- CRE Daily

- Posts

- Rising Office Costs Push Buildout Burden From Tenants to Owners

Rising Office Costs Push Buildout Burden From Tenants to Owners

Buildout costs are up 68% since pre-pandemic, and landlords are footing the bill to stay competitive.

Good morning. The office market’s power shift has redefined deal terms. Buildouts that once fell to tenants are now an owner’s responsibility, reshaping economics across NYC leasing.

Today’s issue is brought to you by Colony Hills Capital—invest as a GP alongside a $1B+ sponsor.

Market Snapshot

|

| ||||

|

|

Tenant Leverage

Rising Costs Push Buildout Burden From Tenants to Owners

In today’s tenant-friendly office market, New York landlords are taking on more of the financial and logistical burden of buildouts to close deals.

Responsibility shift: Pre-pandemic, tenants often received an allowance and managed their own buildouts. But hybrid work, excess supply, and rising competition have flipped the dynamic. Now, landlords not only fund but also oversee construction, eliminating risk and hassle for tenants.

The cost curve: Buildout costs in NYC spiked 14% between 2022 and 2023, from $187 to $213 per SF, before holding steady around $212 in 2025. Still, TI allowances sit nearly 70% higher than pre-pandemic averages, compressing effective rents.

The interest rate factor: When borrowing was cheap, landlords were more willing to front buildout costs, recouping them through higher rents. But as capital grew expensive, enthusiasm waned. Tenants now hold the upper hand, pushing costs back onto owners.

Size matters: The biggest cost surges are hitting Class A assets and larger transactions (50,000 SF+), particularly in gateway markets. Class B and smaller suites—where most deal activity now happens—see less inflation but still rely heavily on landlord-managed improvements.

Beyond the lease: Some owners view buildouts not just as tenant appeasement but as long-term investments in repositioning buildings. Improvements that outlast shorter leases may help attract renewals or new tenants, especially as design and amenities become brand statements for occupiers.

➥ THE TAKEAWAY

Designing for tomorrow: Landlords may be footing bigger buildout bills, but the winners will be those who invest strategically—designing spaces that not only land today’s tenants but also future-proof buildings in a still-uncertain office market.

TOGETHER WITH COLONY HILLS CAPITAL

Invest as a GP Alongside a $1B+ Sponsor

Colony Hills Capital has closed 37 deals since 2008, totaling $1.3B+ in transactions and delivering 20%+ levered IRRs across 13K+ garden-style units.

Their latest offering: Encore at Murrells Inlet — a Class A, newly built townhome community in coastal South Carolina with 92% occupancy, $100+ lease premiums, no major capex, and an assumable 6.21% Fannie Mae loan.

Qualified investors can now invest as a GP in this stabilized, cash-flowing opportunity.

Target returns over a 5-year hold:

5.6% cash yield

17.75% IRR

2.13x equity multiple

This deal delivers strong current income and long-term upside, without lease-up or renovation risk.

This is a paid advertisement. CRE Daily is not a registered broker-dealer or investment adviser. This content is provided for informational purposes only and does not constitute an offer or solicitation to buy or sell any securities. All investments carry risk, including potential loss of principal. Please conduct your own due diligence or consult with a licensed financial professional before making any investment decisions.

✍️ Editor’s Picks

Skip construction development risk: Hearthfire Holdings secured a 927-unit self-storage property at lease-up. EXR is managing. Class A returns 2.7X EM, 23% IRR, until 9/15/25. (sponsored)

Smart CRE stack: These five AI tools are leading the charge in transforming how CRE professionals work, analyze, and close deals.

Mega mergers: Apollo and BlackRock officially closed major acquisitions, adding a combined $57B in real estate assets.

Rural cutbacks: Trump’s budget proposal eliminates the HOME grant program, threatening affordable housing efforts in rural America, where it has funded over half a million homes.

Steady gains: Despite political backlash, women and people of color continue to make progress in CRE leadership, marking five years of advancement.

Permit progress: Recent CEQA reforms are speeding up some California projects, but high costs, interest rates, and market uncertainty still keep many developments stalled.

Default drama: Houston-based Silver Star Properties REIT is battling loan defaults, foreclosure threats, and a heated proxy fight as its founder pushes liquidation.

Distress delay: CRE loan delinquencies are climbing, but actual distressed sales remain rare as lenders show leniency and investors hold out for opportunities.

🏘️ MULTIFAMILY

Family factor: About one in five multifamily households has school-age kids, highest in California metros and lowest in affordable markets like Wichita.

