- CRE Daily

- Posts

- Q3 Marks Inflection Point for Logistics Real Estate Market

Q3 Marks Inflection Point for Logistics Real Estate Market

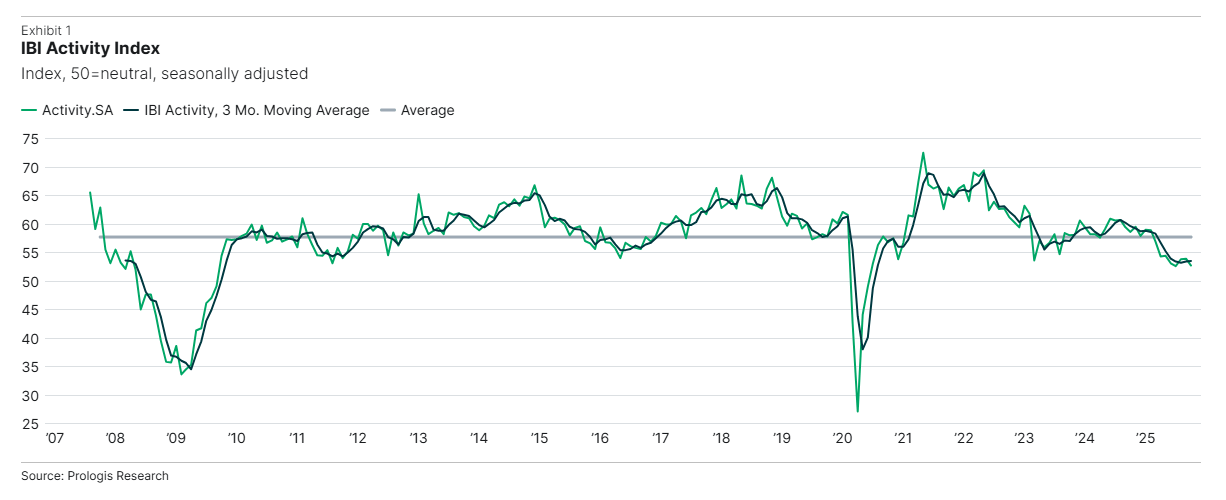

IBI Index cooled to 53 in Q3, with recovery led by large and e-commerce players amid ongoing trade volatility.

Good morning. After a slow start to the year, warehouse demand is picking up speed. Q3 brought stronger leasing, rising utilization, and early signs that logistics real estate is turning the corner.

Today’s issue is brought to you by InvestNext—find & attract LPs who actually commit.

🎙️This Week on No Cap: Seth Weissman of Urban Standard Capital talks Wall Street roots, building a private-credit powerhouse, and why committed capital and lasting relationships set USC apart.

Market Snapshot

|

| ||||

|

|

Logistics Lift

Q3 Marks Inflection Point for Logistics Real Estate Market

After months of uncertainty, the logistics property market is showing early signs of recovery, and strategic demand is making a quiet comeback.

Turning point: Prologis’ Q3 2025 IBI report signals a clear shift: net absorption hit 47 MSF—a 64% jump QoQ—as lease signings and build-to-suit activity returned to healthier levels. While still below long-term norms, the market is moving off the bottom, with high proposal volumes pointing to continued momentum into 2026.

Cautious inventory tactics: Utilization averaged 84% in Q3 and approached 85% in October as customers leaned into “just enough” inventory strategies. This leaves room for upside if demand picks up. Manufacturers and wholesalers led after front-loading freight, while retailers lagged—but that could shift ahead of the holidays.

Confidence creeps back: Major occupiers—particularly in e-commerce, food & beverage, and healthcare—are resuming long-term leases and refocusing on network optimization. Leasing rose 10% in Q2 and Q3 vs. early 2025, signaling a shift in sentiment. Discretionary sectors remain on hold, awaiting more economic clarity.

Vacancy holds steady: Vacancy remains around the mid-7% range—balanced but not overbuilt. Spec development is well below pre-pandemic norms due to tighter margins, zoning hurdles, and limited land. With replacement-cost rents 20% above market, new projects are tough to pencil—especially in high-cost areas.

