- CRE Daily

- Posts

- Prologis Bets Big on Build-to-Suit Warehouses Amid Shifting Market Dynamics

Prologis Bets Big on Build-to-Suit Warehouses Amid Shifting Market Dynamics

Leasing may be cooling, but pre-leased builds are gaining serious momentum.

Good morning. While warehouse vacancies creep up nationwide, Prologis is leaning into what’s working: build-to-suit projects. The logistics giant is ramping up custom development as major tenants lock in future space.

Today’s issue is brought to you by Bullpen—your connection to the top commercial real estate talent.

🎙️This week on No Cap Podcast, RockStep Capital CEO Andy Weiner breaks down why the retail apocalypse was overblown and how his team is turning forgotten malls into durable cash flow machines.

Market Snapshot

|

| ||||

|

|

Tailored Demand

Prologis Bets Big on Build-to-Suit Warehouses Amid Shifting Market Dynamics

As general leasing slows, Prologis is shifting gears with a surge in tenant-specific warehouse construction, betting big on tailored demand.

Development jumps: In Q2, Prologis launched over $900M in new warehouse projects, nearly tripling last year’s figure of $324M for the same period. The surge reflects a clear trend: 65% of those new projects were pre-leased, a sharp contrast to the slow demand for speculative builds.

Build-to-suit demand: CEO Hamid Moghadam highlighted a critical shift on the company’s earnings call, calling recent build-to-suit demand “the strongest it’s been in my career.” Sectors fueling this growth include retail, consumer packaged goods, and auto parts, all hedging on the space they’ll need when construction wraps up.

Macro pressure, micro strategy: Even with consumer demand and trade policy uncertainties, Prologis believes companies can’t delay expansion much longer. “There’s more water building up behind the dam,” Moghadam said, as firms grow increasingly unable to defer long-term real estate commitments.

Broader market still hot: The optimism isn’t universal. Nationwide warehouse vacancy rates rose to 7.1%, up from 6.1% a year ago, the highest since 2014, per Cushman & Wakefield. Spec warehouse builds remain under pressure, with companies choosing to renew existing leases rather than commit to uncustomized space.

Financials show mixed signals: Despite softer earnings ($571.2M vs. $861.3M YoY), Prologis beat revenue and FFO expectations, logging $2.18B in revenue and $1.46 in core FFO/share. The firm raised full-year FFO guidance slightly to $5.75–$5.80 per share, showing cautious optimism.

➥ THE TAKEAWAY

Tailor-made wins the day: In a cooling industrial market, Prologis is finding strength not by betting on broad demand, but by building to spec for tenants who already know what they need.

TOGETHER WITH BULLPEN

Your team deserves the best!

You need top performers at every level of your organization, which means competing with Blackstone, Vornado, and other top companies for the best people.

You don’t have to do it alone. With more than 800 placements under our belt, Bullpen is your CRE recruiting partner.

Whether you’re hiring an Asset Manager in Manhattan or a Head of Acquisitions in the Bay Area, our industry expertise, eye for top performers, and ability to embed with your team set us apart.

*This is a paid advertisement. Please see the full disclosure at the bottom of the newsletter.

✍️ Editor’s Picks

Capture retail capital: Tap into the $7 trillion retail investor market with strategies designed to scale your operations and meet growing capital demand. (sponsored)

Portfolio expansion : Starwood is making a $2.2B bet on net lease real estate with a major acquisition from Brookfield.

Private access: The Trump administration is preparing an executive order to allow 401(k) plans to invest in private equity.

Price paralysis: The Fed’s latest Beige Book shows a national real estate market stalled by economic uncertainty, with hesitant buyers, falling construction, and widespread price sensitivity.

Hidden pressure: CRE’s apparent stability may be disguising deeper risks, as delayed economic responses and tariff impacts threaten sudden market disruptions.

Design dip: US architecture billings ticked up in May but stayed in contraction territory, signaling ongoing weakness in nonresidential construction.

Credit cuts: Trump’s newly signed energy law accelerates the rollback of several key clean-energy tax credits, undoing much of the 2022 Inflation Reduction Act’s climate incentives.

Fund shortfall: AEW Capital closed its largest real estate fund ever at $1.8B, falling short of its $2B target but surpassing its previous fund.

Immigration impact: Prologis CEO Hamid Moghadam warns that US immigration policy is worsening labor shortages, pushing construction costs higher.

