- CRE Daily

- Posts

- The Gap Between CRE’s Winners and Losers Is the Widest in 40 Years

The Gap Between CRE’s Winners and Losers Is the Widest in 40 Years

Higher interest rates and tight supply are redrawing the CRE landscape, with clear winners and losers emerging.

Good morning. CRE is in the middle of a structural reset. Investors who pivot toward high-demand, low-supply sectors could come out on top as the gap between winners and losers keeps growing.

Today’s issue is brought to you by Avalon Risk Management—protect your property, cuts risks, and maximizes ROI.

🎙️This week on No Cap: Heitman’s Brian Pieracci explains why alternatives like self-storage and senior housing are outperforming traditional CRE and reshaping what “core” really means.

Market Snapshot

|

| ||||

|

|

Market Divide

The Gap Between CRE’s Winners and Losers Is the Widest in 40 Years

A structural market reset is deepening the divide between commercial real estate winners and laggards — and it’s not just cyclical.

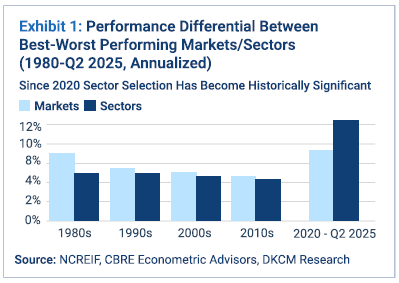

The Great Dispersion: A new white paper from Davidson Kempner Capital Management finds the gap in CRE performance is the widest since the 1980s. High interest rates, inflation, and supply-demand imbalances have triggered a “structural reset,” with U.S. property values down about 18% since 2021.

Rent growth divide: In this high-rate environment, rent growth hasn’t disappeared, but it’s highly concentrated. Assets in constrained markets with strong demand are seeing outsized gains, while weaker sectors are struggling to tread water. Industrial assets lead the pack with 12% returns over five years, compared to a 4% decline in office.

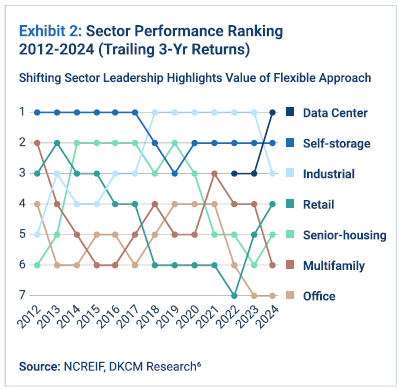

Shifting sector dynamics: Since 2020, sector choice has led CRE returns. Top performers like self-storage, industrial, and data centers averaged 17% versus 9% for the market. High rates and tight supply are widening the gap.

Location still rules: Even within sectors, geography matters. Industrial properties in California’s Inland Empire gained 15% over five years, versus 9% in Chicago. DKCM expects this gap to persist as high borrowing and construction costs limit new supply.

The new gold rush: Data centers are emerging as CRE’s hottest growth story. Demand—fueled by AI infrastructure and cloud expansion—is already six times higher than in 2021 and could triple again by 2030. Capital constraints remain a bottleneck, but the sector’s fundamentals are among the strongest in the industry.

The investor playbook: DKCM suggests investors who can act quickly and buy at discounts in high-demand, low-supply markets will capture the best opportunities. Sectors like industrial, data centers, self-storage, retail, and senior housing have outperformed the broader market by 13%–17%.

➥ THE TAKEAWAY

Winners in scarcity: CRE’s future looks increasingly bifurcated. Investors betting on scarcity-driven sectors—think logistics, data infrastructure, and senior housing—are likely to stay ahead, while oversupplied office and secondary markets risk being left behind in a new era of “haves and have-nots.”

TOGETHER WITH AVALON RISK MANAGEMENT

Get access to the insurance everyone wants but few can get.

Avalon Risk Management is changing commercial property insurance. Forget generic policies and outdated models that cost more.

With real-time data and pricing that beats the competition, Avalon protects your property, cuts risks, and maximizes ROI.

Exclusively available through Arcstone Insurance Advisors, Avalon delivers faster claims, lower premiums, and a team that works relentlessly for your bottom line.

Why settle for the status quo when you can have smarter coverage that works harder for your properties?

*This is a paid advertisement. Please see the full disclosure at the bottom of the newsletter.

✍️ Editor’s Picks

Real estate success: Re-Leased’s playbook gives landlords/owners actionable steps and KPIs across leases, operations, finance, compliance, stakeholders—reducing risk and increasing margins to thrive in a digital-first world. Get the playbook. (sponsored)

Capital relief: Regulators plan to ease capital requirements for large banks under a revised Basel Endgame, potentially unlocking billions in CRE lending.

Messy rescues: Rescue equity is back in commercial real estate, but instead of a tidal wave of distressed deals, capital is trickling into complex, hands-on workouts.

See you in Dallas? Join CRE Daily on November 4th at the Rustic for a high-powered networking event under the stars with 400+ investors, developers, lenders, and operators. (sponsored)

Data blackout: With federal jobs data offline during the government shutdown, private reports reveal a slowing labor market, rising unemployment, and the weakest hiring momentum since 2022.

This time's different: Economists warn the latest government shutdown could hit harder than past ones, as it collides with a cooling job market and persistent inflation.

Fraud fallout: Major firms, including Marcus & Millichap, Perkins Coie, and Columbia Bank, are being sued for allegedly enabling a $250M Ponzi scheme.

Banking merger: Fifth Third Bank will acquire Comerica in an all-stock $10.9B deal, creating one of the nation’s 20 largest banks.

