- CRE Daily

- Posts

- Private Real Estate May Have Finally Found Its Floor

Private Real Estate May Have Finally Found Its Floor

From lender confidence to transaction momentum, the data suggests the market bottom is behind us.

Good morning. Private real estate may have found its floor. After four straight quarters of gains, easier lending, and a pickup in deal flow, the sector is showing its strongest recovery signals since the 2022 downturn.

Today’s issue is brought to you by 1031 Crowdfunding—helping investors access institutional-quality real estate through tax-advantaged vehicles.

🎙️This week on No Cap: Brookfield’s Ben Brown reveals how he navigated the GFC, led $10B+ takeovers like GGP and Forest City, and where he’s betting big today.

Market Snapshot

|

| ||||

|

|

Recovery Mode

Private Real Estate May Have Finally Found Its Floor

After two years of volatility, private real estate is flashing signs of recovery, with returns, lending conditions, and transaction activity all moving in the right direction.

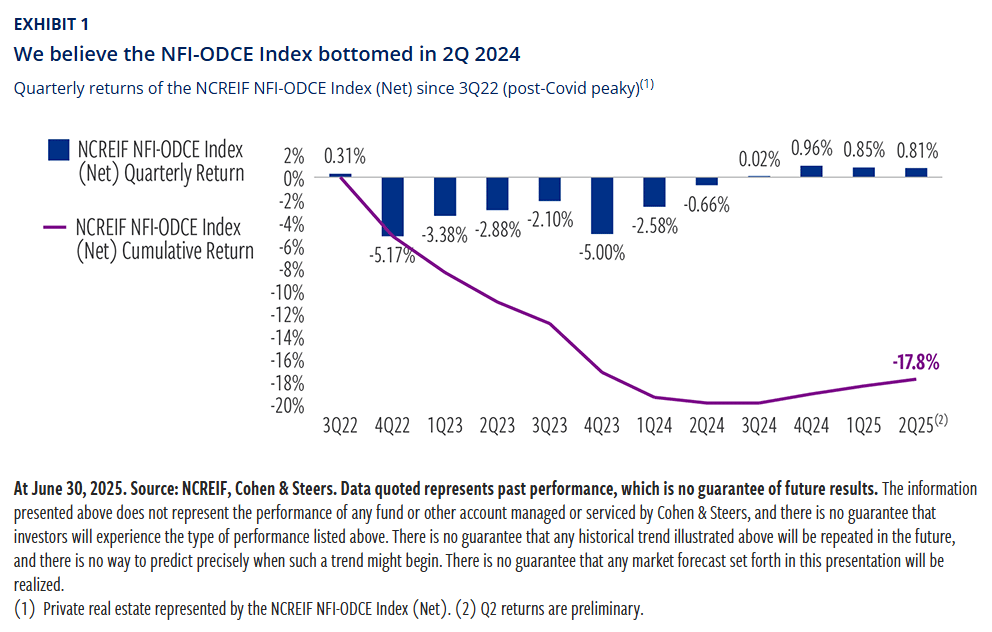

Returns back in the black: Private real estate returns, as measured by the NCREIF ODCE Index, have now been positive for four consecutive quarters—marking the clearest rebound since the post-COVID downturn. Cohen & Steers points to Q2 2024 as the likely bottom, noting this level of consistency historically marks the start of sustained recoveries.

Credit is loosening: Commercial real estate lending standards are loosening. According to the Senior Loan Officer Opinion Survey, only 9% of net respondents reported tighter standards in mid-2025. While lenders still demand discipline—like more equity and pre-leasing on new builds—they’re increasingly comfortable financing acquisitions. Slower construction starts are reinforcing the case for existing assets.

