- CRE Daily

- Posts

- Private Real Estate Investment Sees First Growth Since 2021

Private Real Estate Investment Sees First Growth Since 2021

Private real estate fundraising hit $222B in 2025, its first annual gain since 2021.

Good morning. CRE fundraising jumped 29% in 2025, marking a clear turnaround after years of decline. Data centers emerged as the top target for capital.

Today’s issue is sponsored by Georgetown University—Earn an M.S. in Global Real Assets with one of 20 full-tuition scholarships available now.

This week on No Cap: From Caesars’ bankruptcy to controlling half the Las Vegas Strip, VICI Properties CEO Edward Pitoniak reveals how experiential real estate quietly outperformed the skeptics.

CRE Trivia 🧠

Roughly how much dry powder is sitting on the sidelines in North American private real estate heading into 2026?

(Answer at the bottom of the newsletter)

Market Snapshot

|

| ||||

|

|

Fundraising Trends

Private Real Estate Investment Sees First Growth Since 2021

After a multi-year slump, capital is flowing back into CRE, with data centers now leading the charge.

Fundraising rebound: Private real estate fundraising rose 29% in 2025 to $222B—the first annual gain since 2021, per PERE Credit. Brookfield and Blackstone drove 16% of the total, with Brookfield closing a $16B fund and Blackstone raising $19B across two vehicles.

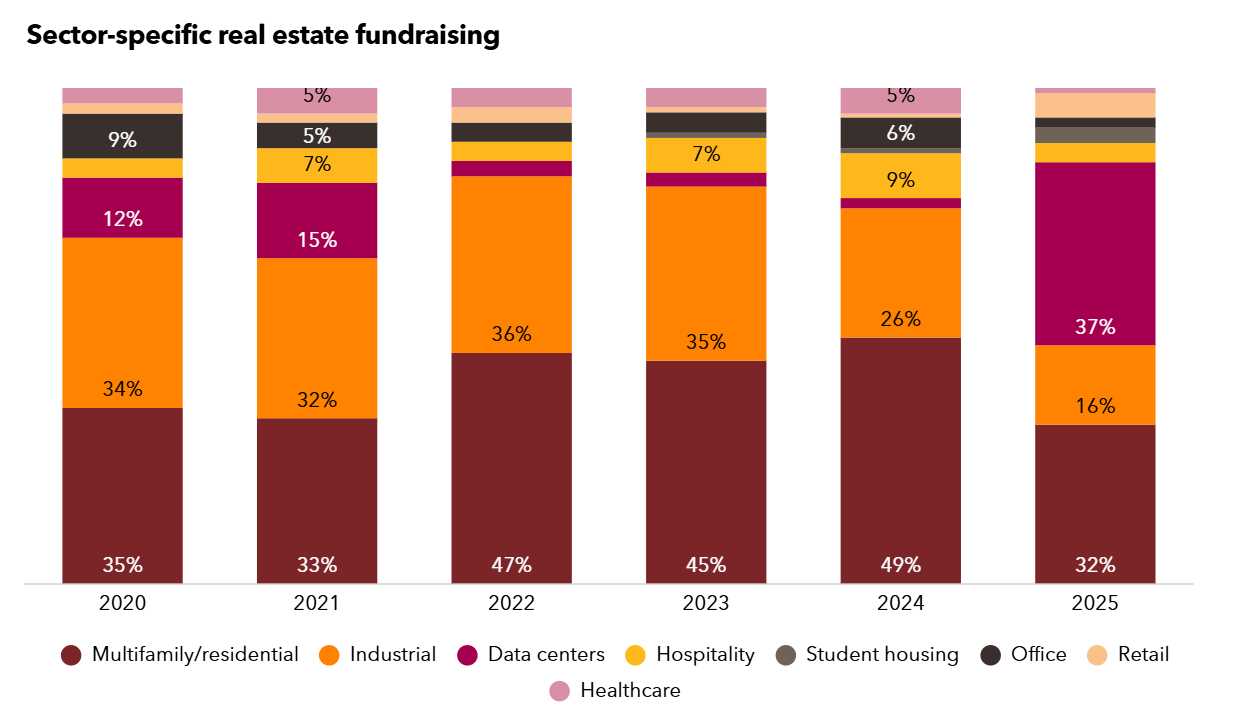

Data in the spotlight: Investor preferences shifted sharply in 2025, with data centers attracting 37% of all capital, up from just 2% in 2024. The surge was driven by large funds like Blue Owl’s $7B and Principal’s $3.6B vehicles, while sectors like multifamily and industrial saw notable declines.

Strategic shake-up: Opportunistic strategies gained momentum in 2025, capturing 33% of capital—up from 18% in 2024—as investors leaned into higher-risk, higher-return plays. Core-plus also grew, while value-add and debt strategies declined, signaling rising interest in asset repositioning and distress.

Slow but successful: Despite rising capital, fundraising remains slow, averaging 25 months to close in 2025, up from around 15 months in 2020–2021. Still, 52% of funds met or exceeded targets, a marked improvement over the previous two years.