Space gets specific: With space tightening in key markets and size ranges, built-to-suit projects are on the rise, reflecting a shift back to long-term planning and growing scarcity. Tenants are locking in leases ahead of rising costs, as Q3 rent declines eased to around -1% and signs point to a market trough.

➥ THE TAKEAWAY

Preparing for 2026: Logistics real estate demand has shifted from pause to planning. With fewer spec projects and rising tenant confidence, scarcity is emerging, setting the stage for a tighter leasing market in 2026.

TOGETHER WITH INVESTNEXT

Investor Acquisition: Find & Attract LPs Who Actually Commit

What separates investors who commit from those who waste your time?

How do you identify prospects who will invest capital to your specific asset class, deal structure, and investment timeline?

Our expert panel shares real-world examples of successful investor acquisition strategies that have helped firms scale from 20 to 200+ qualified investors in Connect, Commit, Close: The Modern Investor Acquisition Playbook.

*This is a paid advertisement. Please see the full disclosure at the bottom of the newsletter.

✍️ Editor’s Picks

Invest smarter for retirement: Passive real estate investing can help retirees earn steady income, defer taxes, and hedge inflation through hands-off vehicles like DSTs and REITs—building wealth without active management. (Sponsored)

Lending rebound: Commercial and multifamily mortgage originations surged 36% YoY in Q3, marking the fifth straight quarter of growth.

Extension game: A looming $180B wall of maturing CRE debt hasn't triggered the expected distress cycle, as lenders broadly opt to extend loans rather than force refinancing or sales.

Distress drift: CRE distress rose to 11.4% in October, nearing a cycle high as matured loans struggle, with office, hotel, and multifamily sectors under pressure.

Cut clash: The Fed faces a sharply divided vote at its December meeting, as softening jobs data and lingering inflation complicate the case for a final 2025 rate cut.

On the hunt: Cerberus Capital Management is raising $3B for a new opportunistic real estate fund targeting data centers, multifamily, and distressed credit.

Stalled momentum: The U.S. services sector expanded in October, but ongoing job market weakness and economic uncertainty are dampening business confidence and clouding outlooks.

Houston heat: Houston’s 55,000 acres of vacant buildings and paved lots are worsening urban heat, prompting city leaders and developers to push for greener infrastructure, tree planting, and heat-reducing design.

Hot spot: Springfield, MA, held its spot as the hottest U.S. housing market in October, as strong demand and limited supply drove rapid sales.

Fuel vs. fortune: A $2B condo project on Fisher Island is clashing with Miami-Dade officials over the planned removal of a key fuel depot vital to PortMiami.

🏘️ MULTIFAMILY

Autumn slump: Multifamily rents in the U.S. saw their sharpest October decline in over 15 years, as elevated supply continues to outpace demand.

Tempered optimism: Multifamily developer confidence rose slightly in Q3, with gains in low-rise and subsidized segments, but overall sentiment remains negative.

Senior setback: Blackstone is unloading a $1.8B senior housing portfolio at a loss after operational challenges, pandemic fallout, and rising costs derailed its investment strategy.

Stable shift: Multifamily demand remains strong as new construction hits decade lows, pushing vacancies down and signaling a shift toward stable, supply-constrained growth.

Reston record: BXP is reportedly selling its Signature apartment towers at Reston Town Center for around $240M, a record-breaking multifamily deal for the area.

Refi of the day: Arden Living secured a $161M refinance loan from Starwood Property Trust for its 222-unit Forty Six Fifty multifamily project in Manhattan’s Inwood.

Market split: U.S. multifamily investment rose 7.5% to $108B through Q3 2025, but CBRE data reveals sharp local divergences.

🏭 Industrial

Industrial focus: Peakstone Realty Trust is selling off its office portfolio, aiming to shed $300M–$350M in assets, to fully transform into a pure-play industrial REIT.

Data doubts: Deutsche Bank is reportedly exploring hedging strategies to manage its growing exposure to AI-fueled data center debt.

Storage slowdown: Self-storage REITs are facing softening fundamentals in 2025, with NOI growth stagnating and returns lagging.