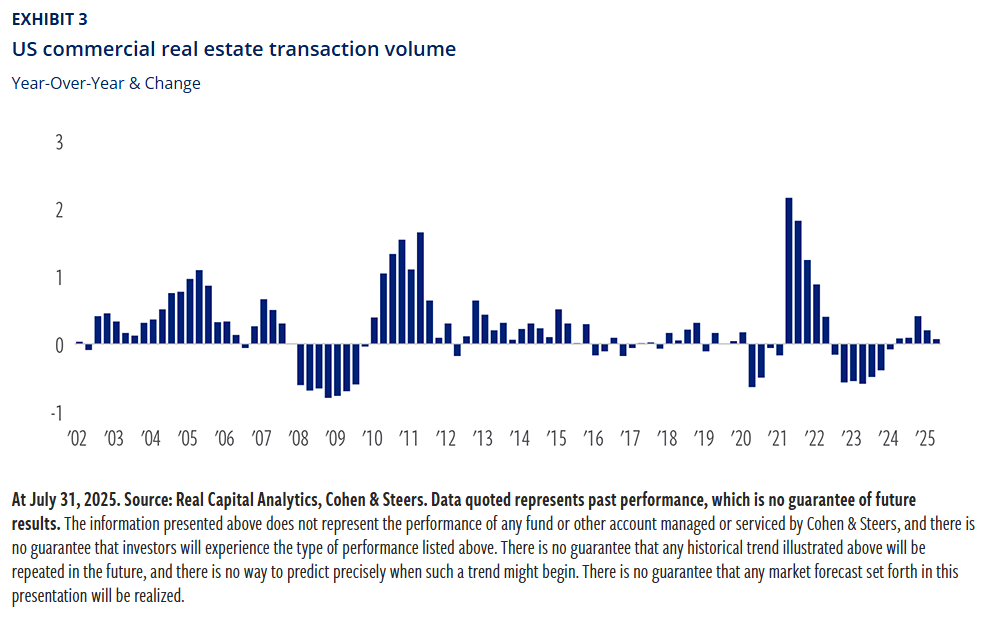

Transactions picking up: CRE transaction volume has now grown year-over-year for five straight quarters. That’s the longest stretch of sustained growth since the market began cooling in 2022. Institutional investors—many of whom had been sitting on the sidelines—are stepping back in as rate clarity improves and valuations recalibrate.

➥ THE TAKEAWAY

Big picture: The private real estate cycle appears to have turned the corner. With steady returns, friendlier lending, and rising transactions, conditions are lining up for investors who have been waiting for the bottom to deploy capital.

TOGETHER WITH 1031 CROWDFUNDING

1031CF Bridge Fund III Available Now!

1031CF Bridge Fund III is a senior secured promissory note paying 15% annual non-compounding interest.

How It Works:

7% interest paid monthly in arrears, 8% accrued and payable at maturity on April 30, 2030.

Backed by real estate assets, with strategies that target value-add or undercapitalized senior housing facilities.

Minimum investment: $25,000

With over $3.4 billion in real estate transactions and $550 million in senior housing investments, the Fund’s manager, 1031 Crowdfunding, has industry-leading expertise in the healthcare real estate space.

Register for a free investor account to gain access to our extensive marketplace of tax-advantaged investments.

*It’s important to note that all investments come with risk. An investment in 1031CF Bridge Fund III is speculative and involves significant risks. To request a private placement memorandum which contains more information, including a further discussion of the risks, please register for an account at 1031Crowdfunding.com or call us at (844) 533-1031. This is a paid advertisement. Please see the full disclosure at the bottom of the newsletter.

✍️ Editor’s Picks

BTR Investing: The BTR market has seen rapid growth, driven by rising housing costs, shifting renter preferences, and a national housing shortage (sponsored)

Private edge: Private non-traded REITs pulled in 45% more capital than their publicly registered counterparts in the first half of 2025.

Deal flow: New York’s Tri-State CRE sales hit $8.8B in Q2, led by a 50% jump in retail, while industrial and office also posted strong gains.

Trophy towers: Investors have poured $3B into refinancing NY office towers as trophy assets tighten vacancies and corporate return-to-office policies boost demand.

Unkept promises: Two decades after Katrina, New Orleans relies on tourism while broader CRE and economic growth remain stalled.

Spiritual development: Churches are bucking attendance declines with new construction that adds community-friendly amenities.

Practical living: Luxury amenities are losing appeal as students opt for cheaper rentals with practical spaces, pushing rent growth down.

🏘️ MULTIFAMILY

Capital moves: Apartment sales rose 1% YoY to $10.6B in July as multifamily prices inched up and major portfolio trades drove activity.

Rent freeze: NYC mayoral candidate Zohran Mamdani’s pledge to freeze rents on stabilized apartments is alarming small landlords, who warn the policy could force them to sell.

Affordable boost: Thrive Living secured a $65M J.P. Morgan loan to build a 290-unit modular affordable housing project in East Hollywood.

Coastal deal: A Pasadena investor bought Marina del Rey’s 198-unit Villa del Mar for $62M, aiming to boost income through slips, parking, and amenities.

Zoning barrier: Over half of Colorado’s residential land blocks multifamily housing, tightening affordable supply.

🏭 Industrial

Tenant demand: Industrial move-ins hit 177M SF in early 2025, led by 3PLs and manufacturers, though net absorption stayed weak.

Investment engine: CoreWeave secured $4B from Blue Owl and partners to build a $6B Lancaster, PA data center campus backed by the White House and Nvidia.

Import impact: Higher U.S. tariffs are squeezing seaport industrial markets and raising costs for everyday goods.

Loan secured: Woodglen Investments secured a $23M loan from Catal Group to build a 788-unit self-storage project near Downtown West Palm Beach.

Data financing: Aligned Data Centers secured over $1B from Blackstone to fund expansion.