Capital allocation trends: North America led capital deployment with $89.2B, followed by global strategies at $69.9B and Europe-focused investments at $40.6B. Heading into 2026, the largest fund in the market is Starwood’s $10B Distressed Opportunity Fund XIII, with Blue Owl and Strategic Value Partners each targeting $6.5B.

➥ THE TAKEAWAY

Capital in transition: The CRE fundraising rebound signals cautious optimism, but the real shift is strategic. Investors are taking longer to commit but are leaning into tech-heavy, opportunistic plays that reflect a changing market.

TOGETHER WITH GEORGETOWN UNIVERSITY

20 Full Scholarships Available for Real Assets Leaders

Georgetown University’s 10-month M.S. in Global Real Assets is offering 20 full-tuition scholarships.

Learn to invest across real estate, infrastructure, sustainability, and energy transition as you prepare to underwrite live deals, analyze global capital flows, and manage risk in a changing market. Plus, leverage connections and career support from our top-ranked business school, the Steers Center for Global Real Assets, and a specialized real estate search firm.

Go further with an M.S. in Global Real Assets.

*This is a paid advertisement. Please see the full disclosure at the bottom of the newsletter.

✍️ Editor’s Picks

Join our team: Help fuel CRE Daily’s next growth phase as our Outbound Sales AE selling across our full media ecosystem.

Prospect faster: DealGround converts your docuents and rent rolls into actionable intelligence and generates high-quality leads for you with verified names, emails, phone numbers, and source links – all built for broker-led prospecting. (sponsored)

CLO rebound: CRE CLO issuance rebounded in 2025 as transitional lenders tapped securitization again, restoring leverage for bridge borrowers after a muted prior year.

OZK exposure: Bank OZK is selling or writing down select troubled loans, signaling where construction and office stress is crystallizing for regional lenders.

Market moves: Reap Capital secures lender-driven sale of Class A multifamily in Dallas at ~25% below replacement cost. (sponsored)

CPACE surge: C-PACE lending hit record volume as owners used long-term, fixed-rate capital to finance retrofits and fill gaps left by cautious banks.

Deal freeze: A single Trump social media post halted a $70M transaction mid-closing, highlighting political volatility as a real execution risk for deals.

Stargate power: OpenAI agreed to fund new power infrastructure for Stargate data centers, reducing utility bottlenecks and accelerating large-scale AI campus development.

🏘️ MULTIFAMILY

Renter urgency: Renter urgency showed early signs of recovery as affordability stabilized and leasing activity improved in select metros.

Housing initiatives: New federal and local programs are accelerating approvals and subsidies, expanding development feasibility for housing projects facing cost and entitlement barriers.

Enrollment lift: RealPage reports student housing occupancy and rents rose into year-end, strengthening cash flows ahead of the 2026 leasing cycle.

Alexandria conversion: Stonebridge secured Amazon-backed financing to convert an Alexandria office property to affordable housing, unlocking a stalled project and advancing office-to-resi execution.

🏭 Industrial

Deal friction: Buyers and sellers remain misaligned on IOS valuations, as higher rates cap bids and slow transaction volume despite sustained tenant demand.

Core hubs: Core logistics hubs continue to dominate leasing as 3PLs consolidate networks, reinforcing rent resilience in infill markets.

Stonemont expansion: Stonemont expanded its national IOS portfolio through new acquisitions, signaling continued capital deployment despite pricing friction.

Link logistics: Link Logistics acquired additional Los Angeles industrial assets, deepening infill exposure where land constraints support long-term rent growth.

Storage innovation: Cubby raised $63M in Series A funding to scale self-storage technology investments, pointing to increased institutional focus on operational efficiency.

🏬 RETAIL

Retail strength: Houston retail occupancy hit its longest sustained high, supporting rent growth and reinforcing strip center stability amid limited new supply.

Market leader: Charlotte continues ranking above peer markets for retail performance, reflecting population growth and steady tenant demand.

Leadership change: Lidl’s US CEO stepped down as competition with Aldi intensifies, raising questions about expansion pace and store productivity.

Local impact: A Northern CA Taco Bell closure highlights how aging assets and redevelopment economics can displace long-tenured retail tenants.

🏢 OFFICE

Miami eviction: A Miami office tower is seeking to evict Banco Master after the Brazilian bank’s failure, underscoring tenant credit risk and vacancy exposure.

Control fight: Cohen Brothers lost its headquarters to foreclosure amid a dispute with Fortress, threatening operational shutdown and illustrating sponsor-lender power dynamics.

Debt access: Office investors secured more financing in 2025 as lenders selectively reopened credit, easing refinancing pressure but favoring stabilized assets.

Boston pricing: Boston office pricing fell sharply, reflecting distress-driven trades that reset values and pressured existing loan covenants.

🏨 HOSPITALITY

Earnings stabilize: Analysts expect hotel performance to improve modestly in 2026 following uneven recovery trends.

Brand expansion: Wyndham added Choctaw Casino Resorts to its upscale lifestyle portfolio, broadening its experiential offerings.