🏘️ MULTIFAMILY

Disclosure debate: States and cities are requiring landlords to disclose all rental fees upfront, prompting pushback from some multifamily operators.

Power struggle: A $700M refinancing deal at Nitya Capital has reignited a bitter feud between co-founders Vivek Shah and Swapnil Agarwal.

Tenant scrutiny: Federal immigration officials are pressuring landlords to share tenant records as part of a broader deportation push.

Building momentum: Multifamily construction delays are falling, and labor is becoming more available, signaling improved project flow.

🏭 Industrial

Storage stabilizing: Self-storage is finding its footing midyear, with Midwest markets showing resilience despite national economic uncertainty and shifting supply-demand dynamics.

Steady growth: Industrial real estate continues to outperform, with small-bay deals thriving and demand projected to rise.

Suburban play: Hines acquired a 404K SF distribution center in Bolingbrook, IL for $29.5M, as industrial deal flow holds steady in Chicago’s suburbs.

🏬 RETAIL

Strong sales: US retail sales jumped 0.6% in June—outpacing forecasts—as consumers showed unexpected strength despite tariff concerns and rising import costs.

Brand backlash: Target’s in-store traffic has declined for five straight months following its rollback of DEI efforts, while its reputation and consumer trust also slipped.

Mall revival: Suburban malls across the Tri-State area are undergoing major redevelopments, swapping anchor stores for apartments, hotels, and open-air social spaces.

🏢 OFFICE

Google effect: Google’s transformation of Chicago’s iconic Thompson Center into a state-of-the-art office hub is injecting new energy into the struggling Loop.

Scandal to sale: After years of controversy and collapse, Atlanta Financial Center has finally changed hands.

Recovery signs: Chicago’s office market is showing signs of life with $759M in YTD investment volume and major leases signed.

Demand dip: Office demand dropped sharply in April, with VTS reporting a 23% decline in new tenant activity, mirroring 2023’s banking crisis slump.

🏨 HOSPITALITY

Zoning clash: Southold’s sweeping zoning overhaul faces strong pushback from business owners, who argue that new restrictions would hinder commercial growth and render hotel development nearly impossible.

Sky-high sands: Las Vegas Sands has begun construction on an $8B luxury resort in Singapore featuring a 55-story hotel, rooftop Skyloop, arena, and high-end retail.

A MESSAGE FROM AGRIPPA

Tailored CRE Deal Flow for Top-Tier Investors.

Institutional investors, family offices, and HNW individuals use Agrippa to access vetted CRE opportunities spanning all asset classes nationwide.

🏢 Proven Performance: Agrippa recently powered a $45M ground-lease transaction. Real results.

🤖 AI-Curated Deal Flow: Preferences and activity determine deal flow. No spam.

🧠 Smart Feedback, Smarter Decisions: Dynamic scoring highlights the best opportunities first. No guesswork.

💬 Direct Communication: Engage one-on-one. No intermediaries.

⌛ Join Agrippa: Find your next strategic partnership—at no cost.

*This is a paid advertisement. Please see the full disclosure at the bottom of the newsletter.

📈 CHART OF THE DAY

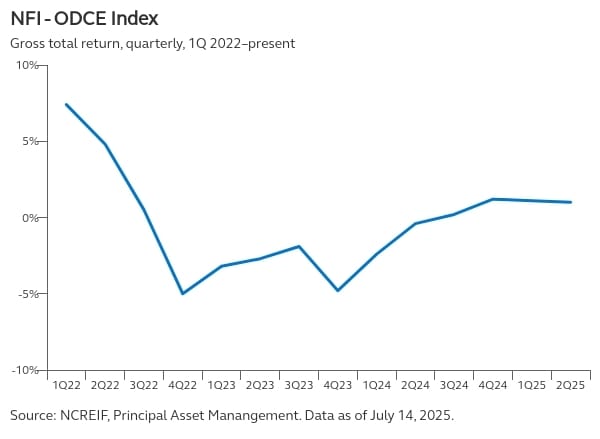

CRE total returns rose for the fourth straight quarter, with the NCREIF ODCE Index posting a +1.03% gain in Q2, driven largely by income returns (+1.01%) and minimal capital appreciation (+0.02%).

You currently have 0 referrals, only 1 away from receiving Multifamily Stress Test Model.

What did you think of today's newsletter? |

Reply