- CRE Daily

- Posts

- Tariffs Stir Inflation, but Cooling Rents Take the Edge Off

Tariffs Stir Inflation, but Cooling Rents Take the Edge Off

With rent inflation down to 3.8%, the Fed has one less reason to rush rate cuts.

Good morning. June’s inflation report brought mixed signals, but one trend stood out: rent inflation is cooling. With multifamily supply surging, shelter costs are easing and playing a major role in keeping CPI in check.

Today’s issue is brought to you by SmartPlan AI—create AI-powered testfits & 3D virtual tours in seconds.

🎙️This week on No Cap Podcast, RockStep Capital CEO Andy Weiner breaks down why the retail apocalypse was overblown and how his team is turning forgotten malls into durable cash flow machines.

Market Snapshot

|

| ||||

|

|

INFLATION CHECK

Tariffs Stir Inflation, but Cooling Rents Take the Edge Off

June’s inflation data adds tension to the Fed’s rate path, but surging housing supply is quietly pulling CPI down.

Inflation edges up: Consumer prices rose 0.3% in June, nudging the annual inflation rate to 2.7%. Core inflation, which excludes food and energy, also rose 0.2% monthly and 2.9% YoY, an uptick from recent months. Tariff-sensitive goods like appliances (+1.9%) and apparel (+0.4%) saw sharp price gains, suggesting tariffs are starting to impact consumers.