📈 CHART OF THE DAY

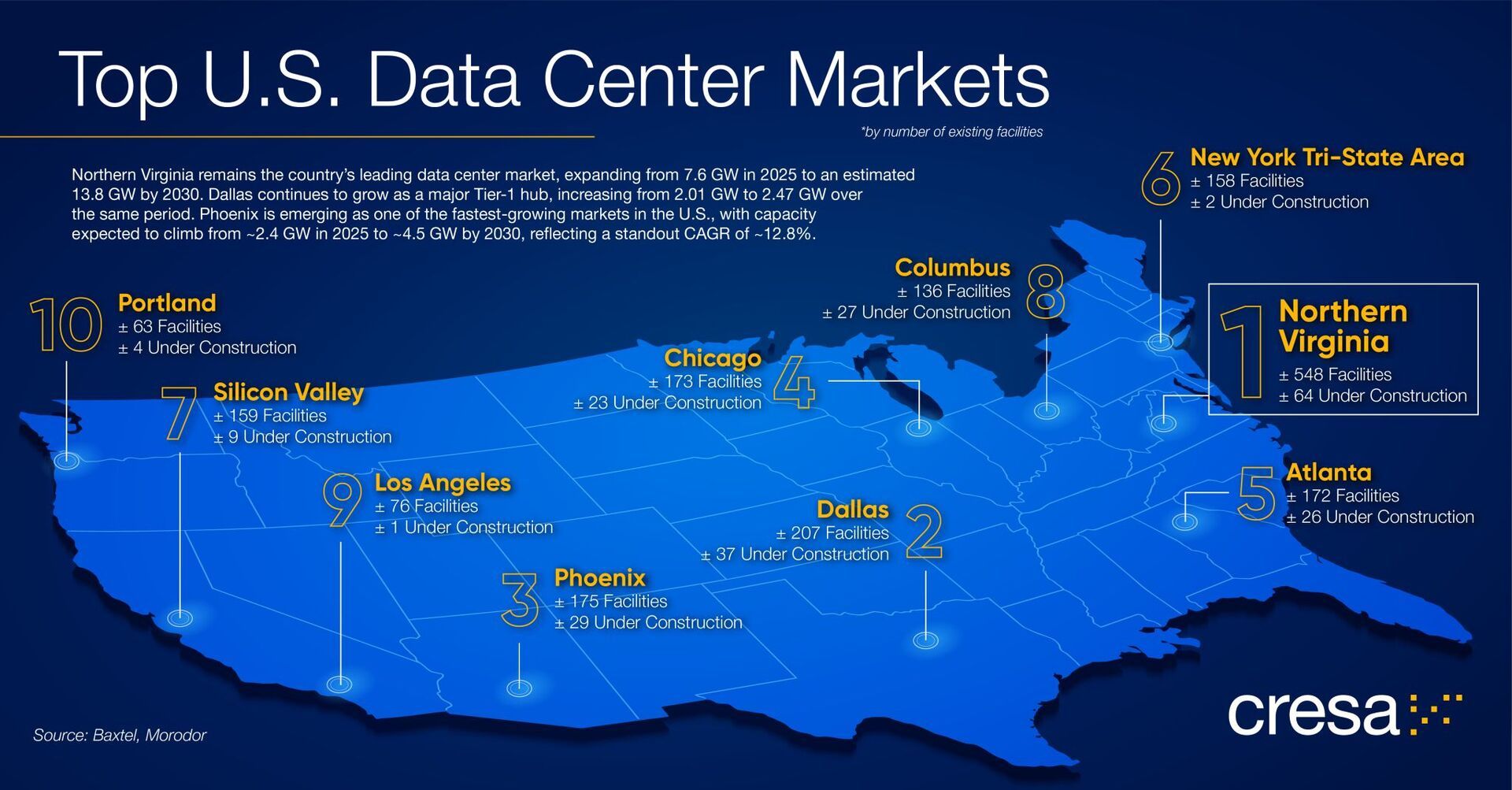

The U.S. data center market is concentrating in power-rich hubs like Northern Virginia, while markets such as Phoenix, Dallas, and Atlanta grow amid rising AI demand and infrastructure investment.

CRE Trivia (Answer)🧠

About $250 billion, positioning 2026 as a potential year of large-scale capital deployment.

More from CRE Daily

📬 Newsletters: Stay ahead of the market with local insights from CRE Daily Texas and CRE Daily New York.

🎙️Podcast: No Cap by CRE Daily delivers an unfiltered look at the biggest trends—and the money game behind them.

🗓️ CRE Events Calendar: The largest searchable calendar of commercial real estate events—filter by city or sector.

📊 Market Reports: A centralized hub for brokerage research and market intelligence, all in one place.

📈 Fear & Greed Index: A fully interactive sentiment tracker on the pulse of CRE built in partnership with John Burns Research & Consulting.

You currently have 0 referrals, only 1 away from receiving Multifamily Stress Test Model.

What did you think of today's newsletter? |

Reply