- CRE Daily

- Posts

- US Apartment Market Maintains Occupancy Amid Slower Growth

US Apartment Market Maintains Occupancy Amid Slower Growth

The US rental market is holding its ground, but early signs of economic drag and demand fatigue are starting to show.

Good morning. The US apartment market held steady in July, with strong occupancy and easing supply pressures. But beneath the surface, signs of softening demand and economic headwinds are beginning to emerge.

Today’s issue is brought to you by Aspen Funds—direct investment in cash-flowing energy assets.

🎙️This week on No Cap podcast, Craig Deitelzweig of Marx Realty reveals how “hotelizing” office buildings is unlocking $50+ PSF rent premiums and rewriting the rules of tenant experience.

Market Snapshot

|

| ||||

|

|

SOFT SEASON

US Apartment Market Stays Resilient, But Cracks Begin to Show

Occupancy and rents held steady in July, but softer-than-expected summer demand and economic red flags suggest momentum could be slipping.

Occupancy holds firm: National apartment occupancy remained unchanged at 95.5% for the second month in a row, still above the five-year average but down slightly from the April–May peak of 95.6%. While that stability looks positive on the surface, RealPage's Carl Whitaker cautions that “demand in both June and July has been weaker than many (myself included) would have thought heading into the summer months.”

Rent growth barely budges: Effective asking rents rose just 0.2% YoY—the smallest gain in 10 months—as operators prioritized occupancy over pricing amid slowing demand. As Whitaker puts it, “Rents respond to occupancy, both in terms of relative level and pace of change,” and this summer, neither moved much.

Demand breaks records: The US logged record apartment absorption, with over 794K units leased in the year-ending Q2 2025, surpassing previous highs set in 2021 and 2022. This surge in demand is helping buoy occupancy rates even as new supply tapers off.

Decade low construction: Despite 535K units delivered in the past year—still historically high—completions have dropped from recent peaks. Construction has declined each quarter since early 2023, hitting a 10-year low in Q2, while permitting continues to fall, signaling tighter conditions ahead.

Regional standouts: Occupancy was highest in the Northeast (96.8%) and Midwest (96.4%) amid limited supply, while the South trailed at 94.8% due to heavy construction. Rent growth led in tech hubs like San Francisco, New York, and San Jose (up 3%–7%), with solid gains in Chicago, Pittsburgh, and Cincinnati.

➥ THE TAKEAWAY

Tempered growth ahead: Apartment fundamentals remain solid, but the market's resilience may be tested in the coming months. With occupancy plateauing and economic softness creeping in, expect a more tempered and regionally uneven landscape for rent growth and leasing activity through the end of 2025.

TOGETHER WITH ASPEN FUNDS

Generate Passive Income Through Institutional Grade, Oil and Gas Investments

Unlike traditional oil & gas funds focused on speculative wildcat drilling solely for tax benefits, 51 Upstream Energy Fund VII prioritizes producing assets and proven undeveloped projects.

By partnering as non-operating working interests or royalty interests, we reduce risk while maintaining upside.

This disciplined strategy has delivered 15% annualized cash-on-cash distributions over the last four quarters in Fund VI, offering investors stable income, growth potential, and long-term capital appreciation in a critical energy sector—while also providing significant tax advantages through drilling cost deductions and depletion allowances that can offset taxable income.

*This is a paid advertisement. Please see the full disclosure at the bottom of the newsletter.

✍️ Editor’s Picks

Book smarts: Upgrade your bookshelf with this curated lineup of top CRE books on everything from investing and development to brokerage and PropTech. (sponsored)

Tax windfall: Trump’s floated plan to eliminate capital gains taxes on home sales would largely benefit wealthy homeowners in high-cost states like California.

Record raise: Carlyle Group has raised a record $9B for its 10th real estate fund, doubling down on residential, industrial, and self-storage assets.

Sentiment shift: Cautious optimism is returning to the market, with 76% of industry pros expecting deal activity to hold steady or rise in the second half of 2025.

Mailbox money: Postal Realty Trust is doubling down on USPS properties, despite rising doubts about the long-term future of traditional mail delivery.

Slow climb: Construction added 2,000 jobs in July as project spending dipped, reflecting growing caution amid tariff and labor uncertainty.

Deal flow: CBRE projects a 10% rise in CRE investment for 2025, with office leading the way.

🏘️ MULTIFAMILY

Density done right: New Rochelle, NY has bucked the affordability crisis by fast-tracking approvals, streamlining zoning, and attracting $2.5B in development.

Parcel potential: Cities are easing zoning rules to unlock housing on overlooked, oddly shaped lots, offering a creative fix for the urban housing crunch.

Distress watch: Texas CRE foreclosures soared to $670M in August, led by distress in multifamily.

Historic glow: For the first time in its 123-year history, NYC’s iconic Flatiron Building will feature exterior lighting as it reopens later this year as a luxury condo tower.