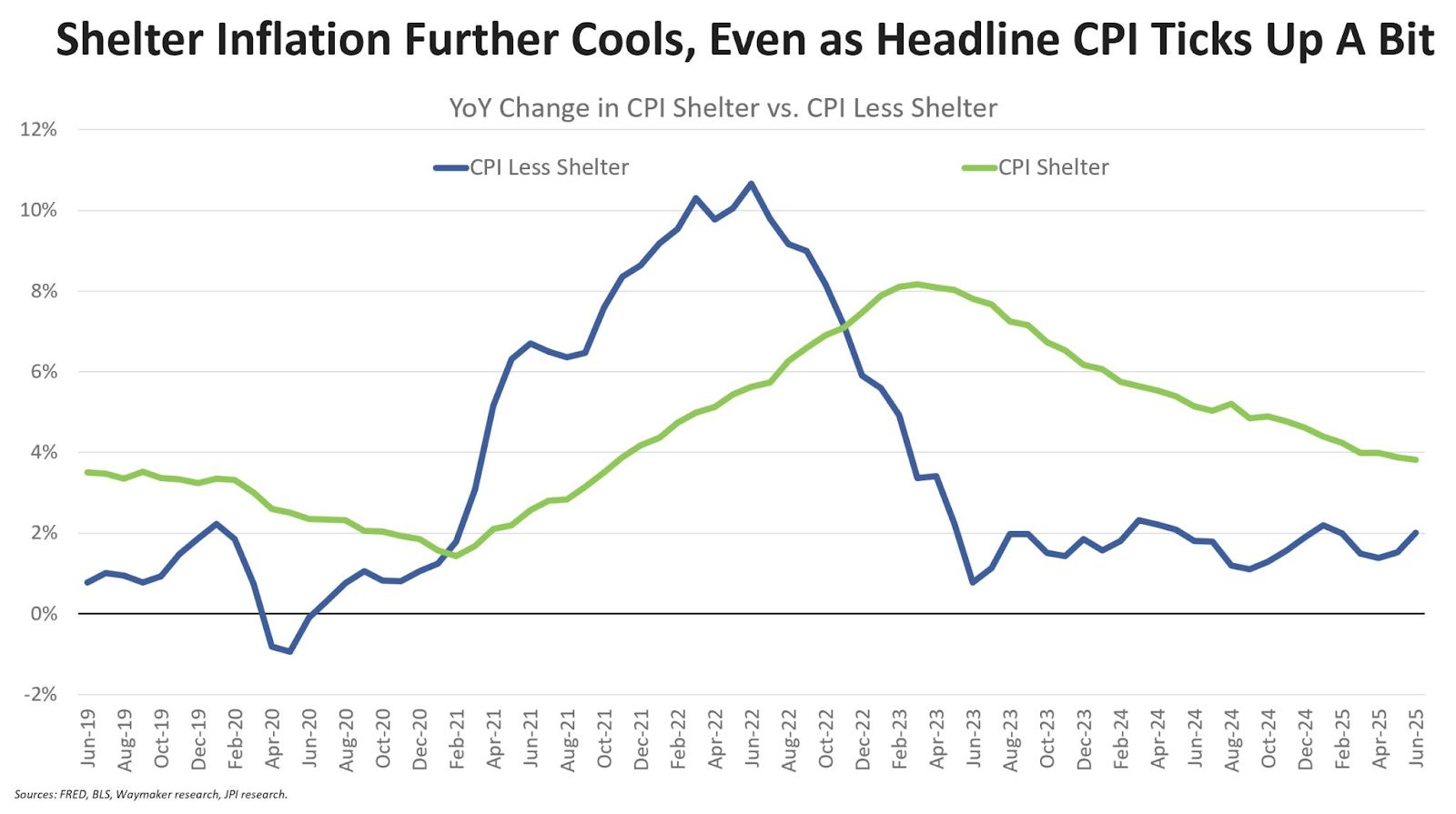

Under the radar: While overall inflation rose, shelter inflation—a major CPI component—kept cooling. It has decelerated in 25 of the past 27 months, with rent inflation falling from a peak of 8.8% in March 2023 to 3.8% in June 2025, returning to pre-pandemic levels, according to Jay Parsons.

The reason? The surge in apartment and BTR completions—now at 40+ year highs—is softening rent growth despite strong demand and improving affordability. Private-sector data shows even weaker rent gains than CPI, which lags due to its focus on renewals. As a result, shelter inflation is likely to keep easing in the months ahead.

Shrinking rate cut odds: Despite sticky headline inflation, cooling shelter costs have eased market expectations for a July rate cut. Futures now indicate a 2.6% chance, down from 6.2% prior to the CPI release. Year-end odds still favor two or more cuts, but confidence has slipped from 71.2% to 62.8%.

Supply squeeze ahead: High mortgage rates and weak builder confidence are pushing more households toward renting, boosting demand and occupancy. Builders are pulling back on land deals and incentives, signaling potential future supply constraints that could boost multifamily income, provided renters can keep up. Notably, the stalled homebuyer market isn’t pushing up rents; CPI data shows rent growth is cooling.

Affordability under pressure: Affordability is becoming a concern. On-time rent payments have dropped four points since April 2023. While not yet alarming, the downward trend—along with rising credit card and student loan delinquencies—could spill into housing if job growth slows.

➥ THE TAKEAWAY

Big picture: Inflation may be ticking up, but a surge in rental supply is helping to keep shelter inflation in check, thereby stabilizing the broader CPI. That gives the Fed more leeway to hold rates steady. For multifamily operators, demand remains solid, but growing signs of renter stress suggest it’s time to stay alert as economic conditions evolve.

TOGETHER WITH SMARTPLAN AI

Quicker Commissions with SmartPlan AI

Close deals faster with Smartplan AI – the ultimate revenue enablement tool.

Instantly respond to tenant rep inquiries with customized, real-time testfits. Wow the prospect on the tour or send via email after, and move to an RFP with a custom 3D virtual tour.

Outpace your competition who rely on slow, manual processes with architects or outdated tools. Close faster. Get paid sooner.

Setup requires only a floorplan PDF. Get ahead in your market now.

*This is a paid advertisement. Please see the full disclosure at the bottom of the newsletter.

✍️ Editor’s Picks

Mindset shift: BTR is reshaping rental housing, but its distinct structure and leasing approach require lenders to rethink traditional financing strategies. (sponsored)

Capital flow: US REITs raised $22.5B in Q225, driven largely by debt offerings, even as M&A activity remained on pause for the year.

Blackstone buy: Blackstone is doubling down on US rental housing, acquiring thousands of units across asset types as it bets on job and population growth.

Community shift: As big banks pull back from CRE, community banks and credit unions are quietly stepping up.

Debt trouble: Wells Fargo trimmed bad CRE loans, but rising apartment debt and a lowered income forecast dragged investor sentiment.

Agency push: Fannie Mae and Freddie Mac ramped up multifamily lending by 33% in Q125, offering looser terms and higher caps to stay competitive.

Private pivot: Wealth managers are turning to private markets for diversification and returns, but success hinges on managing liquidity, fund structures, and long-term commitment.

🏘️ MULTIFAMILY

Supply slide: US apartment completions remained historically high in Q2 2025, but construction volume fell sharply for a second straight quarter.

Muted momentum: Multifamily rents in June 2025 saw modest gains as steady demand was tempered by heavy Sun Belt deliveries and affordability pressures from years of outsized rent growth.

Maintenance edge: Tech-driven last-mile maintenance is emerging as a key value lever in multifamily operations.

Demand spike: Multifamily demand spiked in Fresno, but slow rent growth and high costs are holding back new construction and investment.

🏭 Industrial

Space economy: Investors are eyeing moon-based data centers and space-support infrastructure as the next frontier in real estate.