🏬 RETAIL

Immersive retail: Netflix is opening its first immersive entertainment-and-retail venues, “Netflix House,” this fall in Philadelphia and Dallas.

Import duties: President Trump said furniture imports will face new tariffs within 50 days, adding fresh strain to retailers already hit by broader trade levies.

Rapid expansion: Aldi is converting Winn-Dixie stores and opening new locations at record pace, aiming to add 200+ stores in 2025.

🏢 OFFICE

Bank bid: Dallas is offering Scotiabank $2.7M in incentives to establish a 100K SF U.S. hub that could bring 1,000+ high-paying jobs.

Landmark lease: Siemens Energy signed a 243K SF lease at Lake Nona Town Center in Orlando, marking the city’s largest office deal in a decade.

Space search: The federal government is seeking a new 240K–280K SF office for the National Science Foundation in Alexandria, slashing its footprint by more than half.

Eagle eyes: American Eagle Outfitters is growing its headquarters at 63 Madison Avenue in Manhattan, adding 54K SF to bring its total footprint to 392K SF.

🏨 HOSPITALITY

Casino prospects: Wynn Resorts and Boyd Gaming signaled interest in building multibillion-dollar casinos in Georgia if lawmakers move to legalize gambling.

Asset sale: Ashford Hospitality Trust sold two hotels—Hilton Houston NASA Clear Lake for $27M and Residence Inn Evansville East for $6M—to cut debt and boost cash flow.

A MESSAGE FROM BEQUEST ASSET MANAGEMENT

Earn 10-12% Annual Preferred Returns Backed by Real Estate & Energy – Without the Volatility

The Bequest Legacy Fund combines real estate and energy for predictable growth. Offering 10-12% annual returns, monthly distributions, or compounding options. Backed by a diversified portfolio of U.S. performing mortgage notes, commercial real estate, and energy assets, it provides stability and cash flow.

Open to both accredited and non-accredited investors. Five-year track record with zero missed payments.

What Makes Bequest Different?

Fiduciary-backed, with full transparency

Steady cash flow from every investment

Proprietary controls for sourcing & asset management

Focus on assets that benefit communities and the future

State-licensed Registered Investment Advisor

*This is a paid advertisement. Please see the full disclosure at the bottom of the newsletter.

📈 CHART OF THE DAY

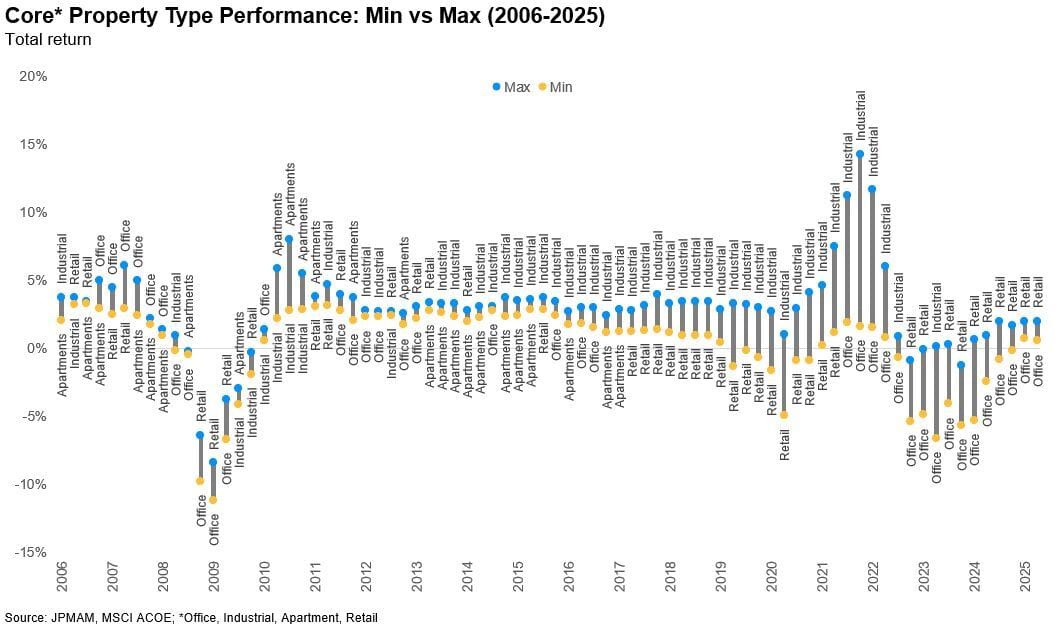

Post-COVID real estate performance was largely dictated by being overweight industrial, but looking ahead, retail has surprisingly emerged as the top performer. The next cycle is likely to reward asset selection as much as sector exposure.

You currently have 0 referrals, only 1 away from receiving Multifamily Stress Test Model.

What did you think of today's newsletter? |

Reply