Rent cooldown: Single-family rents are easing as new supply pushes vacancies to a nine-year high.

🏭 Industrial

Inventory rush: US manufacturers ramped up production and shipping in July ahead of new tariffs, triggering a spike in factory and logistics activity.

Factory slowdown: US factory orders dropped 4.8% in June—the second decline in three months—signaling ongoing weakness in manufacturing.

Logistics win: iDC Logistics inked over 1.1M SF in Southern California leases, including the year’s second-largest in the Inland Empire.

Tampa build: Hazel Street Capital and CIP Real Estate have launched a 331K SF, three-building industrial park near downtown Tampa.

🏬 RETAIL

Guidance boost: Simon Property Group raised its 2025 guidance after Q2 net income hit $556M and occupancy improved.

Debt spiral: Pyramid Management Group has lost its third mall to foreclosure in a year, with lenders moving to auction Aviation Mall in upstate NY.

C-store shift: Cap rates ticked up as convenience stores expand, modernize, and attract investors with long-term leases and strong brand tenants.

Retail layoffs: Retail job cuts are up 249% this year, with store closures and tariff fears stalling new hiring.

🏢 OFFICE

Office bottom: LA office sales more than doubled in Q2 to $1.2B, as brokers and investors signal the market has likely hit bottom.

Refi win: The Durst Organization is set to pull $146M in equity from a $1.3B CMBS refinancing of its 92%-leased Times Square office tower.

Return plan: One week after a tragic shooting at its NYC HQ, Blackstone has reopened its office at 345 Park Ave.

Premium push: With demand for premier office space outpacing supply, BXP is doubling down on Class A developments across NYC.

🏨 HOSPITALITY

California effect: Vegas visits fell 11% in June, partly due to fewer Californians hitting the road.

Tempered outlook: Marriott beat Q2 estimates but narrowed its 2025 guidance amid mixed travel demand.

Growth playbook: Hyatt has reshaped its business through brand launches, joint ventures, and over $4B in acquisitions.

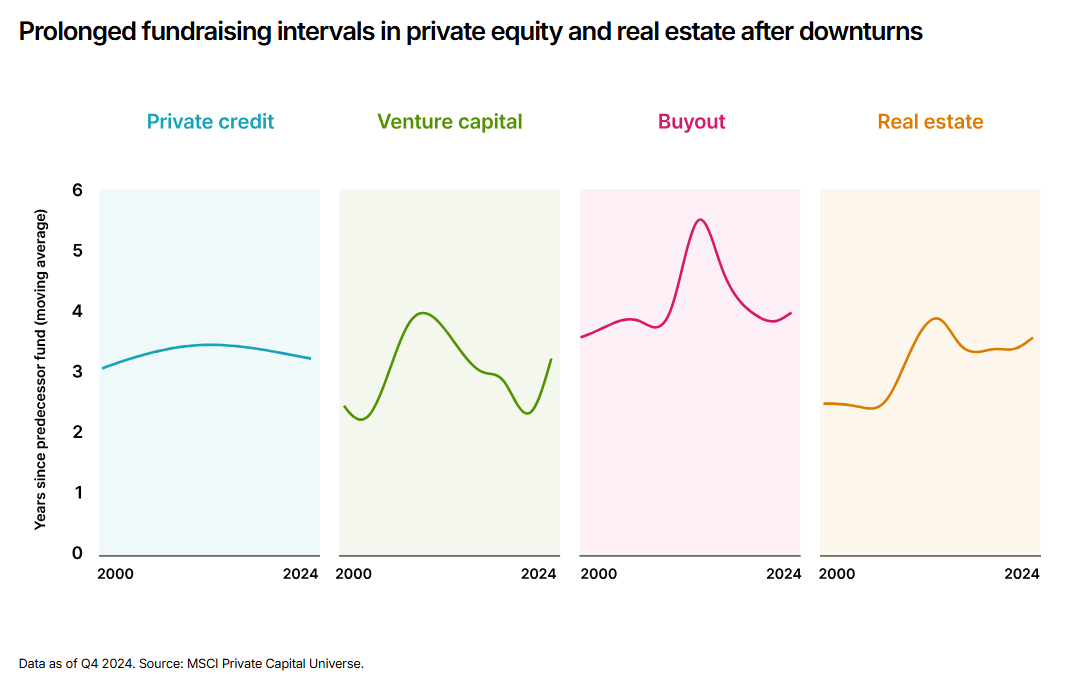

📈 CHART OF THE DAY

Private credit has never weathered a full interest rate cycle, and a sustained downturn could strain fundraising, as it did for venture, buyout, and real estate in past cycles.

You currently have 0 referrals, only 1 away from receiving Multifamily Stress Test Model.

What did you think of today's newsletter? |

Reply