Nevada expansion: Vantage Data Centers will invest $3B in a new Sparks, NV campus with four AI-ready data centers.

Distribution deal: Amazon signed the largest industrial lease of Q2 in Miami-Dade, taking space less than a mile from its major fulfillment center.

Google grid: Google will invest $25B in data centers and AI infrastructure across the PJM grid, backed by a major hydro power deal.

Construction slowdown: Industrial vacancies hit 7.1% in Q2 2025 as absorption dipped and construction slowed.

Factory freeze: Despite bipartisan backing and billions in federal incentives, US manufacturing remains stagnant.

🏬 RETAIL

Consumer behavior: Five years post-COVID, consumer behavior has stabilized, but it's now deeply divided between value and premium segments.

Vacancy rising: Leasing is down 20% YoY as bankruptcies and tariff uncertainty push vacancy rates higher and trigger thousands of store closures.

Grocery headwinds: Expansion plans for ethnic grocery chains are facing headwinds as increased immigration enforcement dampens foot traffic and sales in key markets.

Waterfront win: Bayview PACE secured $61.5M for San Pedro’s waterfront West Harbor project as flexible, non-recourse C-PACE financing gains traction.

🏢 OFFICE

Selective recovery: The office market recovery is underway but uneven, with investor focus shifting toward high-quality, future-proof assets as demand stabilizes in top global cities.

Trophy trend: Class A and trophy offices captured 74% of Manhattan’s $3.2B in office sales so far in 2025.

Contract dispute: Turner Impact Capital is suing Akerman for $45M over lease errors that let a bankrupt tenant exit without paying.

Surging demand: Tampa Bay’s office market is red hot, with high demand for premium space far outpacing supply as companies seek amenity-rich environments to lure talent back on-site.

🏨 HOSPITALITY

New launch: Madison Capital’s Ryan Hanks and Jay Levell have launched Long Road Partners to acquire and reposition lifestyle and golf-focused hospitality assets.

Zoning blocked: Bally’s $4B Bronx casino bid was dealt a major blow after the NYC Council voted down a zoning change, effectively removing the project from contention.

Steady stay: Extended-stay hotels are holding their ground as supply and demand rise modestly, mirroring broader hotel industry trends.

A MESSAGE FROM AIRGARAGE

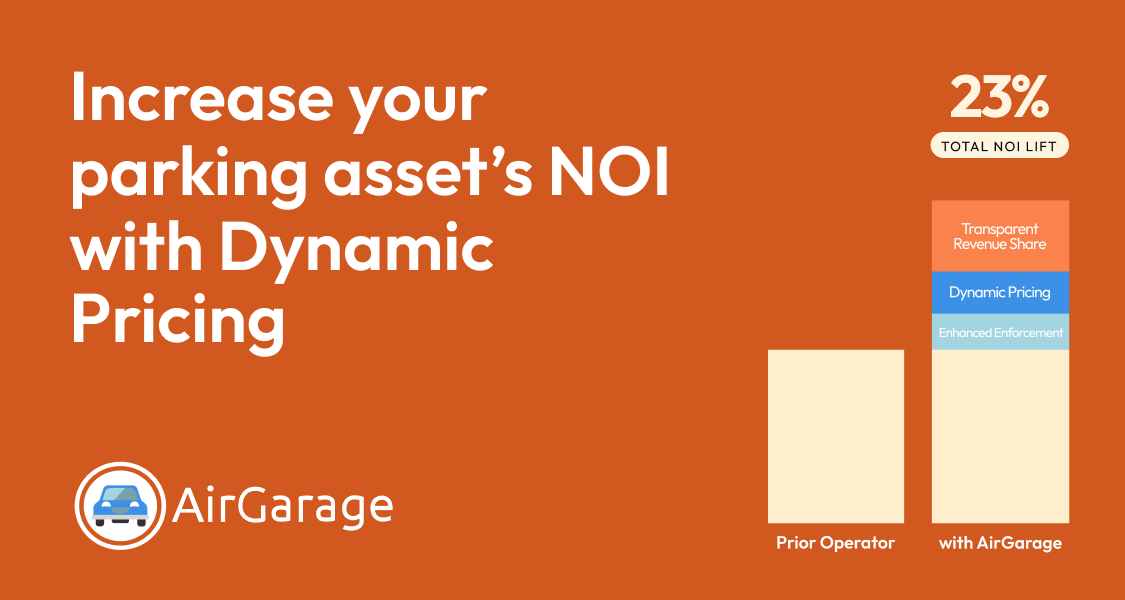

Your Parking Lot Could Be Underperforming—Here’s How to Fix It

Most parking operators pass through hidden costs and miss revenue.