🏘️ MULTIFAMILY

Midtown makeover: Developers are rapidly converting Midtown Manhattan office towers into apartments, driven by declining property values, tax incentives, and a pressing need for housing.

Rent reset: U.S. apartment rents fell 0.3% in Q3, the first third-quarter drop since 2009, as demand cooled and supply stayed high.

New cycle: Lower borrowing costs are reviving major real estate deals, but valuation gaps and capital competition mean the rebound is far from certain.

Software scrutiny: 27 landlords settled for $141M over alleged rent-collusion via RealPage software, as the company fights on in court.

Shutdown strain: Federal job cuts and the shutdown are cooling Washington’s housing market amid rising listings and buyer uncertainty.

Distress lingers: CRE foreclosures in Texas dipped to $575M in October, with most troubled loans tied to multifamily properties.

Impact capital: Institutional and global investors are turning affordable housing into a mainstream, ESG-focused asset class.

🏭 Industrial

Rust belt reboot: Midwest developers are turning vacant factories and offices into AI data centers, reviving old power infrastructure for new tech demand.

Data deal: BlackRock is reportedly in advanced talks to buy Aligned Data Centers for $40B, a move that would mark one of the year’s biggest deals.

AI arms race: OpenAI struck a multibillion-dollar deal with AMD to buy 6 gigawatts of MI450 chips over five years, challenging Nvidia’s dominance.

Dallas expansion: Westcore acquired a 1.1M-SF, 12-building industrial portfolio, growing its Dallas footprint to nearly 4M SF.

Phoenix buildout: Trammell Crow broke ground on West 101 Logistics Center, a five-building, 1M-SF industrial park slated for completion next summer.

🏬 RETAIL

Fresh ambition: Sprouts Farmers Market plans to triple its store count from 455 to 1,400 nationwide, betting big on health-focused shoppers and the demand for fresh produce.

Mall makeover: CenterCal Properties and DRA Advisors bought the 870K SF Long Beach Towne Center for $145M, with plans for a major revamp.

Grocery grab: Asana Partners bought the fully leased Red Bird Center near Coral Gables for $62.1M, anchored by Milam’s Market.

Shopping spree: PGIM lent $260M to Bain Capital and 11North for their $395M buy of 10 Publix-anchored centers in Florida and South Carolina.

Fresh cuts: Amazon will close four Fresh supermarkets in Southern California as it doubles down on Whole Foods and online grocery delivery.

🏢 OFFICE

Y'all street: Financial firms drove a strong Q3 office leasing boost in DFW, with Class-A demand rising and Class-B space showing signs of recovery.

Vacancy vs. value: Downtown Chicago’s office vacancy hit a record 28% in Q3, with Class B space struggling while trophy towers command rising rents and selective tenant demand.

Times Square refi: PGIM, Norges Bank, and SJP refinanced 11 Times Square with a $507M loan, signaling confidence in Manhattan’s office rebound.

🏨 HOSPITALITY

Breaking ground: LA has broken ground on a $2.6B expansion of its convention center, aiming to boost tourism and tax revenue.

Downtown decline: Los Angeles hoteliers face mounting debt, foreclosures, and investor skepticism as high costs, weak tourism, and rising defaults strain the city’s hospitality sector.

Soft brand surge: Wyndham is expanding into economy lifestyle hotels with new Dazzler Select brand aimed at independent conversions and younger travelers.

TOGETHER WITH CRE DAILY

Start the New Year Ahead of Your Competition

Get a head start on your competition in 2026 by tapping into the most engaged CRE audience in the industry with CRE Daily.

ACCELERATE DEAL CLOSINGS

Influence your target audience • Network with dealmakers

DRIVE QUALIFIED LEADS

Create a pipeline of new clients • Connect with decision-makers

ESTABLISH & MAXIMIZE BRAND RECOGNITION

Expand thought leadership • Introduce new products

*This is a paid advertisement. Please see the full disclosure at the bottom of the newsletter.

📈 CHART OF THE DAY

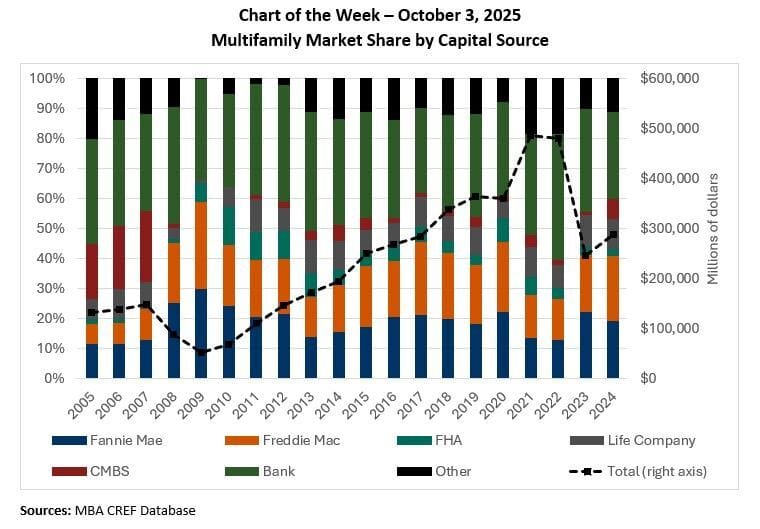

Fannie Mae and Freddie Mac lenders now account for over 40% of multifamily originations, holding steady as overall lending rebounds, with total multifamily volumes forecast to grow 23% in 2025.

You currently have 0 referrals, only 1 away from receiving Multifamily Stress Test Model.

What did you think of today's newsletter? |

Reply