Growth leaders: Markets like Chicago, Omaha, and Lexington are leading US multifamily growth in 2025 with strong rent gains and near-record occupancy

Summer standstill: National multifamily rents held flat in August 2025 as supply and demand stayed balanced, while policymakers ramp up long-term housing initiatives.

Fee transparency: Growing tenant frustration and state crackdowns are pressuring apartment owners to disclose add-on charges more clearly, reshaping how rents are advertised.

🏭 Industrial

Power play: J.P. Morgan Asset Management is investing in industrial sites with the electrical capacity to power advanced manufacturing.

Steady deals: Despite lending headwinds, industrial property sales volume and pricing have remained stable.

Labor slowdown: Midwest warehouse and transportation job growth has eased, but employment remains up 19% over five years.

🏬 RETAIL

Lease lift: With interest rates steady, cash buyers are driving selective net lease deals, favoring QSRs, medical tenants, and mission-critical assets.

Flagship move: Victoria’s Secret has opened a 7,500 SF flagship on Miami’s Lincoln Road under a 12-year lease, marking a major boost for the corridor’s retail revival.

Food fight: Kroger is investing $160M in four new DFW stores to challenge H-E-B’s rapid expansion, fueling a high-stakes supermarket turf war.

Retail reload: Bond Street REIT secured $300M from Conversant Capital to scale its acquisition of Class A convenience retail centers in the Southeast and Midwest.

🏢 OFFICE

Biotech build: Amgen is investing $600M in a new research hub at its Thousand Oaks HQ, part of a broader US life sciences expansion.

Madison move: SL Green is buying the former Brooks Brothers site on Madison Avenue for $160M, with plans for an 800K SF office tower near Grand Central.

Discount deal: Norges Bank and Beacon Capital are acquiring Midtown’s 1177 Sixth Ave. for $571M, about half its 2007 value.

Leasing leaders: Amazon and Piper Sandler signed NYC’s biggest August office leases in Midtown West, while Cushman & Wakefield relocated to the Plaza District.

Fire sale: Charles Cohen is unloading 3 East 54th Street for $188M as part of a scramble to raise cash and repay Fortress.

🏨 HOSPITALITY

Value drag: Hotel property tax burdens vary sharply by region and type, with New England hotels hit hardest and Southern resorts faring best.

A MESSAGE FROM GREYSTEEL

DFW Multifamily Forum: Insights & Networking

Join Greysteel on Thursday, September 18 at Sidecar Social in Addison for a morning of market insights and industry connections. Start with breakfast and networking, followed by a keynote address and an expert panel covering existing inventory and new developments in DFW multifamily.

Gain diverse perspectives, strengthen relationships, and leave with actionable takeaways on ownership and investment trends shaping the region.

This is a paid advertisement. Please see the full disclosure at the bottom of the newsletter.

📈 CHART OF THE DAY

Dispersion of Submarket Forecast Cumulative Rent Growth Within Each Market

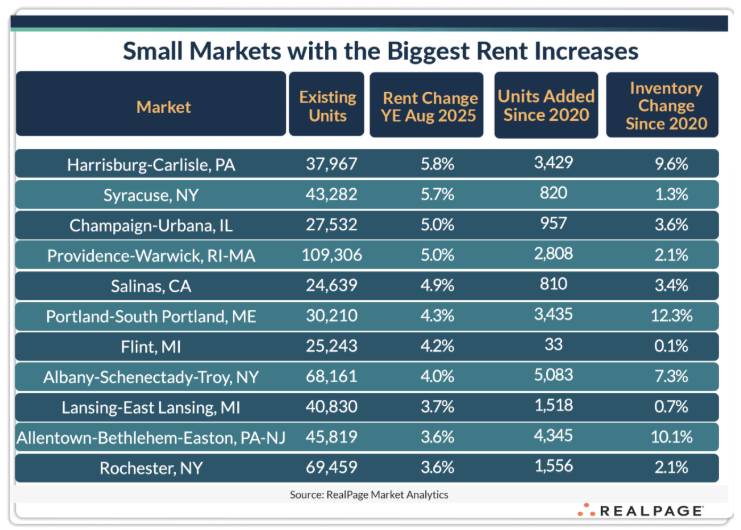

Several small and mid-sized apartment markets—mostly in the Northeast and Midwest—posted annual rent gains above 3.5% through August 2025, sharply outperforming the US average decline of 0.1%.

You currently have 0 referrals, only 1 away from receiving Multifamily Stress Test Model.

What did you think of today's newsletter? |

Reply