AirGarage replaces expensive equipment with its in-house tech—no upfront cost—and uses AI to dynamically adjust pricing based on demand.

Property owners who switch see a 23% NOI increase on average—and deliver a smoother, frustration-free experience that keeps drivers coming back. Hear what our customers have to say.

Ready to see how much more your lot could earn?

*This is a paid advertisement. Please see the full disclosure at the bottom of the newsletter.

📈 CHART OF THE DAY

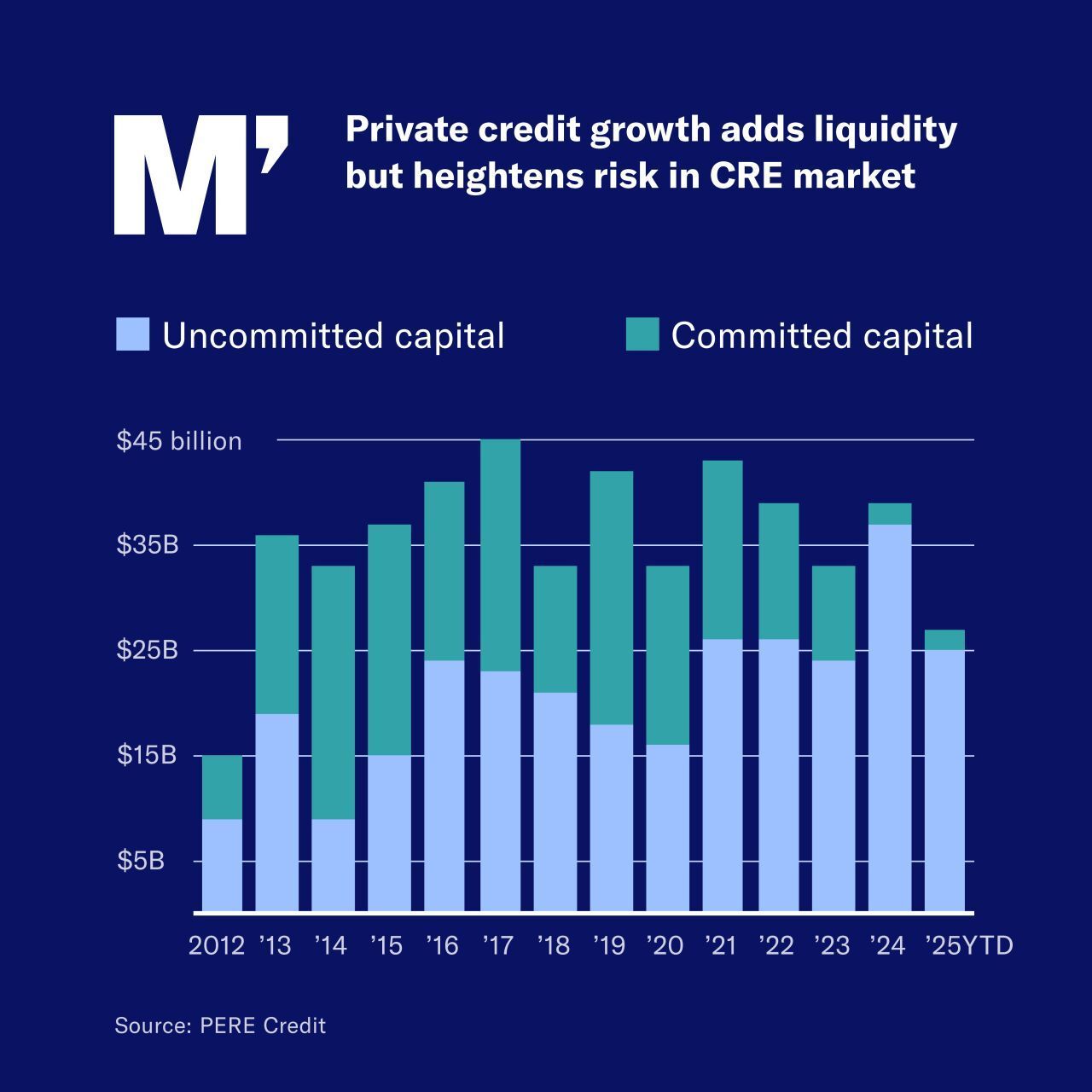

Private credit is stepping up in CRE financing, filling the gap left by traditional lenders as values drop and borrowing costs rise.

You currently have 0 referrals, only 1 away from receiving Multifamily Stress Test Model.

What did you think of today's newsletter? |

Reply