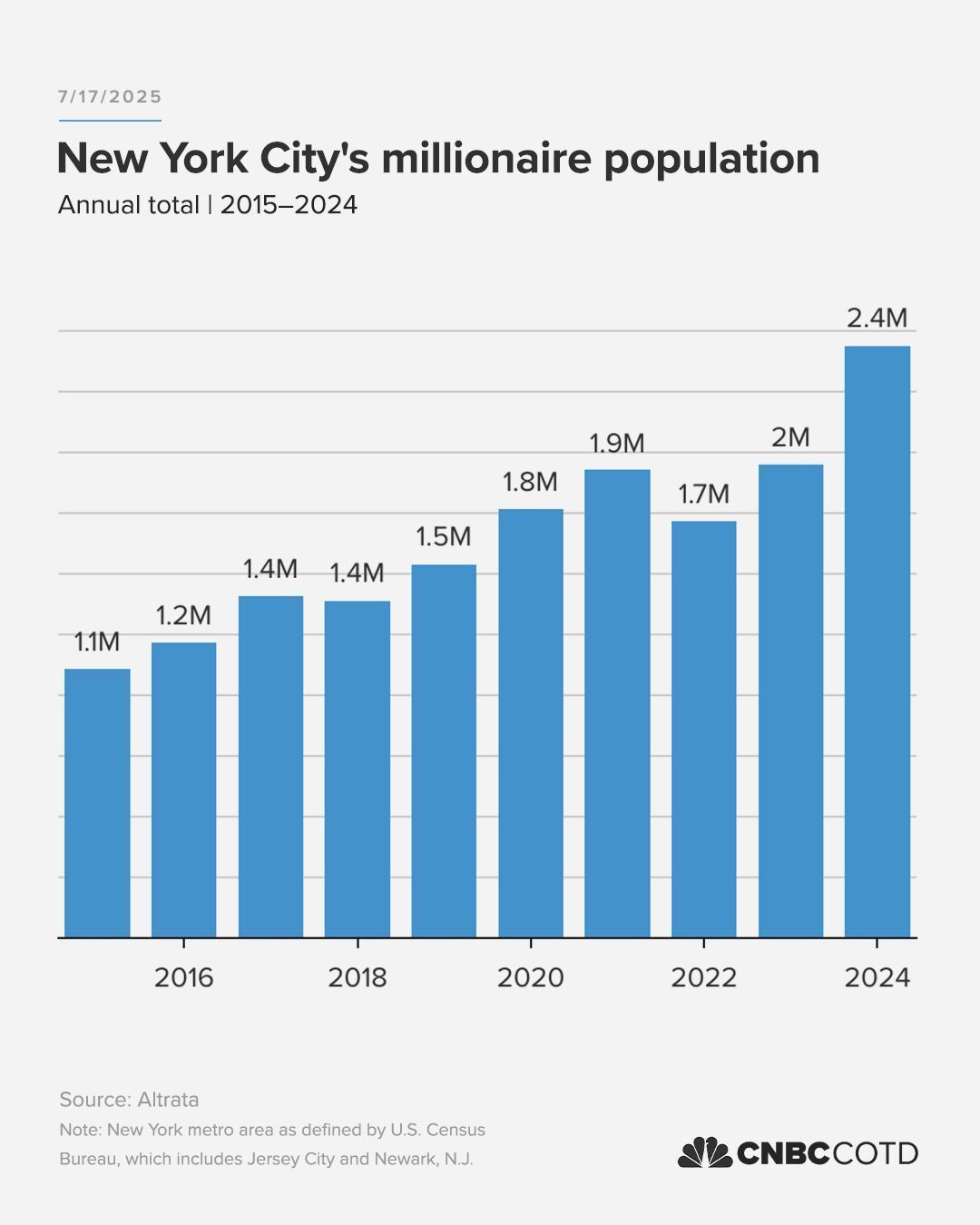

📈 CHART OF THE DAY

NYC's millionaire population has more than doubled over the past decade, now exceeding 2.4M. The city is also home to over 33,000 individuals worth $30M or more—nearly twice as many as Miami—reinforcing its status as the world’s top wealth hub.

You currently have 0 referrals, only 1 away from receiving Multifamily Stress Test Model.

What did you think of today's newsletter? |

Reply