- CRE Daily

- Posts

- Vornado Considers Offloading Iconic Assets to Double Down on NYC Core

Vornado Considers Offloading Iconic Assets to Double Down on NYC Core

A shift in strategy could bring two iconic assets to market, as the REIT leans further into NYC.

Good morning. A strong Q2 showing isn’t the only news from Vornado. CEO Steven Roth signaled the possible sale of The Mart and 555 California, marking a potential exit from all non-NYC markets.

Today’s issue is brought to you by Agora—see how top firms are surviving market volatility.

Join RSN Property Group and Monday Properties on Tuesday, August 12th for a live webinar as they debut a new investment model that blends institutional discipline with retail accessibility—starting with a 291-unit multifamily deal in North Carolina.

Market Snapshot

|

| ||||

|

|

CORE STRATEGY

Vornado Considers Offloading Iconic Assets to Double Down on NYC Core

After years of hints, Vornado may finally be ready to shed its non-NYC trophy assets to sharpen its New York focus.

90% NYC: On Vornado’s Q2 call, CEO Steven Roth said the company is “90% New York-centric” and hinted The Mart and 555 California—the last 10%—could be sold “for the right deal at the right time.” His message: “Nothing is sacred.”

Assets on the table: Past efforts to sell or restructure these assets date back to 2020 and 2021, but this marks the most public willingness to part with them yet.

The Mart: 3.7M SF in Chicago, 78% leased, $25M in Q2 NOI. Acquired in 1998 from the Kennedy family.

555 California: 1.8M SF in San Francisco’s Financial District, 92% leased, $17M+ in Q2 NOI. Vornado owns 70%, with the Trump Organization holding the rest.

Why now? Roth pointed to Manhattan’s strength, calling it the “strongest real estate market in the country,” and stressed that selling the assets would help drive stock performance. Vornado’s shares are up 42% YoY, outperforming the S&P 500.

NYC activity picks up: Vornado reported a strong Q2 with $744M in net income, up from $35M a year ago, fueled by major NYC deals like NYU’s $1.6B lease, the $350M Uniqlo sale, and a Penn 1 rent reset. It signed 1.5M SF in office leases, though occupancy slipped slightly.

➥ THE TAKEAWAY

NYC or bust: Vornado’s shift to a pure NYC portfolio looks closer than ever. If The Mart and 555 California hit the market, it could mark one of the biggest reallocation plays by a major REIT this cycle—and offer a rare chance for buyers to grab iconic but complex assets outside NYC.

TOGETHER WITH AGORA

What 200+ CRE leaders are doing differently in 2025

Capital is tighter. Investors are more demanding. Strategies are shifting. Yet some firms are pulling ahead faster, leaner, smarter.

Agora’s latest report uncovers how the most forward-thinking real estate firms are navigating today’s economic pressures and outperforming the market.

What’s inside:

44% of firms have already pivoted investment plans

58% say raising capital is more difficult in 2025

31% of investors are demanding more transparency

48% are hunting undervalued or distressed opportunities

See what’s driving real decisions and learn how leading firms are staying ahead.

*This is a paid advertisement. Please see the full disclosure at the bottom of the newsletter.

✍️ Editor’s Picks

Build your brand: Maximize LinkedIn’s potential. Learn how to establish authority, connect with key players, and turn your network into valuable leads. (sponsored)

Spending slump: Construction spending keeps falling, easing CRE supply and opening the door for investor upside.

Utility deal: Brookfield is buying 19.7% of Duke Energy Florida for $6B to fund grid upgrades amid rising demand.

Growth move: S2 Capital, a national apartment investor, has acquired Fort Capital’s industrial platform to launch S2 Industrial.

Meme momentum: Opendoor surged 460% after meme-stock buzz, giving its CEO a chance to pivot the business beyond home flipping.

Cautious credit: Big banks posted solid Q2 profits, but CRE lending remains tight as institutions focus on risk management and regulatory compliance.

Modular move: Boxabl plans to go public via $3.5B SPAC to scale prefab housing despite past SEC scrutiny.

Sounding the alarm: Goldman Sachs' chief economist cautions that declining residential investment could be enough to tip the US into recession.

Sector split: Lee & Associates’ Q2 report shows office absorption slipped back into negative territory while multifamily remained resilient.

🏘️ MULTIFAMILY

Disaster DIY: With deep cuts to NOAA and FEMA, property managers in hurricane-prone areas are being forced to build self-reliant disaster plans as federal support wanes.

Go blue: Landmark and Cerca delivered a fully leased, 521-bed student housing project near the University of Michigan, as national pre-leasing trends remain strong.

Housing boost: FHFA doubled the annual LIHTC investment cap for Fannie and Freddie to $4B, aiming to expand affordable housing.

Model mismatch: Senior housing investors face risk as old assumptions clash with today’s slower demand and tighter margins.

🏭 Industrial

Market correction: Inland Empire industrial landlords are battling high vacancies with concessions and flexibility as leasing slows and tenants grow more selective.

Apollo expansion: Apollo Global is acquiring a majority stake in Stream Data Centers to boost its digital infrastructure portfolio.

Cold collapse: A Michigan pension fund is suing cold storage REIT Lineage Inc., claiming it misled investors ahead of its $4.4B IPO.

Border boom: Industrial demand is rising along the U.S.-Canada and U.S.-Mexico borders as record truck traffic and increased USMCA use help offset tariff concerns.

Patience in play: Prologis reports industrial tenants are taking a wait-and-see approach amid economic uncertainty.

🏬 RETAIL

Spooky solution: Spirit Halloween is filling 25 vacant big-box stores across Houston, turning retail bankruptcies into seasonal leasing wins.

Supermarket sweep: Bain Capital and 11North Partners acquired 10 grocery-anchored shopping centers—mostly in Florida—for $395M.

Frugal fanbase: Aldi is rapidly expanding across the U.S. by offering affordable, private-label groceries with a healthy twist.

🏢 OFFICE

Smarter growth: Q2 marked a turning point for the US coworking industry, as operators slowed expansion, consolidated locations, and focused on larger, more efficient spaces.

SEC spotlight: Paramount Group is under SEC investigation after disclosing millions in payments to CEO-affiliated companies.

Corporate cutback: US Bank is cutting its Seattle office footprint by over 85%, continuing a nationwide downsizing trend.

Obsolete office: A major tenant’s departure has pushed a suburban Atlanta office building toward likely demolition, as OA Development eyes an apartment conversion.

🏨 HOSPITALITY

Dubai developer: Kerzner International, operator of Atlantis resorts, scoops up a prime Miami site from Swire Properties for $45M.

📈 CHART OF THE DAY

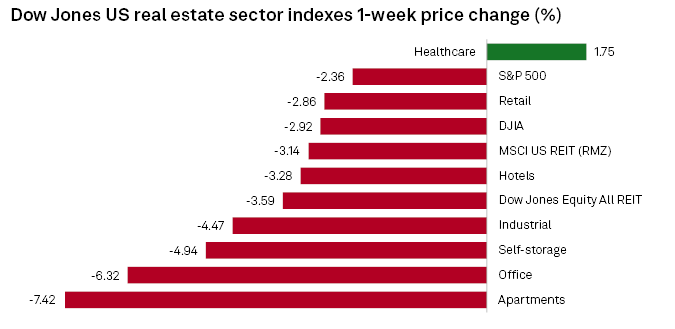

US REITs fell across nearly all sectors last week, led by sharp declines in apartments and office; only healthcare posted gains.

You currently have 0 referrals, only 1 away from receiving Multifamily Stress Test Model.

What did you think of today's newsletter? |

Reply