NoVa surge: Vantage Data Centers has broken ground on a $2B, 192MW data center campus in Stafford County, VA., marking its fourth and largest expansion in the state.

Houston infill: Hanover and Pearlmark have broken ground on Ella 45, a $17.3M, 254,000 SF light industrial project in North Houston.

🏬 RETAIL

Consumer strain: Major fast-food chains like McDonald’s, Wendy’s, and CAVA are seeing weaker traffic from younger and lower-income diners.

Waco revamp: Waco is planning a $1.4B, 12-year downtown overhaul with new parks, civic buildings, a convention center, hotel, town center, and ballpark.

Store closures: Saks Off 5th will close 10 U.S. stores, including locations in NYC, Chicago, and Austin, as part of a strategy to focus on higher-performing locations.

Leasing surge: Retail REIT Macerich saw an 81% YoY jump in Q3 leasing activity, totaling 1.5M SF, with 2025 YTD leases up 86%.

🏢 OFFICE

Boom time: Hudson Pacific plans strategic office sales amid a West Coast leasing rebound, as AI demand and rising valuations signal the market has turned a corner.

PENN power: Robinhood signed October’s largest Manhattan office lease at PENN 2, highlighting strong tenant demand following the tower’s major redevelopment.

Madison meltdown: Vornado is set to lose 650 Madison Avenue after defaulting on its mortgage, as lenders prepare to seize and sell the once-prized Plaza District tower.

Biotech bust: Arena BioWorks, a $500M-backed Cambridge biotech hub, abruptly shut down due to policy uncertainty and weak funding.

HQ dispute: Maryland is suing the Trump administration for canceling the FBI’s planned move to Greenbelt, claiming the reversal is unlawful and harms promised local economic gains.

🏨 HOSPITALITY

Middle squeeze: Hotel operators are struggling with flat RevPAR, weak government and international travel, and mounting debt maturities, pressuring midtier brands hardest.

Casino buyout: Vici Properties is acquiring seven Nevada casinos from Golden Entertainment for $1.2B in a sale-leaseback deal.

AEG revival: AEG is making its third attempt to develop a Downtown L.A. lot across from L.A. Live, filing plans for a 49-story mixed-use tower with 365 residential units, a 334-key hotel, and entertainment space.

Shutdown strain: Pebblebrook remains optimistic for 2026, but short-term hotel performance is hindered by the government shutdown and weak travel demand.

A MESSAGE FROM ARBOR REALTY TRUST

Top Markets for Multifamily Investment Report Fall 2025

As headwinds fade and transaction volume climbs, Arbor Realty Trust & Chandan Economics deliver actionable insights into the most opportunity-rich U.S. multifamily markets.

Our biannual report is your roadmap to the top locations for capital deployment.

*This is a paid advertisement. Please see the full disclosure at the bottom of the newsletter.

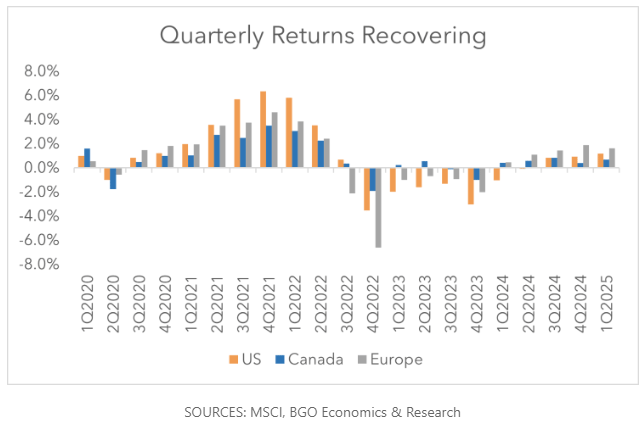

📈 CHART OF THE DAY

Cap rates are expected to compress globally across various scenarios, supporting a medium-term CRE rebound as central banks ease and interest rate cycles shift.

You currently have 0 referrals, only 1 away from receiving Multifamily Stress Test Model.

What did you think of today's newsletter? |

Reply